The Additional Medicare Surcharge

Dividend income can also prompt the Additional Medicare Tax. This tax has been in place since the 2013 tax year. It’s in addition to any income tax you might pay on your dividends.

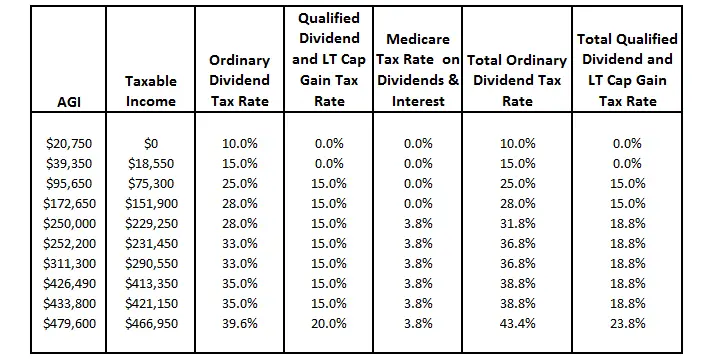

You must pay 0.9% of your net investment income toward this Medicare tax if you’re married filing jointly and your modified adjusted gross income is $250,000 or more. You must pay it if you’re married filing separately and your MAGI is more than $125,000. The income threshold for all other taxpayers is $200,000.

Federal Dividend Tax Credit

Taxes have a way of being unnecessarily confusing. Remember how in the gross-up the CRA decided we needed to increase the taxable amount of dividends? Well, the CRA can be a little bit indecisive. Later on in the return, they realize they were a bit extreme so they give you some of that back in the form of the dividend tax credit. In fact, you get both a Federal and Provincial dividend tax credit.

Tax Treatment Of Qualified Dividends

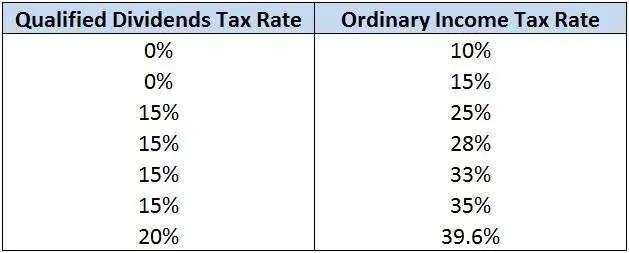

Qualified dividends were taxed at rates of 0%, 15%, or 20% through the tax year 2017. The rate depended on the taxpayer’s ordinary income tax bracket. Then the Tax Cuts and Jobs Act came along and changed things up effective January 2018.

The rates are set at 0%, 15%, and 20%, just as they have always been. But long-term gains have their own tax brackets as of the 2021 tax year , thanks to the TCJA. You’ll fall into the 0% long-term capital gains tax rate for qualified dividends if:

- Your income is less than $40,400 if you’re single

- Your income is less than $80,800 if you’re married and you file a joint return with your spouse

- Your income is less than $54,100 if you qualify as head of household

The 15% tax bracket kicks in at incomes above these 0% thresholds and applies to incomes of up to:

- $445,850 for single filers

- $501,600 for married filers of joint returns

- $473,750 for head of household filers

Only taxpayers with incomes in excess of these 15% thresholds are faced with the 20% capital gains tax rate as of 2021.

Ordinary dividends are taxed as ordinary income according to a taxpayer’s regular, marginal tax bracket.

Also Check: What Is Federal Tax Due

How Are Qualified Dividends Taxed

The dividend tax rate on qualified dividends is the capital gains tax rate, which ranges from 0% to 20%, depending on what tax bracket the investor is in.

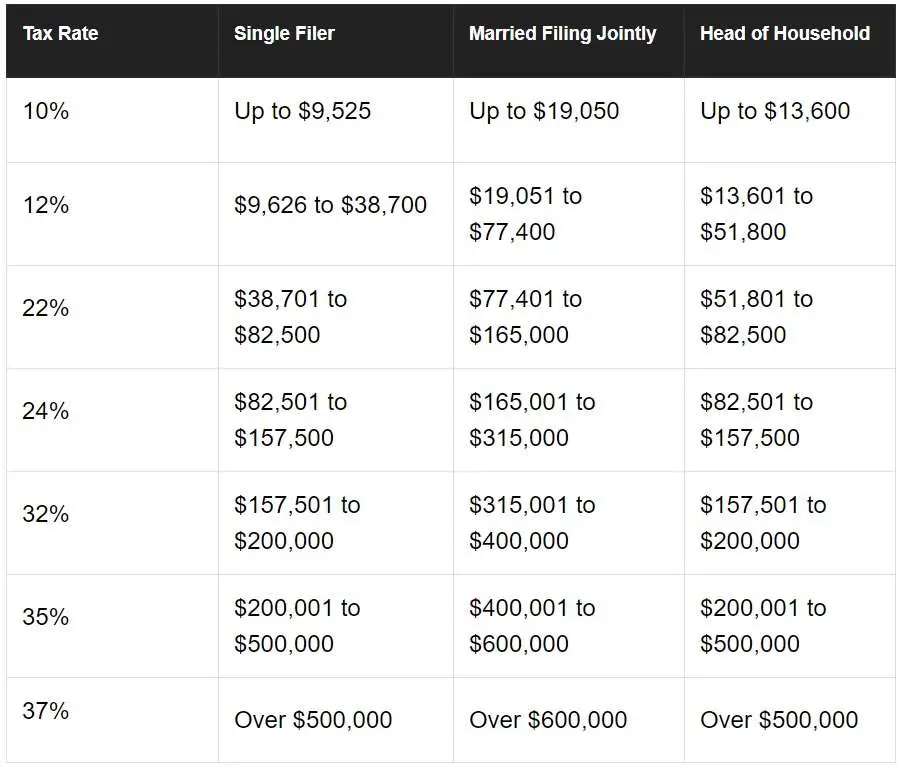

Ordinary dividends are taxed at the investor’s income tax rate, which will depend on what tax bracket they are in. As of 2020, the income tax brackets range from 10% to 37%. These rates can change from year to year and are listed in the instructions for each year’s income tax form.

When buying dividend stocks, it’s important to think about how they will be taxed because the tax rate can make a material difference in how much tax is charged.

Example Of Qualified Dividends

For an example of a qualified dividend in action, let’s take a look at the payout of tech giant Apple . In 2021, the U.S. corporation made regular quarterly dividend payments of $0.22 per share to its investors. Because it’s a U.S. company and paid regular cash dividends, Apple’s dividend qualifies for a lower tax rate. The only factor that would disqualify Apple’s dividend from a lower tax rate is if the investor didn’t meet the required holding period for Apple’s shares.

Another example of a qualified dividend is the one paid by energy infrastructure giant Enbridge . In 2021, the Canadian corporation, which trades on the New York Stock Exchange, paid out $3.34 Canadian dollars per share in dividends. Even though it’s a foreign company, Enbridge’s dividend qualifies for a lower tax rate for U.S. citizens as long as they met the holding period requirement.

Read Also: What Form Do I Need To File My Taxes Late

Are Qualified Dividends Taxable

Please note that the qualified dividends tax rate denotes the capital gains tax rate varying from 0%, 15%, or 20%, per the investors tax bracket. In other words, taxing these dividends at lower tax rates minimizes the tax income. Additionally, they are a proportion of corporate proceeds paid out to shareholders and are taxable earnings.

These dividends are certainly a form of investment income gained through mutual funds and shares containing stocks. Moreover, here lie the details,

| Taxable Income |

|---|

So, here are a few examples to understand the qualified dividends.

Example#1

Lets assume that a firm, ABC Co. pays a dividend worth $0.16 per share. Nonetheless, just 50% of the dividends per shareDividend Per ShareDividends per share are calculated by dividing the total amount of dividends paid out by the company over a year by the total number of average shares held.read more are documented as qualified dividends. Also, the investor possesses 10,000 shares, out of which 7000 are held for the qualified dividends holding period.

Qualified dividends amount = Shares held for holding period x Dividend per share

= 7000 x $0.08

Thus, the amount = $560

Example#2

The Biden administration has recently commenced a proposal regarding qualified taxable dividends for taxpayers possessing an AGI of over $1 million. To clarify, it would charge them at normal income tax rates than the long-term lower capital gains rates .

How Dividends Are Taxed In Canada

In the past month, Ive had countless clients ask me to explain how dividends are taxed in Canada. This has inspired me to write this article to explain to the average person how dividends are taxed in Canada. I think youll be surprised at how straight-forward it is.

To keep this simple, we will be looking at Federal taxation only. With that being said, it works the same way for Provincial taxation except that the rates are different. Also, this article is meant for general information purposes. It is not a substitute for your own research and analysis. It does not make you qualified to deal with corporate taxation matters. There is no substitute for consulting with an online accountant when it comes to tax matters.

Don’t Miss: Can You File Taxes For Unemployment

Many Dividends That Do Not Qualify

There are many dividends from investments that do not qualify. These include BDCs, REITs, MLP, and other partnerships. Dividends also paid from money market accounts do not qualify.

Money market accounts, such as deposits in savings banks, credit unions, or other financial institutions, should not qualify. Lastly, qualified dividends, a bit confusing, dividends that come from shares used for hedging, short sales, puts, and call options.

Capital Gains Tax Strategies

The capital gains tax effectively reduces the overall return generated by the investment. But there is a legitimate way for some investors to reduce or even eliminate their net capital gains taxes for the year.

The simplest of strategies is to simply hold assets for more than a year before selling them. That’s wise because the tax you will pay on long-term capital gains is generally lower than it would be for short-term gains.

Don’t Miss: How Much Do Rich People Pay In Taxes

Qualified Dividends Vs Ordinary Dividends: How Are Dividends Taxed

Many investors view dividends as the same, to their dismay. The government sees two types of dividends: Qualified Dividends and Ordinary Dividends. You do not know which one can negatively affect your portfolio and your wallet tax time.

I have been following the markets for over 25 years, and I sometimes get confused about whether an investment pays a qualified dividend. However, every investor should be able to distinguish between ordinary and qualified dividends. Anyone looking to maximize long-term returns is going to find it easy to learn some basic rules.

From the 100,000 foot perspective of the two types of dividends and their IRS classification matters, heres a view.

Contents

| AD – Recover your investment losses! Haselkorn & Thibaut, P.A. is a national law firm that specializes in fighting ONLY on behalf of investors. With a 95% success rate, let us help you recover your investment losses today. Call now or visit InvestmentFraudLawyers.com to schedule a free consultation and learn how our experience can help you recover your investment losses. No recovery, no fee. |

Unqualified Dividends Vs Qualified Dividends

Dividends paid out of earnings of a company are either classified as unqualified or qualified. An unqualified dividend is also sometimes called an ordinary dividend.

The main difference between a qualified dividend versus an ordinary dividend is that a qualified dividend is taxed at a rate ranging from 0% to 20%, depending on the income bracket. This compares to taxes paid on unqualified dividends, which are taxed as ordinary income and ranges from 10% to 37%.

Qualified dividends were introduced through the passage of the Jobs and Growth Tax Relief Reconciliation Act of 2003 and aimed to remedy a prevalent issue with the U.S. tax code at the time companies opting to conduct share buybacks in lieu of paying out dividends.

It was due to share buybacks being taxed at the capital gains tax rate, which was lower than the ordinary income tax rate faced by ordinary dividends. The establishment of qualified dividends was to incentivize companies to pay out dividends to shareholders by lowering the applicable tax rate for dividends.

You May Like: When Will Taxes Be Deposited 2021

Which Dividends Do Not Qualify

Some dividends are automatically excluded from being considered qualified dividends. These dividends include those paid by real estate investment trusts and master limited partnerships . Excluded dividends also include those made on employee stock options and on tax-exempt companies.

Additionally, dividends that are paid from money market accounts or other financial institutions are reported as interest income and not qualified dividends. Special one-time dividends also aren’t categorized as qualified dividends. Finally, qualified dividends must be paid for shares that aren’t being used for hedging, like those that are sold short and .

Video: Taxes On Dividends Explained

OVERVIEW

If you purchase stock in a corporation or invest in a mutual fund that periodically pays dividends, the payments you receive throughout the year can provide you with some extra income. Watch this video to find out more about how this income may affect your taxes. Note: The tax rates in this video apply for tax years 2012 and earlier.

The information below references tax rates for tax years prior to 2018.

Read Also: How To Check If Tax Return Was Filed

What Are Capital Gain Distributions

Capital gain distributions might be paid by one of these:

- Regulated investment companies

- Real estate investment trusts

Capital gain distributions are always reported as long-term capital gains. You must also report any undistributed capital gain that mutual funds or REITs have designated to you in a written notice. Those undistributed capital gains are reported to you on Form 2439.

Form 1099-DIV should list the distribution in the various categories. If it doesnt, contact the payor.

What Is A Liquidating Distribution

A corporation you own stock in might partially or completely liquidate. In that case, the corporation pays you a liquidating distribution. Liquidating distributions are a return of capital that reduces your basis in the stock. Any liquidating distribution that is more than your basis is treated as a capital gain.

Also Check: How To Avoid Federal Taxes

What Are Ordinary Dividends

Ordinary dividends factor into your overall taxable income, and thus are taxed at your ordinary income tax rate, which tops out at 37% for the highest earners. The IRS requires you to report taxable ordinary dividend amounts above $1,500 on Schedule B of Form 1040.

Ordinary dividends provide steady revenue without the need to sell shares of stock. In this way, investors gain short-term and long-term benefits.

Investors can offset the higher tax rate by keeping the related securities in a tax-advantaged retirement account such as traditional IRA or 401, thus delaying the point when taxes will be due.

“By locating these securities inside a traditional retirement account, the investor gets to defer the taxable event from when the ordinary dividend is paid to when it is later withdrawn,” says Sean Mullaney, a certified public accountant and financial planner at Mullaney Financial & Tax.

With a Roth IRA or Roth 401, you can pay the tax now and make tax-free withdrawals after retirement.

How Are Qualified And Ordinary Dividends Taxed

The tax treatment of dividends in the U.S. depends on whether the Internal Revenue Code classifies them as “qualified dividends” or “ordinary dividends.” Qualified dividends are taxed at the same rates as the capital gains tax rate these rates are lower than ordinary income tax rates.

The tax rates for ordinary dividends are the same as standard federal income tax rates, or 10% to 37% for the tax year 2021 and 2022. Investors pay taxes on ordinary dividends at the same rates they pay on regular income, such as salary or wages. Income-tax and capital gains rates change over time, but in recent years, the latter have been substantially lower than the former.

Don’t Miss: Does Filing Bankruptcy Eliminate Tax Debt

What Are Qualified Dividends And Nonqualified Dividends

A dividend is a . For tax purposes, there are two kinds of dividends: qualified and nonqualified .

Qualified dividends come with the tax advantage of a lower tax rate. Three things usually determine whether a dividend is qualified:

1. It is paid by a U.S. corporation or qualifying foreign entity. For many investors be they in stocks, mutual funds or ETFs this ones easy to satisfy.

2. It is actually a dividend in the eyes of the IRS. Some things dont count as dividends, despite what they might be called, including:

-

Premiums an insurance company kicks back.

-

Annual distributions credit unions make to members.

-

Dividends from co-ops or tax-exempt organizations.

Also, dividends arent the same as capital gains.

3. You held the underlying security for long enough. The definition of “enough” gets a little tricky, but typically, if you owned the security for more than 60 days during the 121-day period that began 60 days before the ex-dividend date that is, the day by when you must own the stock to receive the dividend the dividend is usually qualified.

Here’s an example. If your Ford shares paid a dividend on Sept. 1 and the ex-dividend date was July 20, you would need to have owned your shares for at least 61 days between May 21 and Sept. 19. And when you count the days, include the day you sold the shares but not the day you bought them.

|

Capital Gains Tax Rates For 2021 And 2022

The profit on an asset that is sold less than a year after it is purchased is generally treated for tax purposes as if it were wages or salary. Such gains are added to your earned income or ordinary income on a tax return.

The same generally applies to dividends paid by an asset, which represent profit although they aren’t capital gains. In the U.S., dividends are taxed as ordinary income for taxpayers who are in the 15% and higher tax brackets.

A different system applies, however, for long-term capital gains. The tax you pay on assets held for more than a year and sold at a profit varies according to a rate schedule that is based on the taxpayer’s taxable income for that year. The rates are adjusted for inflation each year.

The rates for tax years 2021 and 2022 are shown in the tables below:

| 2021 Tax Rates for Long-Term Capital Gains |

|---|

| $41,675 to $258,600 | Over $258,600 |

The tax rates for long-term capital gains are consistent with the trend to capital gains being taxed at lower rates than individual income, as this table demonstrates.

Also Check: When Will The Child Tax Credit Payments Start

Example Of Determining Holding Period

Consider this hypothetical situation in which you have dividends reported on Form 1099-DIV as qualified from shares in XYZ fund. You purchased 10,000 shares of XYZ fund on April 27 of the tax year. You sold 2,000 of those shares on June 15, but continue to hold the remaining 8,000 shares. The ex-dividend date for XYZ fund was May 2.

Therefore, during the 121-day window, you held 2,000 shares for 49 days and 8,000 shares for at least 61 days .

The dividend income from the 2,000 shares held 49 days would not be qualified dividend income. The dividend income from the 8,000 shares held at least 61 days should be qualified dividend income.

Consider Using A Retirement Account

-

Owning dividend-paying investments inside one could shelter dividends from taxes or defer taxes on them. Think ahead, though. Do you need the income now?

-

Also, the type of retirement account matters when it comes to determining the tax bill. When you eventually withdraw money from a traditional IRA, for example, it may be taxed at your ordinary income tax rate rather than at those lower qualified dividend tax rates. If you qualify for a Roth IRA, you wont receive a tax break on the contribution, but your eventual withdrawals after age 59 ½ may be tax-free.

Also Check: What Percent Is Sales Tax

Which Dividends Qualify For Lower Tax Rates

In order for dividend payments to be considered qualified dividends, you have to pass these tests:

- The dividends must have been paid by either a U.S. corporation or a qualified foreign corporation. This typically requires that a foreign company either be covered under a tax treaty with the U.S. or that its stock be listed on a U.S. stock market, such as the New York Stock Exchange or Nasdaq Stock Market.

- The dividends must not fall into certain excluded categories, including dividends from mutual banks, tax-exempt organizations, or shares held in employee stock ownership plans.

- You must have owned the stock for at least 61 days in the 121-day period that starts 60 days before the stock trades ex-dividend. A longer holding period applies for preferred stock dividends that cover a period of longer than a year.

If you fail any one of these tests, then the dividend is not qualified, and ordinary income tax rates apply.