Other Ways To Adjust The W

If its so early in the year that you havent yet received any paychecks, you can just divide your total tax liability for the year that just ended by the number of paychecks that you receive in a year. Then, compare that amount to the amount thats withheld from your first paycheck of the year once you get it and make any necessary adjustments from there.

If you adjust your W-4 to make up for any underpayment or overpayment partway through the year, then youll want to fill out a new W-4 in January. Otherwise, your withholding will be off for the new year.

Of course, if your income fluctuates unpredictably, this is all a lot harder. But following the steps above should help you get close to a reasonable number.

And remember: You can redo your W-4 several times during the year if necessary.

What Should I Do If The Information I Provided Does Not Match What Is In The Irs Systems

Check all the information you entered is correct. It must match whats in our systems. Use the exact address and filing status from your latest tax return. If you are still receiving the message, you will have to use the Get Transcript by Mail option or submit a Form 4506-T to the IRS. See detailed instructions above.

What If I Can’t Pay All Of The Debt At This Time

After you receive your BILL FOR TAXES DUE the Department of Treasury may consider an Installment Agreement if your situation meets certain criteria.

For Installment Agreements lasting for 24 months or less, you must complete, sign and return the INSTALLMENT AGREEMENT . The agreement requires a proposed payment amount that will be reviewed for approval by Treasury. All highlighted areas of the form are required and must be filled in completely before your request for an Installment Agreement will be considered for approval. Failure to complete the required areas will result in a delay of processing and continued collection efforts will continue.

If you are interested in an Installment Agreement for a period longer than 24 months, please call the Collection Services Bureau for more information.

The Collection Services Bureau will file liens on Real and Personal property to protect the State’s interest as a creditor. Liens will be filed even when a taxpayer has made payment arrangements and is current with all payments.

If you have been contacted by the Michigan Accounts Receivable Collection System , please contact them directly for more information about Installment Agreements.

Treasury is providing an Offer-In-Compromise program that began January 1, 2015. This program will allow taxpayers to submit an offer to compromise a tax debt for less than the amount due based on specific criteria. To determine if you qualify visit www.michigan.gov/oic.

Read Also: How To Protest Property Tax Harris County

Refigure Your Tax Liability And Withholding As Needed

Making sure youre having enough tax withheld or paid in estimated taxes is never a finished task.

Whenever your situation changes you get married or divorced, you take on a freelance project, for example recalculate your income if necessary and go through the Form W-4 section under the Next Year main tab in TaxAct again.

Its a little more work than just paying too much or hoping for the best, but it pays off by giving you a lot more peace of mind about your standing with the IRS.

Use A Tax Withholding Estimator

The tax withholding estimator on the Internal Revenue Service website is particularly useful for people with more complex tax situations.

It will ask about factors like your eligibility for child and dependent care tax credits, whether and how much you contribute to a tax-deferred retirement plan or Health Savings Account, and how much federal tax you had withheld from your most recent paycheck.

Based on the answers to your questions, it will tell you your estimated tax obligation for the year, how much you will have paid through withholding by years end, and your expected overpayment or underpayment.

Don’t Miss: Protest Property Taxes Harris County

The Irs Places A Lien And Levies On Your Property

What most taxpayers who dont settle their taxes fear is when the IRS levies their property. An IRS levy can be applied to your assets such as bank accounts, houses, and cars. The IRS will also lien on your house at some point if you do not resolve it. And contrary to most think, the IRS does not immediately levy your property or assets right after you receive a notice from them. It usually takes a bunch of notices to be sent out before they actually start taking something from you. Read our post on the different kinds of IRS demand letters to learn more about them.

If Youve Been Overpaying

Unless youre looking forward to a big refund, try increasing the number of withholding allowances that you claim on the W-4.

Note that the IRS requires that you have a reasonable basis for the withholding allowances that you claim. It doesnt want you fiddling with its form just to avoid paying taxes until the last minute.

If you dont have enough tax withheld, then you could be subject to underpayment penalties.

Bear in mind that you need to have enough tax withheld throughout the year to avoid underpayment penalties and interest. You can do that by making sure that your withholding equals at least 90% of your current years tax liability or 100% of your previous years tax liability, whichever is smaller.

Youll also avoid penalties if you owe less than $1,000 on your tax return.

Recommended Reading: Protesting Property Taxes In Harris County

Consulting Tax Relief Professionals

The best way to determine your tax debt is by consulting liability experts. Such include tax attorneys, CPAs, and enrolled agents.

When working with these experts, all you need is to provide them with various identifying details. After that, they will determine the exact amount you owe, including penalties.

The main benefit of working with tax liability experts is that you will have an accurate figure of your debt. Besides, they can guide you in selecting a repayment program that is suitable for your financial status.

How Long Can You Owe The Irs

Penalties begin to accumulate on the day after the filing deadline. The IRS has a ten-year statute of limitations for collection actions. That means that the IRS has ten years from the date your taxes were assessed to pursue payment through collection.

However, each state has its own tax collection legislation.

Don’t Miss: Doordash Tax Forms

Negotiate Your Tax Bill

If your tax assessment is too high, you may be able to negotiate a better deal. Penalties may represent 25% of what you owe to the IRS. Getting these removed can make a real difference. File Form 843 to request an abatement of taxes, interest, penalties, fees, and additions to tax.

You might consider a Partial Payment Installment Agreement where the IRS agrees to accept less than the total you owe. The IRS will only agree to a PPIC if it’s clear that the monthly payments you can make will not cover your total taxes due for many years.

Another option to reduce your total tax liability is an offer in compromise . If the IRS accepts an OIC, it acts as an agreement between a taxpayer and the IRS to settle a taxpayer’s tax liabilities for less than the full amount owed. If you can fully pay your liability through an installment agreement or other means, you won’t generally qualify for an OIC.

How To Find Out If You Will Owe The Irs

If you’re not sure whether you will owe the IRS at the end of the year or get money back, there’s a pretty simple way to find out, according to Anjali Jariwala, a certified financial planner, CPA and founder of FIT Advisors in Torrance, California.

The IRS has a calculator where taxpayers can input their filing information, including how much they’ve worked, what they expect to earn, what deductions they might be eligible for and credits they could receive.

The calculator then estimates if you’re likely to get a refund or will owe the IRS.

“It is especially helpful to run your numbers if you receive large bonuses or other income streams that may not have been expected,” Jariwala said.

Throughout the year, people should also check their paychecks to make sure their employer is correctly withholding a portion of their income for taxes, said Fontes of University of Chicago.

In addition, taxpayers should hold onto any documentation about income such as 1099s, pay stubs and any other forms to prove what you’ve earned. Comparing that information to a previous tax return can also help people assess if they might get a refund or owe the IRS, Fontes said.

Of course, for those with more complex tax returns, Jariwala and Fontes recommend seeking professional help to make sure you’re paying your taxes correctly.

“If you’re a business owner, 1099 or have other tax complexity, then you should really use a CPA and have them run projections throughout the year,” Jariwala said.

Don’t Miss: Www Aztaxes Net

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

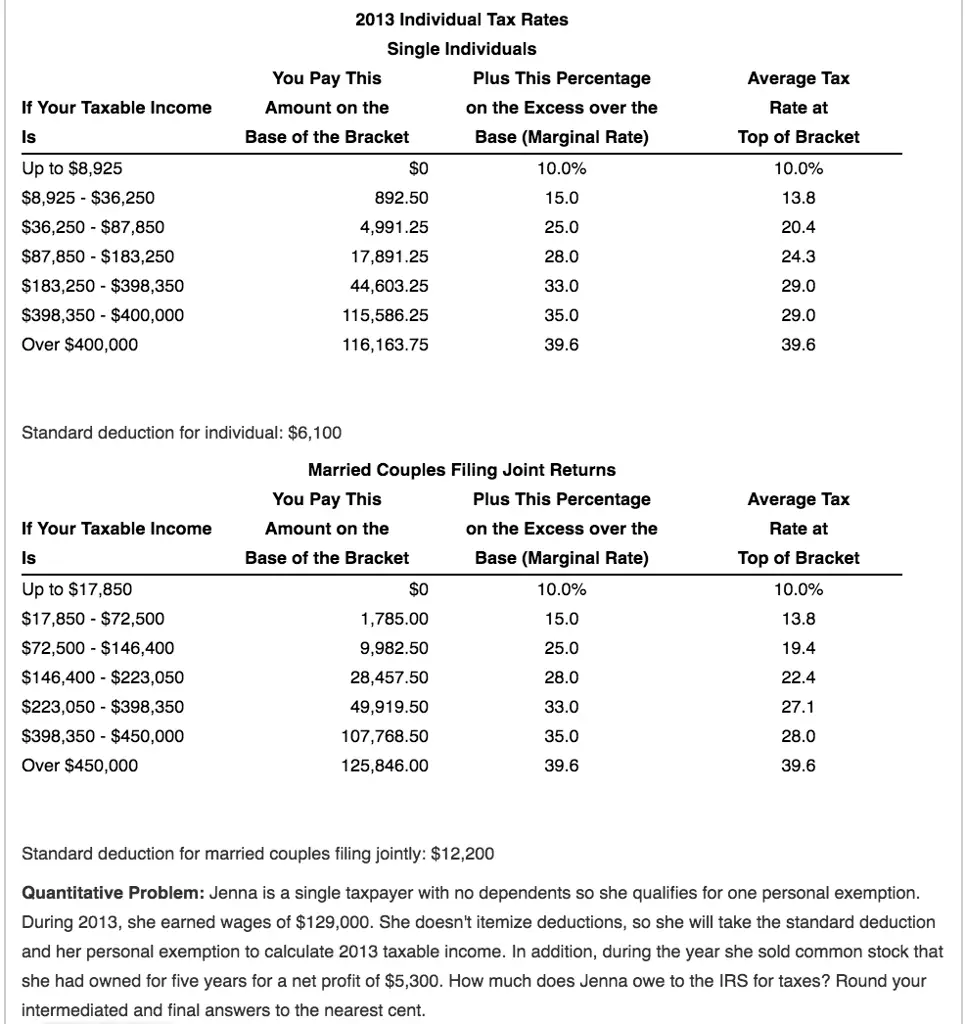

How To Arrive At Your Tax Due

After you’ve figured out your taxable income, there are a few more steps to arriving at your actual tax due.

- Subtract any payments and/or credits from your taxes owed.

- On lines 75 and 76, you will determine whether you owe taxes or will receive a refund.

If you’re getting a big refund, you’re probably having too much withheld from your paycheck. In effect, this means you’re giving the government an interest-free loan. On the other hand, if you have too little withheld, you may be charged an underpayment penalty.

Recommended Reading: Doordash How Much Should I Set Aside For Taxes

Places With The Savviest Investors

SmartAssets interactive map highlights the places in America with the savviest investors. Zoom between states and the national map to see where in the country the best investors live.

| Volatility | Post-Tax Return |

|---|

Methodology Our study aims to find the places in the country with the savviest investors. We wanted to find where people are not only seeing good returns on their investments but where they are doing so without taking too much risk.

In order to find the places with the savviest investors we calculated investment returns and portfolio volatility over the last year. We focused on data of user portfolios provided by our partner Openfolio.

We calculated the risk-adjusted return of the stocks using the Sharpe Ratio. The Sharpe Ratio is the stock return minus the risk-free rate divided by volatility.

We indexed and ranked each of the locations based on this risk-adjusted return to find the places where people were seeing the best returns for the least risk.

Finally, we calculated the amount of money investors were taking home after paying both federal and state capital gains taxes.

Sources: Openfolio – “Openfolio is a free and open network that lets people share their portfolios – but no dollar amounts, only percentages. The idea is that sharing will help everyone be better informed, like with this map.”

Anticipate Late Fees And Penalties

Unfortunately, the IRS is going to charge you interest and penalties on any amount you pay late. Like running a balance due on a credit card, these charges are going to make it harder to pay what you owe.

The more you’re able to pay on time, the less interest and penalties you’ll be assessed.

The IRS will eventually send you a bill, but you don’t have to wait to get the bill to make additional payments.

Pay what you can when you file your return, then send in whatever additional payment you can afford each payday using Form 1040-V.

You May Like: Plasma Donation Taxes

Going Online To Find Out How Much You Owe The Irs

The IRS offers an online tool to help you figure out how much tax you owe. The tool shows the balance for each tax year including the principal amount and any penalties or interest. It also shows payments youve made in the last 18 months and your payoff amount. Furthermore, with an update now in July 2021, you can see letters sent to you, pending payments, the amount owed by year an even economic impact payment information. There is also a way to access account and return transcripts as well.

The tool updates interest and penalties every 24 hours, but it usually takes one to three weeks for payments to post. If youve sent a payment recently, dont be too worried if it doesnt show up right away.

To use the service you need your social security number and date of birth, and to verify your identity, you need your filing status and your mailing address from your last tax return. You also need an email address and a mobile phone with your name on the account. Finally, you need an account number from a mortgage or home equity loan, a car loan, or a credit cardthat also needs to be in your name.

Although this may feel like jumping through a lot of hoops, its all in place to help safeguard your identity. The IRS pulls a credit report to verify you. This is a soft pull and it does not affect your credit rating.

If you need more details, you can use the online tool to view or print a transcript. You may also ask the IRS to mail you a transcriptthat takes five to ten days.

Determine What Percentage Of The Net Income Of The Business Is Yours

Next, you only have to pay taxes based on the percentage of ownership that you have in the company. So if you own 100% of the company you will be responsible for all income taxes however, if you only own 10% you simply need to take the Total Net Income of the business and multiply by your Percentage of Ownership to determine how much of the net income you are responsible for.

Don’t Miss: Doordash Tax Deductions

How To Calculate Your Adjusted Gross Income

Your adjusted gross income is an important part of your tax calculation. To get your AGI, you can subtract certain deductions from your income to reduce the amount of income that will be taxed.

Some examples of deductions that help determine your AGI:

- Deductible IRA contributions

- Contributions to a Keogh retirement plan

- Penalty on early withdrawal of savings

- Teacher’s education expenses up to $250

What Happens If You Can’t Pay Your Taxes

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

What happens if you complete your tax return and find that you can’t pay the amount you owe?

This isn’t supposed to happen. You’re supposed to pay income taxes gradually throughout the year so that in April you won’t owe much or will even be entitled to a refund of overpaid taxes. Employees have income tax withheld from their paychecks. Self-employed taxpayers pay quarterly estimated taxes directly to the Internal Revenue Service .

But sometimes your life situation changes or an unusual one-time event occurs during the year. When you prepare your annual return, you may get an ugly surpriseyou owe hundreds or thousands of dollars that you didn’t expect and simply don’t have.

While this isn’t a good situation to be in, it’s not the end of the world. There are a number of ways to resolve it.

You May Like: Is Selling Plasma Taxable

Is The Ftb A Debt Collection Agency In California

What some taxpayers initially fail to realize is that the FTB is not only a tax authority, but also functions as a debt collection agency for the state of California. Along with tax liens, tax levies, and wage garnishment, the interception of tax refunds is another debt collection tool at the FTBs disposal.

When Do You Have To File Tax Return If You Are Past Due

If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit. We hold income tax refunds in cases where our records show that one or more income tax returns are past due.

Don’t Miss: Tsc-ind

Find Out If You Owe The Irs With Help From Tax Professionals

Let the tax experts handle any back taxes owing to the IRS. Our staff will assist you in determining exactly how much the IRS claims you owe.

Well also assist you in determining tax relief options or payment choices with the IRS. For 30 years, weve been assisting taxpayers in settlements with the IRS. Please get in contact with us right now!

Now That I Know How Much I Owe How Do I Pay

The next step after finding how much you owe to the IRS is to make a payment. In some cases though, It might be difficult to pay the amount needed probably because the accumulated amount is too high, or maybe for reasons. In this case, there are also several options to settle your tax debt if you find it difficult to pay the IRS with the amount theyre asking from you. We do recommend consulting with a tax attorney before making any of the below decisions unless you can already pay it off easily.

Read Also: Doordash Tax Percentage