How A Tax Refund Works

Tax refunds are usually issued as paper checks that go through the mail or direct deposits to the taxpayer’s bank account. Alternatively, taxpayers can use the refund to buy U.S. Series I Savings Bonds. The fastest way to get a refund is to e-file your tax return and choose direct deposit.

Most refunds are issued within a few weeks of the date the taxpayer files their tax return. However, there may be some instances where a refund takes longer.

For example, taxpayers who claim the earned income tax credit will not receive their refunds before March .

Refunds are always pleasant, but it would be better to avoid overpaying in the first place by claiming correctly filling out your W-4 or precisely calculating your estimated taxes. The closer you get your refund to zero, the more money you will have throughout the prior year.

Of course, not everyone agrees. Some people consider tax refunds an alternative savings plan and look forward to the lump-sum repayment.

Why Is My Refund Still Processing After 21 Days

There are cases when you might have to wait for your refund longer than the standard 21-day period:

- If there are misspellings in your application

- If your submitted application was unfinished

- If you are the victim of theft or identity fraud

- If there is an Earned Income Credit or Additional Child Tax Credit included in your tax

- If you have submitted an Injured Spouse Allocation Application 8379, which could take up to 14 weeks for the IRS to process

- If your tax return needs to be reviewed more precisely

You can use the following opportunities to expedite the refund process. The IRS suggests two options that may reduce your waiting period:

- Always e-file your tax return

- Request reimbursement by direct deposit

Try avoiding standard mail on both the front and back of the tax-filling process. Using this tip will get your refund back in your hands a little earlier.

Please, note that IRS telephone agents might confirm your tax status only 21 days after your online submission, and six weeks after the paper filing submission .

If the refund approval process is stressful and devastating for you, or you dont have enough time, please consider relying on DebtQuestUSA. Our specialists are always ready to help you with any tax refund or debt issue, and ready to fix any of your financial problems, saving both your nerves and a lot of money.

See If Our Program Is Right For You

Tax Refund Information 152

I understand why users ask if the tax Topic of IRS 152 is good or bad because the first time they see it on the tax statement it can cause a sudden hiccup, but there is nothing to worry about for whatever reason.

If you didnt request a refund through Wheres My Refund, youll see the refunded item 152 on your tax statement.

Recommended Reading: How Do You Report Plasma Donations On Taxes

But The Irs Told Me To Wait 6 Or 9 Weeks Is That True

No. If you had no issue with your account, you don’t have to wait 6 weeks or 9 weeks. Even if you get an Error Code 9001, you don’t have to wait.

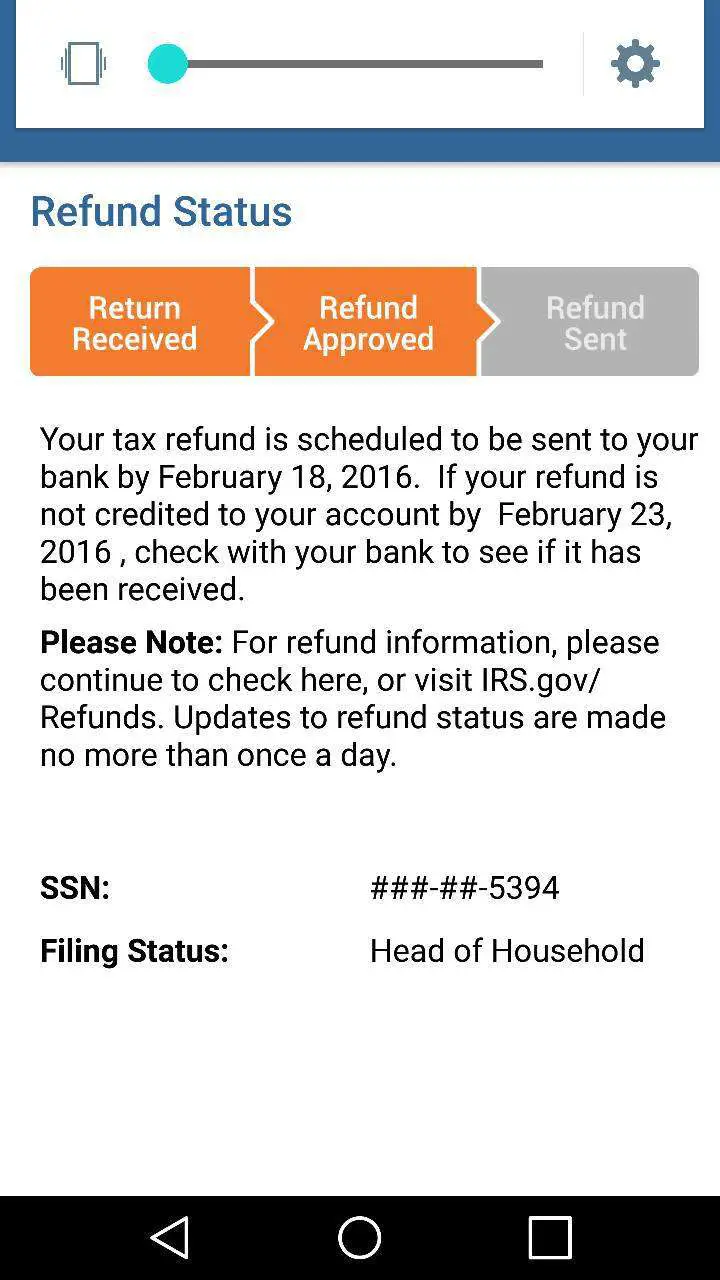

Don’t believe me? Well first, here’s a screenshot from one of our readers who got the 9001 error on 2/5, and now has a direct deposit date:

Second, still don’t believe me? Why would these IRS agents tell me that I need to wait? Because that’s what the operations manual tells them to do.

We went digging because a lot of people were talking about it, and here’s why they tell you this :

If the return was received, but not processed, one of the following will happen:

That sounds scary, but what does each of them mean?

So where did the 9 weeks come from? We couldn’t find it anywhere, but we think that it has to do with reps really trying to advice you NOT to call, because you don’t have to!

What Does Tax Topic 152 Mean My Status Went From Received To Now Tax Code 152

Here’s Tax Topic 152 from the IRS:

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. However, incomplete or inaccurate tax returns may require further review and could take longer than the normal processing time.

IRS representatives can research the status of your return only if:

- It’s been more than 21 days since you received your e-file acceptance notification,

- It’s been more than 6 weeks since you mailed your paper return, or

Processing times may take longer under the following circumstances:

- Refunds from amended returns are generally issued within 16 weeks.

- If you filed an injured spouse claim, refer to Topic 203 for more information.

- For refund claims with an application for an individual taxpayer identification number attached, refer to Topic 857 for more information.

- If you requested a refund of tax withheld on a Form 1042-S Form 1040NR , allow up to 6 months from the original due date of the 1040NR return or the date you actually filed the 1040NR, whichever is later, to receive any refund due.

You can also refer to Topic 303 for a checklist of common errors made when preparing your tax return and for additional items that may delay the processing of your return.

Topic 152 Refund Information. Taxpayers have three options for receiving their individual federal income tax refund:

I don’t know where you’re seeing it, but it means you have to choose how you want to receive your refund. Did you choose it in Turbo Tax?

Also Check: Csl Plasma Taxable

The Irs Might Not Be In The Same Hurry To Send Your Check That You Are In To Get It But You Can Take Steps To Eliminate Unnecessary Processing Delays

Well over half of this country lives paycheck to paycheck. Many people don’t have savings and when there’s an emergency, such as car breaks down, or a major catastrophe, like a fire or a serious illness, they don’t have any money to cope with the situation.

For millions of Americans, a tax refund is one of the biggest checks they see all year. They rely on this check.

If you’ve filed your taxes on time, you may be waiting anxiously for your refund. And waiting and waiting…

The IRS has set up a website appropriately named, Where’s my refund? This site will give you information about your federal income tax return 72 hours after the IRS acknowledges receipt of your return.

You will need to enter 3 things to get started:

1) Your Social Security number or Individual Taxpayer Identification Number

2) Your filing status

3) The exact whole dollar amount of your expected refund

This information will yield the status of your refund within 24 hours of an e-filed return or 4 weeks of a paper filed return. Now, if waiting for that check isn’t trying your patience enough, you may encounter an error code. Irritating, yes, but not insurmountable.

Your next step is to identify the code and see if any action is required. Each error has a specific set of steps that the IRS will follow, called Inquiry Response Procedure.

Here is the list of what the IRM Codes mean.

Another common code is 9001 this means you accessed WMR using a different SSN or ITIN. That could be a red flag.

What Does Your Tax Return Is Still Being Processed A Refund Date Will Be Provided When Available Mean

Although it may drive you crazy waiting for your refund, this status could just mean that the IRS hasnt approved your refund as yet and it reviewing your return.

- Most refunds are issued in less than 21 days. Additional review may be the case if you claim credits such as the Additional Child Tax Credit, or Earned Income Credit. This ensures that youre receiving the correct refund. This process may take longer, but it will change eventually.

You May Like: Michigan Gov Collectionseservice

I’m Getting An Error Code 9001

IRS Error Code 9001 is becoming a very common error code that a lot of people are reporting on Where’s My Refund.

But what does it mean? According to the IRS, all it means is that the Where’s My Refund system was accessed by a secondary SSN on the return.

Some of the common themes I see with this are:

- Wife accessed the return, but husband was primary filer

- Kids accessed the return, but parents were primary filers

- Family isn’t communicating and telling the other person they accessed it

- Typos – Typo on the return or typo entered information on WMR

The bottom line is that IRS Code 9001 means NOTHING for your return status. It has nothing to do with identity theft directly , and it is no reason to call the IRS. For more information, see our detailed write-up on IRS Code 9001.

What Does Return Received Or Accepted Mean

The IRS updates you with We have accepted your tax return and it is being processed. This is solely to update you that your return was successfully received by the IRS. This status update does not mean your return was approved. It simply means the IRS has it and it is in line to be reviewed and processed.

- The Return Received status may remain longer than you were expecting. You may have friends who had this status displayed on their page for only a few days and yours has remained much longer. Dont panic, it happens.

Recommended Reading: Square Dashboard 1099

Irs Tax Refund Processing Schedule And Direct Deposit Cycle Chart When Will I Get My Refund In 2022

The upcoming tax season should hopefully be better than the last, but tax filers should still expect long processing delays and late refund payments. The reasons will likely be the same, but hopefully the severity will be far less.

Delayed refund payments will likely be due in large part to the ongoing processing and payment of catch-up stimulus checks, child tax credits, unemployment income refunds and the many other tax breaks/credits Congress enacted under various pandemic relief legislation bills.

Coupled with ongoing staffing and funding shortages, it is highly likely that the IRS will again push out the start of processing tax returns in 2022 and as expected refund processing will stretch well into summer as the IRS clears their large back log of current and past tax year returns, in addition to making payments.

The estimated 2021-2022 refund processing schedule table below has been updated to reflect the potential delayed start and extension to the tax season. Note that refund deposit dates could be much longer than shown if your return is pulled for additional security or manual processing checks. To get the exact date of your refund payment check the IRS Where is My Refund tool/app. See this article for other reasons your refund payment may be delayed.

Stay In the Know:or follow us on , and

| Tax Return Accepted by IRS |

|---|

I Called And Verified My Id

The IRS has been cracking down on identity theft for the last several years. This is a great thing, because a lot of people were becoming victims of tax refund identity theft.

However, a lot of people think they are “verifying their identity” when they call the IRS. And while this is true, it’s not identity theft related.

You May Like: Tax Lien Investing California

Dont Stress You Wont Miss This Flight

Have you ever walked into an airport and realized you and everyone around you seem to be in a rush? Well, tax filers tend to mimic the same anxious energy, especially those trying to figure out their tax refund status.

We understand that like the airport checking luggage-security-shoes-off whirlwind, tax filing is also something you dont do every day and can be pretty stressful. Actually, filing your taxes is the hardest part though so give yourself a pat on the back, sit back and await your refund.

What Does Refund Sent Mean

Once the IRS updates you that your refund has been sent, the deal is sealed. You should be receiving your refund via check or direct deposit. In most cases, youll even be issued an approximate date to expect your money to arrive.

- If you had your tax refund direct deposited, it may take your bank or financial institution 1-5 business days to deposit the tax refund money into your account. If instead, you opted to have your tax refund sent to you in the mail, by check, you should expect to wait much longer.

Don’t Miss: How To Look Up Ein Numbers For Tax Purposes

Taxpayers Have Three Options For Receiving Their Individual Federal Income Tax Refund:

| 3222 Answers, 6 Friends, 128 Followers |

| 2 |

What does tax refund topic 152 mean?

Add Your AnswerI checked on my return status and it said tax refund topic 152 applies to my situation. Is this a real problem? Should I be worried?| Can you help us by answering one of these related questions? |

We need your help! Please help us improve our content by removing questions that are essentially the same and merging them into this question. Please tell us which questions below are the same as this one:

| What does tax refund topic 152 mean? |

The following questions have been merged into this one. If you feel any of these questions have been included in error help us improve our content by splitting these questions into seperate discussions. Please unmerge any questions that are not the same as this one:

| What does tax refund topic 152 mean? |

What Is Tax Topic 152

Topic 152 is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. Unlike other codes that a taxpayer might encounter, Tax Topic 152 doesn’t require any additional steps from the taxpayer.

According to the IRS, 9 out of 10 tax refunds are processed in their normal time frame of fewer than 21 days. But if you come across a reference to Tax Topic 152, your return may require further review and could take longer than the typical 21 days.

Keep in mind this tax topic doesn’t mean you made a mistake or did anything wrong when filing. It simply means your return is being processed and has yet to be approved or rejected.

Read Also: Tsc-ind Ct

What Does Refund Approved Mean

The IRS updates you with Your refund has been approved. This means that your return was processed successfully and the estimated refund amount was approved by the IRS. Youre one step closer to getting that refund!

- This refund status is the second stage of the IRS refund updates and means you have nothing to worry about.

What Does It Mean When Tax Topic 152 Disappears

When checking your tax status on Wheres my Refund, there are instances where the bars with tax topic 152 will disappear.

When that happens, you do not need to panic.

It does happen on WMR.

Here is why:

Your status on Wheres my Refund keeps changing in the course of processing your tax return.

Sometimes you will get a deposit date but still contains still processing, and in addition to that, the IRS 152 notice will also disappear.

If that happens, it is only the Internal Revenue Service that can give you accurate information on your status as well as the tax code 152.

You May Like: 1099 Nec Doordash

How Can I Ensure There Aren’t Any Delays

Before you sit down to fill out your tax return, make sure you have all of the necessary information at hand. This might include:

- Income-related forms you received, such as W-2s or any 1099s

- Any necessary forms for reporting your health insurance coverage, such as a Form 1095

- Your previous years tax return and your taxpayer identification number

- Personal identification information such as full names, Social Security numbers, and birthdates for yourself, your spouse, and any dependents

- Your Identity Protection PIN if you were issued one by the IRS

TurboTax offers a complete checklist with all of the information youll need to report on your taxes. Beyond the basics, this list also includes information on non-work-related income, such as dividends, and information for reporting credits and deductions, such as childcare costs or the charitable contributions you made during that tax year.

Its important that you dont guess or estimate when filling in any of these amounts. Keeping careful financial records will help you report accurately and avoid errors or delays.

It’s also critical that you double-check all of the information on your return to ensure it is correct and complete. Turbo Tax helps walk you through these steps when filing your return. You can also use e-file and direct deposit to ensure that you’ll receive your refund as quickly as possible.