How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Tax Return Calculator Faq

What is the financial year or tax year?

The financial year begins on 1 July and ends on 30 June the following year. Any money you earn during this period through a salary, wages, investments, shares, or capital gains will represent your taxable income for that tax year.

How much tax can I get back?

The amount of tax you can get back through an end-of-year refund will depend on the amount of tax you have paid throughout the year, and whether the amount is relative to your marginal tax rate. If you think you have overpaid tax, you can use the tax return calculator to estimate your refund in seconds.

Do I need to lodge a tax return myself?

If you earned income during the tax year, you will need to lodge a tax return. If you do not wish to complete your tax return yourself, you can engage the services of a registered tax agent to help prepare and submit your return on your behalf.

What are reportable fringe benefits?

Fringe benefits are benefits received by an employee additional to their salary. If an employee receives fringe benefits with a total taxable value greater than $2,000 during the Fringe Benefit Tax year , the employer must apply a gross-up rate to the amount and show this on the employees payment summary.

Products

Disclaimer

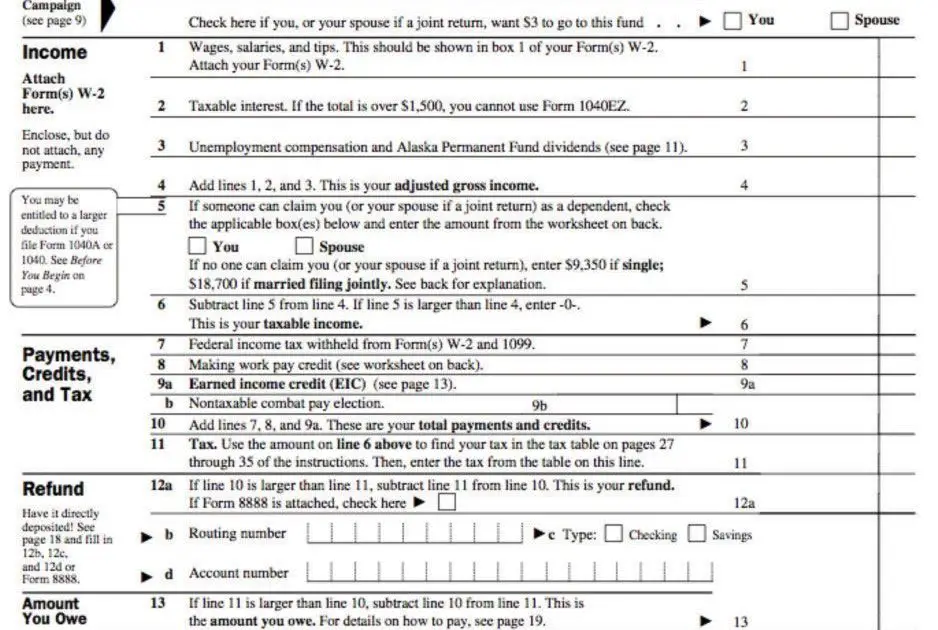

Calculating Self Assessment Tax Bills

You must have an accurate calculation of how much tax is due so that you can make the right payments.

- If you use HMRC’s Self Assessment online service, tax calculations can be handled automatically.

- You can ‘view your calculation’ once you have completed the details in the return but before you submit the return.

- Once you have submitted the completed return, your final tax calculation should be available in your online personal tax account within 72 hours.

- If you choose to complete a paper return, HMRC sends your tax bill to you in the post.

- You may find it easier to use commercial tax return software to help you prepare and file your tax return.

Your online tax account can also show you details of previous year’s tax bills and how they were calculated.

Don’t Miss: Calculate Doordash Taxes

How To Make Your Tax Refund Bigger

Most Canadians prefer to increase their tax refund. This strategy is akin to using the CRA as a kind of piggy bank.

Its pretty easy to increase your tax refund. You can fill out Form TD1 to get your employer to increase the amount collected. Otherwise, you will have to decrease your taxable income through using deductions or decrease your tax payable through using credits.

Your Banking Information Is Incorrect

Have you changed bank accounts since you last filed your taxes? If so, pay close attention to what the direct deposit information says when submitting your return this year. If you accidentally forget to update it with your new direct deposit details, your refund will be sent back to the IRS. This will likely result in a paper check being mailed to your house, which could take several weeks longer to arrive.

Also Check: Do I Have To Pay Taxes For Doordash

What Is My Filing Status

It depends the filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow. If you support a child or relative, they may qualify as your dependent. There are different requirements for qualifying children and qualifying relatives, but both types of dependents must be a U.S. citizen, U.S. national, or U.S. resident alien. You must be the only taxpayer claiming them, and they must be filing single or married filing separately if they’re required to file their own return. For more, see Who Can I Claim as a Dependent?

How To Pay Tax And National Insurance When Self

Each year, youll probably have to submit a Self Assessment tax return for the previous tax year.

For the 202021 tax year, youll need to submit your tax return by:

- 31 October 2021 for paper tax returns

- 31 January 2022 for online tax returns.

You will, among other things, need to declare your total income and expenses.

When youve completed and submitted the return, youll be told how much tax and National Insurance you owe. You need to pay this by 31 January 2022 for the 202021 tax year.

Self Assessment extension

If you cannot file or pay your Self Assessment tax return by 31 January 2022, you will not be charged late filing or payment penalties if your return is submitted by 28 February 2022 and is paid in full by 1 April 2022.

However, you will still be charged interest from 1 February 2022, so if you can pay, its in your interests to do so.

You May Like: How Do I File Taxes With Doordash

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Through A Registered Tax Agent

A registered tax agent can also help prepare and lodge your tax return. You will need to first select an agent registered with the Tax Practitioners Board , and make an appointment to discuss your tax return.

Once youve chosen your agent, you will need to prepare any tax records to take to the appointment if you are using the ATOs myDeductions tool, you can track any work-related deductions throughout the year and email then directly to your tax agent.

Your agent will prepare your tax return and inform you of any possible improvements, or additional deductions which you may be unaware of. As they offer the most comprehensive preparation of your tax return, using a tax agent will often ensure you receive the maximum refund possible.

| Pros | Cons |

|---|---|

|

A professional will prepare your tax returnEnsures all deductions are includedWill offer suggestions on improving your tax return Youll need to keep accurate records of any expenses and possible deductionsCan inform you about deductions you are unaware of |

Fees required to prepare and submit your tax returnRequires choosing a tax agent and making an appointmentYoull need to keep accurate records of any expenses and possible deductions |

Read Also: Pastyeartax.com Reviews

How Do State And Federal Taxes Affect Your Refund

In addition to federal income tax, you may also pay state income taxes depending on where you live. You wont pay state income tax if you live in one of these eight states: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

New Hampshire doesnt tax wages, but does tax dividends and interest, though recent legislation has been passed to phase out this tax beginning in 2024.

If you live in one of the other 41 states, youll need to file a state tax return in addition to your federal tax return. The IRS website contains a directory to help you find information on your states tax requirements.

Key Differences Between State and Federal Taxes

- State tax rates are typically lower than federal tax rates.

- States can have different types of tax credits and deductions.

- The amount of tax withholdings will vary for state and federal taxes.

Who Cannot Get An Estimate Online

You cannot get an estimate online if you:

- are entitled to claim

- were born on or before 5 April 1938 and get the higher allowances

- have other taxable income, for example from dividends and trusts

- are a higher rate taxpayer and want to estimate your Gift Aid tax relief

You can check youve paid the right tax by contacting HMRC or by getting help from an accountant.

You May Like: How Much Money Should I Save For Taxes Doordash

Work Out How Big Your Tax Refund Will Be When You Submit Your Return To Sars

INCOMEOTHER INCOMETAX PAIDTo get this refund you need to fill out your tax return 100% correctly.Please note that this is only an indicator of an estimated refund.TaxTim cannot be held liable for this refund not being received.Get SARS Tax Dates and Deadlines in your InboxDo your Tax Return in 20 minutes or less!TaxTim will help you:

How Long Does It Take To Get A Tax Refund

The IRS usually issues federal tax refunds within three weeks. Some taxpayers may have to wait a while longer, especially if there are errors in your return.

When an issue delays your return, its resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to the IRS website.

The date you receive your tax refund also depends on the method you used to file your return.

If your tax refund goes into your bank account via direct deposit, it could take an additional five days for your bank to put the money in your account. This means if it takes the IRS the full 21 days to issue your check and your bank five days to deposit it, you could be waiting a total of 26 days to get your tax refund. Online services like Venmo and Cash App can deliver your tax refund a few days sooner since there’s no waiting period for the direct deposit.

If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

Also Check: Www.myillinoistax

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

When Do I Pay The Tax Due And What Payment Options Are There

Usually Self Assessment payments are due by 31 January following the end of the tax year to which they relate. So tax due for the 2021/22 tax year is due for payment by 31 January 2023.

Some taxpayers need to make instalment payments towards their annual Self Assessment bill for the following year.

These are called payments on account. Generally speaking, if you come within the payment on account regime you will need to make payments on 31 July in each tax year as well as on 31 January.

It can be quite tricky to get to grips with payments on account, and if you are having trouble understanding your payments, we explain the rules in detail in our self-employment section.

If you are liable to payments on account, the typical payment cycle looks like this:

Self Assessment payment options by LITRG

There are various ways to settle any payments due and these include cheque, bank transfer, debit card, but not personal credit card. See Pay your Self Assessment tax bill on GOV.UK.

Make sure you have the correct reference number when you make any payment so HMRC correctly allocate it to your account. This will be your 10-digit UTR number, usually followed by the letter K.

Read Also: Reverse Ein Search

Tax Incentives For Tesla Buyers

If youre a current or prospective Tesla owner and have read this far, youre probably not super psyched right now. Teslas record number of sales is great for the automaker, but not for your tax return, right?

Tesla has compiled its own database of resources by state to help its customers calculate their potential savings before they even commit to buy.

Its also important to note that all incentives mostly apply to purchases by cash or loan only.

Status Of The $12500 Federal Tax Credit For Evs

When the aforementioned $1.2 trillion infrastructure bill was passed in November of 2021, House Speaker Nancy Pelosi had planned to also vote on the $1.75 trillion Build Back Better Act and the $12,500 federal EV tax credit within it.

However, a small group of moderates in the House refused to support the legislation without a cost estimate from the Congressional Budget Office . As a compromise, the House approved a procedural vote required to open Bidens Build Back Better Act to passage, following an official CBO cost estimate.

While the larger infrastructure bill and social safety net did inevitably pass through the House, the Senate was unable to come to terms on a bill that garners enough votes, thus missing the Presidents deadline to get Build Back Better signed before the end of 2021.

The Build Back Better Act and its potential $12,500 EV credit appears DOA at least for now. We will continue to follow its progress and update this page with the latest as it hopefully moves forward.

Read Also: Www 1040paytax

Will I Get A 2021 Tax Refund

Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe. This most commonly occurs if too much is withheld from your paychecks. Another scenario that could result in a refund is if you receive a refundable tax credit that is larger than the amount you owe. Life events, tax law changes, and many other factors change your taxes from year to year. Use our tax refund calculator to find out if you can expect a refund for 2021 .

What Penalties Can I Be Charged Under Self Assessment

There are four categories of penalty which might be charged under the Self Assessment regime.

All these penalties can be appealed, for example if you have a reasonable excuse, special circumstances apply, or you took reasonable care to get your tax right. If you make an appeal, you must usually do so within 30 days of the date of the penalty notice. Interest will also be charged for late paid tax.

|

Type of penalty |

|

|

Calculated as a percentage of unpaid tax as a result of the inaccuracy |

For taxpayers within Self Assessment, a new penalty regime for late filing and late payment is expected to be introduced from 6 April 2024 for taxpayers who will be in scope of Making Tax Digital for Income Tax Self Assessment . If you will not be in scope of MTD for ITSA, the new regimes will start from 6 April 2025.

Read Also: Doordash Driver Tax Deductions

Work Mileage And Tax Rebates

Travel to temporary worksites is one of the main reasons why people end up being owed tax rebates each year. Our quick and simple will give you an instant estimate* of how much you can claim back from HMRC for your work travel.

The basic system works like this: HMRC has decided on a set of for essential work travel. If youre footing the bill for public transport or travel in your own vehicle to a temporary workplace, the taxman says you can be reimbursed up to the appropriate AMAP rate. If youre getting nothing toward your travel from your employer, or getting less than the AMAP rate you qualify for, you can claim back the difference as a tax rebate.

Cars and vans:

- 45p per mile for the first 10,000 miles.

- 25p per mile after that.

Motorcycles:

Tax Refund Calculations

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

Also Check: Finding Your Ein Number