Estimate Taxable Income For The Year

Letâs start with Stephanieâs income tax. In order to estimate how much income tax she will have to pay for the year, Stephanie estimates her income for the year . She then subtracts any above-the-line deductions she thinks sheâll incur for the year.

$90,000 minus $15,000 = $75,000. This new number is Stephanieâs âadjusted gross income.â

Then, she subtracts the standard deduction for single tax payers in 2020, which is $12,550.

Stephanie can also deduct 50% of her self-employment tax of $12,716.59 . She can deduct $6,358.

So her total estimated taxable income is $56,092.

How To Calculate The Salaries And Benefit Rates Of W

Contractors dont always get the added benefits of health insurance, paid time off, and other employer-paid benefits that W-2 employees do. 1099 workers have to provide these benefits themselves. As a rule of thumb, benefits are worth about 30% of a workers total compensation package, according to the U.S. Bureau of Labor Statistics.

A March 2020 report found that employer costs for employee compensation for civilian workers averaged $37.73 per hour worked. Wages and salaries cost employers $25.91 while benefit costs were $11.82. These benefits include paid leave, health insurance, retirement savings, and other legally required benefits.

Knowing this, a 1099 contractor needs to make a minimum of 30% more than W-2 employees to match employee compensation, including benefits.

Learn How To Calculate Your Estimated Payments

Every individual who must file a New Mexico personal income tax return must pay estimated tax under Section 7-2-12.2 NMSA 1978. You can meet this requirement through withholding or estimated tax payments. If you owe state income tax, you must pay estimated tax when the tax shown on the return for the year is more than the amount withheld under the Withholding Tax Act by at least $500. To make this calculation do not include tax withheld under the provisions of the Oil and Gas Withholding Tax Act .

If the difference between the tax shown on the return and withholding tax paid is more than $1,000 the Department determines whether the required annual payment was made and computes penalty on underpayment. The required annual payment is either 90% of the current years tax liability or 100% of the prior years tax liability. You must have filed a full-year New Mexico personal income tax return in the previous year to be eligible for the second option.

For calendar-year filers who owe estimated tax payments, estimated tax payments are due by April 15, June 15, and September 15 of the tax year, and by January 15 of the following year. If a due date is a Saturday, Sunday, a State or national legal holiday, the payment is timely when the postmark bears the next business days date. Delivery by a private delivery service is timely if the date on the delivery services records is on or before the required mailing date.

Also Check: Taxes For Doordash

One Size Does Not Fit All

It is important to keep in mind, there is no one-size-fits-all scoring for these criteria that automatically determines whether or not someone falls into either employment status. Rather, the IRS suggests that business owners take all of these factors into consideration in order to help determine a worker’s status.

Fortunately, if you’re still unclear after assessing the status of a worker, you can use IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, so the IRS can help determine this for you. Form SS-8 may be completed by either the employer or the worker to determine employment status.

When Are Quarterly Taxes Due For 2021 And 2022

To avoid an Underpayment of Estimated Tax penalty, be sure to make your payments on time for tax year 2021:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

For tax year 2022, the following payment dates apply for avoiding penalties:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

You May Like: Do You Have To Pay Taxes On Plasma Donations

Forms For Investment Income

As mentioned above, you may or may not receive a 1099 form for a specific tax year. Your investment company or financial institution will look at your account activity for the year to determine if you should receive a form. If you dont have a certain type of income activity in that year, you wont get that 1099 type.

For example, if you didnt take money out of your retirement account last year, you wont receive a 1099-R this year .

Add It All Together And Divide By Four

Now, the final step. To calculate her estimated quarterly tax payments for each quarter, Stephanie simply adds together her income tax and her self-employment tax for the year and divides this number by four. Voila.

$8,130.24 + $12,716.59 = $20,846.83 .

$20,846.83/4 = $5,211.71 .

If you filed your previous yearâs taxes with the help of a CPA, they should also be able to send you estimates for this yearâs payments. And if youâre paying estimated quarterly taxes for the first time, it canât hurt to run your numbers by a CPA before submitting.

Recommended Reading: Amended Tax Return Online Free

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

Do You Owe Estimated Taxes

The most important detail to understand is how much and what type of income places you in the position of paying estimated taxes. Self-employed taxpayers normally must pay quarterly estimated taxes. However, individuals who receive large, untaxed windfallsfrom investment gains from stocks for examplemay also be required to pay estimated taxes.

- You generally have to make estimated tax payments if you expect to owe tax of $1,000 or more when you file your return.

- Estimated tax payments are made on a quarterly schedule established by the IRS.

Here are some common myths and misconceptions surrounding quarterly estimated tax payments and IRS Form 1099.

Don’t Miss: How To Correct State Tax Return

The Benefits And Drawbacks Of Being A 1099 Employee

Pros

- You set your own schedule. Work whenever you see fit, so long as you meet your deadlines and obligations.

- Control the projects you take. Choose what you want to work on. If you arent happy with a client, you arent obligated to continue working with them.

- Work from anywhere. As an independent contractor, you can work wherever you can render your services at home, at a friends house, from the cafe down the road or halfway around the world.

Cons

- More tax obligations. With a 1099-MISC, you may have to deal with additional tax payments throughout the year or lump-sum prepayments on top of your usual filing.

- No benefits or protections. Health care and retirement arent built into your services like they are with more traditional employers. With mandatory health insurance regulations in place, youll need to cover your bases to avoid paying the individual mandate penalty.

Instacart 1099 Tax Forms

By January 31st, Instacart sends all their contractors 1099- forms and files a copy to the IRS too, complying with the US tax law. Starting from 2021, the previously used 1099-misc forms are getting replaced with 1099-NEC for non-employee compensation. This form documents your taxable income from last year made through Instacart platform, usually if you are a part-time driver.

If you drove full time, earned more than $20,000, and had more than 200 transactions in 2020, youâll usually get a 1099-K form. Vermont and Massachusetts are an exception to this rule. If you live there and made more than $600 last year as an independent contractor, you’ll receive a 1099-K form, instead of the NEC form.

Don’t Miss: Is Plasma Donation Money Taxable

Let Tax Software Do The Work

If you usually use tax software or an online tax service such as those offered by TurboTax or H& R Block, estimation should be easy. Tax software will estimate your freelancer quarterly taxes for you based on the previous year and any new information you input. You can then complete Form 1040-ES within the software as you do with your other tax forms.

Home Office Or Office Space Rental

Self-employed people often work remotely at home or rent out an office space for themselves. If you rent space, you can deduct your monthly rent payment and any equipment you rent.

If you work out of a home office, you can potentially write it off. However, this is a bit more complicated and involves a few requirements. But it can be done.

The standard method and the simplified method both require exclusive business use. In the standard method, youâll need to determine your home office expenses, making sure to track everything in great detail.

With the simplified option, office space shouldn’t exceed 300 square feet. Youâll need to multiply the square footage of your home office space by the IRS rate. The IRS uses $5 per square foot to calculate your deduction.

Read Also: Do You Have To Pay Taxes On Plasma Donations

How To Make Estimated Tax Payments

Submitting your payment to the IRS is a breeze: just fill out form 1040-ES and mail it along with a check to the IRS office closest to you.

You can also pay estimated taxes online online or by phone via the IRS Payments Gateway.

For corporations, payments must be filed through the Electronic Federal Tax Payment System.

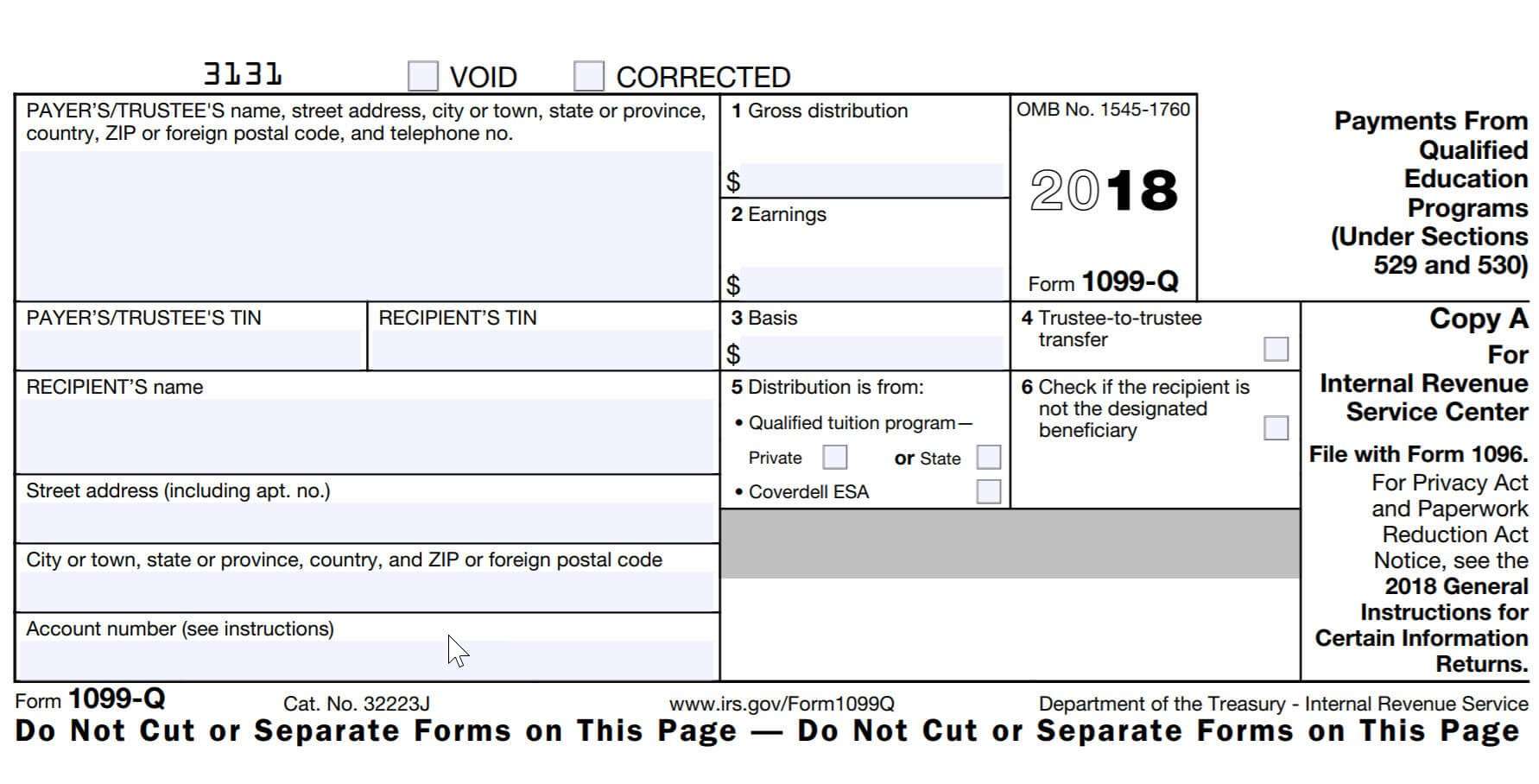

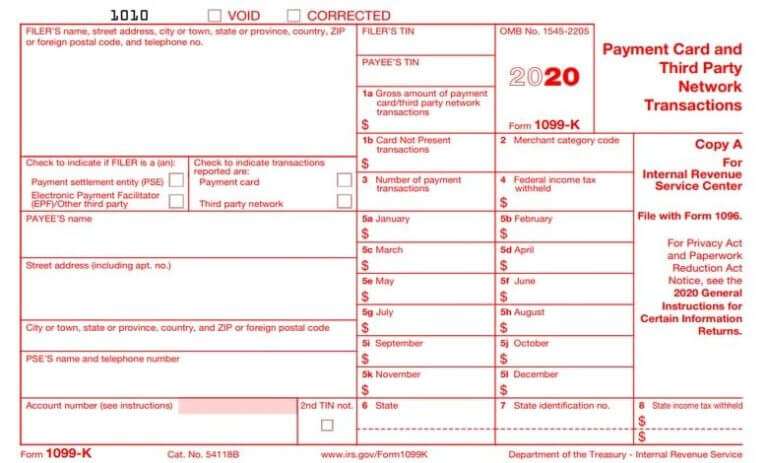

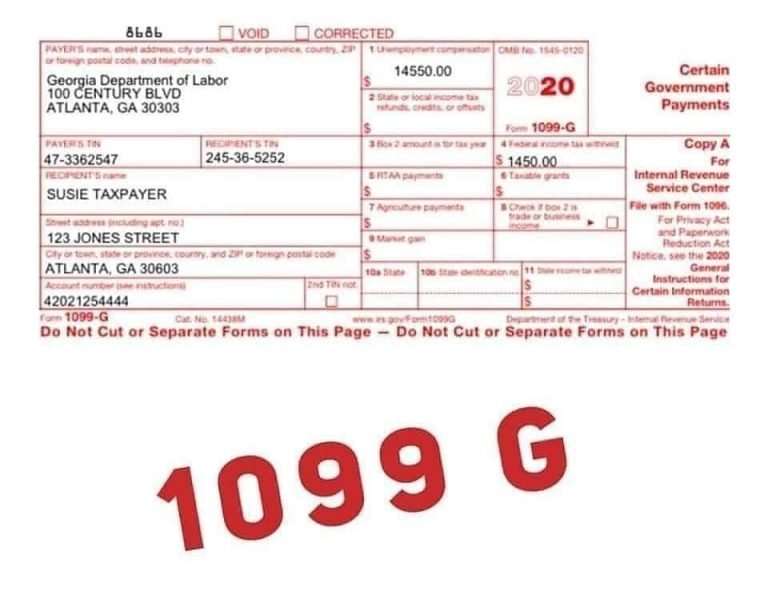

What Is Form 1099

Form 1099 is a tax information return that reports income received outside of wages, salaries and tips. There are three different versions, each with different purposes:

- Form 1099-NEC reports how much a business paid annually to nonemployees, including independent contractors

- Form 1099-MISC reports a businesss miscellaneous payments

- Form 1099-K reports payment card transactions through third-party networks

Read Also: Where Do I File My Illinois Tax Return

Who Is Responsible For The Independent Contractor’s Federal Payroll Taxes

Independent contractors are responsible for their own federal payroll taxes, also known as self-employment tax. This is a two-part tax, with 12.4% going to Social Security and 2.9% going to Medicare, for a total of 15.3%. Payments are usually filed quarterly using Form 1040-ES, Estimated Tax for Individuals. Freelancers may also have to pay state and local tax, depending on the jurisdiction.

As mentioned previously, however, there are some instances where a service recipient is required to deduct taxes from an independent contractors pay. Backup withholding typically occurs when freelancers provide the wrong TIN or incorrectly report their income on a tax return.

How Much Should I Pay And What Can I Deduct

As a worker in the gig economy, you play by the same rules as independent contractors, freelancers, and other gig workers. You have to pay federal and state taxes and the self-employment tax. As painful as it is, your tips are taxable income too, so you have to pay taxes on them too. But thereâs a big advantage that can the higher taxes worth it.

Also Check: Efstatus Taxactcom

Received A Payment And Other Reporting Situations

If, as part of your trade or business, you received any of the following types of payments, use the link to be directed to information on filing the appropriate information return.

- Payment of mortgage interest or reimbursements of overpaid interest from individuals

- Sale or exchange of real estate, for example the person responsible for closing the transaction

- You are a broker and you sold a covered security belonging to your customer

- You are an issuer of a security taking a specified corporate action that affects the cost basis of the securities held by others

- You released someone from paying a debt secured by property or someone abandoned property that was subject to the debt or otherwise forgave their debt to you

- You made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment

What Defines A Verbal Contract

A verbal contract refers to an agreement between two parties that’s made ââ¬âyou guessed itââ¬â verbally.

Formal contracts, like those between an employee and an employer, are typically written down. However, some professional transactions take place based on verbally agreed terms.

Freelancers are a good example of this. Often, freelancers will take on projects having agreed on the terms and payment via the phone, or an email. Unfortunately, sometimes clients don’t pull through on their agreements, and hardworking freelancers can find themselves out of pocket and wondering whether a legal battle is worth all the hassle. Ã

The main differences between written and oral contracts are that the former is signed and documented, whereas the latter is solely attributed to verbal communication.

Verbal contracts are a bit of a gray area for most people unfamiliar with contract law ââ¬âwhich is most of us, right?ââ¬â due to the fact that there’s no physical evidence to support the claims made by the implemented parties.

Also Check: Www Michigan Gov Collectionseservice

When Are The Quarterly Estimated Tax Payments Due

Quarterly tax payments are due April 15, June 15 and September 15 of the tax year, and January 15 of the next year. Your income tax liability accrues on income as it is earned, rather than being due on April 15 of the next year.

If you receive income unevenly during the year you may annualize your income. Complete the MI-2210 Annualized Income Worksheet to determine what quarter your payments are due.

You may make estimated tax payments using Michigan Department of Treasury’s e-Payments system or mail your estimated payment with a Michigan Estimated Tax voucher .

To ensure your estimated tax payment is received timely, allow 3 to 5 days for an electronic payment to be received and 2 weeks to post to your account. Allow 2 weeks for a mailed payment to be received and 8 weeks to post to your account.

Note: Payments that are not received by the due date will be applied to the following estimated tax quarter.

Penalty is 25% for failing to file estimated payments or 10% of underpaid tax per quarter. Interest is 1% above the prime rate.

What Taxes Do Self

As a self-employed individual, you file an annual return but usually pay estimated taxes every quarter. Quarterly taxes generally fall into two categories:

- The self-employment tax

- Income tax on the profits that your business made and any other income

For example, in the 2021 tax year:

- The self-employment tax rate on net income up to $142,800 for tax year 2021 is 15.3%. That breaks down to 12.4% Social Security tax and 2.9% Medicare tax. As your income increases past this amount, the 2.9% Medicare tax continues but the Social Security portion stops.

- High earners generally, individuals with incomes of $200,000 and above or married couples with incomes of $250,000 or more are subject to an additional Medicare tax of 0.9%.

To calculate your taxable income as a business owner:

- Take your expected annual gross income the total revenue you received and deduct expenses and any deductions you’re eligible for. For example, if your annual revenue came to $100,000 and you had business deductions that total $30,000, your taxable income amounts to $70,000.

- $100,000 – $30,000 = $70,000 taxable income

Also Check: How Do I Protest My Property Taxes In Harris County

What Is A 1099

Many people misunderstand what a Form 1099-NEC denotes and who receives it.

If you’re considered an employee of a companywhether salaried or paid by the houryou’ll likely receive a Form W-2. Form W-2 shows how much money has been withheld throughout the year for federal, state, Social Security and Medicare taxes.

- You’ll be responsible for paying half of the payroll taxes due based on your taxable income and it’s withheld from paychecks.

- Your employer pays the other half.

For the income reported on a Form 1099-NEC, however, generally no tax has been withheld by the party that paid a self-employed individual for work performed. If you’re self-employed, you’re responsible for paying both the employer and employee portions of payroll taxes.

- Some people mistakenly believe that if they receive a Form 1099, it does not necessarily mean the IRS received a copy. That scenario, however, is highly unlikely. If you received a 1099, the IRS most likely received one, as well.

- Similarly, people mistakenly believe that if they did not receive a Form 1099, they don’t have to report the income. The IRS does not care whether you received your Form 1099. If you received taxable income, you must report it.

In fact, beginning back in 2012 businesses and corporations must respond, via a line-item question on their tax forms, whether they paid miscellaneous income during the year and whether they issued the appropriate 1099 forms.