What Is The Inheritance Tax In Pennsylvania

If youre planning on transferring your assets to a surviving spouse in Pennsylvania, the good news is that the inheritance tax in that scenario is 0%. There is also a 0% tax if youre giving your assets to your child aged 21 or younger. Any property that is jointly owned between spouses is not subject to inheritance tax.

If your direct descendants or lineal heirs fall outside of the above, there is a 4.5% tax inheritance tax in Pennsylvania. Lineal heirs refer to heirs such as grandchildren. If youre leaving assets to a sibling in PA, that is taxed at a 12% rate. For other heirs, except charitable organizations or institutions exempt from tax, youll be dealing with a 15% tax rate.

In Pennsylvania, inheritance tax is due upon death and becomes delinquent nine months after death. However, if you pay the tax within the first three months of death you receive a 5% discount.

If the property is located in Pennsylvania, the tax is due in PA, even if the heir or descendant is located out of state.

Estate Tax Vs Inheritance Tax

When it comes estate tax vs inheritance tax, what are the main differences? Who pays? And how much? Trust & Will explains what you need to know.

Estate tax and inheritance tax are related, and the terms are often used interchangeably. Although it can be easy to get the two mixed up, they are not the same. If youre expecting to receive an inheritance any time soon, or youre preparing your estate plan, then its best to be informed on how you might be affected. In this guide, well explain the difference between estate tax vs. inheritance tax, and when you might become liable for each. That way, you can have peace of mind knowing you wont get any unpleasant surprises.

How To Avoid Inheritance Tax

One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes. If you trust your friend and you put your friends name on that $30,000 with you , it will cut the bill down to $15,000 at 15% or $2250. It is important to make an asset joint you can cut the tax in half that way.

Making periodic donations to get assets out of your name is another approach to avoid this tax. If you still wish to keep control of it through a single trustee, you may set up an irrevocable trust that will pass it tax-free. That type of trust should be distinguished from a revocable trust, which is still subject to inheritance tax.

Questions about inheritance tax? Contact our staff of experienced legal and financial professionals today at 724-832-2499.

Recommended Reading: How Do You Get The Eitc Tax Credit

To Minimize Or Avoid Pa Inheritance Tax: Buy Farmland And Agricultural Property

Effective for those who die after June 30, 2012, agricultural property and farmland is excluded from PA inheritance tax in certain cases.

The qualifying property must be transferred to members of the same family, it must have operated in the agriculture business at the time of the owners death, it must remain in the agriculture business for at least 7 years following the owners death, and it must produce at least $2,000 of annual revenue from the business of agriculture.

While this technique wont be relevant in the majority of situations, under conditions where a family was already involved in or intended to get involved in the agriculture business anyway, this technique can also be utilized to minimize or avoid Pennsylvania inheritance taxes.

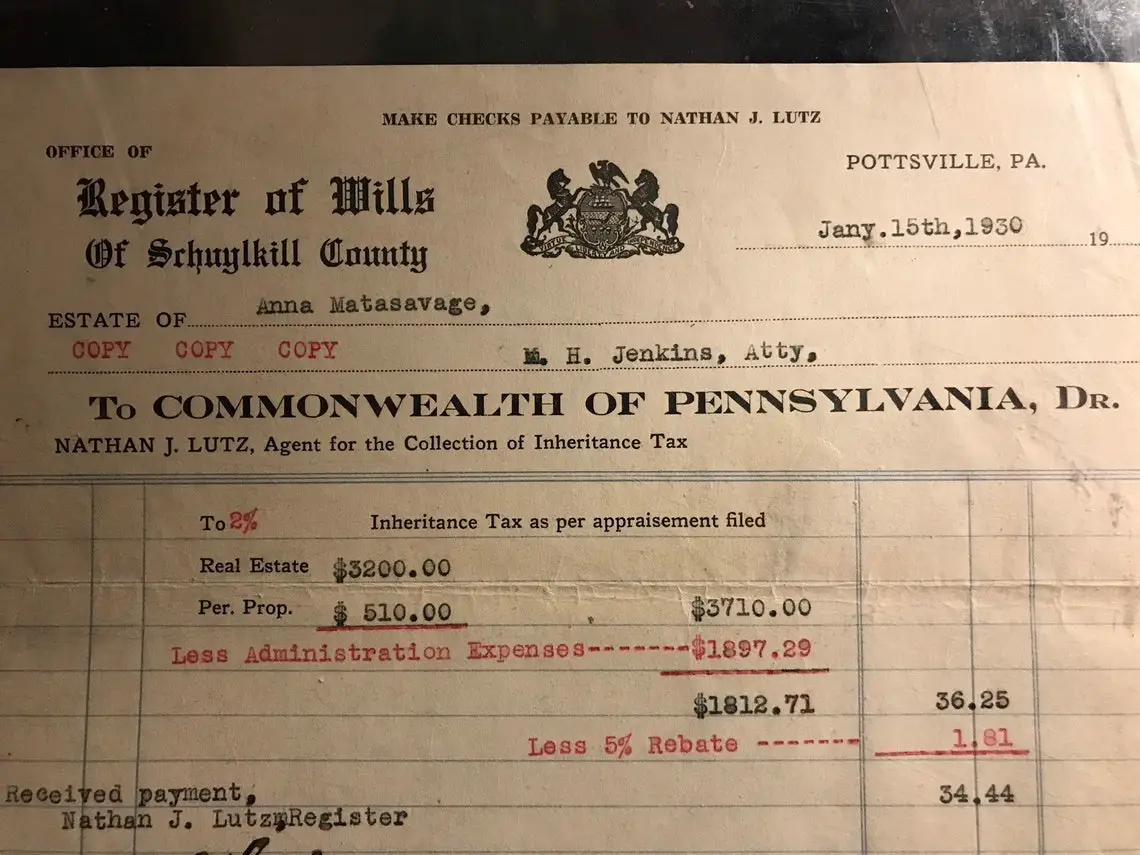

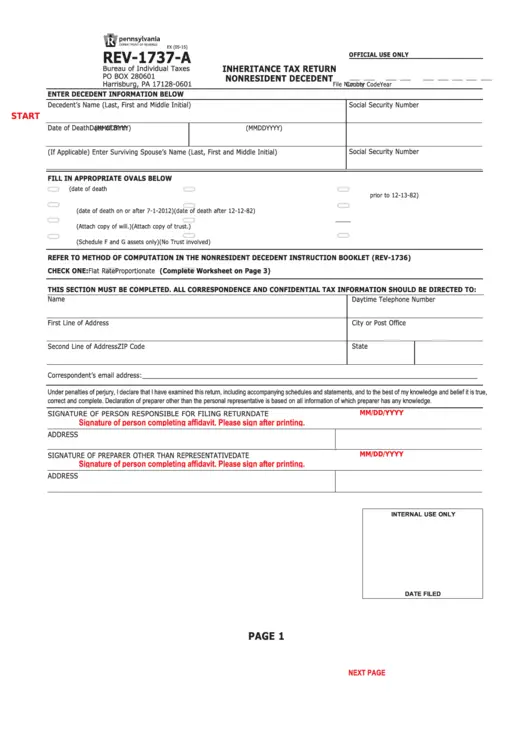

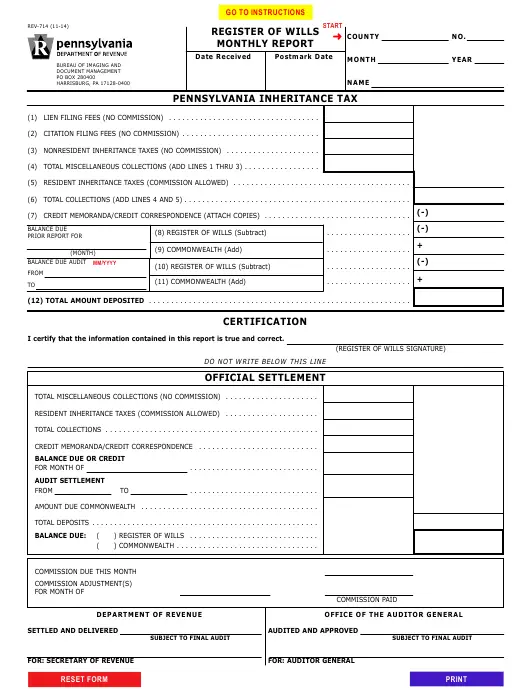

Filing The Pennsylvania Inheritance Tax Return

The Pennsylvania Inheritance Tax Return can be filled out online. The executor or personal representative is responsible for filing the return. Just one return is necessary, even if several people owe tax. The return is filed with both the Pennsylvania Department of Revenue and with the Register of Wills in the county where the deceased person lived.

The tax return is a complicated document, with lots of schedules on which the deceased person’s property and liabilities are listed. As discussed above, different tax rates apply to different inheritors. Executors often seek expert help and advice from an experienced local attorney.

The tax return and payment are due nine months from the date of death, and late payments may trigger a penalty. The state will grant requests for an extension of time in which to file the return, but the tax itself must still be paid by the original due date. If the tax is paid earlythat is, within three months of the deathyou can take a discount of five percent, up to a cap.

Also Check: How Much Is Property Tax In California

To Minimize Or Avoid Pa Inheritance Tax: Gifting

Assets gifted more than 12 months prior to death are excluded from PA inheritance tax.

There is no limit to the amount that can be gifted each year. Gifts can be taxable, but very few people ever have to pay a gift tax .

In 2020, there is currently a $15,000 annual gift tax exclusion, which means that $15,000 or less can be gifted from one person to another during a year without the gift reducing your lifetime gift tax exemption, which is about $11.5 million for 2020.

For example, if you gift $25k in 2020 to one person, which is $10k above the annual gift tax exclusion limit, your lifetime gift tax exemption is reduced by $10k from $11.5m to $11.49m.

Other than slightly reducing the lifetime gift tax exemption of the donor, there is no actual tax implication to either the donor or the recipient .

Based on estate law as of 2020, the lifetime gift exclusion also serves as the federal estate tax exemption amount. As a result, reducing your lifetime gift exclusion by gifting over $15,000 per recipient in a year will also reduce your federal estate tax exemption. With the large amount of the current exemption, this appears not to matter in most cases, at least on the surface.

Its often good planning to keep gifts below $15,000 per recipient per year, which doesn’t reduce your lifetime gift or estate tax exemptions at all, in case the lifetime gift and estate tax exemptions get reduced significantly by a law change in the future.

Buy Extra Life Insurance

The death benefit paid out on a life insurance insurance policy is not subject to the Pennsylvania inheritance tax. So converting non-life insurance assets to life insurance will reduce the tax. Another interesting planning opportunity is to buy a long-term care insurance policy that has a life insurance rider. This way if you dont use up the LTC policy, it can pass tax-free to your heirs.

Also Check: How Old Do You Have To Be To File Taxes

Convert Your Ira To A Roth Ira

The conversion will come at a cost, since you will need to pay an income tax on the conversion. The benefit of paying the income tax before you die though is that it reduces your PA taxable estate for inheritance tax purposes.

- This strategy works best when you have enough funds outside your retirement account to pay for the income taxes on the conversion.

- This strategy is especially valuable if your children are high income earners, this way they can receive distributions from the ROTH, after your death, free of income tax.

- I strongly recommend consulting with a tax attorney or accountant though before doing the conversion.

- This strategy is often best to do over multiple years .

What Is The Pennsylvania Inheritance Tax

An inheritance tax is a tax assessed on the property or money that you inherit upon the death of someone else. As the beneficiary, you are responsible for paying the tax. This is different from an estate tax, where the estate of the deceased person is responsible for paying the tax due prior to the assets being distributed to the beneficiaries.

Currently, inheritance taxes are imposed by the state where you reside, and as of 2022, only six states have an inheritance tax: Pennsylvania, Maryland, Iowa, Kentucky, Nebraska, and New Jersey. There is no federal inheritance tax. There is, however, a federal estate tax that can range from 18% to 40% and generally applies to estates over $12 million. There are also some states that impose a state estate tax.

Recommended Reading: How Do I Get My Tax Return Transcript

In Conclusion: Estate Tax Vs Inheritance Tax

Estate and inheritance taxes are easy to mix up, but they are not at all the same. There are three key ways to identify the differences between them: if the taxes are paid at the federal or state level, who is responsible for paying the tax, and which states impose either tax.

The fact that youre reading up on the difference between estate tax vs. inheritance tax is a great sign. It means that youre preparing in advance of receiving an inheritance, and you want to understand the differences between any taxes you might be subject to. Or perhaps youre on the other end, and youre someone who is setting up a Trust or Will. Knowing these key tax impacts and differences is the first step to maximizing the benefit you can bestow upon a loved one. With the right estate planning tools and strategies, you can do exactly that.

Is there a question here we didnt answer? Reach out to us today or Chat with a live member support representative!

What Is Subject To Inheritance Tax

All real and tangible personal property is subject to inheritance tax including assets such as cash and property, and physical items like their vehicle, furniture, jewelry, etc. Intangibles such as bank accounts, stocks, bonds, etc. are also included and subject to inheritance tax in Pennsylvania if the descendant resides in PA if the descendant doesnt reside in PA, just the physical property is taxable.

Recommended Reading: When Are S Corp Taxes Due

Overall Pennsylvania Tax Picture

Pennsylvania is a tax-friendly state for retirees. Social Security is not taxed, and neither are pensions or withdrawals from retirement accounts. Pennsylvanias income tax rate is a flat rate of 3.07%, and local income taxes range from % 3.8398%. The average 3ffective property tax rates in Pennsylvania is 1.50%. You can use this Pennsylvania paycheck calculator to calculate what your take home pay will be.

The sales tax in the Keystone State is 6% across the state with two exceptions. There is an additional 1% sales tax charged in Allegheny County for a total of 7% and a 2% surcharge in Philadelphia for a total sales tax of 8%.

Reduction In Value Of Land From Conservation Easements In General

When land subject to a conservation easement is valued for Pennsylvania inheritance tax purposes, the restrictions on subdivision, construction of improvements, and activities and uses imposed by the conservation easement are taken into consideration. The reduction in appraised value resulting from conservation restrictions can result in significant savings in the tax that family members or other beneficiaries would otherwise pay upon inheriting land located in Pennsylvania.

Recommended Reading: Do You Have To Pay Taxes On Life Insurance Payout

What Is The 7 Year Rule In Inheritance Tax

The rule enables a gift of money, property or other assets to become exempt from inheritance tax if the person giving it lives for seven years afterwards. This is a fundamental concept for any person planning to pass on wealth to the next generation, particularly if their estate exceeds the current IHT threshold. 5

Everyone Else Pays 15%

All other inheritors pay a tax rate of 15%. This includes aunts, uncles, nieces, nephews, cousins, brother-in-laws, sister-in-laws, friends, and anyone else who does not fall into a category with a lower rate.

Example:Annabel left $100,000 to various family members and friends when she died. She left $40,000 to her husband Tom, $30,000 to her son Gabriel, $20,000 to her sister Claire, and $10,000 to her nephew Allen. The inheritance tax affects her loved ones as follows:

- Her husband Tom pays nothing on the $40,000 he inherits, since he is her surviving spouse.

- Her son Gabriel must pay 4.5% tax on the $30,000 he inherits, or $1,350.

- Her sister Claire must pay the sibling tax of 12% on the $20,000 she inherits, or $2,400.

- Her nephew Allen must pay 15% tax on the $10,000 he inherits, or $1,500.

Also Check: Where Can I Get Tax Forms

Avoid Pocono Inheritance Fines And Unnecessary Inheritance Losses

The laws governing Pennsylvania inheritance taxes are complex and failure to pay them properly can result in expensive fines and unnecessary costs. Fisher & Fisher Law Offices has been helping families settle inheritance tax liabilities for over 30 years in Monroe, Wayne, Pike, Luzerne, Lackawanna, Carbon, and Northampton Counties. We provide service and value to families by handling inheritance tax obligations smoothly and efficiently with an eye on preserving the most assets possible for the beneficiaries.

Timely Filing of Inheritance Taxes & Discounts

Timely filing and correct payment is crucial. Fisher & Fisher Law Offices will help you take advantage of Pennsylvanias 5% discount on inheritance tax and avoid extra fees or interest costs by filing the inheritance tax return within the prescribed time period.

Dont delay. Call Fisher & Fisher Law Offices today for a free consultation.

Other Situations In Pennsylvania Inheritance Law

In order to be a valid heir to an intestate estate, you must survive for at least five days following the death of the testator, the creator of the will. So if a relative or anyone else listed as a possible heir dies within five days of the testator, they will not hold a right to inheritance.

The law in Pennsylvania treats half-blood and full-blood relatives the same in intestate succession. So even if you only share one parent with a brother or sister, he or she gets typical inheritance rights for siblings.

If someone in your family was pregnant when you died, and he or she has their child after youve already died, the child is afforded the same right to inheritance he or she would have had if you were still around, according to Pennsylvania inheritance laws.

Regardless of whether he or she was in your will or not, any individual that willingly murders you will have his or her inheritance rights stripped away by Pennsylvania.

Illegal immigrants and non-citizens are still eligible to be heirs under Pennsylvania law. This is applicable under both intestate succession and situations where there is a valid will.

Read Also: Can You Write Off Refinance Closing Costs On Taxes

Dying With A Will In Pennsylvania

Pennsylvania currently has some of the strictest laws that constitute what a valid, or testate, will is in the U.S. While a testate will is not required to be notarized, it cannot be handwritten or communicated orally. Similar to nearly every other state, though, at least two witnesses must sign your will, indicating they were present at the time of your signature.

Aside from the typical naming of heirs for certain types of property, a testate will must also include an official estate executor, or personal representative. The main responsibilities of this person are to ensure that not only are your wishes met but also that your estates assets handle any outstanding debt or final expenses you incur.

Gift Your Assets To Your Children

This can be a very dangerous strategy, so I strongly recommend consulting with a tax attorney or accountant before making the gift.

- Dangers include giving away an asset that has a low basis resulting in a capital gains tax which could be far more expensive than simply paying the PA inheritance tax.

- If you give away too much, you could be subject to federal gift taxes or generation skipping transfer taxes.

- This could potentially cause problems if you wish to qualify for Medicaid.

Also Check: When Are Tax Extensions Due

To Minimize Pa Inheritance Tax: Buy Real Property In A State Without Estate Or Inheritance Tax

Real property and tangible personal property located in Pennsylvania at the time of a PA residents death is subject to PA inheritance tax. Real property and tangible personal property located outside of Pennsylvania is not subject to PA inheritance tax.

For example, liquid assets such as cash sitting in a bank account is subject to PA inheritance tax. However, a house in Florida isn’t subject to PA inheritance tax, even for PA residents. Therefore, if a PA resident used cash to buy a house in Florida, they would avoid PA inheritance tax on these dollars.

Clearly, avoiding PA inheritance tax isn’t the only factor to consider when making a decision to buy real property in another state.

For example, when property is owned in multiple states, the estate can become subject to probate in multiple states, which can increase probate costs. Also, the other state may have it’s own state-level estate or inheritance taxes that may be higher than PA rates.

An experienced fiduciary financial advisor with retirement planning specialization will work in coordination with an experienced estate planning attorney to design an overall estate plan with the big picture in mind.

The Probate Process In Pennsylvania Inheritance Laws

Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws. This entails going to the court where the decedent owned property in the state and beginning a legal proceeding where a judge will keep a watchful eye over how the will is managed.

Estates that fall underneath that $50,000 mark are titled as small estates and can avoid probate. This will also significantly cut down on the amount of time it takes to execute the estate.

Probate courts are responsible for deciding on an estate executor for intestate estates as well. This will almost always end up being someone who has significant knowledge of not only the decedent and his or her family but also the property in question within the estate.

Read Also: How File Old Tax Returns