Automate The Pay Stub Process With Hourly

Issuing pay stubs to your employees is a must. But manually tracking all the information you need to include on pay stubs is a time-consuming hassle. With Hourly, thereâs no need to worry about keeping track of employee hours or deductions. Our app automatically tracks wages, hours, and deductions, allowing you to issue accurate, up-to-date pay stubs with a few simple clicks.

Ready to simplify your payroll process? Get started with a free trial of Hourly today!

Are You Required To Provide Pay Stubs For Your Employees

Clearly, pay stubs provide a host of helpful information to your employees. But are you required to provide them?

The Fair Labor Standards Act requires business owners to track their employeesâ hours, but how they track that time is ultimately up to them. But while pay stubs arenât mandated under federal law, they are required by the majority of statesâincluding California.

So, if youâre operating a business in California, you need to provide your employees with an itemized pay stub for every pay period worked. But even if pay stubs werenât a requirement, as a business owner, they provide some serious benefits.

When you issue pay stubs through your payroll service every pay period, you can easily track your employeesâ hours, pay, taxes, and deductions. By keeping your finger on the pulse of your employees gross wages and net pay, you can more quickly spot any mistakes or discrepancies and correct them before you run into any issuesâwith your employees, your benefit partners, or the IRS.

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2020, the IRS recommends that you check your withholding amounts again. Do so in early 2021, before filing your federal tax return, to ensure the right amount is being withheld.

Also Check: Doordash State Id Number For Unemployment California

Can A Tax Return Legally Be Filed With A Paycheck Stub

You can’t file your return with just a pay stub. You have to wait until you receive your . However, some of the national tax firms, such as H& R Block, offer an advance loan against your based on your pay stub. These loans are available until January 15. You might want to look into one of those.

Your employer is required to mail your W-2 by January 31. After that, you should start nagging them. If you can’t get a W-2 at all, then the requires that you wait until February 15 to file your taxes using a substitute W-2 based on your last pay stub.

Can I legally file a with my last paycheck stub?

Submitted:

You can’t file your tax return with just a pay stub. You have to wait until you receive your W-2. However, some of the national tax preparation firms, such as H& R Block, offer an advance loan against your refund based on your pay stub. These loans are available until January 15. You might want to look into one of those.

Your employer is required to mail your by January 31. After that, you should start nagging them. If you can’t get a W-2 at all, then the IRS requires that you wait until February 15 to file your taxes using a substitute W-2 based on your last pay stub.

What Else You’ll Need

The information listed above will all be on your pay stub. This should be sufficient to file your taxes. However, to make sure you have calculated the right amount and that you aren’t paying too much , you’ll need a tax calculator.You should always do this before going to file your taxes with pay stub. There is no shortage of trustworthy and accurate tax calculators out there on the web. You’ll be able to calculate it accurately by adding in your year-to-date taxable income alongside any leftover taxable income that is not in the pay stub you are using to file your taxes.You should also provide the calculator with further information. If you have any dependents or other similar outgoings, make sure to include those. Also, try and include any tips or expenses that may be relevant. It’s important to make sure the tax calculator you are using is up to date and relevant to the current tax year.Once ran all of this information through a calculator, you should be able to determine if you’re owed a big fat refund by the IRS. Make sure to run the information through several times in order to confirm that your result is accurate.If you find that you’re owed a particularly large refund, it may be that your employer is withholding too much from your paycheck for deductions. Likewise, if you’re unfortunate enough to owe a lot of extra money to the IRS, you should consider arranging more to be withheld from your paycheck for tax purposes.

Read Also: Is Money From Plasma Donation Taxable

What Can I Use As Proof Of Self Employment

To prove you are self employed, you can use an app or hire an accountant. However, the best way to prove you are self employed is by having a pay stub. Using Paystubs 365 can help you generate a pay stub to provide proof of employment by creating a professional self employment pay stub with either a traditional pay stub or an advanced pay stub.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Does Doordash Take Taxes Out

What Happens If Your Employer Does Not Pay Payroll Taxes

When employees are paid cash, employers often do not pay the appropriate payroll taxes. This is called payroll tax fraud. Employers may try to justify this fraud by claiming that:

- You will receive more money in cash.

- Every small business, or everyone in this industry, is doing the same.

- You will not be hurt in any way.

However, your employers tax fraud does harm you, by creating the following difficulties:

- You cannot document your income because you do not receive W-2s and paycheck stubs. Without proper documentation of your income, it also may be difficult to file an accurate income tax return, which may prompt an audit by the government.

- You may owe the government unreported taxes that will have to be paid all at once,

- You may be ineligible to receive unemployment, disability, Social Security, or Medicare benefits when you need them.

Also Check: How To Correct State Tax Return

Why Is My W

The compensation may be different on a W-2 vs a final pay stub, but heres why. Your salary is a gross dollar amount earned before taxes and deductions. Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions. Pre-tax deductions include employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401 contributions. Thats why your W-2 doesnt match your last pay stub.

| Pay Stub | |

|---|---|

| Gross Dollar Amount of Salary | Taxable Wages Reported |

| After Pre-Tax Deductions Are Taken Out- Health Insurance- 401 | |

| Disability Insurance, etc. |

Unless you opt out of pre-tax deductions, your salary amount will almost always be higher than wages reported on your W-2. To clarify which pre-tax deductions you are opted in to, check Box 1 of your W-2. If you are confused about your Box 1 deductions, our blog Pre-Tax and Post-Tax Deductions: Whats The Difference can help clarify details related to these withholdings.

Don’t Miss: Efstatus.taxact

How To File Taxes Without A W2

Filing your taxes can be tedious especially if you have to account for all your income in the past year.

Have you experienced never getting a W-2?

This article will get into the possible options and scenarios on how to file taxes without a W-2.

Ideally, W-2 forms are filed at the end of every tax year before the 31st of January.

This article with tackle how you can file taxes if you dont have a W2 in hand.

How To File Taxes With Your Last Pay Stub

Tax season is one of the most stressful times of the year, however, it doesn’t have to be. Your W-2 form will provide you with most of the information you need to file your taxes. However, sometimes your employer may have failed to provide you with one, making things a little trickier.Not to worry. As long as you have a pay stub, you’ll be perfectly able to file your own taxes, with minimum hassle. If you want to know how to file taxes with last pay stub, all you need to do is follow a few simple steps.The information on your pay stub, which you can generate yourself online, will help you figure out everything you need to know. You’ll be able to calculate how much you owe, as well as determine whether or not you might be due a refund.As long as you’re filing your taxes online, which is known as e-filing, filing taxes with last pay stub is totally legal and relatively simple. Here’s everything you need to know about filing taxes with your last pay stub.

Recommended Reading: Do You Pay Taxes On Donating Plasma

What Do I Need To File My Return Without A W

When you realize that you simply cant wait any longer for your employer to send a duplicate of your IRS Form W-2, Wage and Tax Statement, dont let this stop you from filing on time. Although your employer has until January 31 to send out your W-2, if you havent received it by February 27th, you need contact the IRS so a follow-up can be conducted with your employer. Unfortunately, you wont be able to e-file your return if you do not have your W-2. Because you also have to attach IRS Form 4852, Substitute for Form W-2, Wage and Tax Statement_,_ which allows you to file your return in the absence of a W-2, you must file a paper return.

You will receive Form 4852 from the IRS along with a copy of the notice that was sent to your employer requesting your replacement W-2. At this point you can continue to wait for your employer to supply the missing W-2, or you can go ahead and use your last pay stub to determine what you need to report on your IRS Form 1040, U.S. Individual Income Tax Return.

What To Do If Youre Missing Information

No one is perfect, and losing a piece of paper, such as a T4 slip, can happen. Rest assured, all hope is not lost, and there is a way to recover your information.

A T4 slip indicates how much you were paid before deductions by an employer, in addition to your Canada Pension Plan , Québec Pension Plan , Employment Insurance contributions, and other amounts deducted from your paycheque during the tax year.

Each employer should give you a T4 slip if you worked for them within the last tax year no matter if youre a salaried or hourly-paid employee. Depending on how many companies you worked for, you may have multiple T4s that youll need to submit as part of your tax return.

Employers are required to send out T4s to all employees by a deadline each year . Even if youre not with the same employer, they are still obligated to send you a T4 slip. But sometimes addresses and contact information change, things slip through the cracks, and youre stuck without a T4 as the tax deadline looms.

Luckily, the Canada Revenue Agency featuresMy Account, an online portal for individuals and businesses. This service allows you to access slips that have been processed. You can also check any balances and forward unused credits from the year before, such as tuition credits and your registered retirement savings plan contribution limits.

Also Check: How Much Tax Do You Pay On Doordash

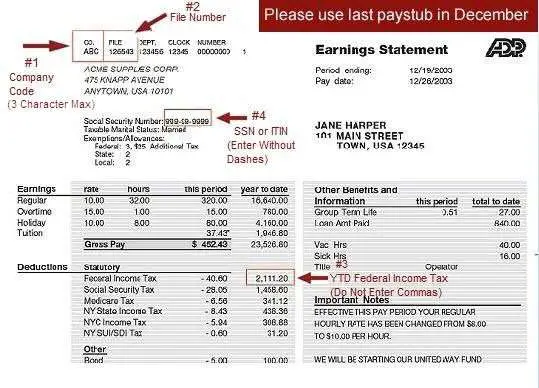

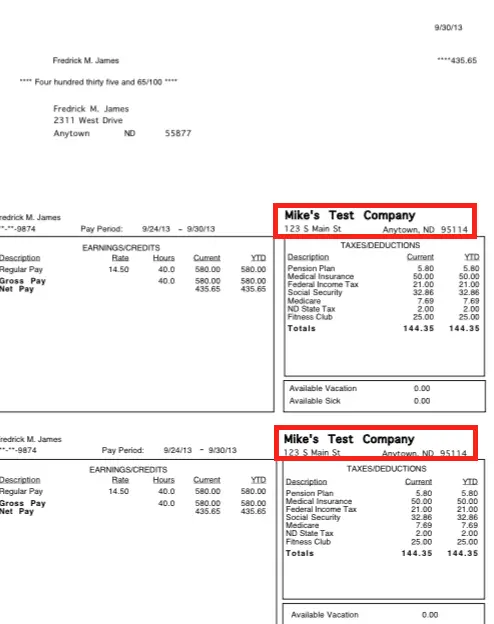

What Information Goes On My Pay Stub

Pay stubs are used to provide proof of your income and can be used for general record keeping. They show how much income you earn and any deductions or additions from local and state tax, social security, or insurance. You will need your pay stubs to properly file your taxes because they show extensive information about where your money went.

The amount that needs to be deducted from your income will vary based on if you are single or married, so it is essential to accurately input that information. Once all deductions are made, you will receive your net pay. Net pay is when the deductions are subtracted from your gross pay. If your gross pay is $9,000, you might only receive $8,000 in net pay.

Can I Use My Last Pay Check Stub And File Today

Please do not try to use your pay stub to prepare your tax return. It will not match the W-2 that you will get from your employer in just a few short weeks. You employer has until the end of January to give you your W-2. By waiting for your W-2 you will be able to file accurately. If you try to guess what goes in the boxes and mess up your return, you will need to amend. It takes about 4 months to amend a tax return. The IRS is not accepting returns yet, so you can wait for your W-2.

You may be aware that in late December Congress passed a major tax reform bill. That has the IRS scrambling to get tax return forms ready for this tax filing season. They were waiting for the laws to pass.

Some forms are not finalized so you cannot file. The IRS has to finalize a number of forms and then approve the finalized forms in the TT software. Many state forms are not finalized either. No reason to be in a rush. The IRS will not be accepting returns until January 29 at the earliest, so filing early will not get you a faster refund. The earliest refunds will not be released until mid to late February. You just have to wait for the forms to be ready.

Recommended Reading: Do You Have To Pay Back Taxes For Doordash

How Long Should I Keep Employee Pay Stubs For

You should aim to keep your employee pay stubs and payroll records for at least four years.

The IRS requires employers to keep their employment tax records for at least four years after filing. Additionally, the Fair Labor Standards Act and the Age Discrimination in Employment Act both require employers to keep at least three years of employment records, while the Equal Employment Opportunity Commission mandates that all employment and personnel records be kept for at least one year.

Whether your workforce is mostly made up of salaried or hourly workers, its clear that youll need a way to calculate and store all of their payroll details. To streamline these record keeping requirements for your small business, look for a payroll service provider or payroll software that keeps electronic copies of these documents on your behalf.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Recommended Reading: Doordash Paying Taxes

Can You Use Your Last Pay Stub To File Taxes

If you are unable to obtain your W-2 form, you might be able to file online using your final pay stub for the applicable year. This is because your December stub shows your cumulative figures as well as figures withheld. However, you will need to have your employers unique Employer Identification Number, and since it is not typically printed on pay stubs, you will have to request it from the employer.Providing an incorrect Employer Identification Number could see to your processing period being lengthened or getting audited. If you have this information, you can start filling out your tax return. Nonetheless, when it comes to filing taxes online, the IRS has it that the service is only free to those earning less than $57,000.If you earn more than that figure in a year, you are required to file taxes by printing and mailing the return. The service is also unavailable to those under the age of 16. Additionally, if you currently live in Guam, the Commonwealth of the Northern Mariana Islands, the U.S Virgin Islands, or American Samoa, you might also not be able to file.You will be able to prepare your tax return online but will need to print and mail it.