How Stocks Are Taxed

The IRS taxes individuals for earned and unearned income. Earned income comes from things like your wages, salary, or tips. Unearned income comes from the gains you make from the sale of stocks and even dividends you are paid. Yes, not even dividend investors will escape the Eye of Sauron that is the IRS.

While some of the top stock brokers dont charge investors commissions, taxes are unavoidable. Uncle Sam dipping into your profits can seriously suck, but the upside is the costs can be calculated and prepared for.

Stocks are going to be taxed based on the gains they generate. If you saw your holdings appreciate in 2020 and then sold them for more than you paid for them, thats again you will owe taxes on the profits.

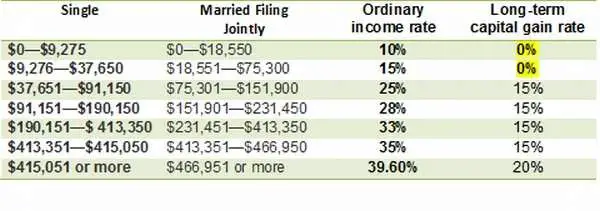

Capital gains tax rates are categorized as either long-term or short-term. Generally, long-term investments are those that have been held longer than 365 days and they have a lower tax rate than earned income and short-term investments.

Use Capital Losses To Offset Gains

If you experience an investment loss, you can take advantage of it by decreasing the tax on your gains on other investments. Say you own two stocks, one of which is worth 10% more than you paid for it, while the other is worth 5% less. If you sold both stocks, the loss on the one would reduce the capital gains tax that you would owe on the other. Obviously, in an ideal situation, all of your investments would appreciate, but losses do happen, and this is one way to get some benefit from them.

If you have a capital loss greater than your capital gain, you can use up to $3,000 of it to offset ordinary income for the year. After that, you can carry over the loss to future tax years until it is exhausted.

Take Advantage Of Tax

When you invest your money through a retirement plan, such as a 401, 403, or individual retirement account , it will grow without being subject to immediate taxes. You can also buy and sell investments within your retirement account without triggering capital gains tax.

In the case of traditional retirement accounts, your gains will be taxed as ordinary income when you withdraw money, but by then, you may be in a lower tax bracket than when you were working. With Roth IRA accounts, however, the money that you withdraw will be tax freeas long as you follow the relevant rules.

For investments outside of these accounts, it might behoove investors who are near retirement to wait until they actually stop working to sell. If their retirement income is low enough, their capital gains tax bill might be reduced or they may be able to avoid paying any capital gains tax. But if theyre already in one of the no-pay brackets, theres a key factor to keep in mind: If the capital gain is large enough, it could increase their total taxable income to a level where they would incur a tax bill on their gains.

You can use capital losses to offset your capital gains as well as a portion of your regular income. Any amount left over after that can be carried over to future years.

Recommended Reading: How Much Is Doordash Taxes

Work Your Tax Bracket

While long-term capital gains are taxed at a lower rate, realizing these capital gains can push you into a higher overall tax bracket as the capital gains will count as a part of your AGI. If you are close to the upper end of your regular income tax bracket, it might behoove you to defer selling stocks until a later time or to consider bunching some deductions into the current year. This would keep those earnings from being taxed at a higher rate.

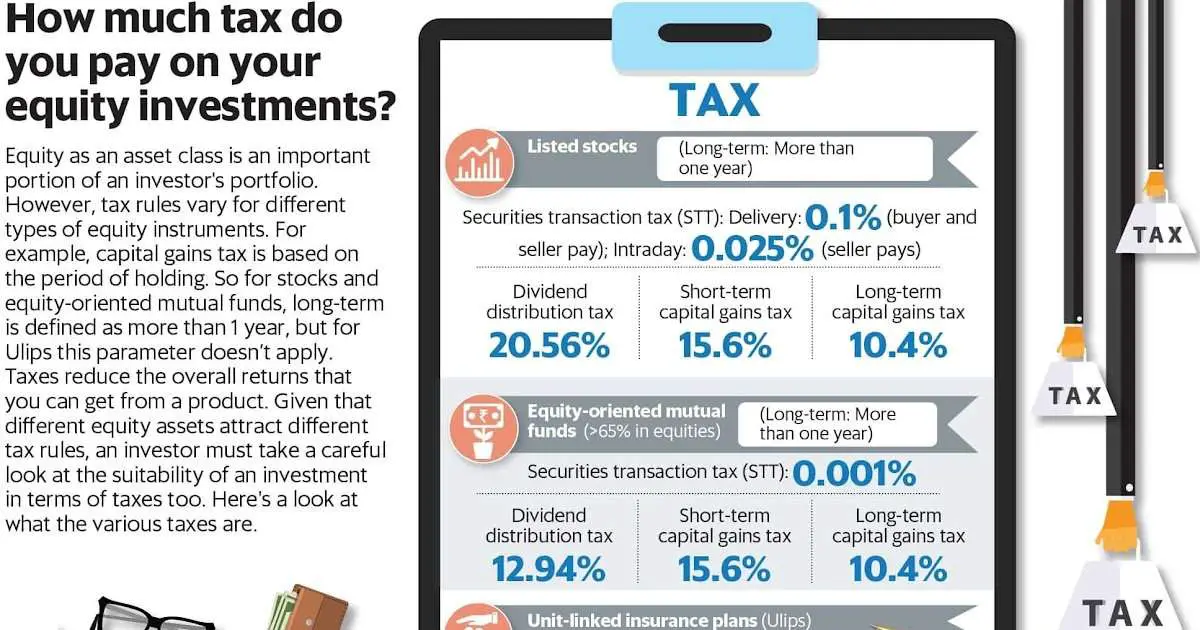

How Are Dividend Stocks Taxed

Dividend stocks may require a bit more mental gymnastics to figure out. Youre basically going to follow the same method that you followed for long-term and short-term gains. If you have a dividend-paying stock that has been paid for a certain period of time, known as the holding period, then that stock is a qualified dividend.

Qualified dividends are taxed at the same 0%, 15%, and 20% rate that you will pay for long-term capital gains. However, the holding period can be a little tricky to figure out.

To meet the holding period requirements, you must hold the stock for more than 60 days during the 121-day period that begins 60 days prior to the ex-dividend date. The ex-dividend date is the latest date a shareholder must hold stock to qualify for the dividend.

If you havent kept track of what dividends are qualified and which arent, dont worry. Your stockbroker will provide you with the 1099-DIV form which will list what dividends are qualified and which arent.

If your dividends are not qualified dividends, then you will be taxed the same rate you are taxed for short-term capital gains. The money you made from dividends will be added to your earned income.

Don’t Miss: Florida Transfer Tax Refinance

How To Avoid Paying Taxes When You Sell Stock

One way to avoid paying taxes on stock sales is to sell your shares at a loss. While losing money certainly isn’t ideal, at least losses you incur from selling stocks can be used to offset any profits you made from selling other stocks during the year. And, if your total capital losses exceed your total capital gains for the year, you can deduct up to $3,000 of those losses against your total income for the year.

I know what you’re thinking: No, you can’t sell a bunch of shares at a loss to lower your tax bill and then turn around and buy them right back again. The IRS doesn’t allow this kind of “wash sale” — called by this term because the net effect on your assets is “a wash” — to reduce your tax liability. If you repurchase the same or “substantially similar” stocks within 30 days of the initial sale, it counts as a “wash sale” and can’t be deducted.

Of course, if you end the year in the 0% long-term capital gains bracket, you’ll owe the government nothing on your stock sales. The only other way to avoid tax liability when you sell stock is to buy stocks in a tax-advantaged account.

How Capital Gains On Stocks Are Taxed

The tax rates on long-term capital gains vary a bit based on your filing status and your adjusted gross income . Here are the capital gains tax rates for both the 2020 and 2021 tax years for the various tax filing statuses.

The first column indicates the percentage of tax that will be applied to your capital gains. Columns two through five indicate your filing status and income level.

Read Also: Taxes For Door Dash

Buy And Hold Qualified Small Business Stocks

Qualified small business stock refers to shares issued by a qualified small business as defined by the IRS. This tax break is meant to provide an incentive for investing in these smaller companies. If the stock qualifies under IRS section 1202, up to $10 million in capital gains may be excluded from your income. Depending on when the shares were acquired, between 50% and 100% of your capital gains may not be subject to taxes. It’s best to consult with a tax professional knowledgeable in this area to be sure.

How Much Tax Do You Pay On Stocks

Your income from investments can be taxed at various rates, depending on how the income is classified and what your total income is from all sources. Short-term capital gains and ordinary dividends are taxed at your ordinary income tax rate based on your tax bracket. Long-term capital gains are taxed at lower rates.

Recommended Reading: Door Dash 1099

How Do I Know If I Have To Report

If you sold any stocks, bonds, options or other investments in 2020, then you will need to report it on your tax return on Schedule D. TurboTax and other mainstream tax preparation software vendors will generally do this for you after asking you to input some data.

If you sold stocks at a profit, you will owe taxes on gains from your stocks. If you sold stocks at a loss, you might get to write off up to $3,000 of those losses. And if you earned dividends or interest, you will have to report those on your tax return as well.

However, if you bought securities but did not actually sell anything in 2020, you will not have to pay any “stock taxes.”

What Is The Capital Gains Tax

There is actually no official term capital gains tax in Canada. However, you must treat as income any capital gain on a stock when you sell. For example, lets say you purchased $1,000 worth of stock and later sell it for $2,000. Your capital gain is $1,000.

The good news is that only 50 percent of the capital gain is taxable. So, in this example, you would be taxed on only $500 of the $1,000 capital gain.

Capital gains apply to individual stocks you own, as well as mutual funds and Exchange Traded Funds .

It can be advantageous to hold stocks in a non-registered account and leave the highly taxed dividends and interest-bearing investment vehicles in your TFSA or RRSP. Thats because your RRSP is not taxed until you withdraw the funds and your TFSA is never taxed.

You May Like: Doordash Taxes 2021

Taking Capital Gains In Different Years

Another option to discuss with your tax professional may be to âspread the sale over multiple tax yearsâthat can help ease the burden,â says Jonathon McLaughlin, investment strategist for Bank of America.

You might, for example, sell part of an investment thatâs performing strongly at the end of 2021, another part during 2022 and the final portion at the beginning of 2023, thereby completing the sale in a little over 12 months while spreading potential capital gains over three tax years, McLaughlin notes.

But donât forget that waiting to sell involves risks. The advantages of holding on to those assets, McLaughlin notes, may not outweigh the benefits of selling now and reaping the rewards, even if it comes with a greater tax bill now.

Making Capital Gains Or Losses

Capital gains

If you sell an investment for more than the cost to acquire it, you make a capital gain. You need to include all capital gains in your tax return in the year you sell the investment. Capital gains are taxed at your marginal rate.

If you’ve held the investment for more than 12 months, you’re only taxed on half of the capital gain. This is known as the capital gains tax discount.

The ATO has information to help you work out your capital gains tax on different investments.

Capital losses

If you sell an investment for less than the cost to acquire it, you make a capital loss.

You can use a capital loss to:

- reduce capital gains made in the year the loss occurs, or

- carry forward the loss to offset future capital gains

Savannah makes use of a capital loss

Savannah bought $2,000 worth of shares in a large mining company.

After 18 months she sold the shares. They had fallen in price to $20 per share. She made a capital loss of $1,000.

Savannah also made a profit of $1,500 from selling others shares she held. She had held these shares for five years.

Savannah can deduct the $1,000 she made a loss on from the $1,500 capital gain. This leaves her with a profit of $500. As Savannah held the shares for more than 12 months, she only includes half the capital gain in her tax return. She’ll pay tax on this $250 at her marginal tax rate.

You May Like: Is Doordash Pay Taxed

How Do I Calculate My Basis In A Capital Asset

For most assets, your basis is your capital investment in the asset. For example, it is your purchase price plus additional costs that you incurred, such as commissions, recording fees, or transfer fees. Your adjusted basis can then be calculated by adding to your basis any costs that youve incurred for additional improvements and subtracting depreciation that youve deducted in the past and any insurance reimbursements that have been paid out to you.

State Capital Gains Tax On Stocks

The federal government is going to take a bite out of your profits, but dont think the taxes stop there. Depending on the state you live in, youll have to fork over more money.

Most states are going to tax you at the normal rate as your income for any money made from stock growth. There are 9 states that tax less for capital gains:

- Arizona

- Vermont

- Wisconsin

Living in these states will give individuals some advantages over the regular income tax rate that almost all other states use. In a few more states, like Colorado, Idaho, or Louisiana, there are other tax incentives to reduce the burden on payers.

Different state taxes on capital gains range from 0% for some of the states mentioned above to 13.30% in California. The situation in each state can be dynamic in the future, some taxpayers could be paying as much as 50% for their gains.

Read Also: Does Doordash Take Out Taxes

Capital Gains: The Basics

A capital gain occurs when you sell an asset for more than you paid for it. Expressed as an equation, that means:

Capital Gain \begin & \text=\text-\text\\ \end Capital Gain=Selling PricePurchase Price

Just as the government wants a cut of your income, it also expects a cut when you realize a profit on your investments. That cut is the capital gains tax.

For tax purposes, its useful to understand the difference between realized gains and unrealized gains. A gain is not realized until the appreciated investment is sold.

For example, say you buy some stock in a company, and a year later, its worth 15% more than you paid for it. Although your investment has increased in value, you will not realize any gains, or owe any tax, unless you sell it.

How To Calculate A Capital Gain

Ottawa uses some fancy terms to calculate capital gains, but its actually pretty straightforward. The phrase adjusted cost base simply means the price of the shares you purchase, plus any fees the brokerage may charge.

Similarly, when you sell the shares you use the selling price and deduct any fees. The capital gain is calculated by taking this selling figure and deducting the adjusted cost base.

Lets look at an example:

Sunny purchased $1,000 worth of Company B. There was a $10 brokerage fee and therefore the total cost, the adjusted cost base, was $1,010. She later sold the shares for $1,500 with a $10 fee. Therefore, the net sale value was $1,490.

The capital gain is calculated by taking the net sale value of $1,490 and subtracting the adjusted cost base of $1,010. Therefore, the capital gain was $480. Again, only half of this is taxable.

Recommended Reading: Csl Plasma Taxable

Do I Need To Pay Taxes On Capital Losses

Capital losses occur when your investments lose money over time. For example, if a companys stocks are $200 each when you buy them and $100 each when you sell them, youll incur a capital loss for the amount of the difference .

These losses arent taxed and you can use them to offset your capital gains tax in Canada. There are 3 main ways you can strategically do this:

Ask An Accountant Or Financial Adviser

How much you will pay in taxes on your investments will vary depending on the number of investments you have, if they made or lost money last year, your current income, and other financial factors. It is important to consult with your accountant and financial advisor about how much you need to save to cover your taxes each year.

If you are just starting to invest, what you earn may not be enough to make a big impact on your tax bill.

As your investments grow, so will your taxes, and you need to be prepared to handle the changesand subsequent tax bills.

In most cases, the changes will come gradually, and you should be able to adjust as your tax burden increases. When you reach a point where you are earning a significant amount in investments each year, its best to hire an accountant to help you come up with a workable tax strategy.

You May Like: How To Appeal Property Taxes In Cook County

Hold The Stocks For A Year Or More

Long term capital gains are almost always lower than short-term capital gains. Because of this, its often a smart move to choose your investments wisely and stick with them long term.

I dont recommend frequently tweaking your stock portfolio or jumping from one hot stock to the next in hopes of beating the market. No ones smart enough to do that, not even the experts.

Theres also another benefit to playing the long game: dying. When you die, you can pass on your investments to your heirs who dont have to pay capital gains on a lifetime of growth. Its almost like passing on your portfolio over with a clean slate. Now thats what I call an inheritance.