Diversify Your Retirement Income

To maximize retirement income, Brown says it’s important to diversify your income sources when possible. “If you have money coming from different retirement sources, try to take a little from both your taxable and nontaxable sources. You must meet your RMD requirements, but when you mix it up a little, you’ll keep your taxable income amount low, and this keeps your overall tax bill low.”

How To Reduce Or Defer The Tax You Owe

You may be able to reduce or defer some of the taxes you owe with any of the following:

- Pension income splitting You and your spouse or common-law partner can choose to split your eligible pension or superannuation income.

- Carrying charges and interest expenses You can claim carrying charges and interest you paid to earn income from investments.

- Registered retirement savings plan Any income you earn in the RRSP is usually exempt from tax as long as the funds remain in the plan.

- Excess registered pension plan contributions between 1976 and 1985 You may have made current service contributions exceeding $3,500 in one or more years from 1976 to 1985 and you could not have fully deducted these excess contributions. Call the CRA at 1-800-959-8281 to help you calculate your deduction and claim these amounts.

- Federal deductions, credits, and expenses Non-refundable tax credits, such as the age amount, the pension income amount and the amounts transferred from your spouse or common-law partner, reduce the amount of income tax you owe.

- Provincial or territorial credits You may be able to claim credits that are specific to your province or territory.

Topic No 410 Pensions And Annuities

If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan, all or some portion of the amounts you receive may be taxable.

This topic doesn’t cover the taxation of social security and equivalent railroad retirement benefits. For information about tax on those benefits, refer to Topic No. 423 and Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

Read Also: How Do You Pay Taxes On Doordash

Maximise The Compounding Growth Of Your Retirement Capital

Not only does this strategy reduce your marginal tax rate but it also ensures that your living annuity capital continues to compound faster, as your capital is eroded more slowly than it would be were you drawing more than the minimum.

Importantly, as with TFSAs, no income or dividend withholding tax is levied in the living annuity and capital gains tax is not applicable in terms of current legislation only income paid by the living annuity attracts tax. As is the case for TFSAs, retirement capital invested in living annuities therefore benefits from increased compounding returns.

Youll Owe Taxes On The Money Now But Enjoy Tax

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve been diligently saving for retirement through your employer’s 401 plan, you may be able to convert those savings into a Roth 401 and gain some added tax advantages.

You May Like: Doordash Tax Form

Stocks Bonds And Mutual Funds

If you sell stocks, bonds or mutual funds that you’ve held for more than a year, the proceeds are taxed at long-term capital gains rates of 0%, 15% or 20%. Compare these figures to the top 37% tax rate on ordinary income.

The 0%, 15% and 20% rates on long-term capital gains are based on set income thresholds that are adjusted annually for inflation. For 2021, the 0% rate applies to individuals with taxable income up to $40,400 on single returns, $54,100 for head-of-household filers, and $80,800 for joint returns . The 20% rate starts at $445,851 for single filers, $473,751 for heads of household, and $501,601 for joint filers . The 15% rate is for individuals with taxable incomes between the 0% and 20% break points. The favorable rates also apply to qualified dividends .

There’s also a 3.8% surtax on net investment income on top of the 15% or 20% capital gains rate for single taxpayers with modified adjusted gross incomes over $200,000 and joint filers over $250,000. This 3.8% extra tax is due on the smaller of NII or the excess of modified AGI over the $200,000 or $250,000 amounts. NII includes dividends, taxable interest, capital gains, passive rents, annuities, royalties, etc.

If you sell investments that you’ve held for a year or less, the gains are short-term and are taxed at your ordinary income tax rate.

Planning For Gifts And Bequests

As you look ahead, you may be thinking about giving some of your assets to family members or friends, which is often beneficial to both you and them as long as you can afford to live comfortably on your remaining retirement income.

Transferring wealth is often a good way to avoid incurring estate taxesand that’s in turn good because these taxes can take a larger bite of your assets than even the highest income tax rate. In addition, some states impose inheritance taxes at various rates on what your heirs receive from your estate.

But the good news is that prior to your death, you can make gifts to whomever you wishand you can do so up to a certain amount without paying taxes. The IRS ceiling for individuals and married taxpayers changes from time to time.

In addition, you can make larger gifts tax-free to your beneficiaries over the course of your lifetime. You have to follow IRS rules carefully to comply with the lifetime exclusion provisions. For more details, read the instructions for IRS Form 709.

There are pros and cons to making tax-free gifts. On the upside, giving the money away reduces your taxable estatethat is, what will be subject to estate taxes when you diewhile also helping your beneficiaries. But on the downside, once the gift is given, if you need access to that money later in your retirement, it’s gone.

You May Like: How To Report Plasma Donation On Taxes

How To Pay Fewer Taxes In Retirement

Your tax rate in retirement will depend on your total amount of income and your deductions. To estimate the tax rate, list each type of income, and how much will be taxable. Add that up. Then reduce that number by your expected deductions and exemptions.

Everyones financial circumstances are different. Paying lower taxes in retirement may be feasible. It takes research or the assistance of a professional retirement planner or tax advisor.

This article is an introduction to tax rules in retirement. If you want to learn more, on YouTube you can watch a recording of our Tax Planning for Retirement. Or listen to Episode 4 of the Control Your Retirement Destiny podcast.

The Control Your Retirement Destiny podcastis available on iTunes or Podbean

When Its Finally Time For You To Retire Paying Your Taxes May Be The Last Thing On Your Mind But Taking A Proactive Approach To Understanding How Your Income Will Be Taxed Can Help You Get The Most From Your Money And Your Golden Years

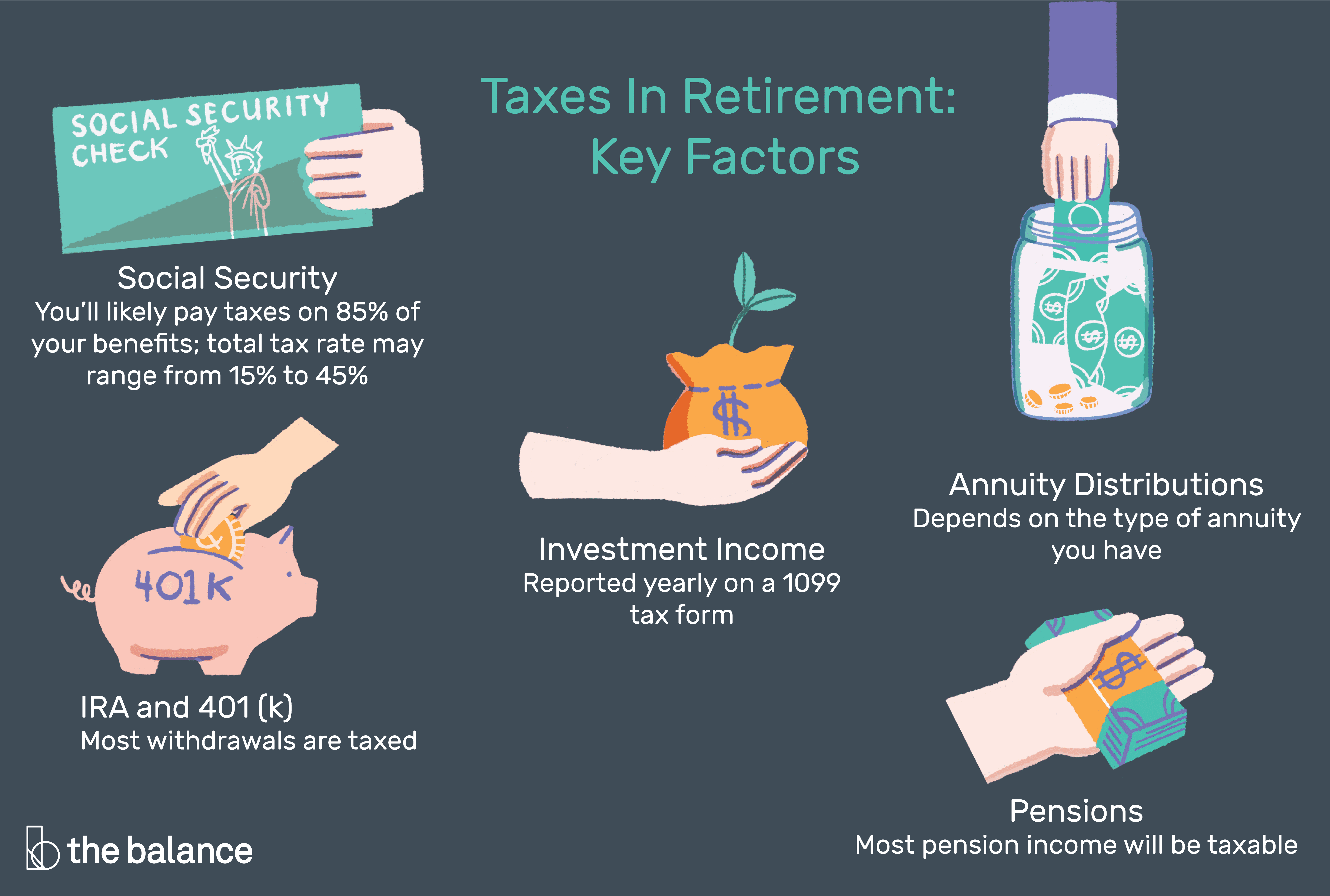

Determine How Social Security Will Be Taxed

One of the first questions you should ask as you prepare to retire is whether your Social Security benefits will be taxed. This depends on your combined income, which the IRS defines as your adjusted gross income plus non-taxable interest and half of your Social Security benefits.

Heres the breakdown:

If you file a federal tax return as an individual and your combined income is:

- Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- More than $34,000, up to 85 percent of your benefits may be taxable.

If you file a joint return, and you and your spouse have a combined income that is:

- Between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

- More than $44,000, up to 85 percent of your benefits may be taxable.

Understand Tax Implications of Taking Benefits Early

If you elect to receive Social Security benefits before your full retirement age, your benefits will be reduced a fraction of a percent for each month before your full retirement age. Beginning the month you reach full retirement age, your earnings will not reduce your benefits no matter how much you earn.

In addition, if you make withdrawals from an individual retirement account before you reach 59 ½, the payments are generally considered an early distribution, and you will likely be subject to an additional 10 percent tax.

Consider Income from Retirement Plans and Part-time Work

Also Check: How To Calculate Doordash Miles

Ially Taxable Retirement Income

The following sources of retirement income are partially taxable. How much is taxable depends on different factors.

- Social Security: Anywhere from 0% to 85% of your Social Security income may be taxable. At least 15% will always be tax-free. How much of your Social Security income is taxable depends on your income and tax filing status. If you are married and file separately, you will likely pay tax on your Social Security benefits.

- Nondeductible IRA withdrawals: If you have traditional pretax individual retirement account contributions as well as after-tax, nondeductible IRA contributions, then a portion of each nondeductible IRA withdrawal may be considered a gain. A portion would be the return of your basis. The gain portion is taxable retirement income.

- Income from an immediate annuity that was purchased with after-tax money: When you buy an immediate annuity with after-tax money, a portion of each payment you receive is interest. A portion is a return of principal. The interest portion is taxable. If the immediate annuity was purchased with pretax money, such as in an IRA or other retirement account, all the income will be taxable.

- Cashing in a cash-value life insurance policy: Cash-value life insurance policies have a cost basis, which is usually the total of all premiums you have paid. If your cash value exceeds your basis when you cash in the policy, that portion will be taxable.

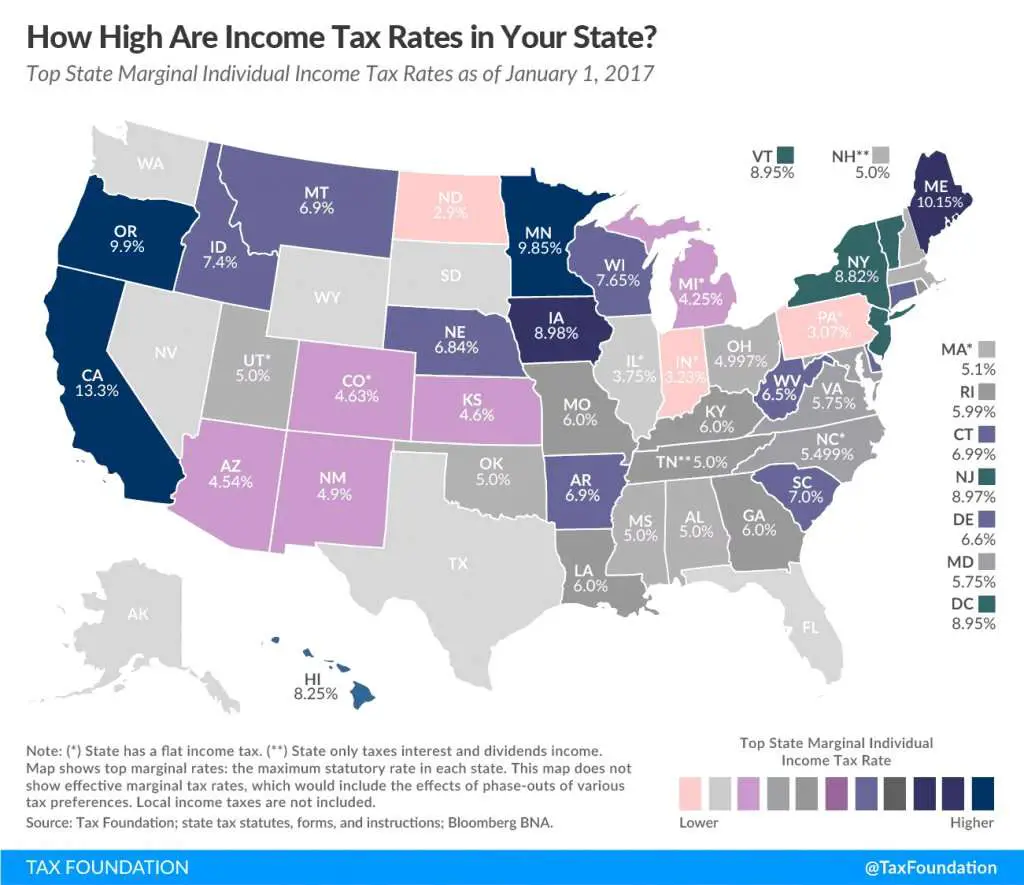

How High Are Sales Taxes In California

California has the highest state sales tax rate in the country at 7.25%. That is the minimum you will pay anywhere in the state, but local taxes as high as 2.50% mean you will likely pay an even higher rate. Overall, the average rate you can expect to pay in California is 8.82%.

The good news is that not all goods are taxable. In fact, a number of exemptions are designed specifically to benefit seniors and retirees. That includes an exemption for prescription drugs and an exemption for most types of groceries.

Don’t Miss: Doordash Tips Taxable

Ira And 401 Withdrawals

Withdrawals from tax-deferred retirement accounts are taxed at ordinary income tax rates. These are long-term assets, but withdrawals aren’t taxed as long-term capital gains. IRA withdrawals, as well as withdrawals from 401 plans, 403 plans, and 457 plans, are reported on your tax return as ordinary income.

Most people will pay some tax when they withdraw money from their IRA or other retirement plans. The amount of tax depends on the total amount of your income and deductions and what tax bracket you’re in. You might not pay taxes on withdrawals if you have a year with more deductions than income, such as a year with a lot of medical expenses, and if you itemize your deductions to claim them.

Roth IRA withdrawals are typically tax-free because you can’t take a tax deduction for your contributions in the year you make them. You’ve already paid taxes on this money once, so you won’t have to pay again when you take it back out.

Overview Of California Retirement Tax Friendliness

California fully taxes income from retirement accounts and pensions at some of the highest state income tax rates in the country. Social Security retirement benefits are exempt, but California has some of the highest sales taxes in the U.S.

To find a financial advisor near you, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: Do I Have To File Taxes For Doordash

Taxes On Iras And 401s

Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular income tax rate. If you deducted any portion of your contributions, you’ll owe tax at the same rate on the full amount of each withdrawal. You can find instructions for calculating what you owe in IRS Publication 590, Individual Retirement Arrangements.

If you have a Roth IRA, you’ll pay no tax at all on your earnings as they accumulate or when you withdraw following the rules. But you must have the account for at least five years before you qualify for tax-free provisions on earnings and interest.

When you receive income from your traditional 401, 403 or 457 salary reduction plans, you’ll owe income tax on those amounts. This income, which is produced by the combination of your contributions, any employer contributions and earnings on the contributions, is taxed at your regular ordinary rate. Keep in mind that withdrawals of contributions and earnings from Roth 401 accounts are not taxed provided the withdrawal meets IRS requirements.

Estimating Your Retirement Tax Income

The best approach is to make a detailed plan for your retirement income long before you actually retire. Once you understand the basic factors that go into retirement income, explained above, you can start putting the pieces together.

It can be helpful to draw up a mock tax return of an average year during retirement. You estimate how much youll receive from your pension plan, your retirement plan, your Social Security income, and any additional income from other investments. You then take into account your deductions, whether or not your spouse has income as well, and head to the tax tables to determine what rates you will be taxed at.

Understanding the numbers can help you make the best decisions now for retirement income later. Most likely youll need the help of a qualified tax advisor, so get in touch with one today to learn more.

Have you been able to calculate your federal taxes on retirement income lately? Let us know in the comments section below.

Also Check: Protest Taxes Harris County

Which States Do Not Tax Military Retirement Pay

Answer itstatestaxdoPennsylvaniaexemptmilitary pensionsState

Also question is, which states do not tax retirement income?

states do not taxincomeretirementstatesincome taxes

What states do not tax your pension or Social Security?

SevenFloridaNevadaSouth DakotaTennesseeTexasWashingtonWyomingDelawareMontana

What Is The California Homeowners Exemption

Owner-occupied homes in California are eligible to receive the homeowners exemption. It reduces taxable value by $7,000. That saves homeowners at least $70 per year, although for many homeowners the savings will be even greater.

In 2016, the state controller reinstated the Property Tax Postponement Program. This allows homeowners who are seniors, are blind or have a disability to defer their property taxes. This is only available for taxes on a primary residence. You also need to have at least 40% equity in the home and an annual household income of $45,810 or less.

Also Check: Doordash Driver Tax Calculator

Estate And Inheritance Taxes

Another type of tax that is of particular importance to retirees is the estate tax. In recent years, legislatures across the U.S. have either repealed their state estate taxes or have increased the local estate tax exemption. For reference, the estate tax exemption is the limit below which estates do not owe taxes.

The federal estate tax exemption has increased over the years to $11.58 million in 2020 and $11.7 million in 2021. Of the 12 states that have their own estate tax, seven have an exemption of $4 million or less. Massachusetts and Oregon have the lowest exemption at $1 million.

Similar to the estate tax, an inheritance tax affects property that’s passed on to loved ones. The tax applies not to the estate itself, but to the recipients of the property from that estate. For example, if you receive $1,000 as an inheritance and are subject to a 10% inheritance tax, you would pay $100 back in taxes.

Six states have an inheritance tax. Of these, one state also has an estate tax. Inheritance taxes typically provide exemptions or lower rates for direct family members, while fully taxing non-relatives.

Invest In Roth Accounts

Distributions from Roth 401 and Roth IRA accounts are not taxable in retirement. You can take as much money out of these accounts as you would like without owing taxes, provided you follow IRS withdrawal rules.

If you don’t want to worry about paying taxes after you retire, use these accounts as your primary retirement savings vehicles. Or, put at least some of your retirement money into them throughout your working life to reduce your future tax bills.

Be aware, though, that Roth accounts do not provide an up-front tax break in the year you make your contributions. As a result, it makes sense to choose Roths over traditional accounts if you expect your tax bracket will be higher in retirement than during the years you’re contributing to your retirement accounts.

It’s possible to convert traditional accounts to Roth accounts. However, there are tax consequences, and a five-year rule may limit your ability to access your funds tax-free if you roll over your account too close to retirement.

Recommended Reading: Doordash Taxes How Much