Business Tax Records To Keep Forever

Companies must keep certain tax records indefinitely. Assets usually have tax consequences upon sale, so the statute of limitations will apply to the future tax return that includes the asset sale.

Businesses also need to retain specific key documents forever. These include company formation documents and ownership records such as stock ledgers, titles, deeds, property records, and contracts.

Corporations must also keep shareholder meeting minutes. Failure to maintain corporate records could cause the corporation’s owners to lose liability protection.

Missing documentation can cause substantial liability and missed opportunities. Keeping tax returns and other records for the appropriate period allows your business to respond to information requests, including tax audits.

About the Author

Stephen Sylvester

Stephen Sylvester, CPA helps CPA and finance firms turn expertise into new clients. By transforming esoteric technical iRead more

Know Your Specific Legal Requirements

Your record-keeping requirements also depend on your business entity type. For instance, there are stricter rules for corporations than for sole proprietorships.

If your business is incorporated, you need to keep business finances and personal finances separate. Your business records need to be organized, clear and distinct to avoid audits. On the other hand, sole proprietors can mix both categoriesand have to be extra careful to keep all relevant records.

Be sure to check with your state and local tax bodies to make sure you understand all related rules or regulations.

Why Do You Need To Keep Business Records

Small business owners sometimes forget to keep good records. However, bad record keeping can cause a lot of problems. Here are a few ways of keeping business records can help you:

- Check your business progress

- Keep track of all deductible expenses

- Provide to authorities in case of an audit

Personal and business purchases can get mixed up. This is more likely if you don’t keep good records. Receipts are important business records to keep. They can keep your personal and professional purchases separated. They can also help you see the source of your expenses.

Some records are for your information only. That doesn’t mean you shouldn’t keep them. Business and sales improvement documents can help you succeed. You don’t need to keep them by law, but it’s wise to hang onto them for a while so you can check your growth. Also, you can use the information to make improvements to your business.

It helps to keep the right records when filing tax returns. If you report an expense or income on your taxes, you need to document it. In most cases, these are the same records you use to prepare regular financial statements. Keep them organized and somewhere easy to access.

Keeping good records is very important when you own a small business. Your records will help you project your tax liability. Once you do that, you can make estimated tax payments.

You May Like: Appeal Taxes Cook County

Ask A Lawyer A Question

You’ll hear back in one business day.

Here are some of the standard limitation periods on tax-related documents, according to the IRS:

-

If you owe additional taxes, keep records for 3 years

-

If you do not report income that should have been reported, and it exceeds 25% of the gross income on your return, keep records for 6 years

-

If you file a fraudulent return, keep records indefinitely

-

If you do not file a return, keep records indefinitely

-

If you file a claim for credit or refund after filing your return, keep records for 3 years from the filing of the original return

-

If you file a claim for a loss due to bad debt deduction or worthless securities, keep records for 7 years

-

Keep all employment records for at least 4 years after the tax is due or paid

Some business records should be kept permanently:

-

Audit reports and charts of accounts

-

Canceled checks for important payments

-

Records of capital stocks and bonds

-

Cash books

-

Contracts and leases still in effect

-

Legal correspondence

-

End of year financial statements

-

Insurance records

-

State and federal income tax returns

-

Trademark registrations

How Long Should You Keep Business Tax Records

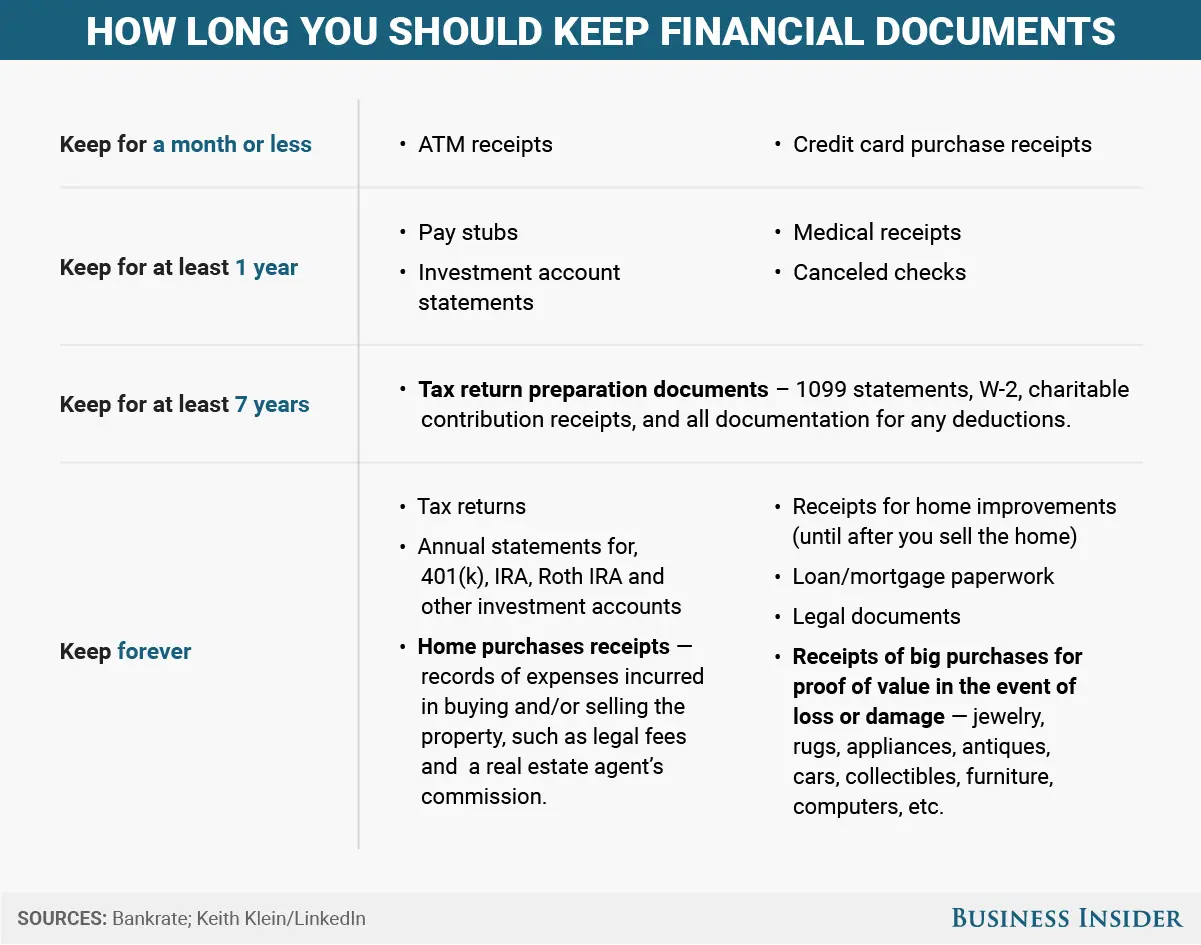

Keep business income tax returns and supporting documents for at least seven years from the tax year of the return. The IRS can audit your return and you can amend your return to claim additional credits for a period that varies from three to seven years from the date you first filed. But it’s a good idea to use seven years as your guide for keeping these documents.

If you don’t file a return at all, the IRS can come after your business at any time.

Examples of supporting documents include:

- profit and loss statements

- financial statements

- invoices.

You May Like: Do I Have To File Taxes For Doordash If I Made Less Than $600

How Long Should I Keep My Tax Records

Heres how long you should keep your records, and exceptions to the three-year rule.

Keep your tax records for three years if:

- No fraud was committed and all income was reported.

- You filed a claim for credit or refund after your return was filed.

Keep your tax record for four years if:

- You maintain employment tax records. Keep these for at least four years after the date that the tax becomes due or is paid, whichever one is later.

Keep your tax records for six years if:

- You could have underreported your income by 25%. If this is the case, the IRS can review your taxes from up to six years ago.

Keep your tax records for seven years if:

- You filed a claim for a loss from worthless securities or bad debt deduction.

Keep your tax records indefinitely if:

- You purchased property, so you can show the amount that you originally paid for it.

- You do not file a return each year.

- You filed a fraudulent return.

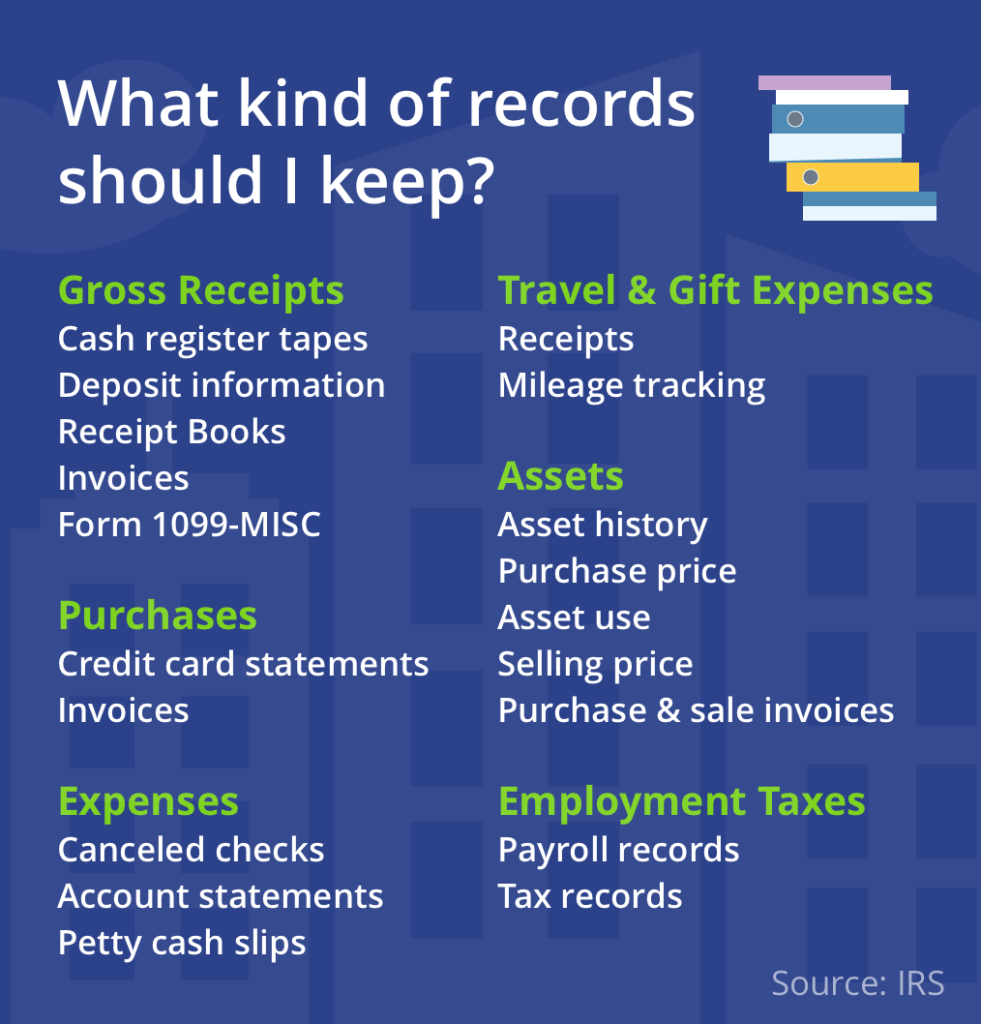

What Are Business Documents

What exactly counts as a business document? Which documents should business owners keep and which should you throw away? First of all, the CRA states that you are required by law to keep records of all your transactions to support your income and expenses . They also state that business owners should keep an organized, daily log of all income and expenses. It is best to keep separate record logs for each business you run to avoid confusion. The CRA also notes that you should not send these records with your tax returns, but instead keep them on file in case of an audit or you are asked to provide them in the future .

If you are unsure what records to keep, the following list provides a brief outline for each category of business document to keep with examples. Remember, all the types of documents listed below should be kept in an organized manner to make your life and tax season easier!

Note: The list below is not exhaustive. For more information about keeping tax records,

You May Like: How Much Does H& r Charge

When Does The Statute Of Limitations Begin

The clock starts ticking on the three-year statute of limitations on the later of the tax return due date or the date you filed your taxes.

If the tax return due date was April 15 and you filed Feb. 15, your timer begins on April 15. If you filed late without an extension on May 3, the timer would begin on May 3.

Professional Document Management Companies

Another great way to keep your documents safely stored and securely disposed of when the time comes is by using a professional document management company. Working with a document management company will help give you peace of mind knowing your business documents are securely stored while not taking up much-needed space in your office!

Securely destroying tax records after the 6-7 year period is also important. It helps save you space, time, and money. At Blue-Pencil, our office shredding programs offer clients the opportunity to contract their documentation destruction management and ensure that everything will be handled securely and properly destroyed and recycled.

We fully assess your current policies and procedures to ensure that they meet standards for security, legal compliance, and cost efficiency. Once the assessment is complete it will be followed by a report that contains recommended actions and our custom program proposal. You can rest assured knowing your business documents will be both stored and destroyed when the time comes in a safe and secure manner.

Also Check: Harris County Property Tax Protest Services

Shred Anything You Dont Keep

If you truly dont need a business record anymore, shred it. This is essential to protect your business, your employees and your customers from identity theft. Otherwise, bad actors can fish in your recycling bin for Social Security numbers, addresses and credit card information.

Keep in mind you may need to keep the original versions of some documents. This includes things like your articles of organization, articles of incorporation, business permits, operating agreements and signed contracts.

If you truly dont need a business record anymore, shred it.

Other Circumstances For Extended Statutes Of Limitations

In some circumstances, the statute of limitations is longer than three years. For example, if you dont report income that youre required to report, and it exceeds 25% of the income shown on that years tax return, the IRS has six years to audit your return.

In addition, not filing or filing a fraudulent tax return allows the IRS to audit you indefinitely. So keep any tax records for those years permanently.

You May Like: How Do I File Taxes For Doordash

Better Safe Than Sorry

When it comes to how long to keep business records, its best to err on the side of caution. If the IRS ever comes knocking, you dont want to stare down an audit because of a few missing receipts.

If you have more documents to hold onto than you thought, dont worry. By digitizing your business records, you can cut down on clutter and stay organized. Regardless of the record-keeping system you choose, stay consistent with your method. That way, you can quickly and easily locate any record you need.

Finally, remember tax and business laws are complex and change often. However, you dont have to go it alone. Check with your accountant or a tax professional before tossing any major records.

The latest news, articles, and resources, sent to your inbox weekly.

12712 Park Central Drive, Ste 350, Dallas, TX 75251

FPT Operating Company LLC is a registered ISO/MSP of of Synovus Bank Columbus GA

Prolific Business Solutions is a registered ISO of Wells Fargo Bank, N.A. Concord, CA.

LTD Merchant Services is a registered ISO of Synovus Bank Columbus GA Wells Fargo Bank, N.A. Concord, CA Esquire Bank N.A. Jericho, NY

Granite Payment Alliance is a registered ISO of Esquire Bank N.A. Jericho, NY.

Philadelphia Processing is a registered ISO of Wells Fargo Bank, N.A. Concord, CA and an ISO/MSP of HSBC USA, N.A. Buffalo, NY.

AMCP Payments Intermediate Company LLC is a registered ISO / MSP of Esquire Bank N.A. Jericho, NY.

Paper Vs Electronic Records

In the digital world, recordkeeping is simplerand takes a lot less physical space! The IRS has determined that electronic records are the same as paper originals. In some cases, electronic is preferred, since paper receipts can fade and become illegible over time. But, if youd prefer to store all your files digitally, feel free to do so.

However, one word of caution: its easy to rely on your financial service provider to access your account information and history. For example, you might log into your online account to view monthly or yearly statements.

Be sure to check the terms of each account to see how long they keep historical records. If its shorter than 7 years, you may need to download and save an annual statement in order to have it on hand for tax recording.

Lastly, keep in mind that youll need to keep originals for important documentation. These are things like articles of incorporation, business licenses, partnership agreements and any signed contracts.

Many companies store such documentation in a corporate binder. Keep the binder in a safe space . Its one of the first things that will be requested should you want to sell your company or be involved in an audit or lawsuit.

Freshly picked for you

about the author

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Review our cookies information for more details.

Don’t Miss: How Do Doordash Drivers Pay Taxes

Determining Expiration Of The Statute Of Limitations

Typically, the statute of limitations for the IRS to audit your tax return is generally three years. For an income tax return, the period of limitations is three years. But the IRS says its wise to keep your tax returns even longer. For example, if the IRS audits you, youll have the documents you need to protect yourself from an audit. The statute of limitations starts running on the later of the due date for your tax return or the date on which you file your taxes.

Let The Industry Experts Help Digitize Your Tax Records

Now you know how long to keep a tax record for business, a final tip before we end this post, i.e., “if you are in doubt whether to keep a certain record, receipt, or document, we recommend you keep it.” Better safe than sorry, right? So make this a rule.

Did you know that 1099 contractors and freelancing entrepreneurs made 36 percent of the U.S. workforce in 2019? The industry experts forecast this number to grow exponentially therefore, as a 1099 contractor, you must protect yourself against upcoming new taxation or work laws by securing your documents for easy access.

If you are a 1099 contractor without any technical knowledge of digitizing your record, you can always seek expert assistance. Keeper Tax is a great app for freelancers & independent contractors to help them save money on taxes and assist with their online bookkeeping. The expense tracker automatically scans your bank account statements for tax deductions.

Moreover, you can visit the Keeper Tax website and check their free resource section for other valuable information. From free income tax calculators to tax advice from CPAs for self-employees, you can benefit from their resources.

Jesus Morales-Grace, EA

Jesus Morales is an Enrolled Agent and has 7 years of bookkeeping and tax experience. He enjoys hiking, traveling, and studying tax law.

Find write-offs.

Don’t Miss: 1040paytax.com Legitimate

Why Digitize Your Records

Digitalization of your tax record helps avoid any accidental loss of data for any reason. Moreover, in case if any of the paperwork fades or retain damage, you can produce the e-copy. IRS will never believe that “your dog ate the tax records.”

While you digitalize your data, you can still keep a backup of all your tax records for the business. Simply use a cloud-storage or an encrypted/password-protected hard-drive.

What Is Adequate Evidence

In general, receipts, canceled checks and bills will be enough to document your expenses. These documents should help you establish the date, place, amount and reason for the expense.

For example, evidence for your hotel stay should include the name and location of the hotel, the dates you stayed and the cost of the stay, with separate charges for things like meals and telephone calls.

If you are keeping evidence for a meal, youll want to have a receipt that shows the name and location of the restaurant, the number of people served, the date of the meal and the cost.

Along with all documentation, you should also make note of the written explanation of the business purpose. Yes, the IRS wants to be sure that the lunch you had with clients had a business purpose and wasnt just for fun so make note of why it was important to have that meal.

You May Like: Do You Claim Plasma Donation On Taxes

How Do I Properly Dispose Of Business Tax Records

- Double check that anyone your business is associated with is okay with you discarding the documents. They may need them for an outstanding claim or other matter, so its best to check in with them first.

- Dispose of your records properly by shredding theminstead of trashing or recycling. Theres a lot of personal and financial data on your old tax returns and other financial records, so do what you can to make sure your information is protected by disposing of your records responsibly.

What Records Should You Keep Permanently

In addition to pension and retirement plan documents, permanently keep business formation documents, corporate by-laws, annual reports, and business licenses and permits to help explain to potential buyers, lenders, and others the actions and decisions you made while running your business.

Your Employer Identification Number or Tax ID Number is like a social security number. It can never be assigned to another business, and you should retain it permanently, even if you no longer operate your business.

If you have an “occurrence-based” insurance policy, you will want to keep it indefinitely. Occurrence-based policies insure you as long as the policy was in effect on the date that the event giving rise to the claim occurred. Should you discover damages or other losses after you have dropped or changed your policy, your coverage remains in effect.

Read Also: Doordash Taxes Calculator

Dispose Of These Documents Carefully

When the time to toss your tax returns finally arrives, its imperative you dispose of the documents properly.

Shred all paperwork so you dont put yourself at risk for identity theft, Zimmelman advises.

Tax documents contain lots of sensitive information, including your Social Security number, bank statements, and brokerage account statements. If this information falls into the wrong hands, you are vulnerable to financial loss.

How Long To Keep Tax Records

Self-employed Self Assessment taxpayers need to keep their business records for at least five years after the 31 January deadline of the relevant tax year.

So if you filed your 2018-19 tax returns ready for the relevant deadline on 31 January 2020, youll need to keep your records until 31 January 2025.

If you run a limited company and need to file a company tax return, there are more rules and regulations.

You need to keep your accounting records for longer six years from the end of the last company year they relate to.

There are some situations when limited companies need to keep records for longer, if:

- they show a transaction covering more than one of the companys accounting periods

- the company has bought something that should last more than six years

- you sent the company tax return late

- HMRC is investigating your company tax return

Also Check: Taxes Taken Out Of Paycheck Mn