Why Do Some States Not Have Income Tax

States without an income tax often make up for the lack of these revenues by raising a variety of other taxes, including property taxes, sales taxes, and fuel taxes. These can add up so youre paying more in overall taxation than you might have in a state that does tax your income at a reasonable rate.

State Income Taxes On Businesses

Some states impose an income tax on corporations, partnerships, and certain trusts and estates. These states frequently offer lower corporate rates and special exemptions to attract businesses to locate there. States cannot impose an income tax on a U.S. or foreign corporation unless it has a substantial connection, called a nexus.

Requirements for a nexus are different among states, but they generally include earning income in the state, owning or renting property there, employing people there, or having capital assets or property there. Even then, the income taxes imposed are apportioned and nondiscriminatory and require that other constitutional standards are met.

What Did Proposition 4 Change About Enacting An Income Tax In Texas

Before Proposition 4, the Texas State Constitution required the state legislature to put legislation enacting an income tax before voters as a statewide referendum, which voters could approve or reject. Placing a referendum before voters required a simple majority vote in each legislative chamber.

Proposition 4 replaced the referendum requirement with a ban on enacting an income tax on individuals. Since Proposition 4’s ban on an income tax added a provision of the Texas Constitution, a two-thirds vote in each legislative chamber and a statewide referendum are needed to repeal or amend the ban.

Therefore, one of the practical effects of Proposition 4 was to increase the legislative vote requirement to authorize an income tax.

Proposition 4 repealed the existing requirement that an income tax, should one be enacted, be used to reduce school ad valorem taxes and increase education funding.

Read Also: File Amended Tax Return Online Free

Texas Property Tax Exemptions

Property tax exemptions reduce the appraised value of your real estate, which can in turn reduce your tax bill. For example, a tax rate of 1.8% applied to an appraised value of $200,000 works out to more than 1.8% of an appraised $175,000 valueit’s a difference of $450.

Texas has several exemptions available.

Texas Has No State Income Tax

Remember, Florida is one of seven states that have no state-level income tax. Therefore, this tax estimator will only calculate your Federal income tax liability.

Having no income tax makes Texas an attractive destination for retirees and others looking to save money on income taxes compared to high-tax states like California and New York, the savings can be significant!

Head over to the Federal income tax brackets page to learn about the Federal Income Tax, which applies in all states nationwide.

You May Like: Doordash Paying Taxes

More Help With Taxes In Texas

Understanding your tax obligations can be confusing. So, get help with H& R Block Virtual! With this service, well match you with a tax pro with Texas tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your TX taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Texas state tax expertise with all of our ways to file taxes.

Related Topics

Do you need to amend your prior year return to add an item? Learn more from the tax experts at H& R Block.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Don’t Miss: Doordash How Much Should I Set Aside For Taxes

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

- Washington

- Wyoming

But States With No State Tax Have Some Pitfalls

There are a few reasons why moving to a state without income tax isnt always beneficial. The first and main reason is that the level of benefit in moving to one of these states is directly tied to your level of income. If you dont make a high income, then paying no income tax is less helpful.

States without income tax still need tax money, so they get that money through other taxes, like property and sales taxes. As a general rule, states with no income tax have much higher property and sales taxes.

So if you move to a state with no income tax but dont make much money, then the money you do make might not go as far. Due to the higher sales taxes, youll be paying more for goods and services in the state. And if you want to own property, then the chances are youll also have to pay a higher property tax.

Aside from income concerns, you could still be subject to an income tax even if you live in a state without one. If you make money from a business thats located in a state with income tax, then you could still be liable for taxes in that state.

Also Check: Do You Have To Report Plasma Donations On Taxes

How Was Proposition 4 Placed On The Ballot

The Texas State Legislature placed Proposition 4 on the ballot in one of the narrowest votes between 1995 and 2019. In Texas, a two-thirds vote is required to place a constitutional amendment on the ballot, which is equal to 100 votes in the state House and 21 votes in the state Senate, assuming no vacancies. The constitutional amendment received 100 in the state House and 22 votes in the state Senate, tying with Proposition 1 , Proposition 2 , and Proposition 12 for having the narrowest margin of approval in the legislature between 1995 and 2019. Most legislative Democrats opposed Proposition 4. Legislative Republicans, along with 29 percent of legislative Democrats, supported the constitutional amendment.

States With No Income Tax Might Put More Pressure On Lower

Income taxes are usually progressive in nature, meaning that they tax higher earners at a greater rate than lower earners. Other taxes typically dont have that Robin Hood-like characteristic.

Sales taxes, for example, are considered regressive. They dont change depending on the income level of the consumer. They treat everyone the same. So do levies on food, gasoline and other key consumable items.

These taxes place a bigger burden on the poor, according to ITEP research. The reason is the lowest earners in the state devote the lions share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their income in their 401s and other investments, have a much smaller proportional exposure to the sales tax.

Also Check: Pastyeartax.com Reviews

Understanding State Income Tax

Tax laws, rates, procedures, and forms vary widely from state to state. Filing deadlines also vary, but for individuals, state tax day usually falls on the same day as federal tax day, which is typically April 15. However, state filing deadlines were updated for the 2019 and 2020 tax years due to the COVID-19 crisis.

Taxpayers must file tax returns in each state and each year that they earn an income more than the states filing threshold. Many states conform to federal rules for income and deduction recognition. Some may even require a copy of the taxpayers federal income tax return to be filed with the state income tax return.

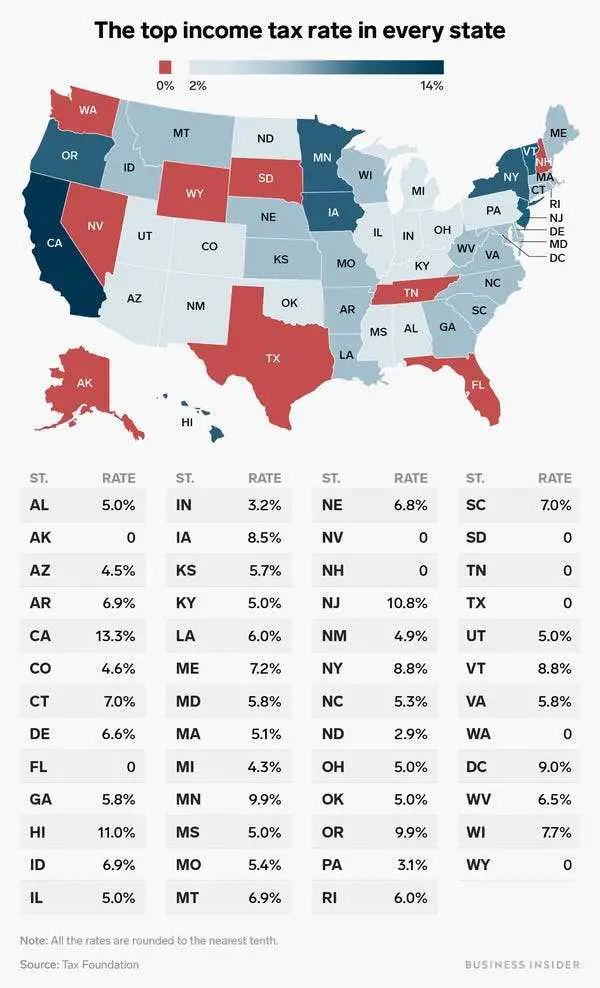

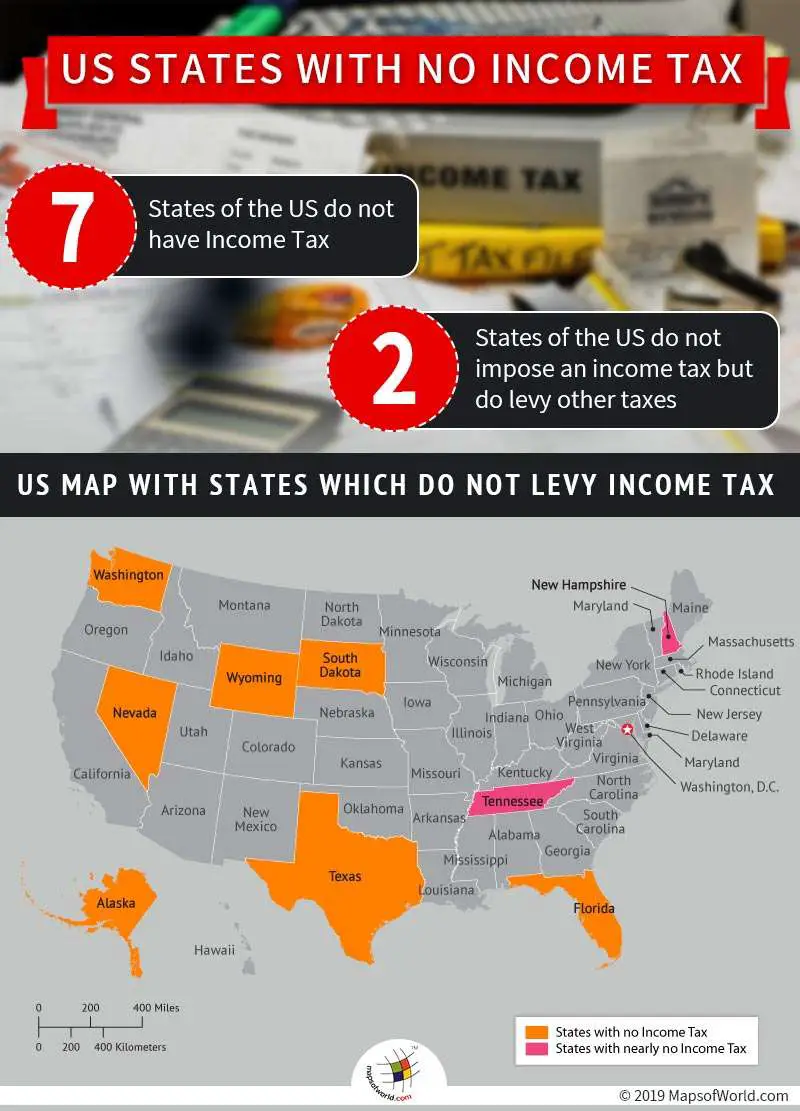

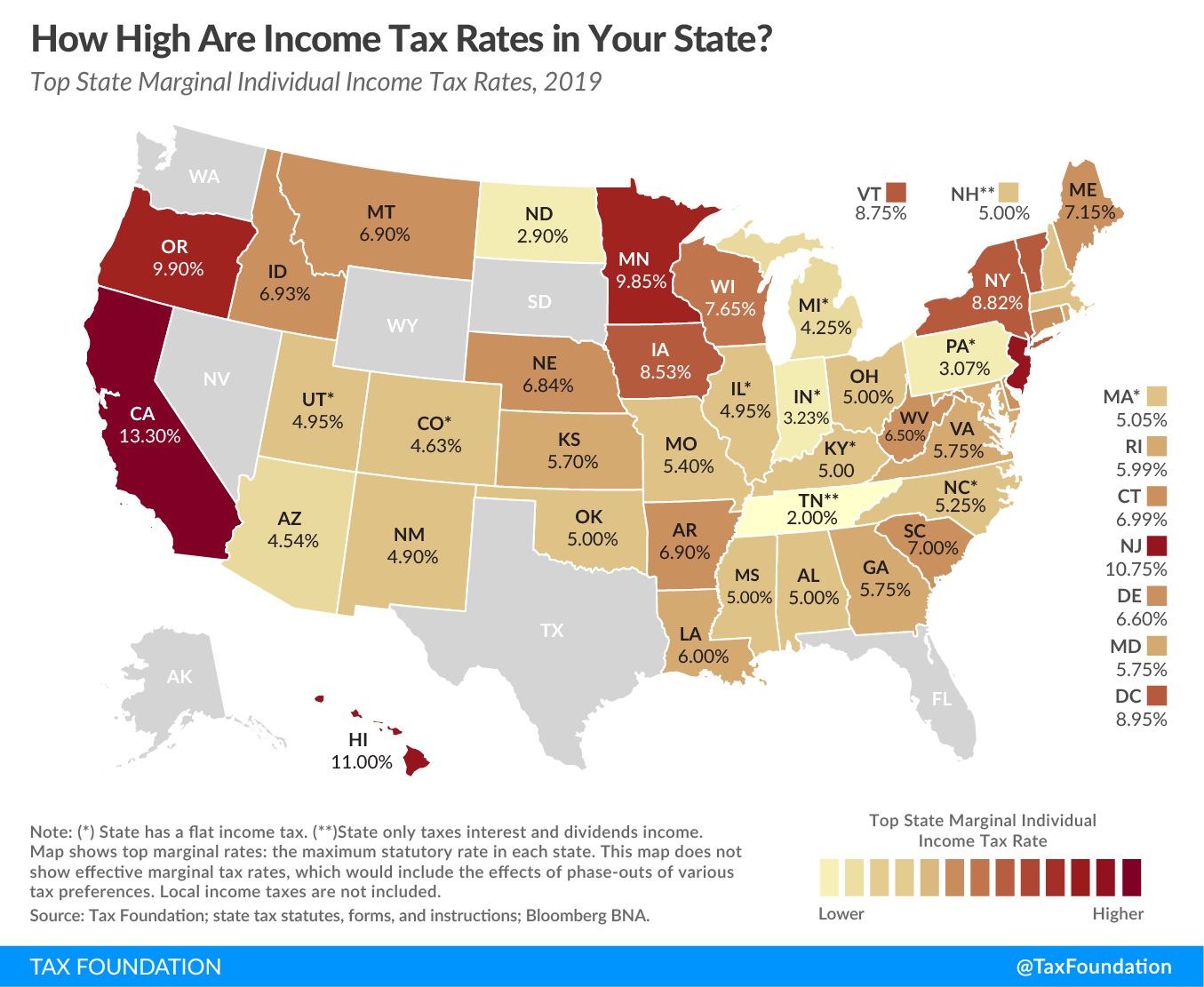

As of the 2021 tax year, eight states have no income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire taxes unearned income, such as interest and dividends, but it will end the practice as of Jan. 1, 2024.

Forty-one states and Washington, D.C., do have a state income tax. If you live in a state that levies an income tax, avoidance of it by working in a no-income-tax state is not possible. Your home state will continue to tax the income even though your earnings were made in a no-income-tax state.

If you have income that is not subject to withholding, such as business or self-employment income, you must estimate your annual tax liability and pay it to the state in four quarterly installments.

Exemptions For Seniors And The Disabled

Homeowners who are age 65 or older, or those who are disabled, can qualify for an additional $10,000 exemption for school district taxes and an exemption for other local property taxes that can’t be less than $3,000.

The school district can’t tax any more than what homeowners paid in the first year they qualified, so the tax is effectively frozen. Widows or widowers age 55 or older whose deceased spouse qualified for the 65-or-older exemption can continue to receive the exemption themselves if they apply.

Don’t Miss: 1040paytaxcom

Here Are The Basic Rules On Texas State Income Tax Withholding For Employees

By David M. Steingold, Contributing Author

Unlike the large majority of other states, Texas does not have a personal income tax. Therefore, if you have a small business with employees who work in Texas, you won’t need to withhold state income tax on their wages. However, you will still need to withhold federal income tax for those employees. Here are the most basic points for withholding employees’ federal income tax.

Texas Alcohol And Tobacco Taxes

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Liquor, on the other hand, is taxed at $2.40 per gallon. All of these taxes are below average for the U.S.

Texas’ taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle of the pack on a nationwide basis.

You May Like: Www.myillinoistax

Using Payroll Service Companies

You may decide that it’s easiest to hand over responsibility for payroll, including withholding taxes, to an outside payroll service. If so, keep in mind that under federal law, the employer remains responsible if an outside company fails to perform any required action. Search “outsourcing payroll duties” on the IRS website for more information.

What Kind Of Tax Will You Owe On Texas Business Income

Most states tax at least some types of business income derived from the state. As a rule, the details of how income from a specific business is taxed depend in part on the business’s legal form. In most states corporations are subject to a corporate income tax, while income from pass-through entities such as S corporations, limited liability companies , partnerships, and sole proprietorships is subject to a state’s tax on personal income. Tax rates for both corporate income and personal income vary widely among states. Corporate rates, which most often are flat regardless of the amount of income, generally range from roughly 4% to 10%. Personal rates, which generally vary depending on the amount of income, can range from 0% to around 9% or more in some states.

Currently, six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming do not have a corporate income tax. However, four of those states Nevada, Ohio, Texas, and Washington do have some form of gross receipts tax on corporations. Moreover, five of those states Nevada, South Dakota, Texas, Washington, and Wyoming as well as Alaska and Florida currently have no personal income tax. Individuals in New Hampshire and Tennessee are only taxed on interest and dividend income.

The taxable margin, on which the franchise tax is based, is equal to the least of the following four amounts:

Note that various possible state credits and discounts that may apply to your particular business are not covered here.

Recommended Reading: Doordash Tax Deduction

States With Local Income Taxes In Addition To State

The following states have local income taxes. These are generally imposed at a flat rate and tend to apply to a limited set of income items.

Alabama:

- Some counties, including Macon County, and municipalities, including Birmingham

California:

Colorado:

Delaware:

Indiana :

- All counties

- Many school districts and Appanoose County

Kansas:

- Some counties and municipalities

Kentucky:

- Most counties, including Kenton County, Kentucky, and municipalities, including Louisville and Lexington

- All counties, and the independent city of Baltimore

Michigan:

Missouri :

New Jersey:

New York :

Ohio:

- Some school districts .

- RITA .

- Most cities and villages on earned income and rental income. Some municipalities require all residents over a certain age to file, while others require residents to file only if municipal income tax is not withheld by employer. Income is reported on a tax form issued by the municipal income tax collector, currently Cleveland‘s Central Collection Agency or the Regional Income Tax Authority , or a collecting municipality. Municipalities such as Columbus and Cincinnati sometimes also collect for neighboring towns and villages.

Oregon:

Pennsylvania:

West Virginia:

- Some municipalities, including Charleston and Huntington

Sales Tax Isn’t The Only Tax To Consider

While you may think you pay a lot of sales tax because of how often you’re charged it, of the list of taxes you will pay in your lifetime, sales tax actually doesn’t amount to as much as you think. Even if you live in a state that has sales taxes, there are legal ways to sometimes avoid paying them, including sales tax holidays. In fact, you will likely pay more in loan interest than sales tax throughout your life.

But if you are considering what your tax burden may be in a new state, be sure to consider these larger tax bills:

Read Also: Pay Taxes On Plasma Donation

Texas Does Not Collect Personal Income Tax

Some states, including Texas, don’t collect personal income taxes but states still require a steady flow of revenue to pay for public goods such as education and infrastructure. According to the Texas Comptroller’s Office, the Lone Star state collects more than 60 different types of taxes, fees, and assessments. Much of these taxes are collected from local governments throughout the state.

States With Flat Tax Rates

Among the states that do have income taxes, many residents get a break because the highest rates don’t kick in until upper-income levels. But this isn’t the case in the 10 states that have flat tax rates as of 2021. The flat-tax states and their rates, from highest to lowest, can be seen in the table below.

| State |

|---|

| None |

Recommended Reading: Efstatus.taxact