Combined Sales And Income Tax Leaders

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2020 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

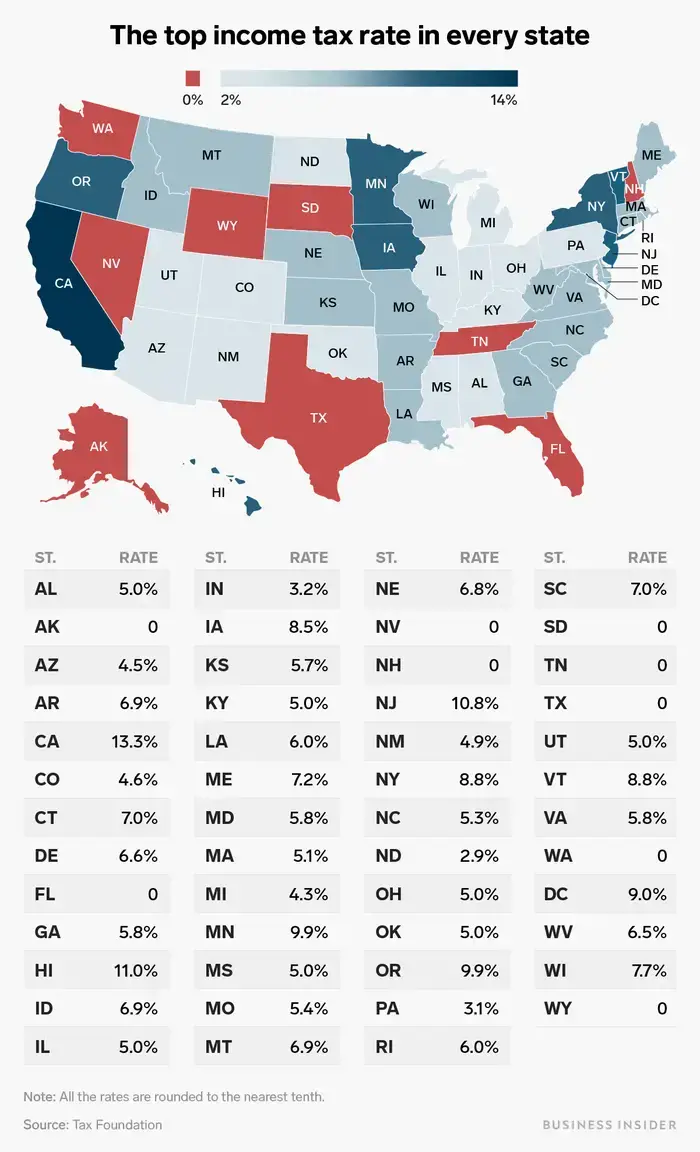

According to the foundation, the top five states with the highest state and local tax combinations are:

- New York 12.7%

- Illinois 11.0%

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Overview Of Wyoming Taxes

Wyoming has no state income tax. At 4%, the states sales tax is one of the lowest of any state with a sales tax, though counties can charge an additional rate of up to 2%. Wyomings average effective property tax rate is also on the low side, ranking as the 10th-lowest in the country.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 – 2021 filing season.

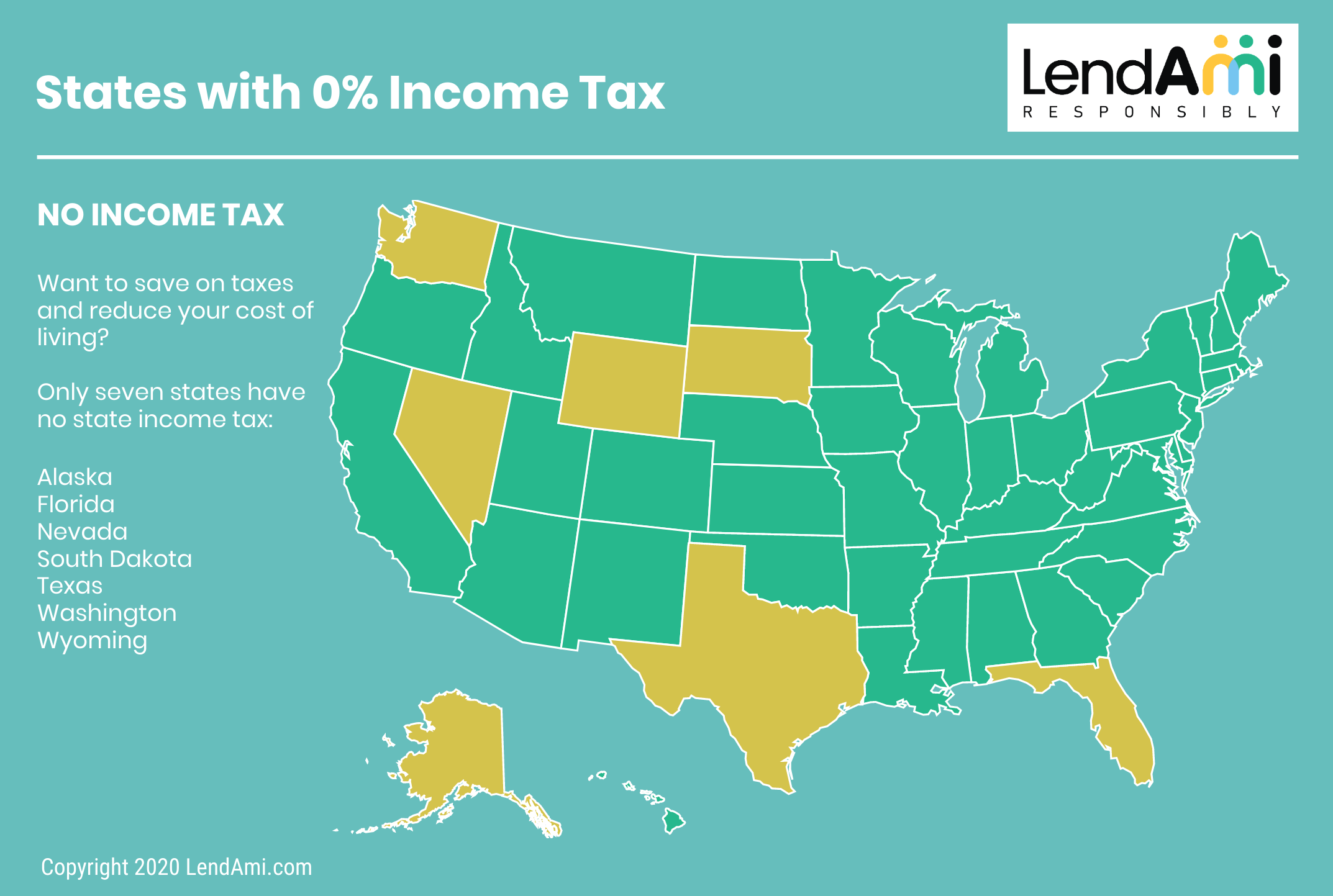

States With No Income Tax

The table below illustrates the differences among states with no income tax. The first two columns show the state’s overall tax burden as a percent of personal income followed by the rank that the state holds among all 50 states.

The third column shows the state’s affordability ranking, which combines both the cost of housing and cost of living, and the last column includes the state’s rank on the U.S. News& World Report “Best States to Live In” list.

These figures are as of the most recent reports: 2020 for overall tax burden, 2018 for affordability, and 2019 for “Best States to Live In.”

| Comparison of States With No Income Tax | |

|---|---|

| No-Tax State | |

| 42 | 37 |

You May Like: How To Correct State Tax Return

States That Don’t Tax Wages

However, two states – New Hampshire and Tennessee – don’t tax a large portion of wages, earning them honorable mentions as pseudo-state-income-tax-free states. In fact, Tennessee is on course to become the actual eighth state without state income tax, as the Hall tax imposed by the state will likely be null by 2020.

Additionally, New Hampshire has some of the most lax taxing on interest and dividend income, reportedly only charging taxes on interest and dividend income over of $2,400 . The state income tax is only 5% in general.

How High Are Sales Taxes In Wyoming

Wyomings sales taxes are very low. The total rate, including the state rate and the average of all local rates, is 5.34%. That ranks as the seventh-lowest rate in the U.S.

Groceries are exempt from sales taxes, though food costs in Wyoming are about 10% higher than the national average. Prescription drugs and medical equipment are also exempt from sales tax.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Are Other Forms Of Retirement Income Taxable In Wyoming

Wyoming does not tax any income. That means withdrawals from a 401, IRA, 403 or any other type of retirement account will not be taxed at the state level in Wyoming. Likewise, pension income is tax-free in Wyoming. Remember that federal taxes will still be owed on these other types of retirement income, though.

How High Are Property Taxes In Wyoming

Wyomings average effective property tax rate is 0.57%, which is the 10th-lowest rate in the U.S. That means homeowners pay about $570 in property taxes annually for every $100,000 in home value.

Budget-conscious retirees will likely be able to find an affordable place to live in Wyoming, where housing costs are generally very low.

In fact, median home values in Wyoming range from about $150,000 in the cheapest parts of the state up to $270,000 in more expensive areas. The one exception is Teton County, which contains all of Grand Teton National Park and 40% of Yellowstone National Park. The median home value there is a whopping $827,400.

Also Check: How To Get Stimulus Check 2021 Without Filing Taxes

Wyoming Tax Benefits: Dynasty Trust

While the Wyoming inheritance tax and Wyoming estate tax are both zero.

The state also has liberal laws regarding trusts. For use in protecting assets from taxes for generations.

For example, in Wyoming, dynasty trust laws allow for trusts that can last 1,000 years.

Okay. Thats todays discussion about Wyoming tax policy. But theres more. Before I wrap up

If You Choose To Live In These States Every Penny You Earn Is Safe From State Income Tax But That Doesn’t Mean You Won’t Have To Pay Other State And Local Taxes

Everyone hates paying taxes. So why don’t we all live in one of the nine states without an income tax? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming don’t tax earned income at all. If you’re retired, that also means no state income tax on your Social Security benefits, withdrawals from your IRA or 401 plan, and payouts from your pension. That sounds pretty darn good to me!

But, of course, no state is perfect. The states without an income tax still have to pay for roads and schools, so residents still have to pay other taxes to keep the state running . And sometimes those other taxes can be on the high end. New Hampshire and Texas, for example, have some of the highest property taxes in the country. So, if you’re thinking of moving to a state without an income tax, continue reading to see some of the other taxes you’ll have to pay in those states. Maybe the state you’re in right now won’t look so bad.

Overall Rating for Taxes: Mixed Tax Picture

State Income Taxes: New Hampshire doesn’t tax earned income, but currently there’s a 5% tax on dividends and interest in excess of $2,400 for individuals . The tax on dividends and interest is being phased out, though. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026. The tax will then be repealed on January 1, 2027.

Sales Tax: New Hampshire has no state or local sales tax.

Inheritance and Estate Taxes: There is no inheritance tax or estate tax.

Recommended Reading: Is Past Year Tax Legit

Make Scheduled Withholding Tax Payments

The IRS has two primary payment schedules for withholding taxes: monthly or semiweekly. There is also an annual payment schedule that applies to employers with low annual amounts of withholding . The IRS will specifically inform you if you will be on an annual payment schedule. In addition, in rare cases where an employer withholds very large amounts of tax, there is a next-day payment requirement, which is not covered here.

In general, your payment schedule will depend on the average amount you withhold from employee wages. The more you withhold, the more frequently you’ll need to make withholding tax payments. New employers start on a monthly payment schedule . After you’ve been an employer for enough time, your schedule will be based on the amount you’ve withheld in the past .

The exact threshold dollar amounts for the different payment schedules, as well as other rules, can change over time, so you should check with the IRS at least once a year for the latest information.

Due dates for the various payment schedules are as follows:

- Semiweekly: Payments are due by the following Wednesday for amounts withheld on the preceding Wednesday, Thursday, and/or Friday, and by the following Friday for amounts withheld on the preceding Saturday, Sunday, Monday, and/or Tuesday.

- Monthly: Payments are due by the 15th day of the month following the month in which the tax was withheld.

- Annually: Payment is due on or before January 31st for withholding for the preceding calendar year.

Living In A State With No Income Tax You Might Not Be Able To Claim The Full State And Local Tax Deduction

Another downside, taxpayers who live in states with no income tax might not be able to take advantage of one type of tax deduction.

Known as the state and local taxes deduction, the current code allows most taxpayers who opt to itemize their taxes instead of taking the standard deductions a maximum deduction of $10,000 from their federal taxes. That total is worth all of the property taxes they paid to state and local government agencies as well as their tally from either sales taxes or individual income taxes.

Since most people rack up more individual income taxes, that is the category they choose to deduct. Yet, without making some big purchases or holding a substantial real estate portfolio, it will likely be harder to hit the new $10,000 cap for individuals who live in a state with no income tax.

Also Check: Have My Taxes Been Accepted

Biggest Tax Requirement Property Tax

The biggest tax burden for residents of Wyoming is the property tax. While significantly lower than most other states, the property tax is the biggest portion of taxes collected in the state. Property taxes are collected based on the fair market value .

For residential and commercial property, the tax collected is 9.5 percent of the value of the property. For industrial lands, this percentage goes up to 11.5 percent. This is the state requirement, but a local mill levy rate is added based on each area’s rates for residential and commercial property. To calculate this rate, you can use this formula: x MLR = Property Tax.

The biggest property tax burden falls on minerals. Wyoming state taxes minerals at 100 percent of the fair market value.

Better Real Estate Agents At A Better Rate

Enter your zip code to see if Clever has a partner agent in your area.

If you don’t love your Clever partner agent, you can request to meet with another, or shake hands and go a different direction. We offer this because we’re confident you’re going to love working with a Clever Partner Agent.

Contact Us

You May Like: How To Buy Tax Lien Certificates In California

Some Pitfalls To Keep In Mind:

- If you want personal money out of a c corporation, you will get taxed twice. Youll distribute money to you personally after you already paid corporate tax rates on it.

- If you need to become an employee of the c corporation, youll end up registering it in your home state.

- Youll spend an extra $500-5,000 in CPA fees depending on how complex you make everything.

There are lots of advantages beyond taxes as well. We recommend you learn about asset protection and how a Wyoming holding company can help with your needs besides taxes.

So Are Wyoming Taxes Different For Non

After reading this youll be glad to know that there are few differences between what US residents must pay and what foreigners must pay.

The main differences are when it comes down to residency issues. These will influence how much tax you pay and the state youll want to incorporate your LLC in when the time comes.

For foreigners who dont have to worry about residency issues, who are typically running an online business, Wyoming is a strong candidate for those who dont want to pay a large amount of money to do business in the country.

Recommended Reading: How To Get A Pin To File Taxes

How Do You Establish Wyoming As Your Taxing State

To be taxed by a state. You need to establish what is called nexus.

For a business, establishing a Wyoming corporation or limited liability company is a good start. Plus having a primary business office, local phone number, and a local bank account are good ideas too.

For individuals, establishing primary residence in Wyoming is the best way. Then make that location the address of record for your financial accounts.

Furthermore, get a Wyoming drivers license. And register to vote in the state. Doing so will establish Wyoming as your state of record. For tax purposes.

The bigger challenge may be convincing your current state that you no longer have nexus there.

And each states rules may be a little different. To get taken off their tax roles.

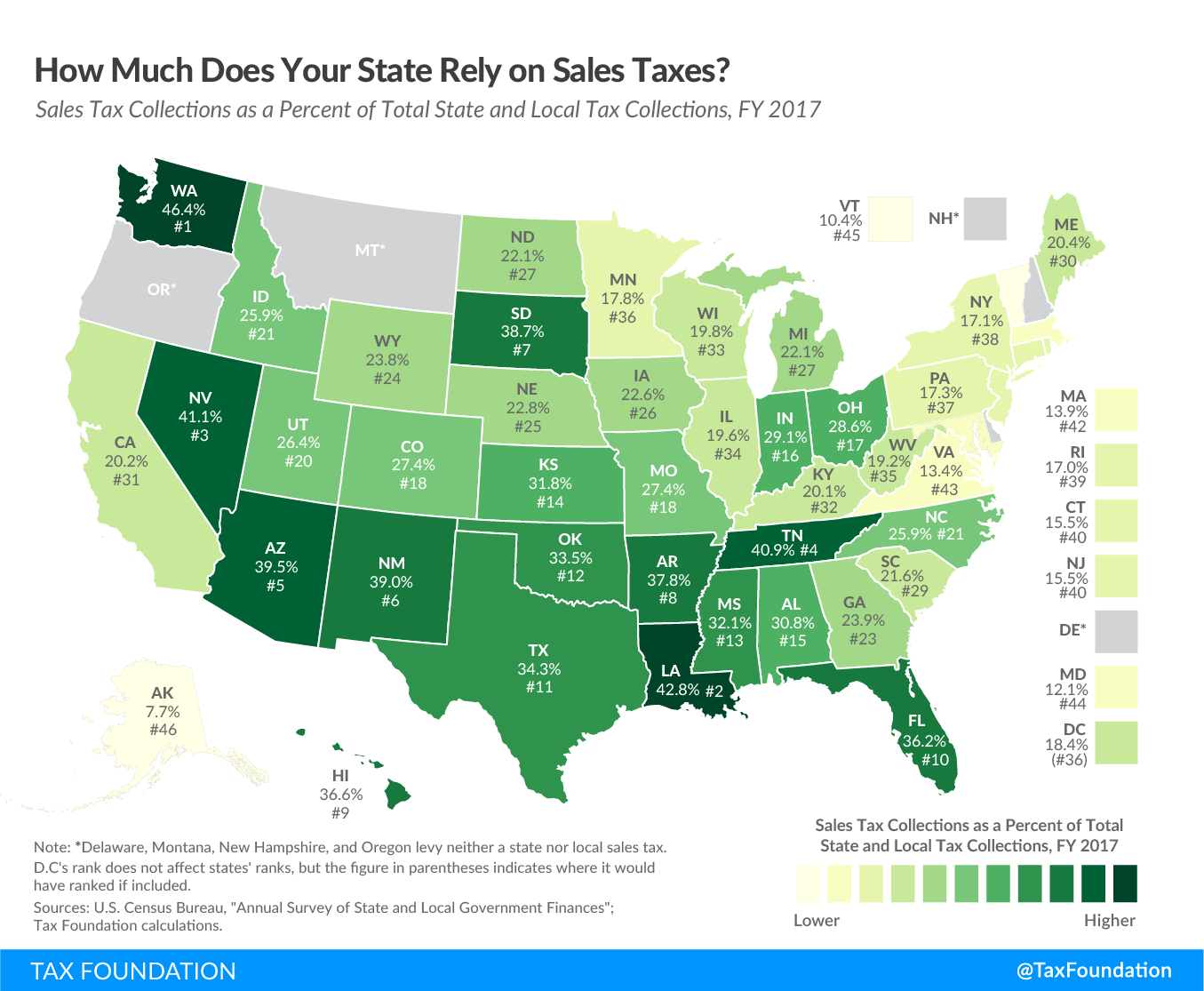

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue. Alaska only levies a paltry 1.76% sales tax rate.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including sales-tax-free Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2020, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2020 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- Alaska 1.76%

- New Hampshire 0%

Don’t Miss: How To Appeal Property Taxes Cook County

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

The Seven States With No Income Taxes

Tweet This

Are you ready to move to a new state to escape state income taxes?

Getty

Residents in high-tax states have seen just how unfairly the Trump Tax Plan has targeted them. That realization has caused many to talk about and consider moving from high-tax to lower-tax states. Nearly all states have an income tax, ranging from 1-13%. Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming are the exceptions because they do not tax residents incomes. Additionally, residents of Tennessee and New Hampshire are only taxed on income earned from dividends.

Budgets vary state-by-state, but as you can imagine, states are unable to properly function without taxes. Each one must receive revenue by other means or other taxes. Think things like sales or property taxes. That being said, states that do not tax income can be quite attractive to retirees or folk with big incomes.

Perhaps you could be neighbors with Sarah Palin if you moved to Alaska. They have no state income… taxes.

Getty

Alaska

Deriving much of its budget from petroleum resources, Alaska is one of the few states without income and sales taxes. That has allowed the state to pay its citizens a five-figure dividend, every year since the early 80s, from the Alaska Permanent Fund.

It literally sounds like people are being paid to live there. After all, it ranks near the bottom as the most populous state in America.

Florida is a haven for retirees looking for warm weather and no state income taxes.

Florida

Read Also: Oregon Tax Preparer License Renewal

Personal And Real Property Taxes

In Wyoming, all property is taxable unless it is specifically exempt. All property tax is based on the assessed value of the property. Wyomings Department of Revenues ad valorem tax division supports, trains and guides local government agencies in the uniform assessment, valuation and taxation of locally assessed property.

Wyomings property tax rate is 11.5% for industrial property and 9.5% for commercial, residential and all other property.

The residence and any additional structures and land are valued. Property taxes are not charged on home furnishings or furniture except where they are part of a furnished rental property.

Assessed value means taxable value. Wyoming is a fractional assessment state. This means property tax applies to only a fraction of the full market value of property. This fraction is the propertys assessed value. For most property, only 9.5% of market value is subject to tax. Consequently, a home worth $100,000 on the market is only taxed on $9,500 in assessed value. The real effect of fractional assessments is to exempt $90,500 of the homes value from taxation.

All taxable property is appraised at its fair market value as of Jan. 1 of each year. The taxpayer deadline for filing a statement of personal property is March 1, unless a written request for extension is received no later than Feb. 15.

Minerals are exempt from property tax, but incur a gross products tax and a severance tax when produced. Underground mining equipment is tax-exempt.

Overview Of Wyoming Retirement Tax Friendliness

Wyoming does not have its own income tax, which means the state will not tax any form of retirement income. This includes Social Security retirement benefits. Property taxes and sales taxes in Wyoming are also among the lowest in the country.

To find a financial advisor near you, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: Plasma Donation Taxable