Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Recommended Reading: Dasher 1099

How Long Does It Take For My Tax Refund To Appear In My Bank Account

It takes the IRS up to three weeks to send your refund if you’ve e-filed and you’ve opted to receive your refund via direct deposit. How long it takes to show in your account can vary by bank. It takes from one to five business days for your deposit to show up once the IRS sends your refund electronically. Your refund could take six to eight weeks to arrive if you opted for a paper check for some reason.

How To Check On Your State Tax Refund

Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

Read Also: Finding Your Ein Number

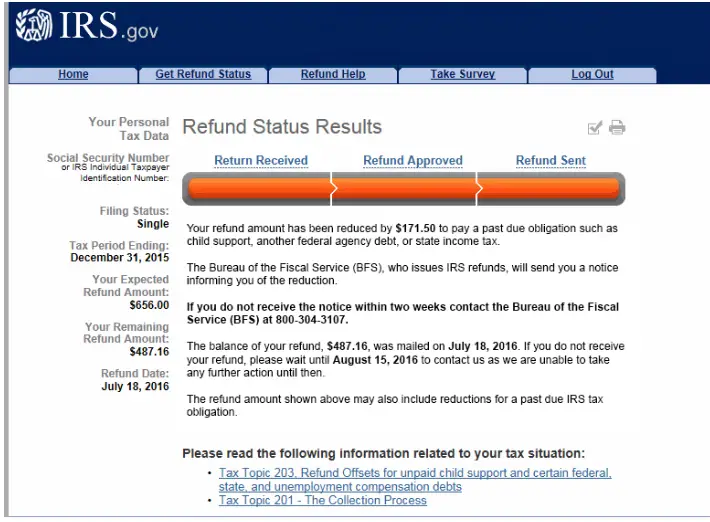

The Where’s My Refund Online Tool

The IRS indicates that it issues nine out of 10 refunds within three weeks if you choose direct deposit and you’ve e-filed your tax return. Refunds can take six to eight weeks if you file a paper return.

Go to Where’s My Refund? on the IRS website to check the status of your refund. The tool is updated every 24 hours. You’ll need some information:

- Your Social Security number or Employer Identification Number as it appears on your tax return

- The filing status you claimed on your return: single, head of household, married filing jointly, married filing separately, or qualifying widow

- The exact refund amount as shown on your tax return

You’ll be redirected to a Refund Status Results screen when you plug in this information. This screen should say one of three things:

- Return received

- Refund approved

- Refund sent

The IRS urges taxpayers to file electronically and to request direct deposit as soon as they have the information they need. This will help speed up their refunds.

You should see an estimated date for deposit into your bank account if your refund has been approved. There should also be a separate date for when you should contact your bank if you haven’t received your refund by then.

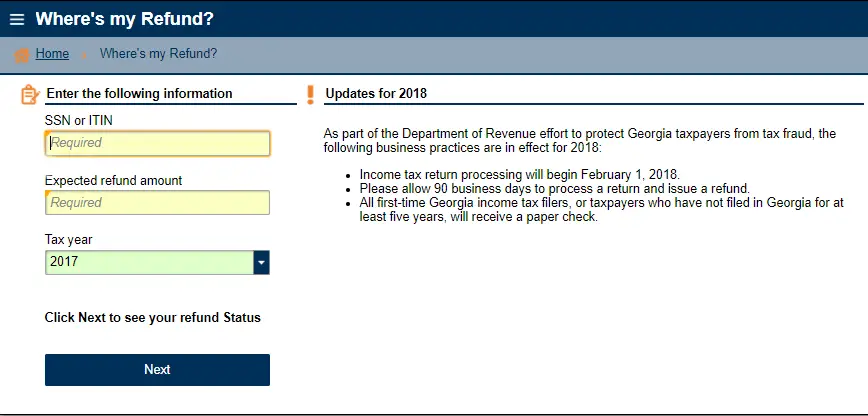

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

Also Check: Ein Number Lookup Irs

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Wheres My State Tax Refund New York

You can use this link to check the status of your New York tax refund. You will need to enter the exact amount of your refund in whole dollars in order to log in. This amount can be found on the state tax return that you filed.

Dont forget that if you paid any local income taxes for living in New York City or Yonkers, those taxes are included in your state return.

Don’t Miss: Payable Com Doordash

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Where’s My Stimulus Check

The first stimulus check recipients saw their payments show up in their bank accounts in mid-April. But some people who are also eligible for stimulus checks have not received their money, and they’re puzzled about why that is â and are perhaps in a panic over whether their coronavirus payment is coming at all.

Here are some of the possibilities why you might not have gotten a stimulus payment yet:

Don’t Miss: Pastyeartax Com Review

Request Electronic Communications From The Department

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

Once you’ve logged in to your Online Services account:

Sample of Individuals account type in Online Services

Sample of Bills and Related Notices screen in Online Services.

How To Check Check The Status Of Your Tax Refund

Online

Visit Refund Status on MassTaxConnect.

You will be asked to:

- Choose the ID type,

- Choose the tax year of your refund, and

- Enter your requested refund amount.

To check the status of your tax refund by phone, call 887-6367 or toll-free in Massachusetts 392-6089 and follow the automated prompts.

Don’t Miss: Florida Transfer Tax Refinance

What Are Possible Reasons I Haven’t Gotten Any Child Tax Credit Payments

The 2021 advance monthly child tax credit payments started automatically in July. Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money as expected for a few reasons. The IRS may not have an up-to-date mailing address or banking information for you. The mailed check may be held up by the US Postal Service or, if it was a recent payment, the direct deposit payment may still be being processed.

It’s also important to note that if you’ve been a victim of tax-related identity theft, you won’t receive child tax credit payments until those issues have been resolved with the IRS. If the issues aren’t cleared up this year, you’ll get the full amount when you file taxes in 2022. And keep in mind that even if you have unpaid state or federal debt, you should still receive child tax credit money if you’re eligible.

In September, roughly 700,000 families did not receive a payment due to an IRS technical error. Problems with missing payments were also reported in previous months among “mixed-status” families, where one parent is a US citizen and the other is an immigrant, though that issue should have been corrected for later payments.

Why Is My Tax Refund Still Being Processed

Your refund is most likely still being processed if it’s been less than three weeks since you e-filed for direct deposit or less than six weeks since you filed by mail for a paper check. You can call the IRS to check on the delay after that time. Reasons for delay might include errors on your return, a mismatch on your direct deposit account, or that you filed an amended return.

Also Check: How Taxes Work With Doordash

What Is A State Tax Lien

Tips For Managing Your Taxes

- Working with a financial advisor could help you invest your tax refund and optimize a tax strategy for your financial needs and goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

Don’t Miss: Pastyeartax Reviews

Can You Transfer Your Refund

Yes, you can ask the CRA to transfer your refund to your instalment account by:

- Selecting this option when filing electronically

- Attaching a note to your paper return

The CRA will transfer your full refund to your instalment account and consider this payment to be received on the date the CRA assesses your return.

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct deposited or mailed your refund.

The turn around time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

You May Like: Efstatus.taxactcom

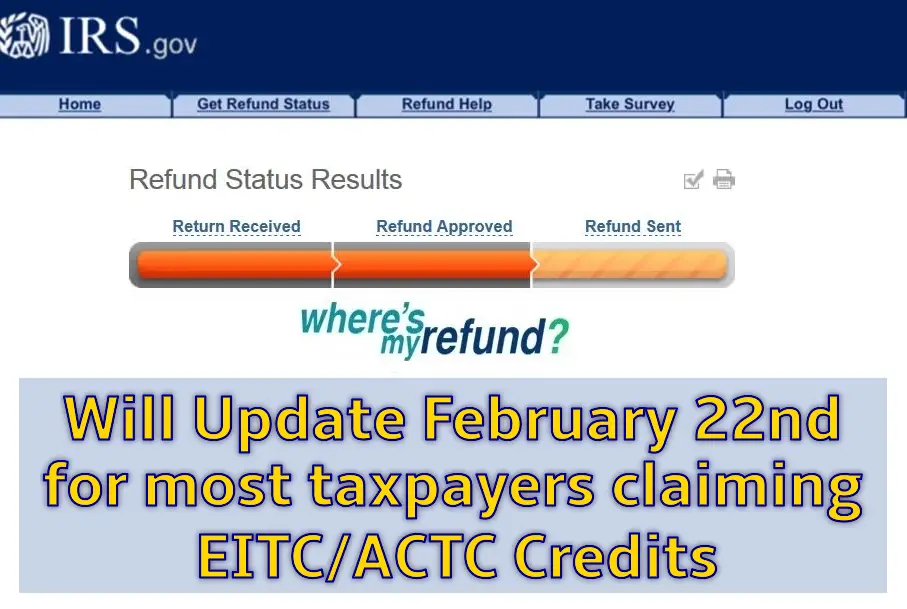

Check Your Refund Status Online In English Or Spanish

Where’s My Refund? – One of IRS’s most popular online features-gives you information about your federal income tax refund. The tool tracks your refund’s progress through 3 stages:

You get personalized refund information based on the processing of your tax return. The tool provides the refund date as soon as the IRS processes your tax return and approves your refund.

It’s Fast! – You can start checking on the status of your return sooner – within 24 hours after we receive your e-filed return or 4 weeks after a mailed paper return.

It’s Up-to Date! – It’s updated every 24 hours – usually overnight — so you only need to check once a day. There’s no need to call IRS unless Where’s My Refund? tells you to do so.

It’s Easy! – Have your tax return handy so you can provide your social security number, filing status and the exact whole dollar amount of your refund.

It’s Available! – It’s available 24 hours a day, 7 days a week.

Find it! – Download the IRS2Go App by visiting the iTunes app store or visit Google Play or

Página Principal – ¿Dónde está mi reembolso? at IRS.gov

If you do not have internet access, call IRS’s Refund Hotline at 1-800-829-1954.

Caution: Don’t count on getting your refund by a certain date to make major purchases or pay other financial obligations. Even though the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days, it’s possible your tax return may require more review and take longer.

Tax Refund Status Faqs

The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer. For example, the IRS may have a question about your return. Here are other common reasons for a delayed tax refund and what you can do.

At H& R Block, you can always count on us to help you get your max refund year after year. You can increase your paycheck withholdings to get a bigger refund at tax time. Our W-4 calculator can help.

The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review.

The IRS’ refund tracker updates once every 24 hours, typically overnight. That means you don’t need to check your status more than once a day.

Your status messages might include refund received, refund approved, and refund sent. Find out what these e-file status messages mean and what to expect next.

Having your refund direct deposited on your H& R Block Emerald Prepaid Mastercard® Go to disclaimer for more details110 allows you to access the money quicker than by mail. H& R Block’s bank will add your money to your card as soon as the IRS approves your refund.

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Recommended Reading: Power To Levy Taxes

Reasons Your Tax Refund Might Be Delayed

Although youre probably eager to receive your refund, it might take longer than 21 days for the IRS to process your return. Several issues might cause a delay, including: