Why The Government Should Just Do Your Taxes For You

The actual work of doing your taxes mostly involves rifling through various IRS forms you get in the mail. There are W-2s listing your wages, 1099s showing miscellaneous income like from one-off gigs, etc. To fill out your 1040, you gather all these together and copy the numbers in them onto the 1040 form. The main advantage of TurboTax is that it can import these forms automatically and spare you this step.

But here’s the thing about the forms: The IRS gets them too. When Vox Media sent me a W-2 telling me how much it paid me in 2017, it also sent an identical one to the IRS. When my bank sent me a 1099 telling me how much interest I earned on my savings account in 2017, it also sent one to the IRS. If I’m not itemizing deductions , the IRS has all the information it needs to calculate my taxes, send me a filled-out return, and let me either send it in or do my taxes by hand if I prefer.

This isn’t a purely hypothetical proposal. Countries like Denmark, Sweden, Estonia, Chile, and Spain already offer “pre-populated returns” to their citizens. The United Kingdom, Germany, and Japan have exact enough tax withholding procedures that most people don’t have to file income tax returns at all, whether pre-populated or not. California has a voluntary return-free filing program called ReadyReturn for its income taxes.

The Obama administration supported return-free filing, and Ronald Reagan touted the idea in a 1985 speech:

Determine If The Irs Filed A Substitute Return

Just because you didn’t file your return doesn’t mean the IRS won’t file one for you. The IRS may file a Substitution for Return or SFR on your behalf. Don’t think of this as a complementary tax filing service. The substituted return may leave off the exemptions or deductions that rightfully belong to you.

Once an SFR is filed, you will be sent a notice to accept the tax liability as filed in this alternate return. If you don’t respond, the IRS will issue a notice of deficiency. At this point, the tax is considered owed by you and the IRS can begin the collection process. To encourage payment, a levy can be placed on your wages or bank accounts. A federal tax lien may also be placed against your home and real estate.

If an SFR was filed, you don’t have to accept the outcome. You can go back and refile those years and include any available deductions. You may be able to decrease the tax owed and reduce any interest and penalties.

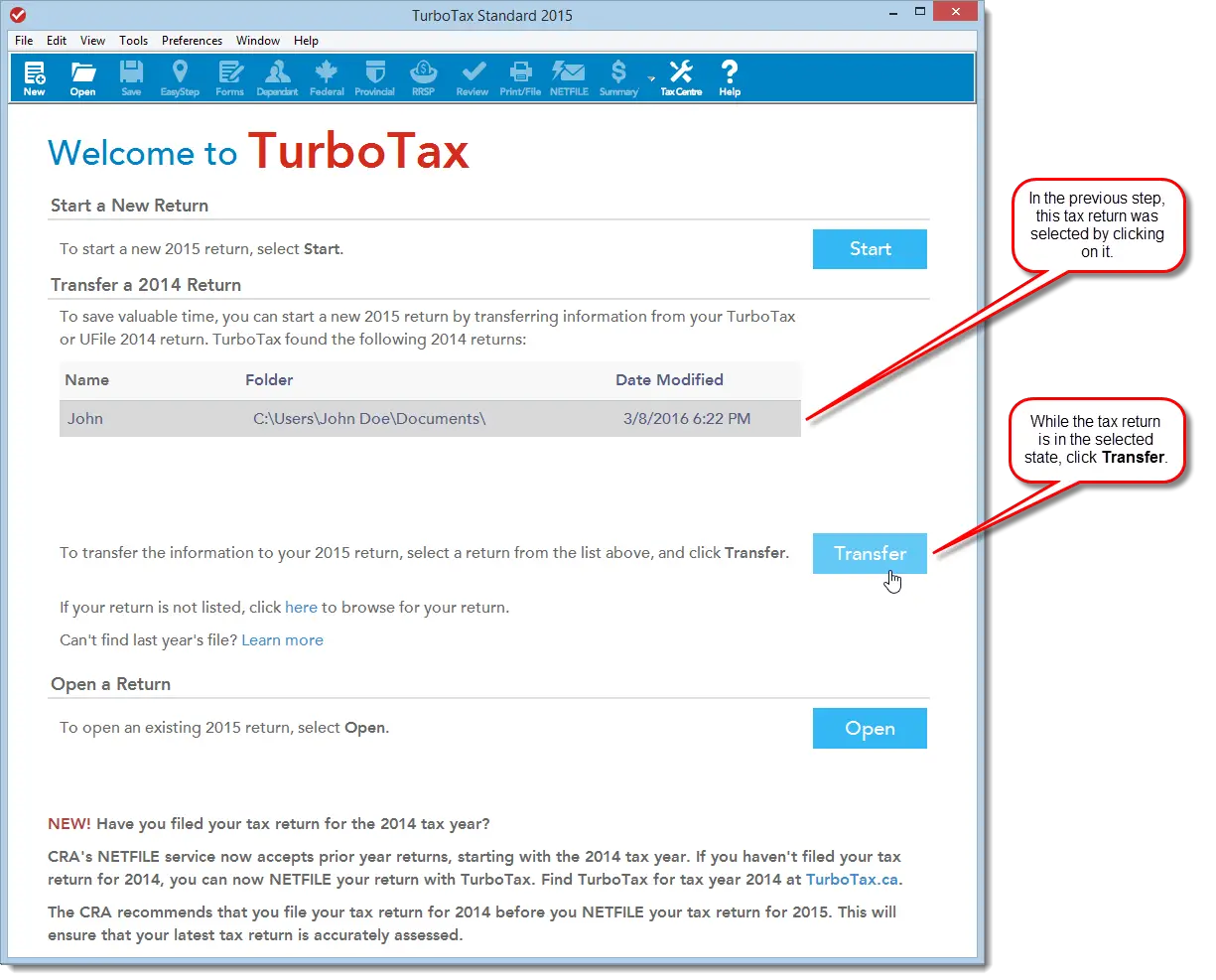

How To File A T4 Missed Last Year

Please see the link below for instructions on how to make changes to your prior year return. Please note that you cannot enter a 2014 slip for a 2015 return, your return would be rejected.

You can make changes to your current tax return, as well as a tax return for any of the previous 10 tax years, whether you filed by mail or electronically using NETFILE. Heres how you should proceed to make changes:

You will need to fill in a T1Adjustment form and return it to Cra. You can either print this form or go on the site above and fill in directly information about your 2014, T4.

Recommended Reading: Doordash Tax Tips

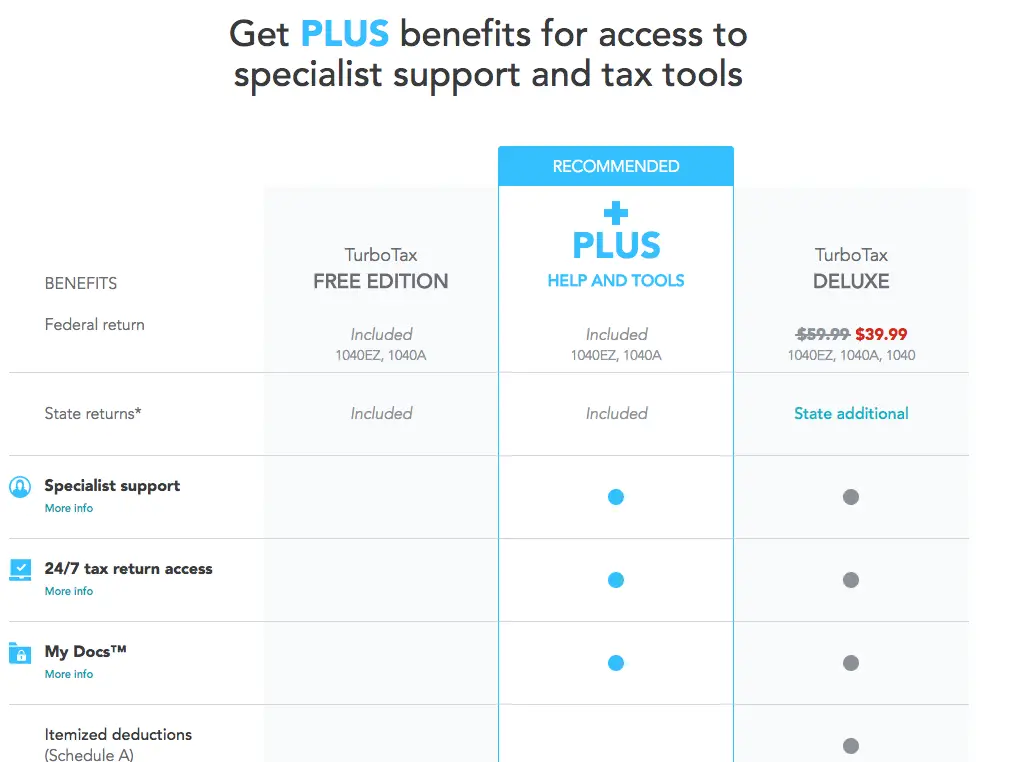

Simple Tax Return Vs Complex Tax Return

A simple tax return is the most basic type of tax return you can file, and many tax software programs let you file this return for free. A simple return generally includes W-2 income, limited interest and dividend income, standard deductions and unemployment income.

Some free plans also include the earned income tax credit , child tax credits and student loan/education deductions .

If your finances are more complicated and you don’t qualify for a simple tax return, you’ll need to file a complex tax return, and most tax software programs will charge you fees to file. Complex tax situations typically include anyone with freelance income , small business owners and landlords, as well as anyone with earnings from investments and stock sales.

The tax program you use will notify you if you can’t file a free simple tax return and instead need to upgrade and pay to file a more complex return. And even if you can file a simple tax return, you may want to pay for the next-tier plan to benefit from more deductions.

Filing Your Taxes Day 2

Next up on this Turbo Tax step by step is day 2. After youve gathered up all the information youll need, its time to begin filing your taxes.Log on to your TurboTax account to get started. Below Im going to go through how to file for beginners, and then do a second tutorial for people who are self-employed.

Read Also: Reverse Tax Id Lookup

Documents For Tax Credits And Deductions

Tax deductions and tax credits reduce the amount of income tax you owe for the year . You may need to gather additional tax documents to claim specific types of credits and deductions. For example, you probably need to have a copy of Form 1098-T if you want to deduct college tuition with the lifetime learning credit.

Even if credits and deductions were changed or eliminated for future years, you can claim them if they were available for the tax return youâre claiming. Learn more about the difference between tax credits and deductions as well as the difference between different types of deductions.

Common documents you may need include:

-

Receipts from charitable donations for the charitable contributions deduction

-

Receipts for unreimbursed employee expenses, such as for travel or union dues

-

Moving expenses if you moved for a job

-

Documents showing the value of any casualty and theft losses, not including losses already covered by your homeowners insurance policy

How Do I File Taxes

You can file online yourself, potentially for free, or visit a tax professional.

If your adjusted gross income was less than $72,000 in 2020, you might qualify to file your federal return, and maybe your state return, at no cost through one of the IRS partners, regardless of how complicated your tax situation is. Also, most active duty military qualify for free filing. Check out your options here.

If your income exceeds $72,000, or you’re not interested in the platforms offered in partnership with the IRS, check out our list of the best tax software to use this year.

After filing out the required forms, your tax preparer will calculate whether you owe additional income tax or you’re getting a refund. If you don’t pay what you owe by May 17, penalties may apply.

Also Check: Csl Plasma Taxable

Who Is Turbotax For

TurboTax is one of the most popular tax planning services out there, and with good reason. Its different plans are suited for a variety of filers, whether theyre students, homeowners or self-employed. TurboTax aims at educating users throughout the process with step-by-step guidance, while still securing the maximum returns and deductions available. Its helpful for people whether theyre first-timers or veteran filers.

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

Don’t Miss: Taxes On Doordash

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

What If I Cant Afford To Pay My Back Taxes

Even if you canât afford to pay taxes you owe in full, always file your return as soon as you can. Then you can request an additional 60 to 120 days to pay. Make this request either online through the IRSâ Online Payment Agreement application or by calling the IRS at 800-829-1040. There is no fee for requesting extra time to make payments.

If you need more than 120 days to pay off your full debt, you can request an installment agreement from the IRS where you make monthly payments until your balance is fully paid. If monthly payments are still unaffordable, you may qualify for an offer in compromise, which is when the IRS cancels your debt for a lesser amount than what you owe.

Recommended Reading: Do You Pay Taxes With Doordash

When Are Taxes Due

The federal tax deadline is automatically extended for individuals this year. Tax returns and payments for 2020 are now due on May 17, 2021.

Due to winter storms, the federal deadline for people in Texas, Louisiana, and Oklahoma is June 15, 2021.

State tax deadlines vary. Check your state’s government website.

An Offer In Compromise

An offer in compromise is a bit more complex. It involves reaching an agreement with the IRS to pay less than your full balance due. An offer in compromise is typically only approved if youre unable to pay through an installment plan and comes with an application fee. Youll probably need the help of a professional for this option.

You must establish that you cannot pay your balance through an installment agreement or by any other means. All your past due tax returns must be filed before the IRS can grant you this relief, and you must have made some payment toward taxes in the current year, either through withholding from your paychecks or by sending in quarterly estimated payments, even though you havent filed a tax return for the year yet.

You May Like: Doordash On Taxes

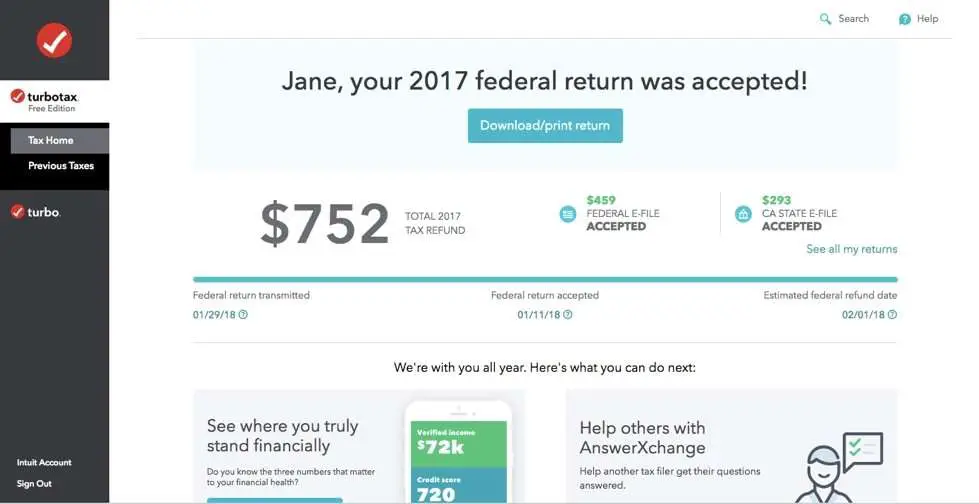

How The Irs Pays Refunds For Back Taxes

Like other tax returns, the IRS can pay refunds to you via either direct deposit or a check. Make sure to choose the appropriate option on your tax return when you file. If you opt for direct deposit, always double check your account number before filing. You may not be able to get your money back of the IRS sends your refund to the wrong place.

An important exception to note is that the IRS only pays refunds via check for amended returns, which are tax returns you file to fix a mistake from a previous yearâs return. Also keep in mind that it may take about six weeks just for the IRS to process your prior-year tax return .

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

The Solution: Boycott Turbotax

So what’s a regular person hoping for return-free filing to do? Well, you could do what Joseph Bankman, the Stanford Law professor who helped design California’s system, did and spend $30,000 out of pocket to hire a lobbyist to push the idea and counter Intuit’s lobbying.

But for those of us without $30k to spare for the greater good, there’s a less demanding option: Stop paying for TurboTax.

Now, if you have a relatively simple return without itemizations, I’m not going to argue that you shouldn’t use TurboTax for free. It, like most tax software, includes a free option for simple returns, or for households making under $62,000 a year. Using that is totally fine, as is using Free File Fillable Forms, a program offered by the tax prep companies in conjunction with the IRS that has a computerized version of the basic 1040 form. As long as you’re not giving any of your money to a tax preparation company, it’s all good.

But resist the urge to pay for anything. Don’t pay for the state version. Don’t pay for one allowing for itemized deductions. Don’t pay for anything. Hell, don’t pay for Intuit’s other products like QuickBooks either if you can help it. Paying means putting money into Intuit’s pocket, which it can then turn around and use to lobby to make your taxes more complicated.

If you have yet to file, don’t pay TurboTax a cent. If enough of us get on board, we might finally get to enjoy the return-free world we deserve.

Recommended Reading: H& r Block Early Access W2

If You Preparedyour Taxes Online

You’ll have to use your TurboTax login if you used the online version of the product. Make sure you sign in to the same account you used to prepare your return. From there, it’s a simple matter of clicking on the “Documents” tab, then on the tax year you want, then finally on “Download PDF.”

TurboTax suggests using the “Account Recovery” tool if you can’t find the return you’re looking for. It’s possible that you’re not signed in under the same account you used to prepare it.

Bottom Line: Should You Use Turbotax

TurboTaxs range of filing options caters to different financial situations, whether youre single, married, a homeowner or self-employed. There are extensive features included with each plan to maximize efficiency and transparency. Its easy to import information and there are explanations of why and how refunds fluctuate. There are also tax calculators, a tips section and access to other services, like QuickBooks. All in all, TurboTax is very user-friendly and does a great job of simplifying tax season.

TurboTax comes at a higher price than other services but it pays for itself if it gets you additional tax savings. If you want something straightforward with fewer features, another tax planning service can likely do the job just fine. For example, someone who has been filing for years and doesnt mind manually inputting information into a tax form may want to go with a cheaper option.

Also Check: Tax Deductible Home Improvements

How To Ask For A Refund

If you made less than $34,000 last year and paid to file your taxes on TurboTax, you may be able to get a refund.

A reader who reported that TurboTax agreed to refund his money said he called the TurboTax customer service line at 888-777-3066.

Spokespeople for Intuit, the maker of TurboTax, didnt immediately respond to a request for comment on its refund policy.

If you made less than $66,000 last year, you should have been able to prepare and file your taxes for free with one of the companies participating in the IRS Free File program. But each company has its own distinct eligibility requirements. Its not clear if the other companies would offer refunds.

What Happens If You Don’t File Taxes For 10 Years Or More

By FindLaw Staff | Reviewed by John Devendorf, Esq. | Last updated December 13, 2021

You may have thought you didn’t have to file taxes because you didn’t make enough money or you were living overseas. However, most people who earn income over a certain amount still have to file their taxes. If it has been years since you filed taxes or paid taxes, you may still be liable for back taxes. You may also be able to claim money for refunds for prior years.

Recommended Reading: Doordash File Taxes

How To Open Previous Tax Returns In Turbotax

You might need a copy of a previous year’s tax return for any number of reasons, from applying for a loan to qualifying for certain benefits during national times of trouble. You can get one for free if you used Intuit TurboTax to prepare your return for the year in question, and it won’t be just a bare-bones copy of the document, either. TurboTax will obligingly include any schedules that you also filed, as well as the worksheets that you used to arrive at the numbers you reported.

TurboTax is available in both desktop and online versions, and TurboTax past returns can be accessed a little differently depending on which you used to prepare your tax return.

Video of the Day

Request Tax Documents From The Irs

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

Recommended Reading: Does Doordash Send A 1099