Calculating Income Tax Rate

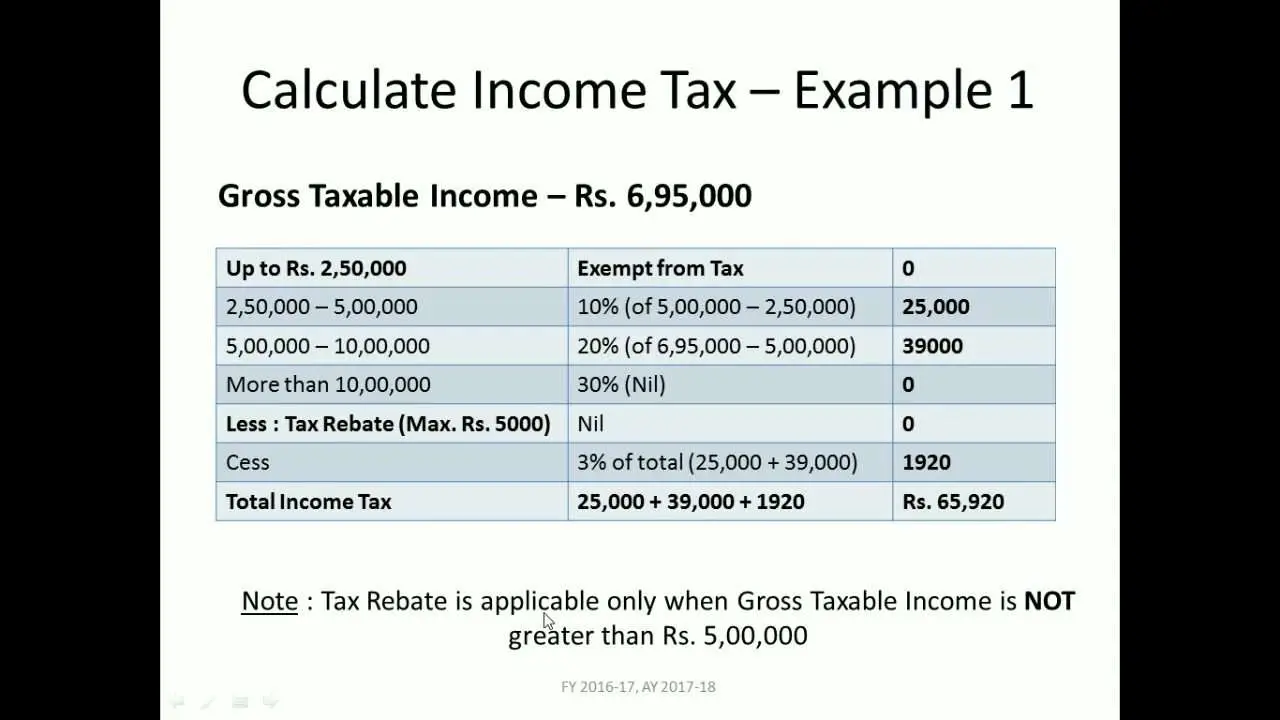

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Estimated Annualized Effective Tax Rate

The interim provision is performed at the legal entity level and starts with the forecasted full year pre-tax book income and the pre-tax book income adjustments. In order to determine the current and deferred estimated annualized effective tax rates, the calculation takes into account the impact of permanent and temporary differences. Tax Provision allows input of the full year estimated amounts for permanent differences as adjustments. The components of the deferred tax expense, the tax effect of temporary differences, NOLs, change in valuation allowance, and tax impact of change in tax rates are entered as adjustments in addition to the Temporary Difference data form. Discrete adjustments are ignored when determining the rate.

The current year statutory rate by legal entity is applied to the forecasted annual taxable income to determine tax expense before additional provision items. Additional provision items are added to/subtracted from tax expense to determine the year-to-date total tax and current and deferred amounts.

After the forecasted total tax expense is determined in local currency, these amounts are converted to reporting currency and then summed to determine the consolidated estimated annualized effective tax rate. The consolidated rate is determined by dividing the total interim provision tax by the pre-tax net income after book adjustments.

Recommended Reading: Tax Preparer License Requirements

How To Calculate Income Tax Paid In Cash Flow Statement

Accounting For Income Taxes> > IAS 14 > > Determining income tax paid: The determination of income tax paid can be complex because in addition to current tax payable, the application of tax effect accounting can generate deferred tax assets and deferred tax liabilities. Again, some of the movements in the current and deferred tax accounts may not be reflected in the income tax expense recognized in profit or loss.

Certain gains and losses and associated tax effects are recognized in other comprehensive income and accumulated in equity accounts. For example, deferred tax may arise from a revaluation of property, plant and equipment that origins a difference between the book value and tax base of those assets, in so doing resulting in a charge for income tax being made to the Revaluation Surplus Account. The determination of income tax paid can be complex because in addition to current tax payable.

Therefore, it is often simpler to reconstruct the Deferred Tax Liability account to determine the allocation of income tax expense. We can use this reconstruction to determine the deferred component of income tax expense recognized in profit or loss, if this is not already identified in the statement of profit or loss and other comprehensive income.

The movement in the Deferred Tax Liability account for XYZ Limited can be summarized as follows:

Opening balance CU 5000

+ Tax recognized directly in OCI CU 600

+ Income tax expense-deferred portion CU 3000

Significance Of Effective Tax Rate

Effective tax rate is one ratio that investors use as a profitability indicator for a company. This amount can fluctuate, sometimes dramatically, from year to year. However, it can be difficult to immediately identify why an effective tax rate jumps or drops. For instance, it could be that a company is engaging in asset accounting manipulation to reduce its tax burden, rather than a managerial or process change reflecting operational improvements.

Also, keep in mind that companies often prepare two different financial statements one is used for reporting, such as the income statement. The other is used for tax purposes. Expenses that are allowed as deductions or for tax purposes may cause variances in these two documents. If a company is effectively utilizing tax deductions and credits, then its effective tax rate will be lower than a company that is not effectively using these strategies.

Also Check: 1040paytax.com Safe

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees. As with federal payroll tax, part of this tax is employer paid and part is employee paid. Keep in mind that âemployee paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees. Have all your SUTA questions answered in just a 3 minute read.

State and local payroll taxes are governed at the state and local level, and every stateâs payroll tax rules are different. The Federation of Tax Administrators published a list of each stateâs taxing authority. You can find out more about payroll tax in your state and local area there.

You May Like: 1040paytax.com Official Site

Asc 740 Provision For Income Taxes

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. This applies only to taxes based on incomenot sales, payroll, or property taxesper ASC 740-10.

Calculating the provision for income taxes under ASC 740 presents a difficult technical challenge. However, the markets most powerful tax provision software provides practitioners an accurate calculation, intuitive design, and thorough footnotes. See how Bloomberg Tax Provision untangles ASC 740s complexity.

Learn more about how to calculate your ASC 740 tax provision accurately and efficiently with in-depth articles and how-to videos.

How And When To Pay Estimated Taxes

Payments are due four times a year:

- 1st payment April 15

- 2nd payment June 15

- 3rd payment September 15

- 4th payment January 15 of the next year.

If your income is steady throughout the year, you can divide your payments up into four equal payments. If your business is seasonal, or you have a change in your business income, you may have to make smaller or larger payments in one or more quarters.

You can use the quarterly vouchers included in IRS Form 1040-ES to make these payments.

If you use a tax preparer or tax preparation software to prepare your tax return, they will include an estimated tax calculation and copies of vouchers. You must make the payments yourself in one of three ways:

- Mailing in the payment with the voucher

- Paying online using IRS Direct Pay, your credit or debit card, or one of the other IRS payment options

See IRS Form 1040-ES for copies of vouchers and details on these and other payment methods.

You can make additional estimated tax payments to make up for a quarter with more income, and you can also make your estimated payments weekly, bi-weekly, or monthly, as long as you have paid enough by the quarterly due date. It’s easier to make these payments online, through one of the IRS-approved payment methods.

Read Also: Reverse Ein Lookup

Calculation Of Deferred Tax

DTA = * 35% * 35% = $175

Therefore, the reported DTA at the end of the first year is $175.

Example #2

A company owns equipment with a useful life of four years. The equipment is worth $2,000. The company uses the straight-line methodStraight-line MethodStraight Line Depreciation Method is one of the most popular methods of depreciation where the asset uniformly depreciates over its useful life and the cost of the asset is evenly spread over its useful and functional life. read more for depreciation and uses the double-declining methodDouble-declining MethodThe Double Declining Balance Method is one of the accelerated methods used for calculating the depreciation amount to be charged in the company’s income statement. It is determined by multiplying the book value of the asset by the straight-line method’s rate of depreciation and 2read more for tax reporting purposes.

Determine the cumulative DTL reported in the balance at the end of year 1, year 2, year 3, and year 4. For the given company, reported EBITDA and interest expenses are $2,500 and $200, respectively. Also, the applicable tax rate for each year is 35%.

Solution:

Let us draw a table to capture the effect of deferred tax expenses for each year, along with calculations:

For year one, a DTL is createdbook profits exceed taxable profits. However, in year 2, the reported tax is equal to the tax payable.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Read Also: Is Plasma Donation Taxable

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

How To Calculate Operating Expense

To calculate operating expense, you simply add all of your operating expenses together. A standard formula might look like this:

Operating expenses = accounting supplies + expenses on office supplies + insurance + licensing fees + legal fees + marketing and advertising + payroll and wages + repairs and equipment maintenance + taxes + travel + utilities + vehicle expenses

To understand what you should include for your business, here are examples of what are not operating expenses:

Don’t Miss: How To Protest Property Tax Harris County

How To Calculate Payroll

Unless youre an accounting wizard, youll probably need help calculating your payroll, paying your employees, and keeping all of your required tax payments straight. There are a few ways to go about this:

Calculate it on your own

Hire an accountant or payroll specialist

Automate the payroll process using a full-service payroll software or online payroll solution, such as QuickBooks Payroll. Most payroll services offer a trimmed-down solution for small business owners who may not need as many features as larger companies.

There are also free online tools, such as QuickBookss Payroll Calculator, which can calculate an employees pay cheque with just a few pieces of information. If you only have one or two employees, this solution might be all you need.

Who Must Pay Estimated Taxes

When you consider whether you must pay estimated taxes, you’ll need to look at all of your income for the tax year, including any income from employment , capital gains, and dividends.

The IRS says you don’t have to pay estimated taxes if you meet all three of these conditions:

- You had no tax liability for the previous year,

- You were a U.S. citizen or resident for the entire year, and

- Your previous tax year was for a full 12 months.

You must pay estimated taxes if:

You owe $1,000 or more for the year , over the amount of withholding from any salary as an employee or refundable credits, or

Your total withholding and refundable credits are:

- Less than 90% of the tax shown on your current year’s tax return, or

- Less than 100% of the tax shown on your previous year’s tax return.

Recommended Reading: Doordash Mileage Calculator

Overview Of Tax Returns And Deposits

Employers have the responsibility to file employment-related tax returns and deposit employment taxes according to set deadlines. If they fail to do so, they may be subject to failure to file and failure to pay penalties. Whats more, responsible persons in the company who fail to deposit trust fund taxesamounts withheld from employees paychecksmay be subject to a 100% personal liability. This trust fund recovery penalty is triggered when a person with the authority to make payment decisions willfully fails to deposit the taxes. The possibility of these penalties means employers must get things right.

Who Pays State Unemployment Taxes

State unemployment taxes are usually paid solely by the employer and are calculated based on an employees wages.

Employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment tax withholding as well. If you employ workers in any of these three states, you will be required to withhold the tax from their wages and remit these funds directly to the state.

Dont Miss: How Much Money Is Taken Out Of Paycheck For Taxes

You May Like: Tax Write Off Doordash

Estimated Taxes For Partnerships Llcs & S Corporations

Owners of partnerships, LLCs, and S corporations are not employees of the business. They receive payments periodically from the business, and these payments are added to their personal tax returns.

These payments are not subject to withholding, so estimated taxes may need to be paid. To calculate estimated tax payments, use the process described above.

The information contained in this article is not tax or legal advice and is not a substitute for such advice. State and federal laws change frequently, and the information in this article may not reflect your own states laws or the most recent changes to the law. For current tax or legal advice, please consult with an accountant or an attorney.

Tax Expense Vs Tax Payable

The tax expense is what an entity has determined is owed in taxes based on standard business accounting rules. This charge is reported on the income statement. The tax payable is the actual amount owed in taxes based on the rules of the tax code. The payable amount is recognized on the balance sheet as a liability until the company settles the tax bill.

If the tax expense is higher than the tax liability, the difference creates another liability, called a deferred tax liability, which must be paid at some point in the future. On the other hand, if the tax payable is higher than the tax expense, the difference creates an asset category, called the deferred tax asset, which can be used to settle any tax expense in the future.

Recommended Reading: Federal Tax Id Reverse Lookup

What Is A Tax Expense

A tax expense is a liability owed to federal, state/provincial, and/or municipal governments within a given period, typically over the course of a year.

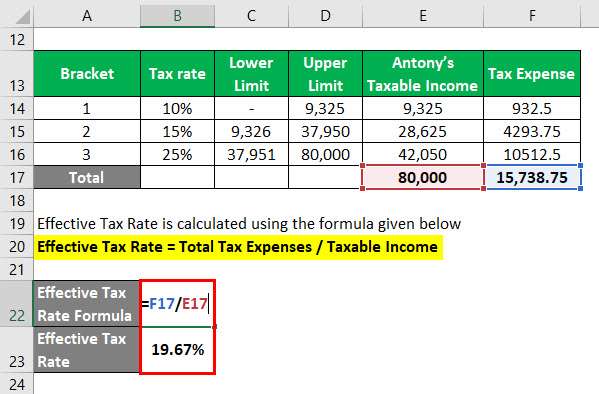

Tax expenses are calculated by multiplying the appropriate tax rate of an individual or business by the income received or generated before taxes, after factoring in such variables as non-deductible items, tax assets, and tax liabilities.

Tax Expense = Effective Tax Rate x Taxable Income

Effective Tax Rate Vs Marginal Tax Rate

The effective tax rate varies from the marginal tax rate, which is the tax rate paid on an additional dollar of income. The effective tax rate is a more accurate representation of a persons or companys overall tax liability than their marginal tax rate, and it is typically lower.

When considering a marginal tax rate versus an effective tax rate, bear in mind that the marginal tax rate refers to the highest tax bracket into which a persons or companys income falls. In the United States, an individuals income is taxed at rates that increase as income hits certain thresholds. This is referred to as a progressive income tax system. Two individuals with income in the same top marginal tax bracket may end up with very different effective tax rates, depending on how much of their income was in the top bracket.

Recommended Reading: 1040paytax.com