Definition And Examples Of Tax Withholding

A tax withholding is money set aside from a payment in order to cover the taxes that are owed in association with that payment. In many cases, for example, your paycheck will be less than your full wages, since your employer has withheld some money to cover your tax liability. That money gets sent by your employer to relevant tax authorities, including the Internal Revenue Service .

Suppose you earn $2,000 per pay period. Instead of receiving $2,000, you receive a paycheck for $1,600, because your employer has set aside $400, or 20%, of your paycheck, as a tax withholding.

Actual withholding rates may differ, and other paycheck deductions, such as a pre-tax health insurance deduction, may complicate this math somewhat. In general, however, a tax withholding enables you to pay taxes with each paycheck. When it comes time to file your taxes, you can see whether this withholding was enough to cover your full tax liability.

In some cases, you might have not had enough tax withheld, so you would owe money to the IRS or other tax authorities. In other cases, you might have had too much tax withheld from your paychecks, such as if you ended up not earning as much as expected that year due to leaving your job. In that case, you might receive a tax refund.

In addition to your paycheck, tax withholding can also apply to other types of payments that might incur a tax liability, such as gambling winnings or Social Security benefits.

What Is Your Small Business Tax Liability

Your business can incur tax liabilities from many taxable events. A taxable event is a transaction that results in tax liability, such as earning taxable income, making sales, and issuing payroll.

The government decides which events are taxable. When a taxable event occurs at your business, you must pay the appropriate tax authority. The amount of your tax liability depends on the event. Generally, you can calculate tax liability as a percentage of the total taxable event.

You may have additional tax liabilities other than the ones listed here, such as franchise or excise tax. But, here are some of the most common tax liabilities many small business owners come across.

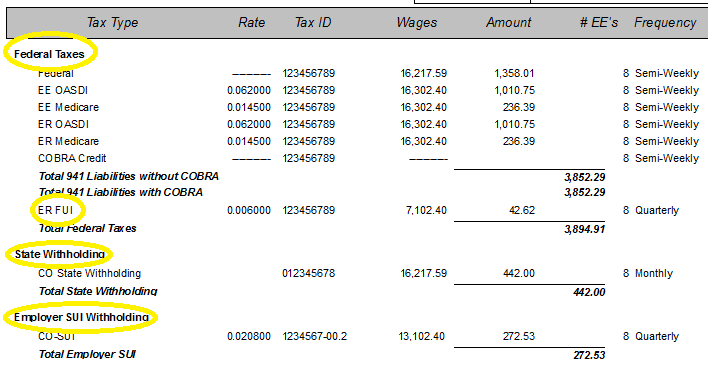

Pay Employment Tax Liability

In addition to income tax, your small business has to pay payroll tax on wages paid to employees and yourself. This is true regardless of industry or employee presence. These taxes typically include:

- Social Security Tax

- Medicare Tax

- Federal Unemployment Tax

Some of these taxes are paid by the employee, but the company is responsible for withholding money from wages and sending it to the IRS. As a self-employed sole proprietor, you will have to pay self-employed tax. This is the sum of social security and Medicare tax liability. This is because there is no other employer to pay half the tax.

Also Check: How Do You Pay Taxes For Doordash

What Are The 5 Sources Of Income For Tax Liability

- Income from salary : It includes individuals earning a steady source of income either through salary or pension.

- Income from other heads : It includes an interest in FDs and savings accounts.

- Residential property income : It is primarily for rental income however, it also includes income from the sale of a property.

- Income from capital gain : This head includes income from the sale of capital assets like shares, mutual funds, etc.

- Income from business or self employment : It includes income earned from the business, freelancing, contracting, doctors, lawyers, Chartered Accountants, etc.

What Are Sales Tax Rates Like In My State

Forty-five states and the District of Columbia collect statewide retail sales taxes, one of the more transparent ways to collect tax revenue: consumers can see their tax burden printed directly on their receipts.

In addition to state-level sales taxes consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could, in fact, have a very high combined state and local rate compared to other states.

The map below provides a population-weighted average of local sales taxes, to give a sense of the average local rate for each state.

Don’t Miss: Payable Doordash 1099

What Are Property Tax Rates Like In My State

While states do rely on property taxes to a significant extent, they are primarily relied upon by localities in the U.S. to fund schools, roads, police departments, and fire and emergency medical services, as well as other services associated with residency or property ownership.

Property taxes generate just over 30 percent of total U.S. state and local tax collections and over 70 percent of local tax collections.

The map below compares per capita state and local property tax collections by state, to give you a sense of the property tax burden where you live.

The Definition Of Tax Liability

The definition of tax liability is the money you are obliged to pay as taxes to the government. If your income is low enough, you will not be taxed at all. And there are many Americans who don’t pay any taxes as many pay federal income tax or payroll tax through their work. There are also state and local taxes, excise taxes, and other taxes that generate income for very low-income people.

Recommended Reading: Payable.com Doordash

What A Tax Withholding Means For Individuals

Understanding tax withholding is important for individuals when it comes to tax management and budgeting. If you dont fill out your W-4 form accurately, for example, you might receive a higher paycheck and spend more money, only to be confronted by a tax bill later on that youll have to figure out a way to pay.

Some individuals might consider intentionally having more withheld from their paycheck so they end up with a tax refund after they file. However, you may want to consider other saving strategies, such as depositing a small amount from each paycheck into an interest-bearing bank account.

What Are Use Taxes And How Do They Differ From Sales Taxes

Sales taxes are a form of consumption tax levied on retail sales of goods and services. If you live in the U.S., you are likely familiar with the sales tax from seeing it printed at the bottom of store receipts.

Youre likely less familiar with the use tax, however.

Use tax is owed on out-of-state purchases for which a sales tax was not charged but would be if purchased in-state.

Whereas retailers collect sales tax from consumers, then remit that to state governments, its the responsibility of consumers themselves to keep track of and pay their use tax liability.

For example, if you live in Massachusetts, but cross the border to purchase an item of furniture in New Hampshire, which doesnt levy a sales tax, youre required to report and pay use tax on that item when filing your personal income tax return.

The use tax rate is equivalent to the sales tax rate that would be owed if the purchase occurred where the taxpayer lives.

Don’t Miss: Door Dash Tax Form

What Are Tax Liabilities

Tax liability is the amount of money a company or individual owes to the government in taxes on the local, state and federal level. Anytime an individual earns income, or a business makes a sale, they need to pay taxes on that amount. Individuals have different tax liabilities based on their income level, while businesses pay different amounts of taxes based on their type.

Employees fill out W-4s with their employers, who then withhold the requested amount of money for taxes and send it to the IRS. Employers send their employees W-2s once a year, which employees then use to file their taxes and ensure they don’t owe more or are due for a tax refund.

Businesses, however, make tax payments to the government throughout the year. Different businesses have varying tax liabilities based on several factors, like their type, amount of sales or income and tax bracket. Accountants calculate all of these factors and make estimated payments based on their figures.

Related:

Small Business Tax Liability

Your business may be subject to tax liability from many taxable events:

- Billable events are transactions that give rise to tax liability

- If your business encounters a paid event, you will need to pay the appropriate tax authorities

- Franchise or excise tax liability is some more common tax liability encountered by many small business owners.

Don’t Miss: Do Doordash Drivers Pay Taxes

Estimate Deductible Business Expenses For The Year

You would follow the same process for estimating expenses as you did for estimating income. For example, in the first quarter, lets say your income was $14,000, while your qualified business deductions were $6,500, leaving you taxable income of $7,500 for the quarter.

You can multiply your quarterly estimates by 4 to arrive at your yearly estimate, or if you expect income or expenses to vary in the next quarter, you can include those variations in your estimate.

Its important to calculate estimated tax liability by the year even though youre required to pay estimated taxes quarterly because taxes are paid based on a graduated tax rate, which well explain next.

What Is Tax Liability

Tax liability is the payment owed by an individual, a business, or other entity to a federal, state, or local tax authority.

In general, a tax liability is incurred when income is earned and when income is generated by the sale of an investment or other asset. A local or state sales tax may be incurred when goods are purchased.

It is possible for people to have no income tax liability if their total tax owed was zero or if their income was below the level that would require them to file tax returns.

You May Like: What Tax Form Does Doordash Use

Employee And Shareholder Benefits

Employee and shareholder taxable benefits ss 173

100. Benefits which employers/corporations provide to employees/shareholders or to a person related to the employee/shareholder may be subject to GST/HST. The taxable status of employee/shareholder benefits is dependent on the treatment those benefits receive under the Income Tax Act. Where a supply gives rise to a taxable benefit under paragraphs 6, , or or subsection 15 of the Income Tax Act and is in respect of a taxable supply , the employer/corporation is deemed to have made a taxable supply of the benefit to the employee/shareholder and is required, with certain exceptions, to remit tax on that amount. More information on employee and shareholder benefits will be available in Chapter 9, ITCs: Taxable Benefits, Allowances and Reimbursements.

How To Calculate Your Total Business Tax Liability

Business tax liability is the amount of taxes owed based on the current income of your business. If your business is structured as a sole proprietorship, partnership, S corporation, or LLC, youll use pass-through taxation, which means that any profits that the business earns are taxed on your personal tax return.

If your business is a C corporation, youll be taxed at the normal federal corporate tax rate, which is 21%, as well as your state tax rate, which varies.

Unless youre a C corporation, you should be calculating your business tax liability quarterly, based on your yearly taxable income. This allows you to make quarterly payments to the IRS based on those estimates, avoiding a big tax bill at the end of the fiscal year. If youre not sure how to calculate tax liabilities, start with the following steps.

Recommended Reading: Is Doordash A 1099

Line 16 Vs Line 23 Of Form 1040

Depending upon your specific situation, however, the federally mandated standard deduction may be more financially advantageous for you. You may not have had to file an income tax return for the prior tax year if your gross income was below a certain threshold. See Who Must File in Publication 501, Dependents, Standard Deduction and Filing Information, for information on filing requirements for most taxpayers. You can use IRS Form 1040 to complete your federal tax requirements.

Line of credit subject to credit and underwriting approval. Products offered only at participating offices. Promotional period 11/14/2019 1/10/2020. Emerald Financial Services, LLC is a registered agent of Axos Bank. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Visit hrblock.com/ez to find the nearest participating office or to make an appointment. Line 16, which appears on page two of Form 1040, is your total tax liability to the IRS.

Emerald Advance line of credit is a tax refund-related credit product. Emerald Card® is a tax refund-related deposit product. This is an optional tax refund-related loan from Axos Bank®, Member FDIC it is not your tax refund.

Just make sure youre eligible to claim it before you mark your income tax return. If you are close to the standard deduction thresholds, dont forget about some additional expenses that may push you over the standard deduction.

What Is Income Tax Payable

Income tax payable is a term given to a business organizations tax liability to the government where it operates. The amount of liability will be based on its profitability during a given period and the applicable tax rates. Tax payable is not considered a long-term liability, but rather a current liability,Current LiabilitiesCurrent liabilities are financial obligations of a business entity that are due and payable within a year. A company shows these on the since it is a debt that needs to be settled within the next 12 months.

The calculation of the taxes payable is not solely based on the reported income of a business. The government typically allows certain adjustments that can reduce the total tax liability.

Recommended Reading: How To File Taxes For Doordash

Classification Of Tax Liability In Balance Sheet

As the name suggests, the current tax liability is reported under the head of current liabilities in the balance sheet. Current liabilities are the financial obligations of a business entity expected to be paid within the next accounting period or fiscal year. Generally, the liabilities that have to be paid within 12 months are recorded under the head of current liabilities.

Tax accruals are also recorded under this head as the tax liability has to be paid in the following year of the financial reporting period.

Two Deduct From The Components Any Reliefs Due Then Add Up The Remaining Balances To Arrive At Net Income

|

Deduct from the components the amount of any relief under a provision listed in relation to the taxpayer in section 24… See sections 24A and 25 for further provision about the deduction of those reliefs. The sum of the amounts of the components left after this step is net income. |

Certain reliefs can be deducted from any component but others are restricted to a particular component. For example, if the client is a trader and sustains a trading loss in the tax year then the loss can be deducted against general income of the same or preceding tax year with any unrelieved loss then carried forward and set off only against future income from that same trade.

Section 24 of ITA 2007 lists the various reliefs which are potentially deductible and Section 25 tells us that the reliefs can be deducted in the way which will result in the greatest reduction in the clients income tax liability . That means deducting, as far as possible, from non-savings, non- dividend, income . Any remaining relief is then deducted from savings income and finally from dividend income. Clearly these reliefs need to be deducted from the individual components rather than from total income, to achieve this objective.

Finance Bill 2020 gained Royal Assent on 22 July 2020.

Note that there is a limit on the amount of income tax relief deductible at Step 2 for certain reliefs. The cap is the higher of £50,000 or 25% of the individuals adjusted total income.

Example of the cap on income tax relief –

Also Check: Do You Have To Pay Back Taxes For Doordash

The Seven Steps Required To Calculate An Individuals Income Tax Liability

What are the seven steps required to calculate an individuals income tax liability. Find everything you need to know in our knowledge library.

-

In this article

- Tax law states that seven steps are required to calculate an income tax liability

- There are fixed order of income rules that need to be followed

- Savings income includes onshore and offshore bond gains

Advantages Of Total Liabilities

In isolation, total liabilities serve little purpose, other than to potentially compare how a companys obligations stack up against a competitor operating in the same sector.

However, when used with other figures, total liabilities can be a useful metric for analyzing a company’s operations. One example is in an entity’s debt-to-equity ratio. Used to evaluate a company’s financial leverage, this ratio reflects the ability of to cover all outstanding debts in the event of a business downturn. A similar ratio called debt-to-assets compares total liabilities to total assets to show how assets are financed.

You May Like: How To Look Up Employer Tax Id Number

Income Tax Expense Vs Income Tax Payable

Income tax expense and income tax payable are two different concepts.

Income tax expense can be used for recording income tax costs since the rule states that expenses are to be shown in the period during which they were incurred, instead of in the period when they are paid. A company that pays its taxes monthly or quarterly must make adjustments during the periods that produced an income statement.

Basically, income tax expense is the companys calculation of how much it actually pays in taxes during a given accounting period. It usually appears on the next to last line of the income statement, right before the net income calculation.

Income tax payable, on the other hand, is what appears on the balance sheet as the amount in taxes that a company owes to the government but that has not yet been paid. Until it is paid, it remains as a liability.