How Does It Work For Divorced Parents

Generally, the custodial parent can claim a child as a dependent on their tax return. Sometimes parents will alternate years. Because the 2021 child tax credit is being split into advance payments and a regular tax credit, things can get complicated.

Initially, the advance payments which the IRS will begin in July will be based on 2020 tax returns, since that’s the most recent information available to the IRS. Ultimately though, the tax credit applies to 2021 tax liability. The parent claiming the child for 2021 is meant to get the entirety of the tax credit it won’t be split between both parents.

The IRS is working to build an online portal that will allow tax filers who are eligible for the child tax credit to log in and update their tax information so that the parent claiming the child as a dependent for 2021 will get the payments. If the payments are made to the incorrect parent, they might have to repay the money when they file taxes next year.

What Is The Child Tax Credit And How Much Of It Is Refundable

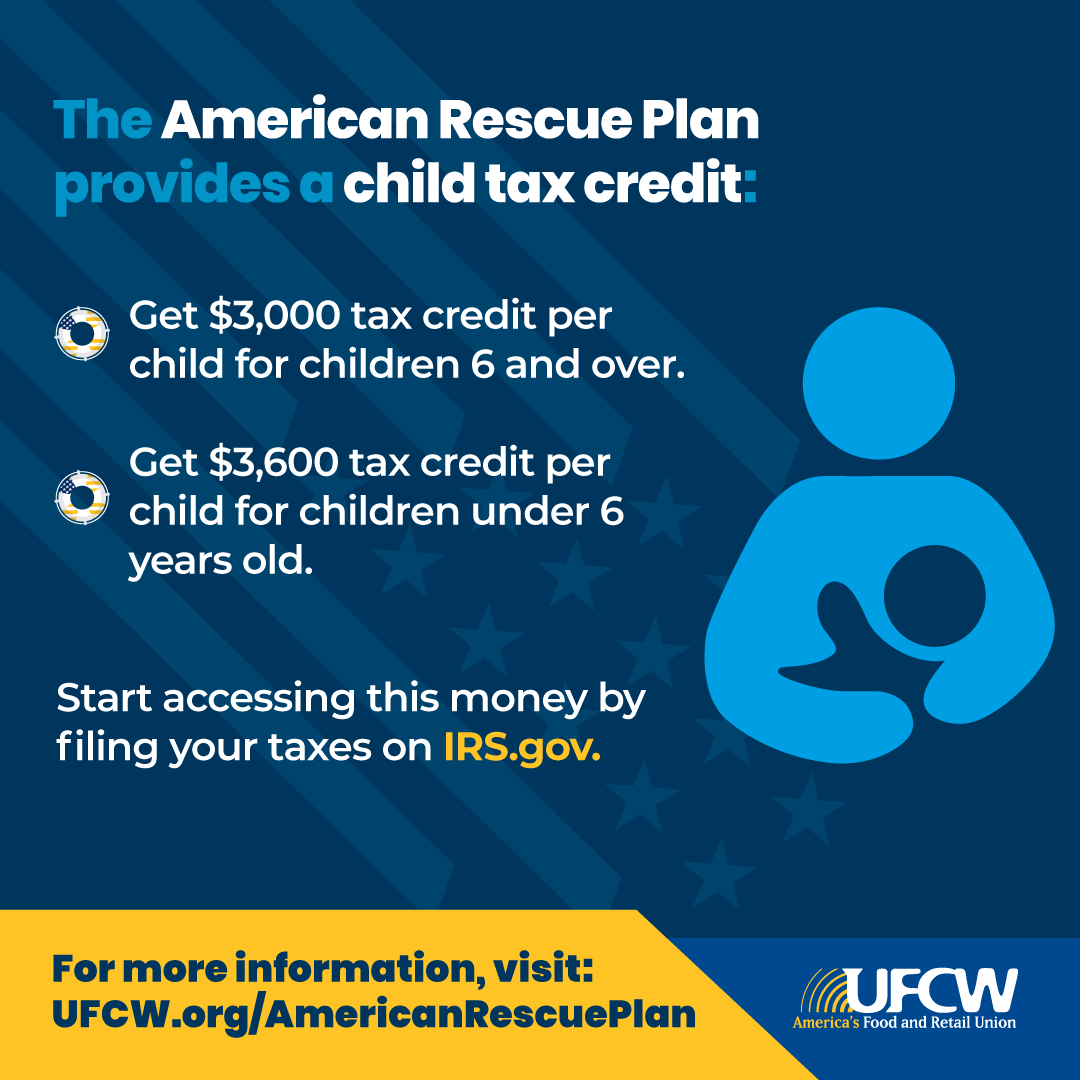

The Child Tax Credit, which has been expanded significantly by Congress since it was first written into law nearly 25 years ago, is a significant element of the federal governments effort to aid families with children. Congress expanded it substantially when it passed President Bidens American Rescue Plan in March 2021.

How The Expanded Child Tax Credit Payments Work

The Biden administration is beginning to distribute expanded child tax credit payments, giving parents on average $423 this month, with payments continuing through the end of the year

The Biden administration is beginning to distribute expanded child tax credit payments, giving parents on average $423 this month, with payments continuing through the end of the year.

President Joe Biden increased the size of the tax credit as part of his $1.9 trillion coronavirus relief package, as well as making it fully available to families without any tax obligations. The benefit is set to expire after a year, but Biden is pushing for it to be extended through 2025 and ultimately made permanent.

A closer look at how the payments work and who can receive them:

HOW BIG ARE THE CREDITS?

The credit is $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17. But six months of payments will be advanced on a monthly basis through the end of the year. This means eligible families will receive $300 monthly for each child under 6 and $250 per child older than that.

This is a change from last year, when the credit totaled $2,000 per child. Families who did not owe the government income taxes were also unable to claim the credit, a restriction that Biden and Congress lifted.

ARE THERE LIMITS ON WHO CAN QUALIFY?

HOW CAN YOU APPLY?

WHY ARE THE PAYMENTS MONTHLY?

CAN THE MONTHLY PAYMENTS BE STOPPED?

Also Check: Do You Have To Pay Unemployment Back In Taxes

What About The Monthly Payments Mentioned Earlier

Since the American Rescue Plan was meant to help families financially impacted by the pandemic the thinking was that each element in a COVID relief package should benefit people while the pandemic is still raging the federal government is allowing eligible families with children to receive monthly payments that will be subtracted from the value of the new child tax credit. Another difference is that the tax credit is now fully refundable. Heres how it works: Lets say a family with one child under 6 qualifies for the $3,600 credit. They can elect to receive monthly payments of $300 from July to December. That means theyll collect $1,800 in monthly payments over the next six months. Then, come tax time next year, lets say the family owes $200 in taxes. Since they have $1,800 of value left on their tax credit , theyll receive a check for $1,600 . The system would work the same way for a family with a child between the ages of 6 and 17, except the monthly payments would be $250 and the total tax credit value would be $3,000. And remember, eligible families can receive these tax credits for each child. That means families with several children will get a lot of financial assistance through this new system.

How Much Will I Receive In Child Tax Credit Payments

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

This amount may vary by income. These people qualify for the full Child Tax Credit:

- Families with a single parent with income under $112,500

- Everyone else with income under $75,000

These people qualify for at least $2,000 of Child Tax Credit, which comes out to $166 per child each month:

- Families with a single parent with income under $200,000

- Everyone else with income under $200,000

Families with even higher incomes may receive smaller amounts or no credit at all.

Don’t Miss: How To File Llc Taxes As S Corp

Do Advance Payments Count As Income Do I Need To Report It On My Tax Return

No. Advance payments are not income and do not need to be reported as income on your tax return. These payments were early payments of your 2021 Child Tax Credit, which you would normally claim as part of your tax refund when you file your tax return. Even though the advance payments dont need to be reported on your tax return, in January 2022, the IRS sent you Letter 6419 that tells you the total amount of advance payments sent to you in 2021. Please keep this letter for your tax records. On your 2021 tax return , you may need to refer to this notice to claim your remaining CTC. You can either use Letter 6419 or your IRS account. Learn more about Letter 6419.

Child Tax Credit And Advance Child Tax Credit Payments Topic A: General Information

Q A1. What are advance Child Tax Credit payments?

A1. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax return. If the IRS processed your 2020 tax return or 2019 tax return before the end of June 2021, these monthly payments began in July and continued through December 2021, based on the information contained in that return.

Note: Advance Child Tax Credit payment amounts were not based on the Credit for Other Dependents, which is not refundable. For more information about the Credit for Other Dependents, see IRS Schedule 8812 , Credits for Qualifying Children and Other Dependents.

Q A2. What did I need to do to receive advance Child Tax Credit payments?

A2. Generally, nothing. If you were eligible to receive advance Child Tax Credit payments based on your 2020 tax return or 2019 tax return , you generally received those payments automatically without needing to take any additional action.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021, generally based on the information contained in your 2019 or 2020 federal income tax return. If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2021 tax return.

Q A3. Did I need income to receive advance Child Tax Credit payments?

Read Also: What Is The Last Day To File Taxes

How Has The Child Tax Credit Evolved Over The Years

The credit has its roots in a 1991 report by a bipartisan National Commission on Children, which declared that it is a tragic irony that the most prosperous nation on earth is failing so many of its children and recommended a $1,000 refundable credit for all children through age 18. A version of the credit was proposed by Republicans in their 1994 Contract with America and by President Clinton in 1995, and was eventually enacted in 1997 as a $500-per-child, non-refundable credit aimed at middle and upper middle income families.

After George W. Bush promised to double the credit as part of the tax cuts he proposed during his 2000 campaign, my Brookings colleague Isabel Sawhill argued for making it refundable so it would aid poor children. This would be, she wrote, controversial: Many Republicans, in particular, are likely to label it as social welfare by another name. Democrats will point out that, without some refundability, income tax cuts do little to help many Americans. But it was one way, she argued, to make sure that at least some of the benefits of the Bush tax cuts went to low-income families. When Congress enacted the Economic Growth and Tax Relief Reconciliation Act of 2001, it both doubled the Child Tax Credit to $1,000 per child and made it partly refundable.

Were My Advance Payments Reduced If I Owed Child Support Payments Back Taxes Federal Or State Debt Or Money To Creditors Or Debt Collectors

No. The IRS did not reduce or offset your advance payments to pay past-due child support, back taxes, and federal or state debts. However, theywere not protected from garnishment by creditors and debt collectors.

When you file your tax return and receive the rest of your CTC as part of your tax refund, it can be reduced to pay past-due child support payments, back taxes, Federal or state debts, and garnishment by creditors and debt collectors.

Don’t Miss: How Long Does It Take For Taxes To Be Processed

Keep Track Of Letter 6419

In January of 2022, the IRS sent out a document to taxpayers called Letter 6419. This document will tell you how much money you’re entitled to from the child tax credit.

Hang onto this letter, because you’ll need this information to claim the credit on your tax return.

Make sure that the information is accurate, because if it’s not, this could delay your tax refund.

Reconcile Your Advance Payments Total On Your 2021 Tax Return

If you received advance payments of the Child Tax Credit, you need to reconcile the total you received with the amount youre eligible to claim.To reconcile advance payments on your 2021 return:

- Get your advance payments total and number of qualifying children in your online account.

- Enter your information on Schedule 8812 .

You can also refer to Letter 6419.

If Married Filing Jointly

If you received advance payments based on a joint return, each spouse is treated as having received half of the payments, unless one of you unenrolled.

To reconcile your advance payments on your 2021 tax return, add your advance payments total to your spouses advance payments total.

Each of you can find your advance payments total in your online account.

If Letter 6419 Has a Different Advance Payments Total

For the majority of taxpayers, the advance payments total in Letter 6419 will match the total in online account.

If the advance payments total differs between your Letter 6419 and your online account, rely on the total in your online account.

Your online account has the most current advance payment information. Do not rely on Tax Transcripts for the advance payments total.

Keep Letter 6419 for your tax records.

Frequently Asked Questions: Reconciling Your Advance Payments

Read Also: When Does Taxes Start 2021

How The Child Tax Credit Will Affect Your Taxes

For the 2021 tax year, the CTC is fully refundable that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to get a tax refund check for anything left over. How much of the credit you claim on your 2021 return will depend on whether you opted in for advance payments, how much you received as an advance, as well as your tax-filing circumstances.

What Is The Child Tax Credit For 2021

Here’s how the American Rescue Plan’s child tax credit compares to the current child tax credit.

Note that the new rules don’t completely replace the current rules they work in conjunction. If you don’t meet the income qualifications to get the larger credit that’s available for 2021, you can still qualify to get the $2,000 credit up to an AGI of $400,000.

|

Up to $400,000 married filing jointly Up to $200,000 for all other filing statuses |

||

| What income can I use? |

2020 modified adjusted gross income |

2020 modified adjusted gross income, or 2019 if higher |

| How does it impact my refund? | Half of your credit will be split into monthly payments the other half can result in a refund in 2022 | You can get up to $1,400 back as a refund |

*There are a few more requirements you can use this tool to find out if a person is a qualifying child.

Also Check: How Can I File Previous Years Taxes For Free

Let’s Spread The Word

Here are some answers to common questions and concerns

How much is the Child Tax Credit worth?

$3,000 per child ages 6 to 17, and $3,600 per child under 6. If you already received the first half of your child tax credit last year, you will receive the second half after filing taxes this year.For example: if you have two children, ages 4 and 7, and received $3,330 last year, you will receive another $3,300 this year.

Will getting the Child Tax Credit reduce my benefits?

No, the Child Tax Credit does not count as income for federally-funded benefits,including SNAP.

What will I need to file taxes so I can get the Child Tax Credit?

You will need an email address, ID, and your childs Social Security Number. If you received child tax credit payments last year, you will also need the amount you received. You can find that information on Letter 6419 that the IRS sent to you, or by creating an account with the IRS and logging in.

What does “fully refundable” mean?

The Child Tax Credit is applied against the taxes you owe to the federal government, helping to offset any tax burden you might have. If you don’t owe any taxes, this money is paid out to you as a refund. Fully refundable means you can receive the full amount of the credit as a refund.

Do I have to file taxes?

Yes, you have to file taxes and claim your children to receive your Child Tax Credit this year.

Will I owe taxes on the money I receive?

I owe back taxes from previous years. Will my payments be reduced?

The Maximum Child Tax Credit Amount Will Decrease In 2022

In 2021, the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to $3,000. For children under 6, the amount jumped to $3,600. For 2022, that amount reverted to $2,000 per child dependent 16 and younger.

Last year the tax credit was also fully refundable, meaning that if the credit amount a taxpayer qualified for exceeded the amount of taxes they owed, they could get the difference back. There was also no minimum amount of income you needed to earn to get the refund.

In 2022, the tax credit will be refundable only up to $1,500 , depending on your income, and you must have earned income of at least $2,500 to even be eligible for the refund.

Letâs create your financial plan.

Our advisors will walk you through what to do next â and will be there every step of the way.

You May Like: Where’s My Tax Refund Ga

Check Out More Child Tax Credit Resources

- GetCTC.org:This mobile-friendlytoolis created in partnership with the White House and allow people to sign up for their CTC and any missed third stimulus payments. You can use GetCTC through November 15, 2022.

- Free Tax Filing: This webpage lists free in-person and virtual tax filing resources you can use toget your CTC and any other tax credits you are eligible for. These resources include help from IRS-certified volunteers to file your taxes.

- ChildTaxCredit.com: This website features FAQs and a CTC eligibility calculator that can help you understand how much you can get from the credit.

You Said Families Can Elect To Receive The Monthly Payments Is There Another Option

Yes, families can choose to forgo the monthly payments altogether and collect the full value of their child text credit or credits during tax time next year. It’s too late to opt out of the July 15 payment, but you have until Aug. 2 to unenroll from the remaining monthly payments. That is the last opportunity youll have to opt out, so if you want to collect as much as you can in refunds next year, make sure to not miss the Aug. 2 deadline.You can unenroll from monthly payments here.

Read Also: What Day Are The Taxes Due

How The New Expanded Federal Child Tax Credit Will Work

By: Laura Olson– July 11, 2021 8:54 pm

Starting this week and ending in December, the vast majority of U.S. households with children will begin receiving monthly payments as a result of changes in a new law expanding and reworking the federal child tax credit. Getty images

WASHINGTON The most ambitious part of the pandemic stimulus package signed by President Joe Biden earlier this year is about to hit the bank accounts of millions of U.S. parents.

Starting this week and ending in December, the vast majority of U.S. households with children will begin receiving monthly payments as a result of changes in that law expanding and reworking the federal child tax credit.

The tweaked tax credit drew less attention than stimulus checks and expanded unemployment benefits in that wide-ranging COVID-19 relief legislation.

But the effect may be longer-lasting, with Democrats already angling to prevent the temporarily broader tax credit from shrinking again next year.

The new law not only makes more families eligible for the child tax credit, it also changes when families receive its financial benefits.

For the first time, half of the tax credit will be distributed through monthly payments, instead of only when families file their taxes. That will send families up to $250 a month for every child between 6 and 17 years old, and up to $300 a month for kids under 6.

Heres more on how the program will work:

What exactly is the child tax credit?

Who is eligible?

How does it work?