Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What You Need To Know For The 2021 Tax

Ottawa, Ontario

Canada Revenue Agency

This year, the COVID-19 pandemic may have affected your tax-filing situation and may also affect the way you usually file your income tax and benefit return. Over 30 million returns were filed last season, and the Canada Revenue Agency wants to help you get ready to file your return this year.

Heres what you need to know for this tax-filing season, including filing options, COVID-19 benefits, and whats new.

What Is The Due Date For Calendar Corporate Income Tax Returns For Businesses That Received An Extension

The filing extension provides an extension to file the 2020 Arizona corporate returns. The extension due date for calendar year corporate Arizona returns is due October 15, 2021.

The federal calendar year corporate returns are due October 15, 2021.

Corporate income tax payments can also be made on AZTaxes.gov, but registration is required.

You May Like: Louisiana Payroll Calculator

What Happens If I Miss The Tax Deadline

If you received an extension and fail to file your income taxes by midnight on Oct. 15, what happens next depends on your situation. If you are owed a refund, there is no penalty for filing late, though this may be different for your state taxes. But if you owe the IRS, penalties and interest start to accrue on any remaining unpaid tax due. There’s also a $330 failure-to-file penalty under the Taxpayer First Act of 2019.

In most states, taxpayers who are granted a federal extension to file automatically receive an equivalent extension to file their state income tax return.

An important note: If you are owed a refund or you filed for an extension through Oct. 15, you were supposed to pay your taxes by May 17. If you owe money, you would have been required to estimate the amount due and pay it with your Form 4868. If you did that, you should have automatically been granted an extension.

Another caveat: If you’re serving in the military — in a combat zone or a contingency operation in support of the armed forces — you may be granted additional time to file, according to the IRS.

Bottom line? It’s best to e-file or postmark your individual tax return as early as possible. CNET’s roundup of the best tax software for 2021 features an array of packages that can help you take care of business quickly and affordably.

See also

The 2021 Tax Brackets

Tax brackets should be straightforward: you find your annual income on your T4 slip and voilà, you have a rate. Except its not that simpletheres some math to be done, as the federal, provincial and territorial tax brackets work more like a ladder with various tax rates applying at different income levels. So, depending on your annual income, you could be subject to tax rates from two or three brackets.

To save you time, we break down the 2021 tax brackets for Canada and the provinces and territories based on annual income, showing the minimum and maximum tax dollars for each bracketbefore tax credits, deductions, etc.

Knowing your tax brackets will help you estimate how much you could owe come April 30, and to plan and prep accordingly. Could boosting your registered retirement savings plan contributions change your brackets? Maybe. You can also see if your employer is taking off enough tax from your paycheque. Plus, checking your tax brackets well before the payment deadline gives you time to save up, if youre expecting to owe.

Read Also: How Do I Protest My Property Taxes In Harris County

I Have Questions About My Taxes Can I Call The Irs

There are numerous ways to contact the IRS. The agency no longer offers live online chatting, but you can still submit questions through its online form. If you prefer to talk to a person, the IRS maintains a number of dedicated phone lines that are open Monday through Friday, from 7 a.m. to 7 p.m. . Individuals can call 800-829-1040 and businesses can call 800-829-4933. Note, however, that the IRS says “live phone assistance is extremely limited at this time.”

And there’s always the Interactive Tax Assistant, an automated online tool that provides answers to a number of tax law questions. It can determine if a type of income is taxable, if you’re eligible to claim certain credits and whether you can deduct expenses on your tax return. It also provides answers for general questions, such as determining your filing status, whether you can claim dependents or if you even have to file a tax return.

If you have a question for the IRS specifically related to stimulus checks and your taxes, the IRS recommends that you check IRS.gov and the Get My Payment application.

File For An Extension By Tax Day

If you can’t finish your return by the May 17 tax deadline, file IRS Form 4868. This will buy most taxpayers until Oct. 15 to file their tax returns. See more about how extensions work.Note: A tax extension gets you more time to file your return, not more time to pay your taxes. You still must pay any tax you owe, or a good estimate of that amount, by the tax deadline. Include that payment with your extension request or you could face a late-payment penalty on the taxes due.

» MORE: See how to set up an installment plan with the IRS by yourself

Also Check: How To Get Tax Preparer License

When Are Taxes Due Important Tax Deadlines And Dates

OVERVIEW

Make sure your calendar is up-to-date with these important deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2021.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

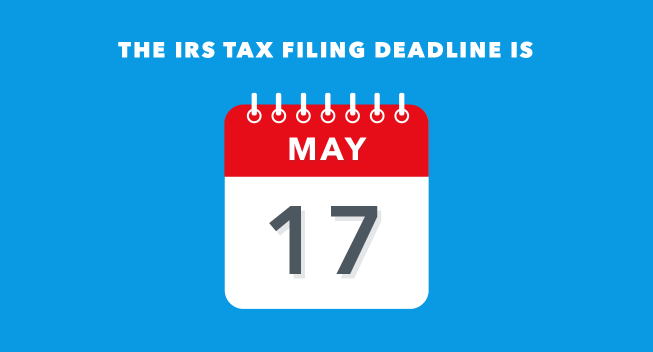

It Is Tax Day Heres What You Need To Know

- May 17, 2021

Its May 17 and its Tax Day, the deadline for filing your 2020 taxes. The Internal Revenue Service in March said that Americans who needed it could take extra time to file their taxes. That time has arrived.

The one-month delay from the usual April deadline did not offer as much extra time as the I.R.S. gave people last year, when the filing deadline was pushed to . But the aim was the same: to make it easier for taxpayers to get a handle on their finances as well as tax changes that took effect this year with the signing of the American Rescue Plan.

Still have questions? Here are some articles that might help.

Don’t Miss: Where’s My Refund Ga

Do Not Risk Having Your Benefits And Credits Interrupted

Doing taxes on time is the best way to ensure your entitlement to benefits and credits, like the Canada child benefit , the Old Age Security pension payments, and the goods and services tax/harmonized sales tax credit, are not interrupted. Even if you owe tax, dont risk having your benefits and credits interrupted by not filing. If you cannot pay your balance owing, the CRA can work with you on a payment arrangement.

Company Was Dormant For The Financial Year 2020

Yes, you have to file your Corporate Income Tax Return, unless your company has been granted a waiver to file the return.

If your company did not carry on business and had no income for the whole financial year 2020, it is regarded as a dormant company for YA2021. You may file your Corporate Income Tax Return using the File Form for Dormant Company digital service at mytax.iras.gov.sg.

Learn more about dormant companies.

Also Check: Www.myillinoistax

What If You Miss A Date

You’ll probably be hit with a financial penalty, if only an extra interest charge, if you don’t submit a tax return and make any payment that’s due by its appropriate deadline. The late-filing penalty for a 1040 return is 5% of the tax due per month as of tax year 2020, up to a cap of 25% overall, with additional fees piling up after 60 days. The IRS says you should file your return as soon as possible if you miss a deadline.

Federal Tax Deadline Extensions

The federal tax filing deadline for 2020 taxes has been automatically extended to May 17, 2021. Due to severe winter storms, the IRS has also extended the tax deadline for residents of Texas, Oklahoma and Louisiana to June 15, 2021.

This extension also applies to 2020 tax payments. Individual taxpayers may defer tax payments until the new filing deadline, interest and penalty free. The new federal tax filing deadline is automatic, so you don’t need to file for an extension unless you need more time to file after May 17, 2021.

If you file for an extension, you’ll have until October 15, 2021 to file your taxes. But, you’ll still need to pay any taxes you owe by May 17.

The new federal tax filing deadline doesn’t apply to 2021 estimated tax payments. First and second quarter estimated tax payment deadlines are still April 15, 2021 and June 15, 2021.

You May Like: Www.1040paytax

State Tax Deadline For Individuals Postponed Until May 17 2021

03/19/2021

Sacramento â The Franchise Tax Board today announced that, consistent with the Internal Revenue Service, it has postponed the state tax filing and payment deadline for individual taxpayers to May 17, 2021.

We recognize what a challenging year this has been for Californians statewide, said State Controller Betty T. Yee, who serves as chair of FTB. I am pleased we are able to postpone tax filing and payment deadlines for all individual taxpayers in California to May 17. Hopefully, this small measure of relief will continue to allow people to focus on their health and safety and navigate the complexities caused by the pandemic.

This postponement applies to individual filers whose 2020 tax returns and payments were originally due on April 15, 2021. Taxpayers do not need to claim any special treatment or call FTB to qualify for this postponement. FTB will waive any interest and late payment penalties that would otherwise apply if the returns are filed and the payments are made by May 17.

The postponement only applies to individual taxpayers, and it does not apply to estimated tax payments, which are still due on April 15.

Please visit our FAQs website for updates as they become available.

What If I Don’t Normally Have To File Taxes But Want To Claim A Missing Stimulus Check

If you typically aren’t required to file taxes because you’re on SSI or SSDI, you’re retired, or you don’t meet the IRS’ income threshold, but you need to claim missing stimulus money, you will have to file a 2020 tax return. The good news is, you’ll likely be eligible to use the IRS’ Free File program to do so. We’ve got a guide for how nonfilers can get started filing their 2020 tax return to claim stimulus money here.

You May Like: Have My Taxes Been Accepted

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

C Corporation Tax Returns Due

Today is the deadline to file C corporation tax returns . C corporations in Texas, Oklahoma, and Louisiana have until June 15 to submit their tax returns.

April 15 is also the deadline to file for an extension to file your corporate tax return.

Forms:

Further reading:What is Form 7004 and How to Fill it Out

You May Like: Have My Taxes Been Accepted

How To Get Started Doing Your Tax Return

If you procrastinate with your tax return, know that youre not alone: in 2020, over 60% of Canadians didnt file on time. Being late can be costly, though, so we want to help you conquer procrastinationand avoid penalties and interest chargesthis tax season. Get motivated with the psychological hacks in our article: How to do your taxes and beat procrastination.

Are Ador Offices Open

In light of COVID-19, the Arizona Department of Revenue has temporarily modified current services in an effort to protect the health and safety of its customers and employees while continuing to provide information and support to Arizona taxpayers.

Customers requiring in-person assistance can make an appointment with a department representative at ADORs locations in Phoenix and the Southern Regional Office in Tucson. They can do this by emailing or calling 716 ADOR .

A drop-box is available at the three ADOR locations for payments, forms, applications, and returns without an appointment. Items are collected throughout the day and taxpayers can receive a submission confirmation by including their email address on the top of the envelope.

Online Filing and Call Center AssistanceADOR also offers a Live Chat feature, which is available online Monday through Friday from 7 a.m. to 6 p.m. to answer inquiries for general questions and offers navigational guides in real-time.

Customers seeking information on particular private taxpayer matters or confidential account information can speak to our Customer Care Center at 255-3381 or 800-352-4090.

You May Like: Oregon Tax Preparer License Renewal

What If Im Owed A Refund Will I Still Be Penalized

There is no penalty for filing late if it turns out that you are owed a tax refund. However, the longer you wait to file the longer it will take to get your money back from the government. As well there is a three-year limitation to claim any tax refund that you have coming your way. Because Tax Day was delayed this year, you have until 17 May, 2024 to get any tax refund that’s due to you.

Likewise, taxpayers have three years to correct a tax return to claim any refund money they left on the table. If you file for an extension you will have from the date you filed your return with the IRS to claim any money you missed out on in your original filing. After the three-year period the federal government will keep any money that went unclaimed.

There are exceptions to the three-year refund rule. In the case of deductions for bad debt or worthless securities, taxpayers have seven years to claim a refund. The limit does not apply for those who are unable to manage their financial affairs due to physical or mental impairments.

Quarterly Payroll Taxes For Employers

If you employ one or more people in your business, you should file Form 941, Employers Quarterly Federal Tax Return. Then deposit your taxes on the following dates:

- for first quarter

- for second quarter

- for third quarter

- for fourth quarter of the previous calendar year

The IRS gives you an additional 10 calendar days to file your return if you deposit all your taxes before they are due.

Don’t Miss: How To Buy Tax Lien Properties In California

Is Tax Filing Compulsory

It depends.

If you dont owe taxes to the government, you may not need to file a tax return. However, there are other reasons why you may need to file a return and they include if:

- You are expecting a tax refund. Duh! CRA wont chase you around if you dont owe them. If you want whats yours i.e. tax refund, you better go get it!

- You are eligible for and want to collect government benefits including GST/HST credits, Canada Child Benefit, GIS or Allowance benefits.

- You have an open Home Buyers Plan or Lifelong Learning Plan account through your RRSP.

- You are contributing to the Canada Pension Plan .

There are a few other scenarios where a tax return filing is required even if you do not owe taxes. If in doubt, just file there are many ways to do it for cheap, or even free.

Changes To Income Taxes For 2021

The past two years have been unpredictable to say the leastand that uncertainty applies to filing our tax returns, too. CRB or T2200, anyone? If you dont know what those are, we have you covered in our 2021 Canadian tax update, including new tax deductions and programs. Get information on the Canada Worker Lockdown Benefit, home office deductions, how to claim a tax credit for digital news, the minimum 15% tax for high-income individuals, credits for home buyers and more.

You May Like: How Can I Make Payments For My Taxes