Failure To Collect Texas Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

Motor Vehicle Sales And Use Tax

Expiration of Temporary Waiver for Motor Vehicle Tax Payment Extension

The temporary waiver issued for motor vehicle tax payment will end on April 14, 2021. The ending date is consistent with the announcement by the Texas Department of Motor Vehicles to end the temporary waiver for title and registration on certain vehicles.

If a motor vehicle is purchased after April 14, 2021, the purchaser must remit motor vehicle tax to their local county tax assessor-collector within 30 calendar days after the vehicle is delivered to the purchaser. For example, if tax is due on May 14, 2021 the CTAC will assess a 5 percent penalty if the tax is paid 1-30 days after that date, or a 10 percent penalty if tax is paid more than 30 days after that date.

For motor vehicles purchased on or before April 14, 2021, CTACs will continue to waive the motor vehicle tax penalty in the Registration and Titling System , provided the tax is remitted to the CTAC within 60 days of April 14, 2021.

Note: The extension does not apply to seller-financed motor vehicle sales. In these cases, the motor vehicle tax is reported and paid directly to the Comptroller’s office instead of a CTAC upon registration.

How To Get Help Filing A Texas Sales Tax Return

Lastly, here is the contact information for the state if case you end up needing any help along the way:

Electronic Reporting and WebFile Technical Support: 442-3453

Sales and Use Tax: 252-5555

But if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if youre interested in becoming a client!

Recommended Reading: How Can I Make Payments For My Taxes

How To Determine Location Of Online Sales

A retail transaction that takes place entirely online is sometimes taxed according to the shipping address.

States presume that online orders are physically placed from the shipping address with the intent to use the item at the shipping address. Make sure that you read the rules for the specific states in which you do business.

Other Texas State Taxes

The state’s gas tax has been set at 20 cents per gallon on diesel and unleaded fuels since 1991. That works out to just under $10 per month for the average driver.

Texas taxes cigarettes at $1.41 per pack. Using a hotel, bed and breakfast, or similar short-term stay will cost you another 6% of the cost of the room in taxes. Certain cities, counties, and other districts might impose an additional local hotel tax.

Texas also used to have a fireworks tax of 2%, but this law was repealed effective September 1, 2015.

Recommended Reading: Plasma Donation Taxes

Overview Of Texas Taxes

Texas is often considered tax-friendly because the state does not collect any income taxes. But there are other taxes that Texans have to pay, such as significant property and sales taxes.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 – 2021 filing season.

How Use Tax Works

If you purchase something for your business or personal that you use, give away, store, or consume in your home state without paying sales tax, use tax kicks in.

Here are some examples of when youd have to pay use tax:

- If you purchase something in one state and then bring it back to your home state without paying sales tax. For example, if you found a great deal on some supplies that you need for your food truck business while on vacation in Texas and the vendor ships them to your business in Los Angeles.

- If you buy something from someone who is not authorized to collect sales tax , such as buying a used food truck from someone on Craigslist.

- If you purchase something online without paying sales tax.

Any item that would typically be subject to sales tax would be subject to use tax if sales tax isnt collected. As we mentioned earlier, items that are not subject to sales and use tax are food, prescribed medications, electronically downloaded software, music, and books and any products that are purchased for resale.

If you owe use tax, you can use the sales tax rate that would apply in your home state to calculate the amount of use tax that you owe. For example, if your sales tax rate is 7% then you would use this same rate to also calculate your use tax for any items that you purchased and did not pay sales tax on . You must report and pay use tax in the same manner that you report and pay sales tax.

You May Like: Efstatus.taxact

Texas Car Sales Tax: Everything You Need To Know

Texas car sales tax rates vary based on the city or county you live in. When you purchase a car, you’ll need to know due dates for vehicle taxes and how rebates, incentives, and trade-ins are taxed in Texas.

Texas car sales tax rates vary based on the city or county you live in. When you purchase a car, you’ll need to know due dates for vehicle taxes and how rebates, incentives, and trade-ins are taxed in Texas.

Avalara Sales Tax Management Software

Avalara is a sales tax management software that will make sales tax a breeze. Here are a few of the tasks that it will take care of for you:

- Calculate sales tax rates using geolocation and address verification tools.

- Evaluate whether or not you are exempt from sales tax.

- Collect sales tax and then remit to the appropriate tax authorities.

- Automatically update rate changes in real time.

Avalara even has a free sales tax rate map which lets you check your local sales tax rates:

The best part about Avalara is that it will integrate with most accounting software programs like QuickBooks. Pricing for the QuickBooks/Avalara integration starts at $50/year. You can learn more about how Avalara integrates with QuickBooks here.

You May Like: How To Get Tax Preparer License

Buying And Storing Precious Metals In Texas Yields Tax Benefits

Precious metal investors and enthusiasts across the nation now have another reason to buy and store their gold, silver, and platinum in Texas.

The U.S. Supreme Court decision in South Dakota vs. Wayfair, Inc. makes Texas attractive to investors who live in states that unlike Texas tax purchases of precious metals. Thats because businesses may now be required to collect sales taxes for those states even if they dont have a physical presence there. The Wayfair paved the way for states to require out-of-state sellers to collect use tax on items delivered into their state.

Texas is one of many states that does not tax the sale of numismatic coins or gold, silver or platinum bullion. That means buyers do not have to pay the tax if the precious metals are purchased from a Texas precious metals dealer either through the internet or over the phone and not shipped to a state that has a sales tax. In this situation, sales tax is not applicable as the precious metals did not leave the State of Texas.

Adding to the Lone Star States allure is the Texas Bullion Depository, which accepts precious metals purchased here or elsewhere.

Using the state-of-the-art depository is not a requirement for getting the sales tax break, provided the ultimate delivery location is within Texas. But as a storage solution, the Texas Bullion Depository provides many advantages over purely private vaults.

Buy it here. Keep it here. Protect your assets.

Filing When There Are No Sales

Once you have a Texas seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.Failure to submit a zero return can result in penalties and interest charges.

Read Also: How Can I Make Payments For My Taxes

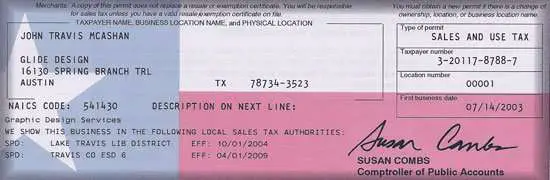

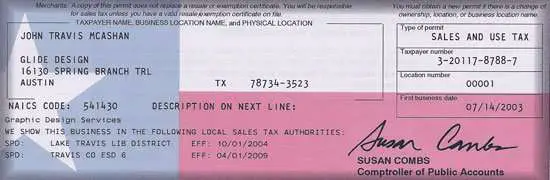

State Sales Tax Registration

After you have determined that you must collect sales tax in a specific state, go to the website of your state’s taxing authority to register for your sales tax permit. The permit will allow you to collect, report, and pay sales taxes on taxable items. You will first need to have your Federal Employer ID Number and all of the information about your business and its owners. Most states allow online registration, so have all the information ready before you begin the process.

What Taxes Can I Pay With Webfile

- Sales and Use

- Boat and Motor Boat Sales and Use

- Cement Production

- Compressed Natural Gas/Liquefied Natural Gas Dealer

- CNG/LNG Interstate Trucker

- Direct Pay Sales and Use

- Fireworks

- International Fuel Tax Agreement

- Loan Administration Fee

- Manufactured Housing Sales and Use

- Maquiladora Export

- Mixed Beverage Sales and Gross Receipts

- Motor Fuel

- Motor Vehicle Sales and Use

- Motor Vehicle Seller-Financed

- Oil and Gas Well Servicing

- Oyster Sales

Taxpayers who paid $500,000 or more for a specific tax in the preceding state fiscal year are required to pay using TEXNET.

Paying by credit card will incur a non-refundable processing fee:

| Amount Paid |

|---|

| 2.25% of the amount plus a $0.25 processing fee |

Payment Deadlines

- TEXNET ACH Debit payment of $100,000 or less, must be scheduled by 10:00 a.m. on the due date. Payments above $100,000 must be initiated in the TEXNET system by 8:00 p.m. the business day before the due date.

- Late payments are subject to penalties and loss of timely filing and/or prepayment discounts.

- If you are required to pay electronically, there is an additional 5% penalty for failure to do so.

Read Also: Do You Have To Pay Taxes On Plasma Donations

If I Close My Business Do I Need To File A Final Sales Tax Return

Yes. You have to file a final sales tax.

You also want to keep in mind your permit is only valid if you are actively engaged in business as a seller. It is best to notify the Comptroller if you are not in business anymore so they can cancel your permit. If they find out on their own that you are no longer in business, they could also cancel your permit.

How To Collect Sales Tax In Texas

Now itâs time to tackle the intricate stuff! Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations.

The state-wide sales tax in Texas is 6.25%.

There are additional levels of sales tax at local jurisdictions, too.

Texas has a destination-based sales tax system, * so you have to pay attention to the varying tax rates across the state. Charge the tax rate of the buyerâs address, as thatâs the destination of your product or service.

* Important to note for remote sellers: While this is generally true for Texas, some state have peculiar rules about tax rates for remote sellers. Texas is establishing destination sourcing for internet orders and sales made by a marketplace seller through a marketplace. Contact the stateâs Department of Revenue to be sure.

Don’t Miss: Property Tax Protest Harris County

Property Taxes In Texas

Property taxes are based on the assessed current market value of real estate and income-producing tangible personal property.

“Income” is the key word when it comes to personal property. Your vehicle might be considered tangible personal property, but it’s not subject to a tax as long as you never use it to earn a living. Driving it back and forth to your place of employment is okay.

For real estate, appraisals are performed by county districts. The appraiser will compare your home to other similar homes that have recently sold in the area, and it will determine the value from there.

The appraised value of your real estate is then multiplied by the local tax rate to determine your tax bill. These rates are set by counties and school districts. They’re based on yearly budgets and how much revenue the districts need to cover their costs.

Local governments regularly hold public hearings to discuss tax increases, and citizens of Texas can petition for a public vote on an increase if it exceeds certain limits.

Owners of agricultural or timberland property can apply for special appraisals based on the value of crops, livestock, and timber produced by the land. This can result in lower appraisals and lower taxes.

How Much Sales Tax Should You Charge

This is the million dollar question! Even if you have just one location, you may be required to collect tax for multiple jurisdictions such as state, county, and city. These rates vary and change quite often which makes it difficult to keep up with. If you have out of state sales, that just adds another level of complexity. We will discuss how to deal with out of state sales later on in this article.

The amount of sales tax charged will either be based on the sellers location or the buyers locale. Here is a brief description of the two methods:

- Origin If the origin method is used, you will charge sales tax using the rules based on your business location. In general, most sales that take place within the same state will use this method to determine the sales tax to charge customers.

- Destination If the destination method is used, you will charge sales tax using the rules based on your customers location. This method is generally used for interstate sales.

Also Check: How Do I Protest My Property Taxes In Harris County

Paperwork That Must Be Filed To Pay Sales And Use Tax

You are required to file an application to collect and report taxes before you start doing business in that state. Sales and use tax registration processes vary from state to state.

In an effort to streamline the process of the complex state sales tax system, the streamlined Sales Tax Agreement was established in 2000. To date, 24 states have adopted this agreement, which requires them to adhere to the following rules:

- Sales taxes should be remitted to a single state agency. This means that businesses should not have to file a sales tax return in each jurisdiction where they do business.

- For example, if you do business in the state of Nevada which has 17 different counties that charge sales tax you can report the sales tax collected from all 17 counties on one sales and use tax return. Payment for all counties can be made with one check and sent to the Nevada Department of Taxation.

What Are Some Common Compliance Pitfalls For Small Businesses

Managing your tax obligations isnt easy and non-compliance unintentional or not can result in serious consequences for your business. Knowing some common compliance pitfalls ensures that you wont be surprised by an unexpected sales tax obligation.

- Falling behind. Falling behind on sales tax legislative updates in various states is a concern for many small business owners. And if youre doing business in multiple states, it can be a monumental task to make sure you know about and understand tax legislation when it gets passed.

- Breaking down rates. Inability to break down rates required by a tax jurisdiction can also be an issue. Sales tax rates include the state rate, plus any local or other taxing jurisdiction at the point of sale. Knowing how to navigate the increasingly dense tax rates, and the ability to track and ensure compliance across your business, is critical to success.

- Understanding nexus. Neglecting to collect tax where you have nexus will quickly become a problem. The first step is understanding and identifying where and when you have a nexus and how that will affect the amount of tax you must remit to the individual state.

- Exemption certificates. Failing to collect exemption certificates on exempt sales is a common problem. In most cases, asking for an exemption certificate immediately is the best course. But it does cause extra work for both you and your customer. However, having the completed forms is necessary and expected during an audit.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Requirements For Reporting And Paying Texas Sales And Use Tax

Select the amount of taxes you paid in the preceding state fiscal year to find the reporting and payment methods to use.

Select one of these payment methods:

- Web Electronic Funds Transfer or credit card via Webfile

Select one of these payment methods:

- Web Electronic Funds Transfer or credit card via Webfile

Select one of these payment methods:

- Web Electronic Funds Transfer or credit card via Webfile

Select one of these payment methods: