Can Retirees Contribute To A Roth Ira

Retirees can continue to contribute earned funds to a Roth IRA indefinitely. You cannot contribute an amount that exceeds your earnings, and you can only contribute up to the annual contribution limits set by the Internal Revenue Service . People with traditional IRAs must start taking required minimum distributions when they reach age 72, but there is no such requirement for Roth IRAs.

Special Considerations For Roth And Traditional Iras

A key consideration when deciding between a traditional and Roth IRA is how you think your future income will compare to your current situation. In effect, you have to determine if the tax rate you pay on your Roth IRA contributions today will be higher or lower than the rate youll pay on distributions from your traditional IRA later.

Although conventional wisdom suggests that gross income declines in retirement, taxable income sometimes does not. Think about it. Youll be collecting Social Security benefits, and you may have income from investments. You might opt to do some consulting or freelance work, on which youll have to pay self-employment tax.

And when the kids are grown and you stop adding to the retirement nest egg, you lose some valuable tax deductions and tax credits. All this could leave you with higher taxable income, even after you stop working full time.

In general, if you think youll be in a higher tax bracket when you retire, a Roth IRA may be the better choice. Youll pay taxes now, at a lower rate, and withdraw funds tax-free in retirement when youre in a higher tax bracket. If you expect to be in a lower tax bracket during retirement, a traditional IRA might make the most financial sense. Youll reap tax benefits today while youre in the higher bracket and pay taxes later on at a lower rate.

Application Of The Canada

1.8 Article XVIII of the CanadaU.S. Treaty includes provisions that can defer or exempt U.S. pensions from taxation in Canada. The term pension includes a Roth IRA, as long as no contributions are made to the Roth IRA while the owner is resident of Canada. In most cases, these provisions will result in no portion of a Roth IRA being subject to taxation in Canada.

Deferral of taxation of income accrued

1.9 An individual resident in Canada can file an election under paragraph 7 of Article XVIII to defer taxation in Canada with respect to any income accrued in a Roth IRA, but not distributed. The term income accrued means amounts that are included in computing the individuals income under the Act as outlined in ¶1.3 to 1.7.

1.10 The procedures for filing the Election are described in ¶1.15 to 1.21.

Exemption from taxation of distributions

1.11 Pursuant to paragraph 1 of Article XVIII, a distribution from a Roth IRA to an individual resident in Canada is not taxable in Canada to the extent that:

- the payment would not be taxable in the U.S. if the individual was a resident of the U.S and

- the Roth IRA qualifies as a pension.

Canadian Contribution

1.12 If an individual resident in Canada makes a contribution to their Roth IRA or a contribution is made on their behalf , part of the Roth IRA will cease to be considered a pension. This will result in the loss of treaty benefits, as follows:

Recommended Reading: How To Find My Tax Id Number Online

Roth Ira Deductions Vs Traditional Ira Deductions

Lets take a closer look at what you need to know about IRA tax deductions.

Because traditional IRAs make it possible to save using pre-tax money , you can deduct your annual contribution to your traditional IRA so you can avoid paying income tax on that money when you file your federal income tax return. Because you wont pay income tax on that money when you make the contribution , you need to pay income tax later. Because income levels drop drastically at retirement age, the hope is youll pay less income tax when you make your withdrawals.

How to Open a Roth IRA

How to Open a Roth IRA

It takes just a few simple steps to open a Roth IRA and start saving for retirement.

When it comes to Roth IRAs you cant make deductions on your federal income tax return as you use post-tax income to make contributions. When you get to benefit tax wise is when it comes time to withdraw your earnings as you wont have to pay income tax on that growth.

So, how can someone decide whether they should be contributing to a traditional or Roth IRA?

First, one should determine if they are even eligible to make a Roth IRA contribution, Lacroix says. Depending on your tax filing status and adjusted gross income, you may not be eligible.

Assuming you are eligible to make a Roth IRA contribution, Lacroix then suggests considering where you are from a tax perspective.

How Roth Ira Contributions Are Taxed

Contributions to a traditional IRA are made using pretax dollars and may be tax deductible, depending on your income and if you or your spouse are covered by a retirement plan at work.

If you are eligible to deduct your traditional IRA contributions, it will lower the amount of your gross income thats subject to taxes. And that effectively lowers the amount of tax you owe for that year.

When you start withdrawing from these accounts after your retirement, youll pay taxes on those funds at your ordinary income tax rate. Thats why the traditional IRA is called a tax-deferred account.

Roth IRAs do not benefit from the same up-front tax break that traditional IRAs receive. The contributions are made with after-tax dollars. Thus, a Roth IRA doesnt reduce your tax bill for the year when you make contributions. Instead, the tax benefit comes at retirement, when your withdrawals are tax free.

Recommended Reading: What Time Is Tax Deadline

What Are The Disadvantages Of A Roth Ira

Among the disadvantages of Roth IRAs is the fact that, unlike 401s, they do not include an up-front tax break. Also, annual contribution limits are about a third of 401s. For some high-income individuals, there are reduced or limited contribution amounts. Finally, there is no automatic payroll deduction.

If You Want To Withdraw Your Earnings

Different rules apply if you withdraw earnings from your Roth IRA. You would normally get dinged on those. If you want to withdraw earnings, you can avoid taxes and the 10% early withdrawal penalty if youve had the Roth IRA for at least five years and at least one of the below circumstances applies to you:

- You are at least 59 ½ years old

- Have a permanent disability

- You die and the money is withdrawn by your beneficiary or estate

- Use the money for a first-time home purchase.

If youve had the account for less than five years, you can still avoid the 10% early withdrawal penalty if:

- Youre at least 59 ½ years old.

- The withdrawal is due to a disability or certain financial hardships.

- Your estate or beneficiary made the withdrawal after your death.

- You use the money for a first-time home purchase, qualified education expenses, or certain medical costs.

Recommended Reading: What Happens If I File My Taxes Wrong

Which Should You Choose

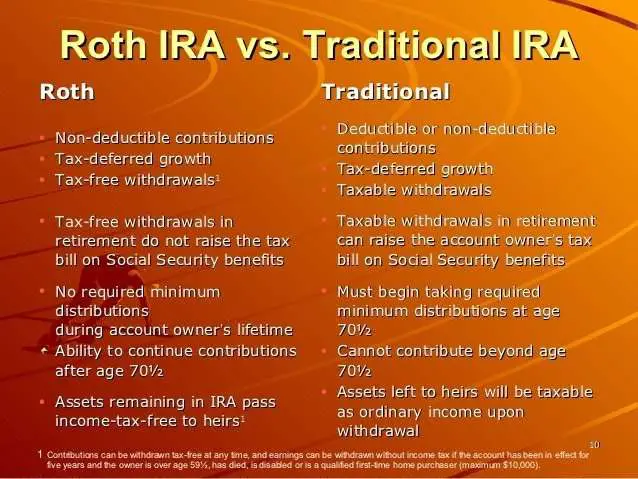

Traditional and Roth IRAs are both tax-advantaged ways to save for retirement. While the two differ in many ways, the biggest distinction is how they are taxed.

Traditional IRAs are taxed when you make withdrawals, and you end up paying tax on both contributions and earnings. With Roth IRAs, you pay taxes up front, and qualified withdrawals are tax free for both contributions and earnings.

This is often the deciding factor when choosing between the two.

There Are No Required Minimum Distributions

Roth IRAs do not have required minimum distributions for the original owner. Generally, traditional IRAs, 403s, Roth and traditional 401s, and other employer-sponsored retirement savings plans do. If you don’t need your distributions for essential expenses, RMDs may be hard to keep track of. The RMDs have to be calculated and withdrawn each year, and may result in taxable income. Because a Roth IRA eliminates the need to take RMDs, it may also enable you to pass on more of your retirement savings to your heirs .

Recommended Reading: How Can You Pay Your State Taxes Online

What Happens If You Withdraw Funds From Your Roth Ira Before Reaching The Age Of 59

If you withdraw funds from Roth IRAs before reaching the age of 59½, you will typically have to pay a ten percent early withdrawal penalty. However, there are a few exceptions to this rule. For example, if you are disabled or if you use the money for qualified higher education expenses or to cover certain medical costs, you may be able to withdraw funds without incurring a penalty.

Tax Breaks For Roth Ira Contributions

The incentive for contributing to a Roth IRA is to build savings for the futurenot to obtain a current tax deduction. Contributions to Roth IRAs are not deductible for the year when you make them rather, they consist of after-tax money. That is why you dont pay taxes on the funds when you withdraw themyour tax bill has been paid already.

However, you may be eligible for a tax credit of 10% to 50% on the amount contributed to a Roth IRA. Low- and moderate-income taxpayers may qualify for this tax break, called the Savers Credit. This retirement savings credit is up to $1,000, depending on your filing status, AGI, and Roth IRA contribution.

Here are the limits to qualify for the Savers Credit for the 2022 tax year:

- Taxpayers who are married and filing jointly must have incomes of $68,000 or less.

- All head of household filers must have incomes of $51,000 or less.

- Single taxpayers must have incomes of $34,000 or less.

The amount of credit that you get depends on your income. For example, if you are a head of household whose AGI in the 2022 tax year shows income of $29,625, then contributing $2,000 to an IRA generates a $1,000 tax credit, which is the maximum 50% credit. The IRS provides a detailed chart of the Savers Credit.

The tax credit percentage is calculated using IRS Form 8880.

Read Also: How Many Years Do You Need To Keep Tax Returns

Converting A Traditional Ira To A Roth Ira

If you are strapped for cash, the Roth IRA option may be a tougher commitment to make. The traditional IRA takes a smaller bite out of your paycheck because it reduces your overall tax liability for the year.

Even if you feel that you have to forgo the Roth option for now, you might consider converting your account from a traditional IRA to a Roth IRA in a few years, when youre more financially comfortable. But be aware that all the taxes you were deferring in the traditional IRA will come due in the year when you do the conversion.

A Roth IRA is generally the better choice if you think you will be in a higher tax bracket after retiring. Income tax rates could increase. Or your overall income could be higher due to a variety of factors, such as Social Security payments, earnings on other investments, or inheritances.

If youre considering converting from a traditional IRA to a Roth IRA, you may be able to lessen your tax liability if you time the conversion right. Consider making the move when the market is down , your income is down, or your itemizable deductions for the year have increased.

Record Keeping For Roth Ira Contributions

You do not have to report your Roth IRA contribution on your federal income tax return. However, it is highly advisable for you to keep track of it, along with your other tax records for each year. Doing so will help you demonstrate that youve met the five-year holding period for taking tax-free distributions of earnings from the account.

Each year that you make a Roth IRA contribution, the custodian or trustee will send you Form 5498, IRA Contribution Information. Box 10 of this form lists your Roth IRA contribution.

Also Check: How Much Is Sales Tax In Texas

Earned Income Tax Credit

If you have a relatively low earned incomeand you meet other qualificationsyou may be eligible for the federal earned income tax credit , which can reduce your tax bill or result in a refund. To qualify for the credit, you must file a tax return even if you dont owe any tax or otherwise wouldnt be required to file one.

The EITC was conceived as a type of work bonus plan to supplement the wages of low-income workers, help offset the effect of Social Security taxes, and encourage work to move people off welfare. It continues to be viewed as an anti-poverty tax benefit aimed to reward people for employment.

Note that as part of the American Rescue Plan Act of 2021, the EITC cap is temporarily raised from $543 for childless households to $1,502 for 2021. The bill also expands eligibility for childless households.

As usual in these matters, if you are unsure about whether you qualify or have questions about your specific situation, seek advice from the IRS or an independent tax expert.

Who Can Benefit From A Backdoor Roth

A backdoor Roth can be a valuable tool for someone who wants to take advantage of the tax benefits this type of account offers, but who isnt eligible to contribute directly to a Roth IRA.

At higher income levels, a contribution to a Traditional IRA is no longer tax-deductible, Eric Figueroa, a Certified Financial Planner and the founder of Hesperian Wealth, told The Balance in an email. At that point, you might as well contribute to a Roth IRA, where your contribution is also not tax-deductible but you’ll never owe taxes on the account and its earnings again.

If you or your spouse arent covered by a retirement plan at work, you can deduct your full traditional IRA contribution no matter what your income is. But if you do or your spouse does have access to a workplace retirement plan, there are some limits on traditional IRA deductions.

In 2022, the IRS allows investors with a workplace retirement plan to deduct their full traditional IRA contribution if they earn $68,000 or less for a single filer or $109,000 for a married filer. If your income exceeds that amount, you can take a partial deduction. But once your income exceeds $78,000 for a single filer or $129,000 for a married filer, you cant deduct any of your contributions.

Recommended Reading: How To Reduce Income Tax

What Is The Saver’s Tax Credit

The saver’s tax credit is a non-refundable tax credit that can be claimed by taxpayers who make salary-deferral contributions to their employer-sponsored 401, 403, SIMPLE, SEP, or governmental 457 plan, or make contributions to their traditional or Roth IRAs. The amount of the credit varies and depends on the adjusted gross income of the taxpayer and the amount of the contribution or contributions.

Timing Your Roth Ira Contributions

Although you can own separate traditional and Roth IRAs, the dollar limit on annual contributions applies collectively to all of them. If an individual under age 50 deposits $2,500 in one IRA for tax year 2022, then that individual can only contribute $3,500 to another IRA in that tax year.

Contributions to a Roth IRA can be made up until tax filing day of the following year. Thus, contributions to a Roth IRA for 2022 can be made through the deadline for filing income tax returns, which is April 15, 2023. Obtaining an extension of time to file a tax return does not give you more time to make an annual contribution.

If youre an early-bird filer and you received a tax refund, you can apply some or all of it to your contribution. You must instruct your Roth IRA trustee or custodian that you want the refund used in this way.

Conversion to a Roth IRA from a taxable retirement account, such as a 401 plan or a traditional IRA, has no impact on the contribution limit. However, making a conversion adds to MAGI and may trigger or increase a phaseout of your Roth IRA contribution amount. Also, rollovers from one Roth IRA to another are not taken into account for purposes of making annual contributions.

Also Check: How To File Income Tax

You Wont Be Forced To Take Distributions Once You Reach A Certain Age

One reason so many people love the Roth IRA is that it offers flexibility in retirement. Not only can you take out your contributions early if you need to, but you arent forced to take distributions once you reach a certain age, either.

A 401 and traditional IRA, by comparison, force you to take distributions at age 70 1/2 or pay a penalty. If you want as many financial options as possible when it comes to riding out your retirement, this is a huge benefit.

What Is The Roth Basis

The Roth IRA basis is the total amount of money you have contributed to your Roth IRA account. This includes any contributions you have made on an after-tax basis and any conversion amounts. The Roth IRA basis also includes any earnings on your contributions. When you take distributions from your Roth IRAs, you will only pay taxes on the amounts that are above your basis.

Recommended Reading: How To Calculate Your Tax Bracket

How Does A Roth Ira Work

You can put money that youve already paid taxes on into a Roth IRA. It will then grow, and when you come to withdraw once you retire, you wont have to pay any further taxes.

A Roth IRA can be funded from a number of sources:

- Regular contributions

- Conversions

All regular Roth IRA contributions must be made in cash they cant be in the form of securities or property. The Internal Revenue Service limits how much can be deposited annually in any type of IRA, adjusting the amounts periodically. The contribution limits are the same for traditional and Roth IRAs. These limits apply across all your IRAs, so even if you have multiple accounts, you cant contribute more than the maximum.

Similar to other qualified retirement plan accounts, the money invested within the Roth IRA grows tax free. However, a Roth IRA is less restrictive than other accounts. The account holder can maintain the Roth IRA indefinitely there are no required minimum distributions during their lifetime, as there are with 401s and traditional IRAs.

Conversely, traditional IRA deposits are generally made with pretax dollars you usually get a tax deduction on your contribution and pay income tax when you withdraw the money from the account during retirement.

Roth IRA Vs. Traditional IRA