Taxes On Larger Businesses

The state taxes businesses that do not file the E-Z Computation form at a rate of 0.75% on their taxable margins . It defines this as the lowest of the following three figures: 70% of total revenue, 100% of revenue minus cost of goods sold , or 100% of revenue minus total compensation.

Nearly all business types in the state are subject to the franchise tax. The only exceptions are sole proprietorships and certain types of general partnerships.

Small businesses with gross receipts below $1,180,000 pay zero franchise tax for tax year 2020.

For many businesses, the actual tax rates are much lower than the stated rates. For example, the franchise tax for retail and wholesale companies, regardless of the size of the business, is 0.375%. Businesses that earn less than $20 million in annual revenues and file taxes using the state’s E-Z Computation form pay 0.331% in franchise tax.

However, the E-Z Computation form does not allow a business to deduct COGS or compensation, or to take any economic development or temporary credits.

How Much Are Taxes In Texas

Property taxes in Texas are calculated based on the county you live in. The average property tax rate in Texas is 1.80%. This is currently the seventh-highest rate in the United States. Breaking this out in dollars, if your home is valued at $200,000, your personal property taxes at the average rate of 1.80% would be $3,600 for the year.

What Tax Rate Do I Use

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent. You will be required to collect both state and local sales and use taxes. For information about the tax rate for a specific area, see Local Sales and Use Tax Rates on our sales and use tax web page.

For information on collecting and reporting local sales and use tax, see 94-105, Local Sales and Use Tax Collection A Guide for Sellers For a list of local tax rates, see Texas Sales and Use Tax Rates. We also provide tax rate cards for all combined tax rates.

Sales and use taxes are collected at the same rate. See Purchases/Use Tax for additional information.

Also Check: How To Appeal Property Taxes Cook County

Other Texas State Taxes

The state’s gas tax has been set at 20 cents per gallon on diesel and unleaded fuels since 1991. That works out to just under $10 per month for the average driver.

Texas taxes cigarettes at $1.41 per pack. Using a hotel, bed and breakfast, or similar short-term stay will cost you another 6% of the cost of the room in taxes. Certain cities, counties, and other districts might impose an additional local hotel tax.

Texas also used to have a fireworks tax of 2%, but this law was repealed effective September 1, 2015.

Small Business Taxes In Texas: The Basics

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Texas has the second-largest economy in the U.S., with a gross state product of $1.76 trillion in 2020. Much of that money is made in the oil and gas industry, though farming, steel, banking, and tourism were also big contributors. Part of the reason may be that Texas, in the 21st century, has a very pleasant business climate.

You May Like: Where’s My Tax Refund Ga

Which Counties Have The Lowest Property Taxes In Texas

Each county in Texas is responsible for setting its own property tax rates, resulting in taxes in Texas that vary across the state. When you compare property taxes with other counties, keep in mind that, typically, counties with low property taxes have smaller populations. As of 2020, the five counties with the lowest property tax rates in Texas were:

- Borden

- Crockett

Texas Sales Tax Nexus

A sales tax nexus is a term that means that a retailer as a significant presence within a state. If you have nexus in Texas, you are required to collect and remit sales tax on your businesss orders.

A business with a physical presence within the state of Texas will have nexus. That means if you have an office within the state, you must collect sales tax on retail sales.

Other activities that create Texas sales tax nexus are:

- Having an employee, or other agent who operates under the authority of the seller, within the state

- Having an independent salesperson within the state

- Having a distribution center in Texas

- Storing products within a Texas-based warehouse, including Fulfillment by Amazon warehouses

For a complete list of activities that may cause your business to have nexus in Texas, please refer to this web page maintained by the state of Texas.

If you are unsure whether your business is required to collect sales tax, consult with a tax attorney or other licensed professional.

You May Like: How To Correct State Tax Return

How Do You Get A Sales Tax Id

Contact your states tax authority or department of revenue. States usually allow you to apply for your sales tax number online. Youll want to take this step as soon as possible, because your state may not allow you to conduct sales until your number has been issued, usually in the form of a paper certificate.

How Long Is A Texas Resale Certificate Valid

A seller is required to keep resale certificates for a minimum of four years from the date on which the sale is made and throughout any period in which any tax, penalty, or interest may be assessed, collected, or refunded by the comptroller or in which an administrative hearing or judicial proceeding is pending.

Don’t Miss: How To Get Tax Preparer License

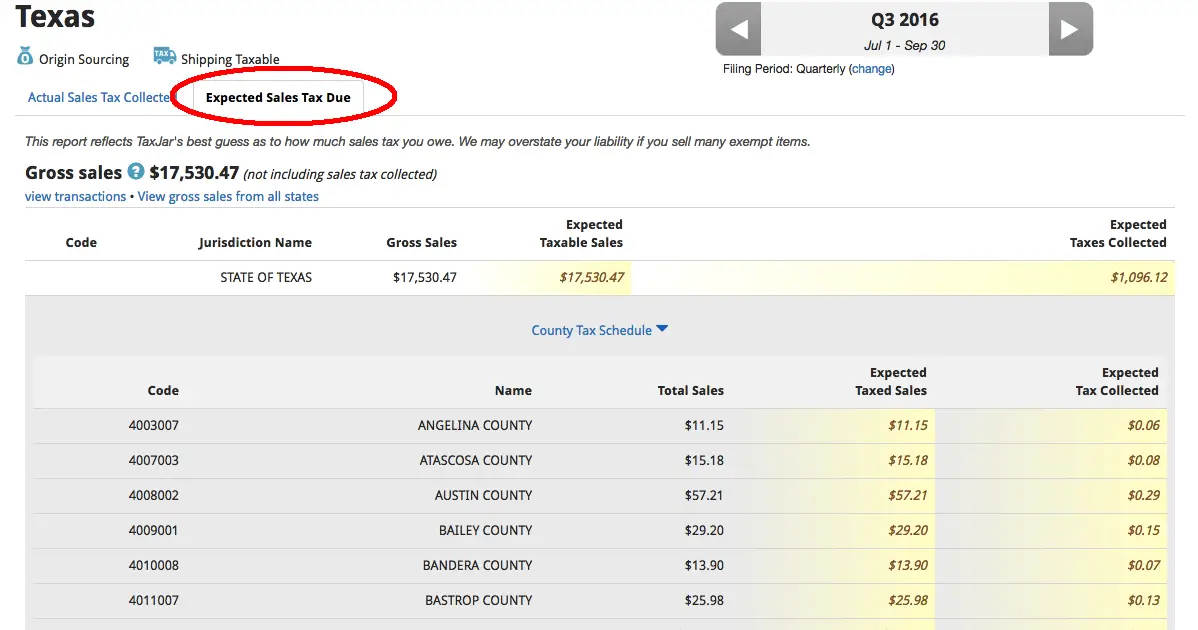

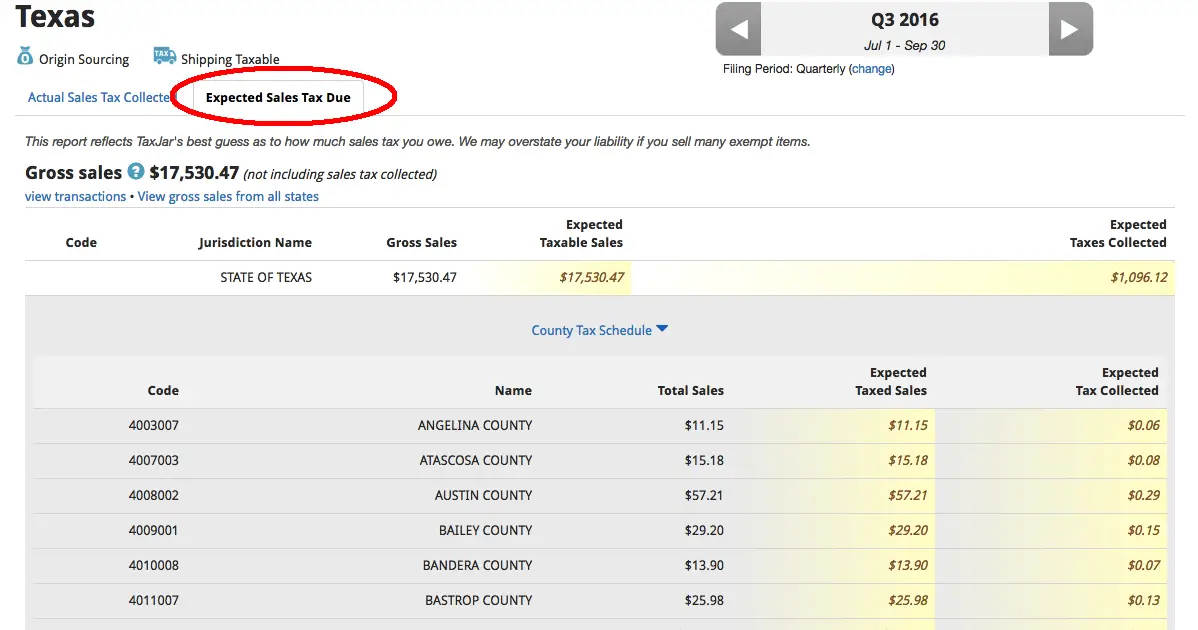

Texas Sales Tax Rates

Texas sales tax varies by location. There is a statewide sales tax of 6.25%. In addition, local taxing jurisdictions such as counties, cities, special purpose districts or transit authorities, can impose a sales tax of up to 2%, for maximum tax rate of 8.25%.

Texas has a few transit authorities, departments and districts that impose their own sales and use tax. Find those rates and districts here.

Texas is an origin-based state for in-state retailers, meaning that a retailer should charge its local rate on all in-state orders. Out-of-state sellers are expected to use the tax rate at the destination of the order, which make calculation more difficult due to the variety of taxes and rates across the state.

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See .

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Also Check: Efstatus/taxact

How To Deduct Sales Tax In The Us

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Buying And Storing Precious Metals In Texas Yields Tax Benefits

Precious metal investors and enthusiasts across the nation now have another reason to buy and store their gold, silver, and platinum in Texas.

The U.S. Supreme Court decision in South Dakota vs. Wayfair, Inc. makes Texas attractive to investors who live in states that unlike Texas tax purchases of precious metals. Thats because businesses may now be required to collect sales taxes for those states even if they dont have a physical presence there. The Wayfair paved the way for states to require out-of-state sellers to collect use tax on items delivered into their state.

Texas is one of many states that does not tax the sale of numismatic coins or gold, silver or platinum bullion. That means buyers do not have to pay the tax if the precious metals are purchased from a Texas precious metals dealer either through the internet or over the phone and not shipped to a state that has a sales tax. In this situation, sales tax is not applicable as the precious metals did not leave the State of Texas.

Adding to the Lone Star States allure is the Texas Bullion Depository, which accepts precious metals purchased here or elsewhere.

Using the state-of-the-art depository is not a requirement for getting the sales tax break, provided the ultimate delivery location is within Texas. But as a storage solution, the Texas Bullion Depository provides many advantages over purely private vaults.

Buy it here. Keep it here. Protect your assets.

Recommended Reading: How To Get A Pin To File Taxes

Whats The Highest Sales Tax Rate In Texas

However, the combined rate of local sales and use taxes cannot exceed 2%, making the highest possible combined tax rate 8.25%. Not all Texas cities and counties have a local code. Cities and counties without a local code do not charge a local sales and use tax. An example of the complexity of Texas state law is Spring, Texas.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

You May Like: How Much Does H& r Block Charge For Doing Taxes

What Is Sales Tax

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax or goods and services tax , which is a different form of consumption tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. In other countries, the listed prices are the final after-tax values, which include the sales tax.

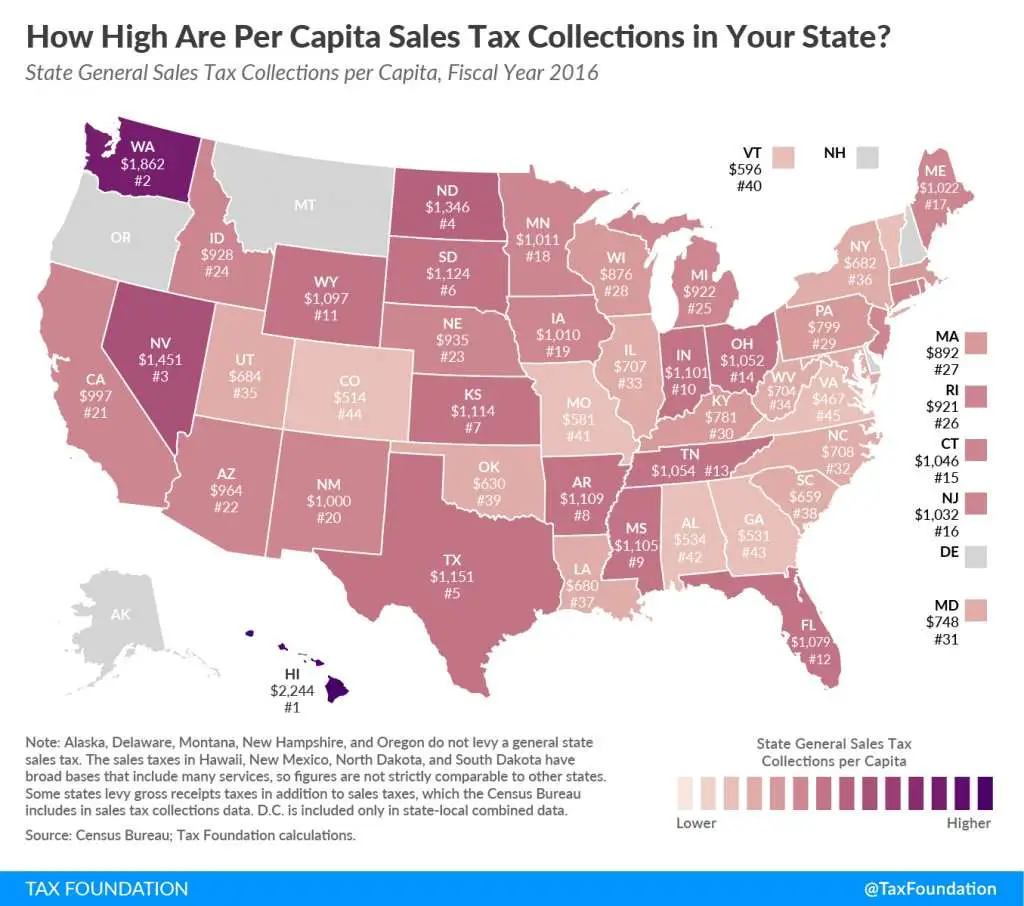

How 2021 Sales Taxes Are Calculated In Texas

The state general sales tax rate of Texas is 6.25%. Cities and/or municipalities of Texas are allowed to collect their own rate that can get up to 2% in city sales tax.Every 2021 combined rates mentioned above are the results of Texas state rate , the county rate , the Texas cities rate , and in some case, special rate . The Texas’s tax rate may change depending of the type of purchase. Some of the Texas tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Texas website for more sales taxes information.

You May Like: How To Get Tax Preparer License

Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least quarterly. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Property Taxes In Texas

Property taxes are based on the assessed current market value of real estate and income-producing tangible personal property.

“Income” is the key word when it comes to personal property. Your vehicle might be considered tangible personal property, but it’s not subject to a tax as long as you never use it to earn a living. Driving it back and forth to your place of employment is okay.

For real estate, appraisals are performed by county districts. The appraiser will compare your home to other similar homes that have recently sold in the area, and it will determine the value from there.

The appraised value of your real estate is then multiplied by the local tax rate to determine your tax bill. These rates are set by counties and school districts. They’re based on yearly budgets and how much revenue the districts need to cover their costs.

Local governments regularly hold public hearings to discuss tax increases, and citizens of Texas can petition for a public vote on an increase if it exceeds certain limits.

Owners of agricultural or timberland property can apply for special appraisals based on the value of crops, livestock, and timber produced by the land. This can result in lower appraisals and lower taxes.

Recommended Reading: How Much Is Payroll Tax In Louisiana

Distinguishing Goods From Nontaxable Items

Since services and intangibles are typically not taxed, the distinction between a taxable sale of tangible property and a nontaxable service or intangible transfer is a major source of controversy. Many state tax administrators and courts look to the “true object” or “dominant purpose” of the transaction to determine if it is a taxable sale. Some courts have looked at the significance of the property in relation to the services provided. Where property is sold with an agreement to provide service , the service agreement is generally treated as a separate sale if it can be purchased separately. Michigan and Colorado courts have adopted a more holistic approach, looking at various factors for a particular transaction.

Exemption For Disabled Veterans

Veterans of the U.S. Armed Forces who have been disabled as a result of their service might be eligible for a very generous disabled veteran’s exemption. This exemption is equal to 100% of the appraised value of their primary residence.

Texas also offers a property tax exemption for solar- or wind-powered energy devices, as well as several exemptions for charitable organizations and businesses.

Recommended Reading: Www.1040paytax.com Official Site

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

What Is Taxable In Texas

Tangible personal property sold within the state of Texas is subject to sales tax.

In addition, certain services are also taxable. At the time of this writing, these services are:

- Amusement Services

- Cable And Satellite Television Services

- Motor Vehicle Parking And Storage Services

- Nonresidential Real Property Repair, Restoration Or Remodeling Services

- Personal Property Maintenance, Remodeling Or Repair Services

- Personal Services

Read Also: How Can I Make Payments For My Taxes