Business And Personal Tax Returns And Estimated Tax

Most business owners pay tax on their business income through their personal tax returns. These are called “pass-through taxes,” because the tax liability passes through to the owner.

In these cases, business owners have a special schedule included with their 1040 form showing business income. For sole proprietors and single-member LLC owners, that’s Schedule C. For partners, multiple-member LLC owners, and S corporation owners, that’s Schedule K-1.

In addition, partnerships, S corporations, and corporations must file a business tax return and a separate extension application for it.

The IRS extended the filing and payment deadline to May 17, 2021, for 2020 tax returns. The filing and payment were further extended to June 15, 2021, for taxpayers in Texas, Louisiana, and Oklahoma, which were declared winter-storm disaster areas.

What Happens If You Don’t File An Extension And Miss The Deadline

If you don’t file your taxes by the deadline means the IRS will charge you interest on the unpaid balance and a late payment penalty, ranging from 5% to 25% of the amount owed each month it goes unpaid.

The failure to file penalty is 5% and the failure to pay penalty is 0.5% of the unpaid taxes for each month or partial month, up to a maximum of 25%. If both the failure to file and failure to pay penalties apply in the same month, the failure to file penalty is reduced by the amount of the failure to pay penalty for that month. For returns over 60 days late the minimum penalty is $435 or 100% of the tax required to be paid on the return, whichever is less.

For example, if you miss the April 18 deadline for 2021 without filing an extension, your late fee is 5%. If you owe $1,000, that’s a $500 penalty . That’s not even including interest. You’ll get charged interest on the unpaid amount until the entire bill is paid, Cook says.

Why You Might Consider Filing A Tax Extension

Here are some common reasons why you might need to file a tax extension:

- You’re waiting on some tax documents. This is probably one of the most common reasons why you might need to request an extension. If you’re a freelancer, you might be waiting on some 1099s from your clients. Or maybe you misplaced a form you need to file your return, and are waiting for a replacement.

- You weren’t prepared to file by the deadline. Ideally, you prepared months ago by gathering receipts and tax documents. If you find yourself falling behind, you can file an extension.

- Life throws you a curveball. The unexpected death of a loved one, getting divorced, moving, having a baby can all be life events that get in the way of filing your returns on by the mid-April deadline.

You May Like: What Can I Write Off As A Doordash Driver

Why Should I File A Tax Extension

- Youve got a few things left to organize before you can file

- A sudden change in your life that needs your full attention

- Youre still waiting for tax forms or documents

- Your W-2 or other forms need to be replaced

- Extreme weather or another event delays your tax filing

- Filing later has tax planning advantages

- You want to avoid late filing penalties

When Your Application Is Approved

If you applied for the first time on your property and your application is approved:

If you renewed your application:

- You will not receive an approval letter

You can check your application status online at any time.

Note: Only property classifications for Residential and Residential and Farm are deferrable. All other property classifications must be paid to your tax office.

Fees

If you applied for or renewed the Regular Program, a fee is added to your account:

- $60 for new applications

There are no fees for the Families with Children Program.

Interest

Simple interest is charged on the deferred tax amount starting from the date your property taxes are due or the date you applied to defer, whichever is later. Find out how interest is applied to your tax deferment loan.

Also Check: How To Get Tax Form From Doordash

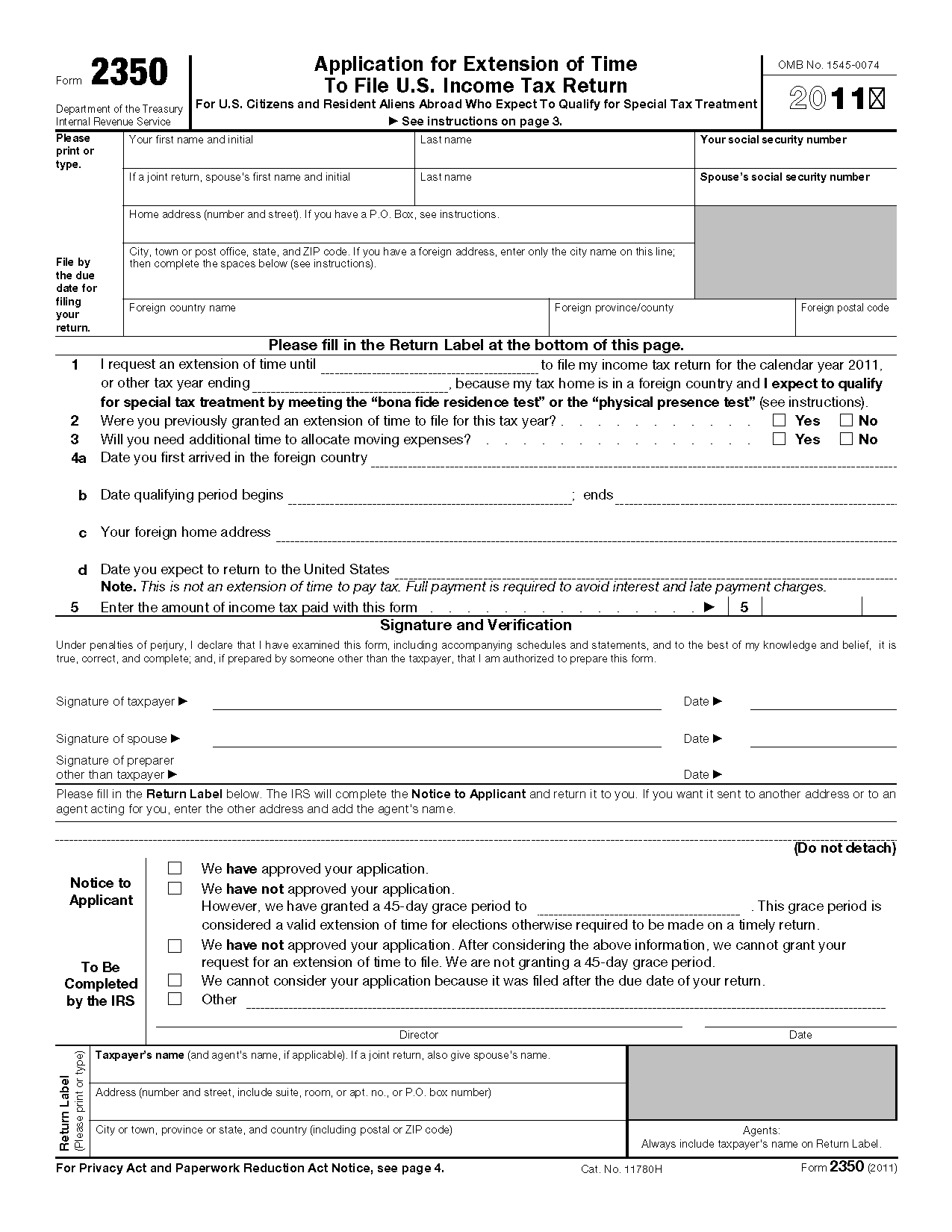

Out Of Country Extension

If you are required to file a North Carolina individual income tax return and you are out of the country on the original due date of the return, you are granted an automatic four-month extension for filing your North Carolina individual income tax return if you fill in the Out of Country circle on Page 1 of Form D-400. Out of Country means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date until the tax is paid.

If you are unable to file your income tax return within the automatic four-month extension period, an additional two-month extension may be obtained by filling in the circle at the bottom right of Form D-410 or selecting Y at the Out of country on due date prompt on the Departments personalized form creator. To receive the additional two-month extension, Form D-410 must be filed by August 15. Importantly, a taxpayer who is granted an automatic extension to file the corresponding State income tax return if they certify on the State return that the federal extension was granted. Consequently, an Out of Country taxpayer granted an automatic six-month extension to file the State income tax return will not be required to file Form D-410 to receive the additional two-month extension.

Cant Recharacterize An Ira Contribution

You were able to change the nature of your IRA by the October extended deadline before the enactment of the Tax Cuts and Jobs Act as long as your IRA was funded by the April deadline. You could essentially turn your traditional IRA contribution into a Roth IRA, or vice versa, or even use this provision to recharacterize a Roth conversion back to a traditional IRA.

Unfortunately, conversions made after this date cannot be recharacterized under the TCJA as of January 1, 2018.

Don’t Miss: How Do You Claim Doordash On Taxes

Preserve Your Tax Refund

Some people end up filing several years late, and there’s a three-year deadline for receiving a refund check from the IRS if it turns out that you’re due one. This three-year statute of limitations begins on the original filing deadline for that year .

The refund statute of limitations is also extended by six months when you file for an extension, which can preserve the ability of taxpayers to receive their federal tax refunds, even if they’re behind with submitting their tax returns.

What If The Irs Owes Me A Refund

If it turns out the IRS owes you money, you’ll have to wait until after the IRS processes your tax return for the refund. So if you hold off until October 17 to file, you won’t get the refund until about three weeks after that date based on the IRS’ assessment that most taxpayers receive their refund within 21 days of filing.

This year’s average refund is more than $3,200, according to the latest IRS data.

If you believe the IRS owes you money, you don’t have to send in a check by April 18 to the IRS, of course. However, you should be confident that you are correct in your assessment, otherwise you’ll face penalties for failing to pay your debt to the IRS.

Recommended Reading: Reverse Tax Id Lookup

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify forGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Victims In Fema Disaster Areas: Mail Your Request For An Extension Of Time To File

Find out where to mail your form.

Need more time to prepare your federal tax return? This page provides information on how to apply for an extension of time to file. Please be aware that:

- An extension of time to file your return does not grant you any extension of time to pay your taxes.

- You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

- You must file your extension request no later than the regular due date of your return.

You May Like: Doordash How Much To Save For Taxes

What A Tax Extension Is And Isnt

First, its important to realize that a tax extension gives you more time to file your tax return, not more time to pay any balance you owe. Your 2021 tax payment is still due on the normal April tax deadline.

A tax extension gives you six months from the usual standard deadline of April 15 to file your tax return. So, the extended tax deadline is October 15 unless a weekend gets in the way, which it does in 2022. To make a long story short, if you file an extension this year, you have until Monday, Oct. 17 to file your 2021 tax return.

Before we move on to the how, one final point to keep in mind is that while youre technically requesting an extension, its an automatic process. If you file an extension by the April 18 tax deadline, youll receive the additional time.

Recommended Reading: Doordash Quarterly Taxes

Corporate Income Tax Return

You can apply for an extension for between 1 April and 1 June. You can do so in various ways . You apply for an extension until 1 November. The Tax and Customs Administration will send you a written response within 3 weeks of your application. Do you want an extension of more than 5 months? Then you must explain why you need such a long extension in your application.

You May Like: Efstatus Taxact Online

Do I Have To File An Extension With My State

That depends. Once you’ve requested an extension from the feds, check if you’ll need to do so for your state. According to the IRS, “State filing and payment deadlines vary and are not always the same as the Federal filing and payment deadline.”

Some states will automatically give you an extension on your state taxes if you receive a federal extension. In other states, you’ll need to request an extension separately. The Federation of Tax Administrators offers a rundown of how to check for tax information for the state you live in.

If you live in one of the nine states without personal income tax, you’re likely in the clear. However, two of those states New Hampshire and Tennessee still tax investment income, so, if you have earnings from dividends, stock sales or other investments, you may still have to file a state tax return in those states.

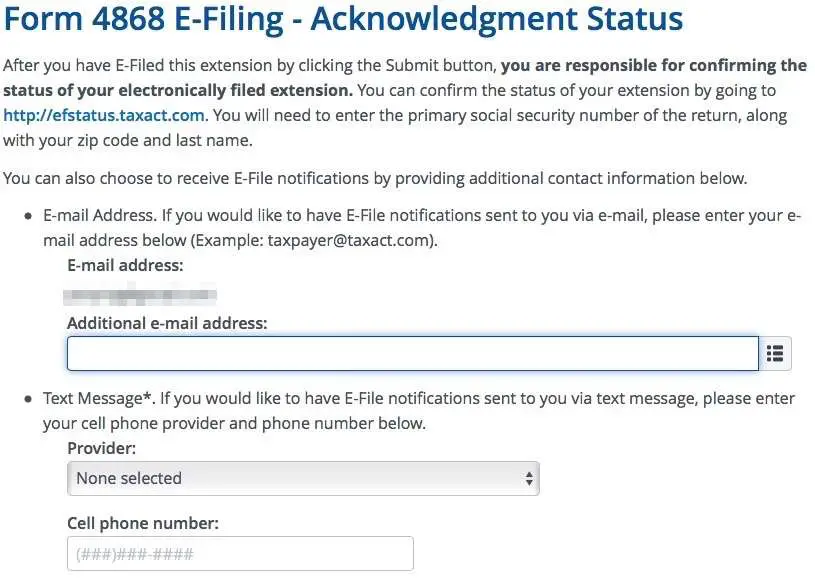

File A Tax Extension Request Online

IRS e-file is the IRSs electronic filing program, which allows you to send tax forms, including Form 4868, directly to IRS computers. You can get an automatic extension to file your tax return by filing Form 4868 electronically through IRS e-file on your own, using free or commercial tax software, or with the help of a tax professional who uses e-file.

In any case, you will receive an email acknowledgment you can keep with your tax records.

If your adjusted gross income is below a specified figure$72,000 for 2020you can use brand-name software at no cost from Free Filea free service that provides taxpayers with federal tax preparation and e-file options.

If your income is above the threshold, you can use the IRSs own Fillable Forms tool. There are also some tax-software companies that offer free filing under certain conditions.

You May Like: Irs Gov Cp63

Is There Such A Thing As A Free Tax Extension

Yes, there is. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS’ free fillable forms, assuming they are comfortable handling their taxes. If that’s not the case, there are several tax-software companies that offer free filing under certain conditions.

Business Tax Extensions: A Chart

| Business Type |

| 7004 or online |

The exact due date for a specific year may change if it falls on a weekend or holiday. Check this article on business tax return due dates for the exact dates for the current year.

Here are details on extension applications for specific business types:

- Sole proprietorship and single-member LLC tax returns, filed on Schedule C and included with the owner’s personal tax return, are due on April 15 for the previous tax year. If you want an extension, you must file the extension application for a Schedule C and personal return by the tax return due date of April 15.

For the 2020 tax year, the deadline for sole proprietors and single-member LLC tax returns filed on Schedule C with the owner’s personal tax return was extended to May 17, 2021. In Texas, Oklahoma, and Louisiana, the deadline was extended to June 15, 2021, in regions declared winter-storm disaster areas by FEMA.

Also Check: How Do You File Doordash On Your Taxes

Pay Any Estimated Taxes By The Original Due Date Of The Return

An extension of time to file your state income tax return does not also mean an extension to pay any taxes you may owe. If you end up owing owe tax at the end of the year, you may be subject to late-payment penalties if you fail to submit a payment by the original tax deadline. To avoid paying any penalties, its a good idea to calculate a quick estimate of what you might owe and submit a payment. Even if you overpay, you can always claim a refund in a few months when you eventually file your state tax return.

To get help estimating your taxes, use TurboTax Online.

Where Should I Be Extra Careful

Take extra time to review both the recovery rebate credit and the child tax credit to avoid potential mistakes that could lead to long delays of your refund.

The IRS has sent out more than 250 million letters to help taxpayers match their IRS records for both the third stimulus payment issued last year and the monthly payments issued for the advance child tax credit, according to testimony made by IRS Commissioner Charles Rettig before the Senate Finance Committee on April 7.

Letter 6475 refers to the stimulus money paid out last year from March through December. Some people saw the money all at once others saw some “plus up” payments.

Letter 6419 refers to up to six monthly payments received in 2021 as an advance payment for the child tax credit. Those payments were made from July through December, often around the 15th of the month.

Rettig noted that taxpayers also are able to verify these amounts by accessing their individual online account through IRS.gov.

You also want to review your bank statements and financial records to double check the payments received.

Last year, major headaches were set off when more than 10 million federal income tax returns for 2020 reported numbers that didn’t match IRS records for two Economic Impact Payments received in 2020. Each of these returns, the IRS said, then “required a manual review and resolution by an IRS employee.”

Don’t Miss: Door Dash Tax Form

What If I Expect A Refund Do I Still Need To Apply For An Extension

Yes. If you have overpaid your North Carolina income tax and you expect to receive a refund from the State, but you are unable to file your individual income tax return by the original due date of the return, you should file an application of extension. You will not receive the refund until you file your income tax return.

What To Watch Out For When Filing A Tax Extension

Tax extensions are pretty cut and dry, but there are a few potential drawbacks to watch out for:

- Special rules for taxpayers who are out of the country. If youre in the military or work outside of the US, you may automatically get two extra months to file your return and pay your tax bill. Members of the Armed Forces who are in a combat zone get an extension equal to 180 days past their last day in a combat zone.

- It doesnt extend your payment date. A tax extension doesnt give you more time to pay your tax bill it only gives you more time to file. If you owe money and dont pay it by the tax deadline, youll incur late penalties. But the IRS may cut you a break if youve paid at least 90% of your tax liability before the deadline.

- It doesnt apply to state tax extensions. Filing out Form 4868 gives you an extension on your federal tax return only. State extensions vary depending on where you live. Some states such as Alabama, California and Wisconsin give automatic six-month extensions, but others require you to fill out a separate form.

Don’t Miss: Will A Roth Ira Reduce My Taxes