What You Should Know About Sales And Use Tax Exemption Certificates

Some of the most frequently asked questions from clients concerns securing exemption certificates from qualifying customers. Each business owner should be concerned about exemption certificates and understand when and why they should obtain them so they can minimize sales tax exposure should the business be audited.

What Is A Tax Exemption Certificate

Tax exemption certificates play a crucial role in your tax compliance as an online business. Imagine: A new customer approaches you and claims that they donât have to pay you US sales tax. Are they lying to you? Trying to scam you out of paying taxes youâll have to cover?

New retailers arenât always aware of tax exemption certificates, but as your business grows, itâs something youâre likely to encounter. Depending on the type of business you run, you may even want to file for one yourself so that you can purchase goods intended for resale without paying taxes.

Not sure what your tax exemption certificate obligations are? Read on for our advice:

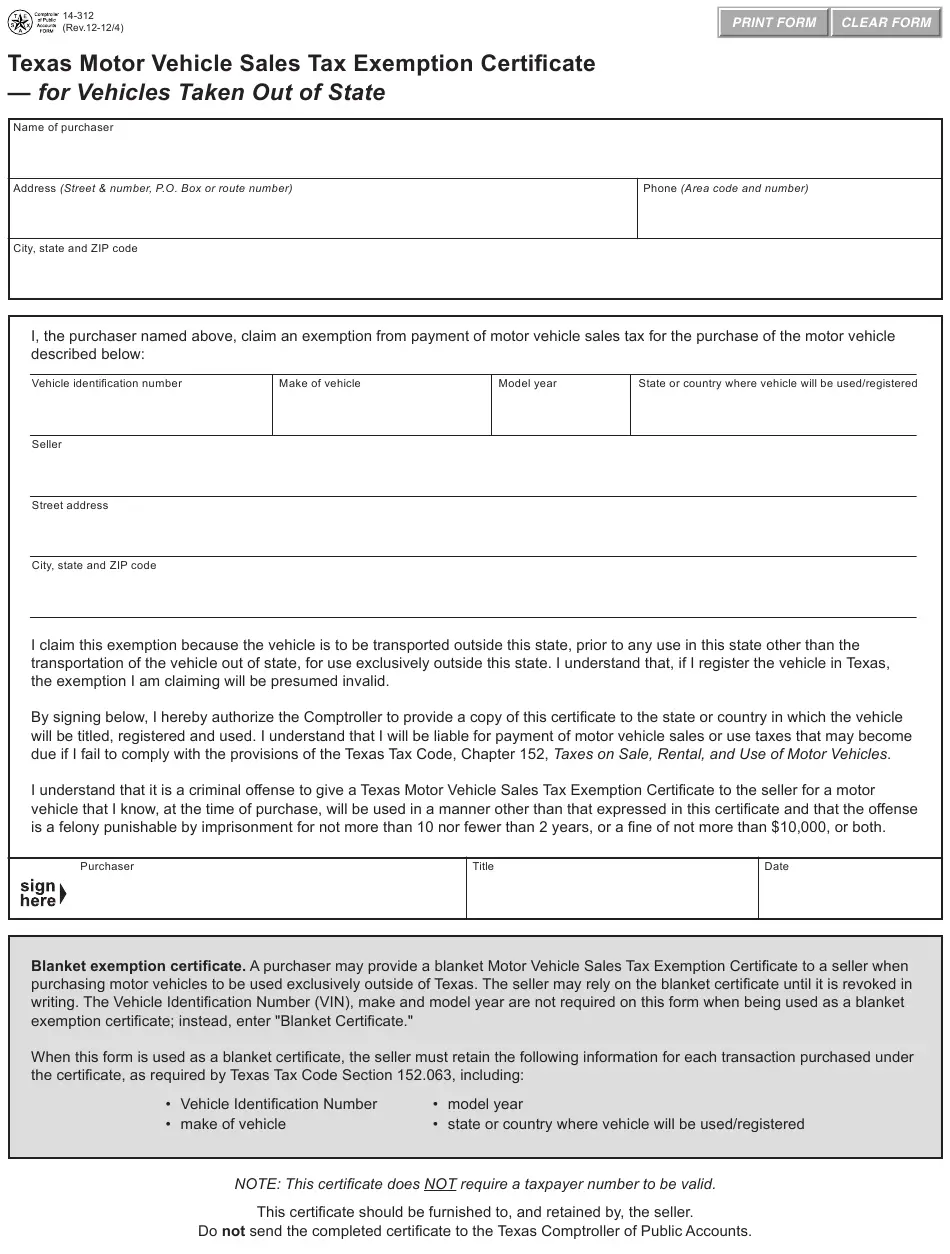

Sales Tax Exemptions In Texas

In Texas, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.

An example of an item which is exempt from Texas sales tax are items which were specifically purchased for resale.

Many states have special, lowered sales tax rates for certain types of staple goods – such as groceries, clothing and medicines. Restaurant meals may also have a special sales tax rate. Here are the special category rates for Texas:

Clothing

OTC Drugs

EXEMPT

These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items. Groceries are generally defined as “unprepared food”, while pre-prepared food may be subject to the restaurant food tax rate.

Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a “grocery”:

is NOT considered a groceryis NOT considered a grocery

Recommended Reading: How Much Should I Set Aside For Taxes Doordash

Online Purchases And Telephone Orders

During the holiday you can buy qualifying emergency preparation supplies in-store, online, by telephone, mail, custom order, or any other means. The sale of the item must take place during the specific period. The purchase date is easy to determine when the purchase is made in-store but becomes more complicated with remote purchases. The purchaser must have given the consideration for the item during the period even if the item may not be delivered until after the period is over.

For example, if a purchaser enters their credit card information in an online shopping website on Monday April 25, 2022 at 5:00 p.m.to purchase a qualifying generator, but the generator will not be shipped until Friday April 29, 2022 and will not arrive until Tuesday May 3, the purchase will still qualify for the exemption. However, if the charge to credit card is declined by the payment processor at 11:00 p.m. on Monday April 25, 2022 and the purchaser does not resubmit payment until Tuesday April 26, the purchase is taxable.

Managing Sales Tax Exemptions

Although managing sales tax exemption certificates may seem like a simple process, anything associated with sales tax proves otherwise. Often times, companies do not spend the proper amount of time documenting and storing certificates. The importance of these tasks is only realized when a company is audited and missing or invalid certificates come to light. While each state has its own complicated set of rules on filling out and accepting exemption certificates, most companies do not realize there are numerous low-cost ways to reduce their risk.

Also Check: License To Do Taxes

As A Seller How Do I Know Which Exemption Certificate Applies To A Transaction

As noted above, there are no quick and easy rules regarding exemption certificates. Different certificates apply for different exemptions, and there may be unique certificates for specialized property or services. One must research the various tax department web sites or consult with their SALT advisor to determine which form applies. For example, the New York State Department of Taxation and Finances website posts a very helpful Tax Bulletin, ST-240 Exemption Certificates for Sales Tax, which explains who may use exemption certificates, how to use them properly and which certificate should be used based upon general sales tax exemptions in the Tax Law. The bulletin can be found at: .

Direct Payment Permits Shift Liability For Tax From Seller To Purchaser

Many states authorize purchasers to apply for a direct payment permit. Purchasers holding such permits do not pay any sales tax to their sellers. Rather, the permit holders assume the full responsibility for determining which of their purchases are taxable and which are exempt, and remit any tax that may be due directly to the state. Upon receiving a valid direct payment certificate, a seller is relieved of all responsibility for collecting tax from the permit holder.

Also Check: Pastyeartax Reviews

Nebraska Sales Tax Exemptions

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue until amended. A guidance document does not include internal procedural documents that only affect the internal operations of DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

This guidance document may change with updated information or added examples. DOR recommends you do not print this document. Instead, at revenue.nebraska.gov to get updates on your topics of interest.

This list of exemptions and descriptions should only be used for general information. Please refer to the regulation or statute referenced in the right-hand column for more detailed definitions, explanations, and limitations.

Business Across State Lines

Exemption For Forestry And Wood Products Machinery Equipment And Repair Parts

In 2017, purchases of specific types of machinery used in timber cutting, timber removal, and the processing of timber or other solid wood products, as well as repair parts, became exempt from the Vermont Sales and Use Tax. In 2019, purchases of specific accessories used on these machines also became exempt. Some purchases require a completed exemption certificate. Learn more about the exemption for forestry and wood products machinery, repair parts, and accessories, and print an exemption certificate.

Recommended Reading: Protest Property Taxes In Harris County

Do States Differ In Their Treatment Of Sales Made To Exempt Organizations And Governmental Agencies

Yes, states differ in their treatment of sales made to exempt organizations status for income tax purposes) and governmental agencies. A general rule of thumb is that purchases by the Federal government are exempt in every state, but documentation requirements vary. Some states tax state and local government purchases including MN, SC, WA, CA, AZ and HI. States that do exempt state and local governmental agencies generally require the purchases must be for the exclusive use of the exempt entity and the exempt entity must be the payer of record.

Most clients think all sales made to not-for-profit 501 organizations are automatically exempt. This could be a costly presumption. In order for a not-for-profit to be exempt the organization must apply for, and be granted, exempt sales and use tax status in the state in which they conduct business. Dont be fooled by the organizations exempt sounding name, ensure you obtain a properly completed exemption certificate if tax is not charged or you may be subject to penalties for not collecting sales tax.

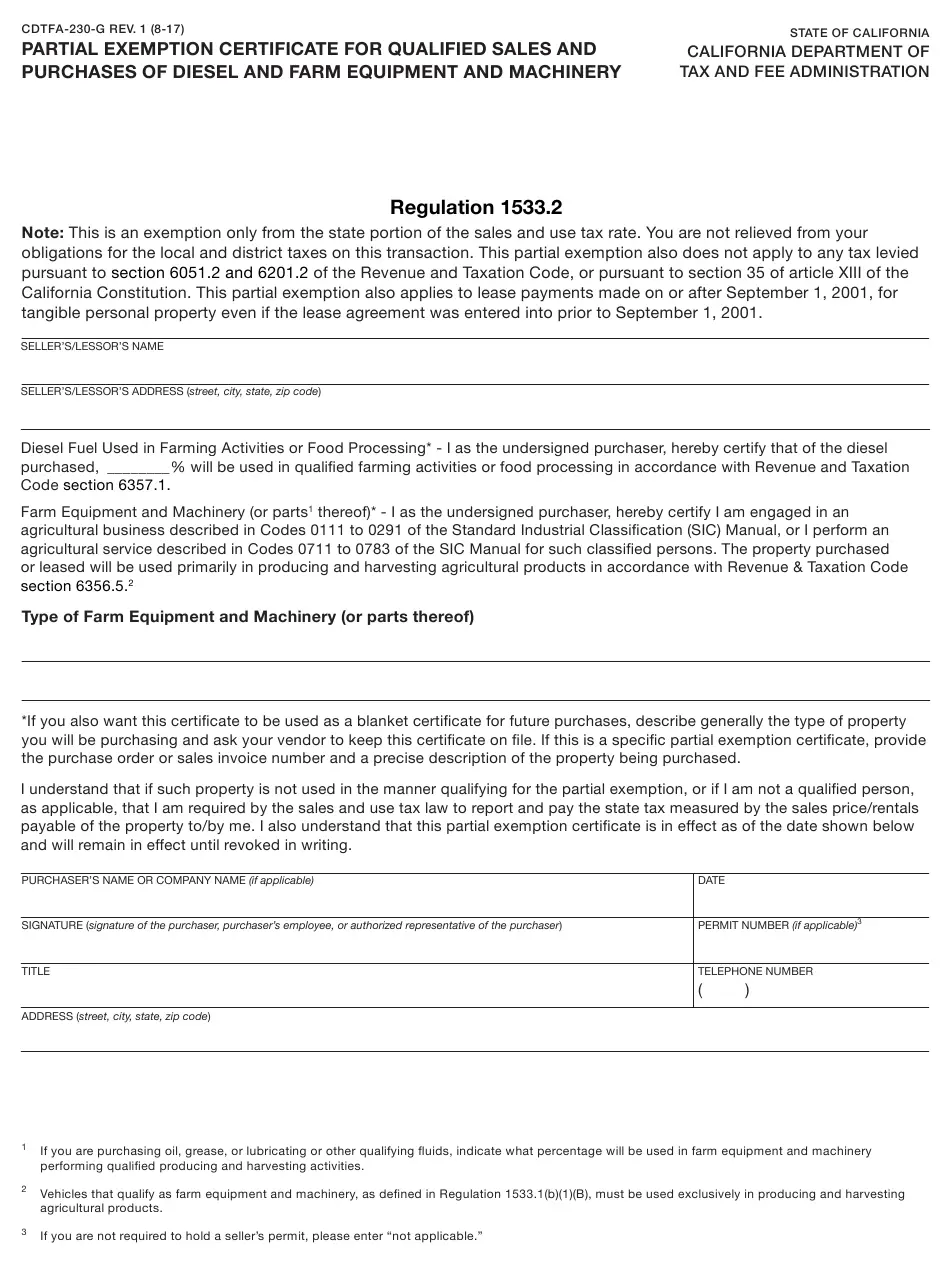

Exemption For Agricultural Machinery And Equipment

Agricultural machinery and equipment is exempt from sales and use tax if it is used predominately in the production of agricultural or horticultural commodities for sale. Predominately means 75 percent of the time it is in use. Learn more about the exemption for agricultural machinery and equipment.

Don’t Miss: Amend Tax Return Online For Free

Why Are Exemption Certificates Required

Sales tax exemption certificates are required whenever a seller makes a sale of taxable goods or services, and does not collect sales tax in a jurisdiction, in which they are required to. The certificate is issued by a purchaser to make tax-free purchases that would normally be subject to sales tax. Most state sales tax exemption certificates do not expire and the seller is required to maintain exemption certificates for as long as sales continue to be made to the purchaser and sales tax is not collected. Exemption certificates are not required for items that are not taxable by statute.

What Items Qualify For Emergency Supplies Sales Tax Holiday Weekend

Governor Greg Abbott and the Texas Division of Emergency Management are encouraging Texans to take part in this years Emergency Supplies Sales Tax Holiday Weekend, which runs April 23rd through the 25th, 2022. A product of Senate Bill 904 that was signed into law by Governor Abbott in 2015, this annual holiday weekend allows Texans to purchase certain emergency preparation supplies tax free either online or in person.

Hurricane season is approaching, so I encourage Texans across the state to prepare today for a safer tomorrow, said Governor Abbott. Texas Emergency Supplies Sales Tax Holiday ensures that Texans can purchase necessary emergency preparedness supplies to protect themselves and their loved ones during potential disasters in the future.

Read Also: Protesting Property Taxes In Harris County

Sales Tax Exemptions: Are You Asking These Important Questions

There are two sides to every story, and sales tax exemptions are no exception. It may appear that the person who holds the most responsibility for handling sales tax exemptions correctly is the person who is making the tax-exempt purchase. But as with all things sales tax, it is rarely that simple. Sellers who accept exemption certificates have responsibilities too. And on either side whether youre the purchaser or seller not handling exempt transactions and exemption certificates correctly could lead to costly issues come audit time.

Were going to reveal some of the questions you need to ask yourself if you handle exemption transactions, both for purchasers and sellers. Asking yourself these questions could be the first step towards making sure you or your business is compliant for sales tax exemptions.

Questions for Sellers who Handle Exempt Transactions

Ok, so youre a seller. Exemptions are easy, right? If a purchaser wants to make a tax-exempt purchase, your sales representative or cashier gets the purchasers exemption certificate, and if everything looks good, the sales rep or cashier keys in the sale as tax exempt. Well, its not that simple.

If youre a seller making exempt sales, these are some of the questions you need to ask:

These questions are good starting points to get you thinking about changes you may need to make in your company protocol for handling exemption certificates.

Questions for Purchasers Making Exempt Purchases

Key Actions For Filing & Paying Sales/use Tax

The following categories of sales or types of transactions are generally exempted from the sales/use tax:

Food & clothing

Sales of food for human consumption and clothing costing $175 or less. For items that cost more than $175, sales tax is only due on the amount over $175 per item.

Periodicals

Sales of periodicals such as newspapers and magazines. Newsletters, however, are generally not treated as newspapers and may be taxable.

Admission tickets

Sales of tickets to activities such as sporting and amusement events.

Utilities and heating fuel

Sales of utilities and heating fuel to:

- Residential users – Residential use includes use in any dwelling where people customarily reside on a long-term basis, whether or not they purchase the fuel, including: Residential users don’t have to present exemption certificates.

- Apartment buildings

- Nursing homes

- Single family or multifamily homes

Telephone services to residential users

- Haircuts

- Car repairs

Recommended Reading: Doordash Taxes For Drivers

Alternative Minimum Tax And Exemptions

The alternative minimum tax is an alternative method for determining tax liability. AMT adds back specific tax-exempt items into the personal tax calculation. Interest from private activity bonds exempt from regular tax, for example, is added to the AMT tax calculation. Individual taxpayers must include the AMT calculation with their original tax return and pay tax on the higher tax liability.

Additional Charges Affect The Sales Price

Delivery, shipping, handling and transportation charges are part of the sales price. If the emergency preparation supply being purchased is taxable, the delivery charge is also taxable. Consider these charges when determining whether an emergency preparation supply can be purchased tax free during the holiday.

For example, you purchase a rescue ladder for $299 with a $10 delivery charge, for a total sales price of $309. Because the total sales price of the ladder is more than $300, tax is due on the $309 sales price.

You May Like: How Does Doordash Do Taxes

Retail Sales Tax Refunds

You can get a refund of RST that has been:

- incorrectly charged on insurance premiums or benefit plans

- paid in error when transferring a vehicle at a ServiceOntario centre.

Complete and send a refund application form to the Ministry of Finance within four years from the date the RST was paid. With your completed application, include all supporting documents and proof that RST was paid.

- Retail Sales Tax Act, and

- Tobacco Tax Act.

The Clearance Certificate indicates that all taxes, penalties and interest collectable or payable by you, the seller, have been paid or that satisfactory arrangements have been made for such payment or for securing such payment.

A purchaser that fails to obtain a copy of the Clearance Certificate from the seller could be liable for any taxes, penalties and interest owing by the seller at the time of the sale.

The requirements apply to sellers who held or who were required to hold a permit under the Retail Sales Tax Act on or before June 30, 2010, as well as to sellers who, at any time after June 30, 2010, hold or are required to hold a permit under the Retail Sales Tax Act.

All requests for Clearance Certificates must be made in writing, at least two weeks before the sale takes place, and signed by the seller or the seller’s authorized representative.

The request should be sent by fax to 905 436-4474 or by mail to:

Ministry of Finance33 King Street West PO Box 627Oshawa ON L1H 8H5

Retailers Buying Products To Resell

In the US, sales tax is considered a consumption tax. Its paid by an end user who then uses the product. This is also why sales tax is sometimes called sales and use tax.

So, when a retailer buys items to sell at resale from a manufacturer or distributor, that retailer is not the end user of the item. In that case, the retailer is not required to pay sales tax when purchasing inventory to resell, because they are not the end user, i.e. the person who consumes the product.

Also keep in mind that manufacturers, distributors, wholesalers and other vendors reserve the right to refuse service if they are unsure about your tax exempt status. More on that in the How to Claim a Sales Tax Exemption section below.

Recommended Reading: How Does Doordash Do Taxes

What Can One Do To Avoid Or Minimize Exposure On Audits When Obtaining Exemption Certificates

The following best practices can help minimize or eliminate exposure on audit of your businesss non-taxable sales:

Whether you sell taxable products or services and dont collect sales tax, or you purchase items without paying sales tax, you must know the sales and use tax consequences of your activities in each state you do business in. Be sure to obtain exemption in states where nexus has been established, then focus on the type of exemption being claimed to insure the correct exemption certificate is obtained.

Seek the advice of a Marcum SALT professional so that you can avoid, or at the very least, minimize unnecessary tax exposure on audit of your non-taxable sales or purchases due to issues with exemption certificates.

Confirm Your Sales Tax Exempt Status In Each State

Double check with your state whether or not you truly can buy items tax free. Remember, only some states allow charitable nonprofits or government entities to purchase items without paying sales tax.

Also keep in mind that sales tax is governed at the state level, and each state makes their own rules and laws. If your business or organization does business in more than one state, you will likely have to deal with wildly different sales tax rules and regulations.

For example, nine states do not allow retailers with out-of-state resale certificates to purchase items tax free. Your business can use exemption certificates in those states, but only if you also register with that states taxing authority as an in-state business first. And depending on your business type, this may or may not be worth the hassle.

Or, if you are a government entity near the Georgia/South Carolina border, you may find that when you buy items on the Georgia side of the border your items are tax free, but when you buy items on the South Carolina side of the border, your items are taxable.

We always recommend speaking with a vetted sales tax expert should you have any questions on your sales tax exempt status.

Also Check: Does Doordash Send 1099

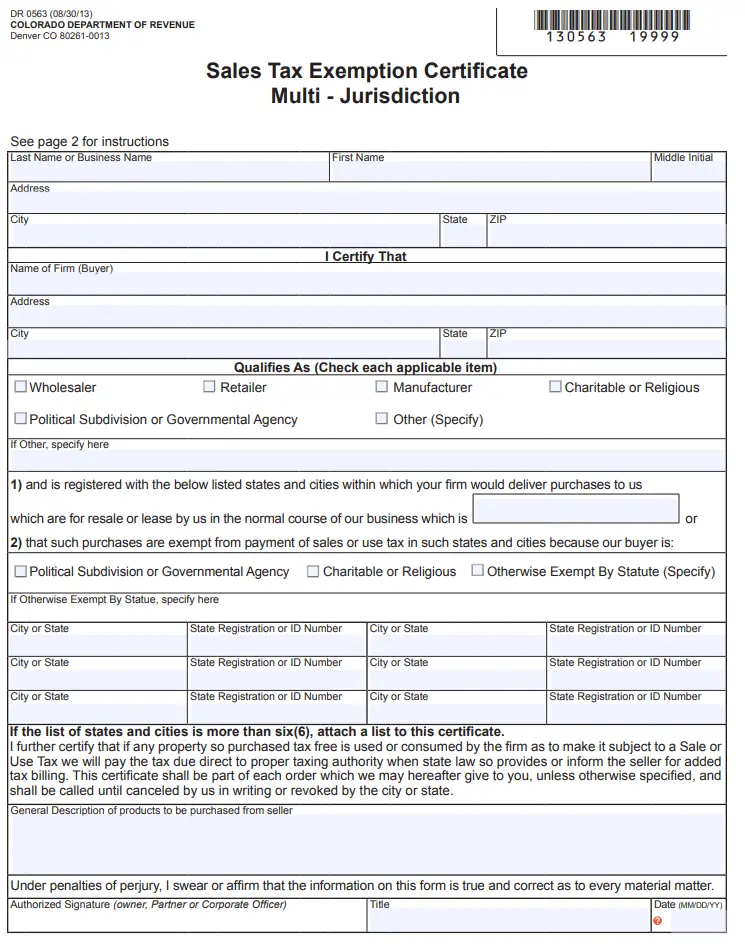

Is There A Global Exemption Certificate That Can Be Used In Multiple States

No, unfortunately there are no global rules regarding exemption certificates. Each state has its own set of exemption certificates as well as rules and regulations covering their use.However, some general rules do apply. For example, most states have broad categories of exemptions resale, government, manufacturing, exempt organizations, telecommunications, agricultural, etc. Since not every state has every exemption in place, local rules and local compliance requirements must be considered.