Summary Of Calculating Tax Owed

Gross Income> Adjusted Gross Income> Taxable Income> Tax Bill

The above is a quick representation of the route that you need to follow when calculating the tax owed. Once you get to the tax owed, factor in the amount of tax paid during the tax year and see if you qualify for a refund chances are you do qualify for a tax refund for paying more than what you owed to Uncle Sam.

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize the failure-to-file penalties by filing as soon as possible, paying as much as you can when you file and setting up an installment plan for the balance.

How Much Does It Cost To Pay Arizona Income Tax With A Credit Card

2.35% convenience fee, minimum of $1.50, to make a tax payment with a credit card. $3.50 convenience fee to make a tax payment with a debit card. Note: To determine if you have a Visa Corporate debit card or a Visa Consumer branded debit card, please contact your financial institution that issued the card.

You May Like: Buying Tax Liens In California

Did Arizona Conform To The Federal Law

Yes. On April 14, 2021, Governor Ducey signed Senate Bill 1752, which conformed to the definition of federal adjusted gross income , including federal changes made during 2020 as well as through the 2021 American Rescue Plan. The bill does not add any new non-conformity additions or subtractions. However, additions and subtractions created for prior non-conformity adjustments for issues such as bonus depreciation are still in place.

2020 conformity includes the federal 2020 Cares Act, the federal Consolidated Appropriations Act of 2021, and the federal American Rescue Plan of 2021.

Filing An Extension On The Extension

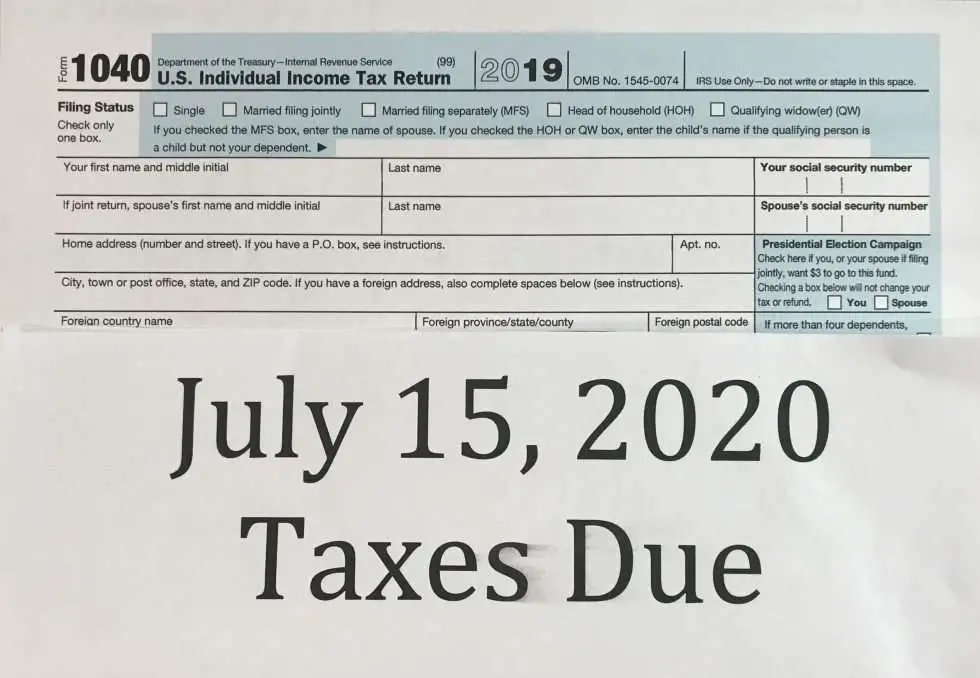

The July 15 deadline applied to individuals, pass-through businesses such as S corporations, sole proprietorships, partnerships, and C corporations. Self-employed taxpayers who normally would have made April 15 or June 15 quarterly estimated tax payments in 2020 also had the additional time to pay. Anyone who needed to file an extension beyondJuly 15 was required to file IRS Form 4868, or Form 7004 for businesses, by July 15. That would automatically give them until Oct. 15 to file a return.

Under normal circumstances, anyone requesting an extension would still need to make a payment by the normal filing deadline if they anticipated owing taxes, to avoid fees and interest. July 15 was the adjusted deadline, so you had until July 15 to file for the extension and to make payments of any estimated tax due for 2019. The same applied in 2021 with the adjusted May 17 date.

Recommended Reading: Have My Taxes Been Accepted

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Irs Provides Details On April 15 Postponement

On Monday, the IRS issued guidance with details on its postponement of the April 15 tax deadline for individuals . The IRS had announced in a news release on March 17 that it was delaying the April 15 deadline for individuals until May 17, 2021. Mondays notice clarifies and adds details about the postponement. Like the news release before it, the notice does not extend the April 15 due date for estimated tax payments.

Under the notice, the postponement applies to any individual who files a federal individual income tax return on Form 1040, 1040-SR, 1040-NR, 1040-PR, 1040-SS, or 1040 or has a federal tax payment reported on one of these forms that would otherwise be due April 15, 2021. The IRS says the postponement also applies to the filing of all schedules, returns, and other forms that are filed as attachments to forms in the Form 1040 series or are required to be filed by the due date of the Form 1040 series. The IRS lists as examples Schedules H and SE, as well as Forms 965-A, 3520, 5329, 5471, 8621, 8858, 8865, 8915-E, and 8938. Also, elections that are made or required to be made on a timely filed form in the Form 1040 series will be considered timely if filed on such form or attachment, as appropriate, on or before May 17, 2021.

The notice also extends the postponement to claims for credit or refund of federal income tax that absent the notice would expire on or after April 15, 2021, and before May 17, 2021 .

Read Also: Is Plasma Donation Money Taxable

What Is The Due Date For Calendar Corporate Income Tax Returns For Businesses That Received An Extension

The filing extension provides an extension to file the 2020 Arizona corporate returns. The extension due date for calendar year corporate Arizona returns is due October 15, 2021.

The federal calendar year corporate returns are due October 15, 2021.

Corporate income tax payments can also be made on AZTaxes.gov, but registration is required.

When Are 2020 Estimated Tax Payments Due

What a strange and difficult year it’s been! Our routines have been wrecked by the coronavirus pandemic. That includes the regular process of making estimated tax payments for people who are self-employed or don’t have taxes withheld from other sources of taxable income .

Estimated taxes are typically paid in four equal installmentsone installment for each quarter of the year. The first quarter estimated tax payment for 2020 was originally due April 15, 2020, and the second quarter payment was originally due June 15, 2020. However, for this year, payments for the first and second quarter weren’t due until July 15, 2020. As a result, the 2020 estimated tax payment schedule is adjusted as shown in the table below.

Recommended Reading: How Do I Get My Pin For My Taxes

I Am Having Issues Downloading The Income Tax Forms Online What Is The Issue

The most compatible browsers for this form are Internet Explorer or Mozilla Firefox. If you are using Google Chrome or Safari and see a blank/warning/error message, please view the form within your computer’s Download folder instead of online. For more forms technical help, see .

C Corporation Tax Returns Due

Today is the deadline to file C corporation tax returns . C corporations in Texas, Oklahoma, and Louisiana have until June 15 to submit their tax returns.

April 15 is also the deadline to file for an extension to file your corporate tax return.

Forms:

Further reading:What is Form 7004 and How to Fill it Out

Read Also: Prontotaxclass

Still Living Paycheck To Paycheck

Some top economists have called for more direct aid to Americans. More than 150 economists, including former Obama administration economist Jason Furman, signed a letter last year that argued for “recurring direct stimulus payments, lasting until the economy recovers.”

Although the economy is improving, millions of people continue to suffer from reduced income and have not been able to tap government aid programs, Nasif said. Only 4 in 10 jobless workers actually received unemployment aid, according to a from economist Eliza Forsythe.

Many people never applied for unemployment benefits because they didn’t think they were eligible, while others may have given up due to long waits and other issues.

“You’ll see reports about how the economy is starting to grow, but there are a lot of Americans living paycheck to paycheck, and for a lot of them the government relief programs haven’t been able to help,” said Greg Nasif, political director of Humanity Forward.

When Are Quarterly Taxes Due

People who work for companies have estimated taxes withheld from their paychecks, but independent contractors, business owners, and those who live on investment income are required to proactively pay estimated taxes on a quarterly basis.

Payments are typically made incrementally, on the following quarterly tax dates:

| Due Dates for Estimated Taxes |

|---|

| Payment Period |

If a due date falls on a weekend or legal holiday, then payments must be issued on the next business day.

For 2021 taxes, this is only the case for the fourth payment, as Jan. 15, 2022, falls on a Saturday. Since Jan. 17, 2022, is Martin Luther King Day, the fourth payment deadline gets booted to Jan. 18, 2022.

Also Check: Where Is My State Refund Ga

Income Tax Payment Relief

For an affected taxpayer, the due date for making federal income tax payments usually due April 15, 2020 is postponed to July 15, 2020.

Any person with a federal income tax payment due April 15, 2020, is affected by the COVID-19 emergency for purposes of the relief described in section III of the Notice .

Observation. Treasury Secretary Mnuchins March 17 announcement indicated that the extension was for 90 days. That would have brought the extension to July 14, 2020. The Notice thus provides a 91-day extension.

For an Affected Taxpayer, the due date for making federal income tax payments due April 15, 2020, in an aggregate amount up to the Applicable Postponed Payment Amount, is postponed to July 15, 2020. The Applicable Postponed Payment Amount is up to $10,000,000 for each consolidated group or for each C corporation that does not join in filing a consolidated return.

For all other Affected Taxpayers, the Applicable Postponed Payment Amount is up to $1,000,000 regardless of filing status. For example, the Applicable Postponed Payment Amount is the same for a single individual and for married individuals filing a joint return. In both instances the Applicable Postponed Payment Amount is up to $1,000,000.

The due date is postponed only for federal income tax payments for 2019 normally due on April 15, 2020 and federal estimated income tax payments due on April 15, 2020 for the 2020 tax year.

Observation. The Notice does not provide any filing date extensions.

How To File Your Federal Income Taxes

Many individuals work with a tax professional or use tax preparation software to file their income taxes. Another option is the Free File Program offered by the IRS. If your adjusted gross income is $72,000 or less, Free File offers tax preparation services through a partner site at no cost. If your AGI is above $72,000, you can use IRS Free File to prepare your own taxes online for free.

If youre expecting a refund, then youll want to file electronically if possible. Individuals who do so typically receive their refund within three weeks of when the IRS received it. You can also choose to mail a paper return to the IRS, but it may take six to eight weeks to process.

However, the COVID-19 pandemic has caused considerable delays in processing paper returns.

Recommended Reading: How Can I Make Payments For My Taxes

Related Small Business Insights

Our small business tax professional certification is awarded by Block Advisors, a part of H& R Block, based upon successful completion of proprietary training. Our Block Advisors small business services are available at participating Block Advisors and H& R Block offices nationwide.

1. Includes up to 3 appointments during the year purchased. See Terms and Conditions for details.

2. See Terms and Conditions for details. H& R Block does not provide legal representation. Business tax audit support does not include reimbursement of any taxes, penalties, or interest imposed by tax authorities.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are called brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2020 tax year, which are the taxes due in early 2021.

Read Also: How Much Is Payroll Tax In Louisiana

Calculating Your Estimated Tax Payments

Use Form 1040-ES to calculate your estimated tax payments. Start by figuring your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year there’s a worksheet to help you out in the instructions for Form 1040-ES. You can also look at your previous year’s tax return for a general guide. What you ultimately want is an estimate of the income you expect to earn for the year.

If your estimate is too high, just complete another Form 1040-ES worksheet to recalculate your estimated tax for the next payment. Likewise, if your estimate is too low, go to the Form 1040-ES worksheet again to readjust your next estimated tax payment. You should also recalculate if your own personal situation changes or if there are tax law changes that can affect your tax liability for the year.

Contribute To Or Open An Ira By Tax Day

Contributions to a traditional IRA can be tax-deductible. You have until the May 17, 2021, tax deadline to contribute to an IRA, either Roth or traditional, for the 2020 tax year. The maximum contribution amount for either type of IRA is $6,000 or $7,000 if you’re age 50 or older. See all the rules here.

» MORE: Learn how IRAs work and where to get one

You May Like: How Much Does H& r Block Charge For Doing Taxes

Wildfire And Hurricane Relief

The IRS announced tax deadline extensions on October 19, 2020, for individuals and businesses impacted by the California wildfires and by Hurricane Delta. Those affected by the California wildfires and who had a valid extension to file their 2019 tax returns by October 15 had until January 15, 2021, to file their returns and make tax payments.

Those affected by Hurricane Delta who had valid extensions to file by October 15, 2020 were given until February 16, 2021, to file their tax returns and make payments. This relief applies to areas that FEMA has designated as needing assistance.

Further extensions have been provided for victims of Hurricane Ida. The first gives all residents of Louisiana and those who own businesses there until January 3, 2022, to file any returns or make any estimated tax payments that would have been due on or after August 26, 2021. This extension also applies to tax-exempt organizations.

The IRS then announced on September 8, 2021 that it would extend a similar courtesy to victims of Hurricane Ida in New Jersey and New York. They also have until January 3, 2020, to file and make certain tax payments that were due after September 2, 2021. This extension doesn’t apply to all residents but only to those who live in areas designated by the Federal Emergency Management Agency . It includes businesses and tax-exempt organizations in six counties in New York:

- Bronx

- Passaic

- Somerset

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2021 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2021, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2021 federal tax return, or

- 100% of the tax shown on your 2020 federal tax return .

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2021. Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

Recommended Reading: Protesting Property Taxes In Harris County

What Is The Deadline For Tax Year 2020 Individual Income Tax Returns

The State of Arizona has announced it has moved the deadline for filing and paying state individual income taxes from April 15 to May 17, 2021.This follows the Treasury Secretary announcement that the Internal Revenue Service has moved the deadline for 2020 federal individual income tax returns to May 17, 2021.

The extended deadline only includes individual returns. The extended deadline also includes Form 140PTC and Form 140ET.

Do I Have To Enter My Driver’s License Or State

In an ongoing effort to protect taxpayers from identity theft, the IRS, state tax agencies and the tax industry are asking for drivers license numbers or state-issued identification numbers. Providing this information helps verify identity and can prevent unnecessary delays in tax return processing.

Also Check: How To Buy Tax Lien Properties In California