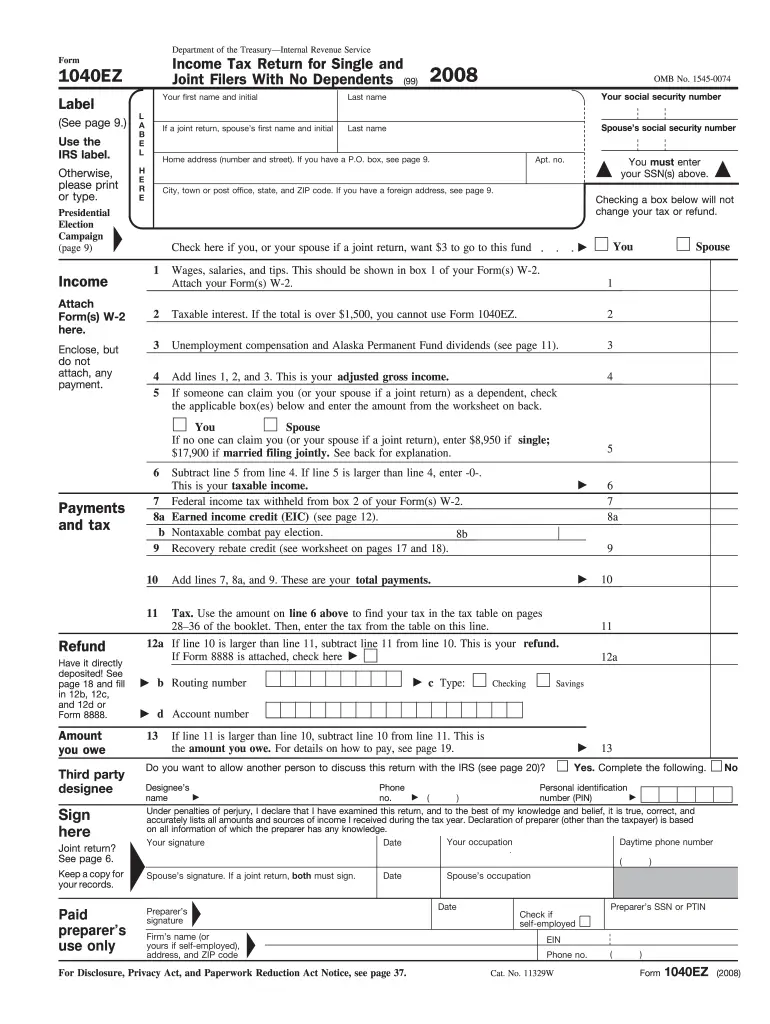

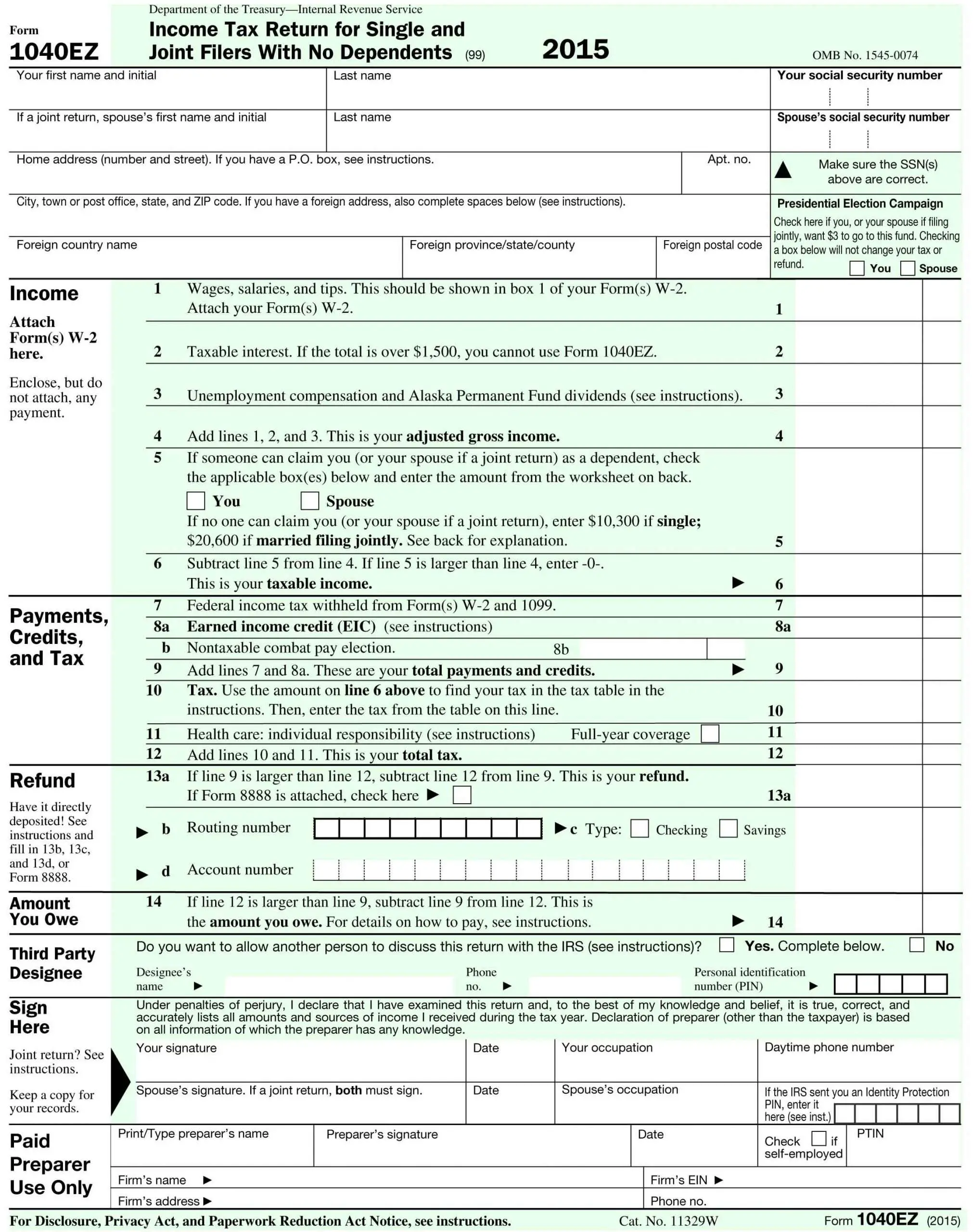

Ez Form And Instructions

US Individual Income Tax Return

Form 1040EZ is the simplest form available to federal income tax payers. The abbreviation EZ is widely used to mean Easy

.Form 1040EZ has been discontinued by the IRS beginning with the 2018 income tax year. If you filed Form 1040EZ in prior years, then you will use the redesigned IRS Form 1040 or Form 1040-SR for the 2021 tax year. Prior year 1040EZ tax forms and instructions may still be printed using the links below on this page.

File Form 1040EZ if you meet these requirements:

- Filing status is single or married filing jointly.

- No dependents to claim.

- You and your spouse were under age 65 and not blind.

- Taxable interest income of $1,500 or less.

- Taxable income is less than $100,000.

- Earnings are from wages, salaries, tips, taxable scholarships or grants, unemployment compensation, Alaska Permanent Fund.

- No deductions for educator expenses, student loan interest, tuition and fees, or itemized deductions.

- No credits for education, retirement savings, or health coverage.

- No advance earned income credit received.

- You CAN claim the earned income credit using this form.

If you do not meet the above requirements, go to Form 1040A next.

Get Your Federal Tax Refund Fast

Not only have we tried to make it as painless as possible to prepare and file your return, filing electronically will also get your tax refund much faster. After all, it’s your money. Why wait any longer than necessary to get it back.

At E-file.com, we work to get your federal tax refund as fast as possible thanks to the electronic filing program with the IRS. Filing electronically with the IRS and selecting to have your refund direct deposited to your bank allows you to get your refund as fast as possible.

Franchise Tax Board Privacy Notice On Collection

The privacy and security of your personal information is of the utmost importance to us. We want you to have the highest confidence in the integrity, efficiency, and fairness of our state tax system.

Your Rights and Responsibilities

You have a right to know what types of information we gather, how we use it, and to whom we may provide it. Information collected is subject to the California Information Practices Act, Civil Code Sections 1798-1798.78, except as provided in R& TC Section 19570.

If you meet certain requirements, you must file a valid tax return and related documents. You must provide your social security number or other identifying number on your tax return and related documents for identification.

Reasons for Information Requests

We may request additional information to verify and collect the correct amount of tax. You must provide all requested information, unless indicated as âoptional.â

Consequences of Noncompliance

We charge penalties and interest, if you:

- Meet income requirements but do not file a valid tax return.

- Do not provide the information we request.

- Provide false information.

We may also disallow your claimed exemptions, exclusions, credits, deductions, or adjustments. If you provide false information, you may be subject to civil penalties and criminal prosecution. Noncompliance can increase your tax liability or delay or reduce any tax refund.

Disclosure of Information

Responsibility for the Records

- Phone

You May Like: Tax Preparer License Requirements

Eligibility Requirements For All Exempt Organizations

All nonprofits must meet the following requirements to obtain 501 status, regardless of which application they use:

- Exempt purpose. The organization must operate exclusively for a recognized “exempt purpose,” which includes charitable, religious, educational, scientific, or literary purposes.

- No private inurement. The organization must use the nonprofit’s money and assets for a public purpose, and not for the private gain of individuals.

- No political campaigning. The nonprofit can’t engage in political campaigning

- No substantial work on influencing legislation. The organization can’t devote a substantial part of its activities to influencing legislation.

In your 1023 application, you must verify that your organization meets the above criteria.

Who Could File Form 1040ez: Income Tax Return For Single And Joint Filers With No Dependents

To use the form, a taxpayer had to have taxable income of less than $100,000, less than $1,500 of interest income, and claim no dependents. Other requirements for filing the Form 1040EZ included:

- The taxpayer and their spouse, if married filing jointly, had to be under age 65 at the end of the relevant filing period.

- They could not be blind as of the end of the relevant filing period.

- The filer could take no deductions for student loan interest, educator expenses, tuition and fees, or itemized deductions.

- If the filer received interest income, they could not have been required to file Schedule B, didnt have amounts in boxes 11, 12, or 13 of Form 1099-INT or boxes 6 and 10 of Form 1099-OID, and didnt earn any interest as a nominee.

- Tax credits for retirement savings, health coverage, and education were not allowed.

- The tax filer could not have received any advance earned income credit , although they would have been allowed to claim the EIC when filing Form 1040EZ.

- The filer could not be a debtor in any Chapter 11 bankruptcy case that was filed after October 16, 2005.

- The filer, their spouse, if married filing jointly, or any of their dependents for which they claimed the personal exemption didnt receive any advance payments of the premium tax credit offered for health coverage plans sold on the Marketplace.

- The filer doesnt owe any household employee taxes on wages paid to household employees.

You May Like: Is Freetaxusa A Legitimate Company

Who Can File A 1040ez

A taxpayer must meet all of the following to qualify to file Form 1040EZ:

- The taxpayers filing status must be single or married, filing jointly.

- The taxpayer cannot claim any dependents.

- The taxpayer cannot claim any adjustments to income

- The taxpayer can only claim theearned income tax credit . No other credits can be claimed with the Form 1040EZ.

- The taxpayer must be under age 65 and not blind at the end of the tax year.

- The taxpayers taxable income must be less than $100,000.

- The taxpayers income consisted of only wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends.

The taxpayers taxable interest must not be over $1,500.

To claim a single status on the Tax Form 1040EZ, the taxpayer must be:

- Not married.

- According to state law, they were legally separated under a decree of divorce or separate maintenance.

- Widowed before the first day of the tax year and not married during the tax year.

To claim a married filing jointly status on Tax Form 1040EZ, the taxpayers:

- Must be considered legally married as of the last day of the applicable tax year

- Or be considered legally married as of the last day of the tax year, and the taxpayers spouse died before the return was filed.

If you qualify for the Form 1040EZ, it may still be more beneficial to file the Form 1040 to make income adjustments or credits that you may be eligible for.

What Irs Tax Form Should I Use And What Are The Requirements For Using Form 1040a Form

Your return can be a little more complex with Form 1040A.

For example, you can have capital gain distributions or distributions from an IRA and still use Form 1040A.

You can claim certain tax credits using Form 1040A, including the credit for child and dependent care expenses, credit for the elderly or the disabled, education credits, retirement savings contribution credit, child tax credit, earned income credit, and additional child tax credit.

You cannot itemize your deductions using Form 1040A.

In addition, some less common tax items prevent you from filing Form 1040A.

You May Like: H& r Block Early Access W2

S To Determine Filing Requirements

Step 1: Is your gross income more than the amount shown in the California Gross Income chart below for your filing status, age, and number of dependents? If yes, you have a filing requirement. If no, go to Step 2.

| On 12/31/21, my filing status was: | and on 12/31/21, my age was: | 0 dependent |

|---|---|---|

| Dependent of another person Any filing status | Any age | More than your standard deduction, see Frequently Asked Questions, question 1. |

Step 2: Is your adjusted gross income more than the amount shown in the California Adjusted Gross Income chart below for your filing status, age, and number of dependents? If yes, you have a filing requirement. If no, you do not have a filing requirement. If you do not have a filing requirement, you must file a tax return to claim your withholding. You may be eligible for the federal Earned Income Credit see Whatâs New and Other Important Information for more information.

California Adjusted Gross Income| On 12/31/21, my filing status was: | and on 12/31/21, my age was: | 0 dependent |

|---|

Texas Franchise Tax Report Forms For 2021

If you are unable to file using Webfile, use our downloadable .PDF reports, designed to work with the free Adobe Reader. While other browsers and viewers may open these files, they may not function as intended unless you .

The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically.

For the 2021 report year, a passive entity as defined in Texas Tax Code Section 171.0003 an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,180,000 an entity that has zero Texas gross receipts an entity that is a Real Estate Investment Trust meeting the qualifications specified in Texas Tax Code Section 171.0002 or an entity that is a pre-qualified new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report.

- 05-166, Affiliate Schedule – ANNUAL or FINAL

- 05-175, Tiered Partnership Report – ANNUAL or FINAL

- 05-177, Common Owner Information Report – ANNUAL or FINAL

For the 2021 report year, an entity, including a combined group, can file using the EZ Computation if it has annualized total revenue of $20 million or less.

- 05-166, Affiliate Schedule – ANNUAL or FINAL

- 05-175, Tiered Partnership Report – ANNUAL or FINAL

- 05-177, Common Owner Information Report – ANNUAL or FINAL

Read Also: Do I Have To Claim Plasma Donation On Taxes

Qualifying To Use Form 540 2ez

Check the table below to make sure you qualify to use Form 540 2EZ.| General |

|---|

|

Note: You cannot use Form 540 2EZ if you can be claimed as a dependent and any of the following are true:

- You have a dependent of your own.

- You are single and your total income is less than or equal to $15,953.

- You are married/RDP filing jointly or a qualifying widow and your total income is less than or equal to $31,856.

- You are head of household and your total income is less than or equal to $22,556.

- You are required to use a modified standard deduction for dependents. See Frequently Asked Questions, question 1, Do I have to file?

If you do not qualify, go to ftb.ca.gov for information about CalFile and e-file or download and print Form 540 at ftb.ca.gov/forms.

If you are a nonresident or part-year resident, get Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. See âAutomated Phone Serviceâ, or go to ftb.ca.gov/forms.

New Form 1040 Instructions

Here are the new 1040 form instructions as of 2019 from the IRS:

You will use the redesigned Form 1040, which now has three new numbered schedules in addition to the existing schedules such as Schedule A. Many people will only need to use Form 1040 and none of the new numbered schedules. However, if your return is more complicated , you will need to complete one or more of the new numbered schedules. Below is a general guide to which schedule you will need to use based on your circumstances. See the 1040 instructions for the schedules for more information. If you e-file your return, you generally wont notice much of a change and the software will generally determine which schedules you need.

Read Also: Www.1040paytax.com Official Site

How Do Irs Forms 1040

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If you need to file an individual federal tax return, youll now use IRS Form 1040 or the new 1040-SR for seniors. The previous other alternativesForms 1040EZ and 1040A ended starting in the 2018 tax year.

You can only use Forms 1040-A and 1040-EZ for tax years through 2017. Starting with the 2018 tax year, these forms are no longer used. Only form 1040 and 1040-SR remain in use.

How The Ez Could Cost You

Even if you can file 1040EZ, it might not be the best move.

Take the case of 2016 tax filer Joe P. Taxpayer. Joe finished college last year and got his first full-time job making $40,000. Hes single, renting and has no investment income. A perfect 1040EZ filer, right? Sure, if youre Uncle Sam, because Joe will overpay his taxes by using the short form.

Why? The Form 1040EZ doesnt offer Joe some valuable tax breaks found on the other two returns.

Joe has a student loan. By filing Form 1040A, he can subtract from his income the $2,500 interest he paid on that debt. He cant do that with the shortest form. Joe also started planning for his retirement by putting the maximum $5,500 into a traditional individual retirement account. Because his new employer doesnt offer a company retirement plan, Joes deductible IRA contribution can reduce his taxable income further, but only if he files the longer form.

Joe also would get the chance to reduce his actual bill if he files the longer 1040A. If Joe took a course to improve his job skills and was not reimbursed by his employer for the cost, he could claim the Lifetime Learning tax credit its also available on the long Form 1040. The better tax news for Joe is that a credit allows you a dollar-for-dollar reduction of what you owe the IRS. But the only tax credit shown on the 1040EZ is the earned income tax credit, available only to low-income taxpayers.

Recommended Reading: Efstatus.taxact 2013

Health Care And 1040ez Form Limits

Once you purchase a health insurance plan from the Affordable Care Acts federal marketplace, you cannot file a 1040EZ form. This is because options are given when purchasing a health insurance plan to receive an advance payment of a premium tax credit. The credit is designed to assist in affording some of the cost of the insurance plan. When you file your taxes, you have to claim the advance payment.

Now, if the advance was not enough, taxpayers could receive an extra amount. Taxpayers that were overpaid are held responsible for the overage. When taxpayers are left with a balance to pay, it can be deducted from the next advance payment. The taxpayer can also pay it.

To determine whether you were advanced funds appropriately or not, complete IRS Form 8962. This form must be filed with a 1040 or 1040A return.

Used This Form If You Plan To Claim Certain Tax Credits But Not Itemize Your Deductions

IRS Form 1040-A sat in between Form 1040-EZ and the standard Form 1040 in terms of complexity and the amount of time it takes to complete. It offered more room for tax breaks than Form 1040-EZincluding childcare, education, and retirement savings . Still, it was limited in terms of allowable deductions and credits compared to the standard 1040. If you couldn’t use Form 1040-EZfor example, because you had dependents to claimyou would have been able to use 1040A if:

- You are filing as single, married filing jointly or separately, qualifying widow or widower, or head of household

- Your taxable income is less than $100,000

- Your income is only from wages, salaries, tips, taxable scholarships, and fellowship grants, interest, ordinary dividends, capital gains distributions, pensions, annuities, IRAs, unemployment compensation, taxable Social Security or railroad retirement benefits and Alaska Permanent Fund dividends

- You dont itemize deductions

- You didnt have an alternative minimum tax adjustment on stock you acquired by exercising a stock option

- Your only adjustments to income are deductions for an IRA, student loan interest, educator expenses, and tuition and fees

- The only credits you claim are for child and dependent care expenses, EIC, the elderly or the disabled, education, child tax credit, premium tax credit or the retirement savings contribution credit

Don’t Miss: Efilemytaxes

Assembling Your Tax Return

Assemble your tax return and mail it to the FTB.

To help with our processing costs, enclose, but do not staple, your payment. Attach your federal Form W-2 to the lower front of your tax return. Include California supporting forms and schedules behind Side 4 of Form 540 2EZ.

Do not enclose a copy of your federal tax return or any other document with your Form 540 2EZ.