How Much Is Capital Gains Tax On Real Estate

Based on your income bracket and filing status, the capital gains tax rate on real estate is either 0%, 15%, or 20%. The majority of Americans fall into the lowest couple of income brackets, which are assessed 0% in capital gains tax. However, note that these tax rates only apply if youve owned your property for more than one year.

Some States Have Tax Preferences For Capital Gains

The federal government taxes income generated by wealth, such as capital gains, at lower rates than wages and salaries from work. The highest-income taxpayers pay 40.8 percent on income from work but only 23.8 percent on capital gains and stock dividends.

While most states tax income from investments and income from work at the same rate, nine states Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin tax all long-term capital gains less than ordinary income. These tax breaks take different forms. Typically, these states allow taxpayers to exclude some or all of their capital gains income from their taxable income, but others levy a lower rate than the state tax on ordinary income or provide a credit equal to a percentage of the taxpayers capital gains. In addition, a handful of states provide breaks only for capital gains on investments in in-state businesses, and a few states target preferences to investments in specific industries, like farming in Iowa and Wisconsin.

How Can I Avoid Capital Gains Tax On A Home Sale

If you used the rules before 1997, it does not mean that you are disqualified from claiming the exclusion on any sales now.

You also dont have to worry about using your profit from the sale of your home to purchase another home, either. Another great benefit is there is no limit on the number of times you can claim the home-sale exemption. Usually, you can keep those tax-free profits each time you sell one of your homes.

There are some requirements that have to be met to avoid paying capital gains tax after selling your home.

1. The property has to be your principal residence . If it is an investment property, you will have to follow the usual capital gains rules.2. You have to live in the residence for two of five years before selling it. .

The good news is, if your gain does not exceed the limit, you dont have to file anything with the IRS.

Don’t Miss: When Is The Last Day To Apply For Tax Return

Retirement Information Ira Topics Pension Exclusions Social Security Benefits

Q. Im planning to move to Delaware within the next year. I am retired. I am receiving a pension and also withdrawing income from a 401K. My spouse receives social security. What personal income taxes will I be required to pay as a resident of Delaware? I also would like information on real estate property taxes.

A. As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, persons 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income . Eligible retirement income includes dividends, interest, capital gains, net rental income from real property and qualified retirement plans , such as IRA, 401 , and Keough plans, and government deferred compensation plans . The combined total of pension and eligible retirement income may not exceed $12,500 per person age 60 or over. If you are under age 60 and receiving a pension, the exclusion amount is limited to $2,000.

Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income.

Also, Delaware has a graduated tax rate ranging from 2.2% to 5.55% for income under $60,000, and 6.60% for income of $60,000 or over.

For information regarding property taxes you may contact the Property Tax office for the county you plan to live in.

Home Protection Trust Rules Clarified

In a clarification that is important for elder law attorneys and their clients who are seeking to protect their homes from Medicaid Estate Recovery, the regulations state that a residence held in a grantor trust qualifies for the capital gains exclusion when sold by the trust. Some elder law attorneys use irrevocable grantor trusts to protect their clients homes from nursing home and other long term care costs and related Medicaid Estate Recovery claims.

These trusts are often written as grantor trusts so that a residence transferred to the trust will continue to qualify for favorable income tax treatment, including the Section 121 exclusion.

The federal regulations make it clear that the Settlor of a properly drafted grantor trust remains the owner of a residence for purposes of this tax break, even though the home was irrevocably transferred to the trust to protect it from long term care related costs.

Read Also: Do Unemployment Benefits Get Taxed

How To Avoid Capital Gains Tax As A Real Estate Investor

If the home youre selling is not your primary residence but rather an investment property youve flipped or rented out, avoiding capital gains tax is a bit more complicated. But its still possible. The best way to avoid a capital gains tax if youre an investor is by swapping like-kind properties with a 1031 exchange. This allows you to sell your property and buy another one without recognizing any potential gain in the tax year of sale.

In essence, youre swapping one investment asset for another, says Re/Max Advantage Plus White. He cautions, however, that there are very strict rules regarding timelines and guidelines with this transaction, so be sure to check them with an accountant.

If youre opting out of the rental property investment business and putting your money in another venture that does not qualify for the 1031 exchange, then youll owe the capital gains tax on the profit.

State Capital Gains Tax Rates

| Rank | |

|---|---|

| 0.00% | 0.00% |

Real estate, retirement savings accounts, livestock, and timber are exempt for capital gain taxation in the state of Washington.

- Values shown do not include depreciation recapture taxes.

- AK, FL, NV, NH, SD, TN, TX, WA, and WY have no state capital gains tax.

- AL, AR, DE, HI, IN, IA, KY, MD, MO, MT, NJ, NM, NY, ND, OR, OH, PA, SC, and WI either allow taxpayer to deduct their federal taxes from state taxable income, have local income taxes, or have special tax treatment of capital gains income.

- This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

- Realized does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Need to figure out your Capital Gains Tax liability on a sale of an asset? The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Also Check: How Do I Know If I Have To Pay Taxes

How Do I Avoid Capital Gains Tax In Pa

To exclude the gain on the sale of your home from tax you must have owned and used the property as your principal residence for two of the five years immediately before the sale. The ownership and use need not be concurrent. You can generally claim the Section 121 tax exclusion only once every two years.

How much is capital gains in Pennsylvania?

State Capital Gains Tax Rates

| Rank |

|---|

| 3.07% |

States With Capital Gains Preferences Should Eliminate Them

States that tax capital gains income at a lower rate than wage, salary, and other ordinary income should eliminate this special treatment. Taxing capital gains at the same rate as ordinary income would mitigate the increase in wealth concentration and could raise significant revenues.

Eliminating capital gains preferences in the eight states that had them in 2011 would raise some $500 million per year, the Institute on Taxation and Economic Policy estimates. Rhode Islands elimination of its capital gains preference in 2010 brings in over $50 million in additional revenue per year. Vermont and Wisconsin scaled back their preferences to raise revenue in the wake of the Great Recession. New Mexico reduced, from 50 percent to 40 percent, the share of capital gains that are exempt from taxation in 2019.

Only one state without an income tax currently taxes capital gains at all. Washington State recently enacted a tax on extraordinary profits from the sale of financial assets of over $250,000 per year, which will take effect in 2022. The remaining non-income-tax states could levy a tax on just this type of income.

Don’t Miss: Are You Required To File Taxes

How Much Tax You Pay When Selling A Rental Property In 2022

Selling a rental property can create a much larger tax liability than when you sell your primary residence. Thats because the IRS views your rental property as a business investment and will try to recapture some of the benefits you received during the time you owned your income property.

Fortunately, there are several ways to minimize and even avoid paying tax when you sell a rental property.

How To Reduce Your Capital Gains Tax Bill

There are several ways to legally reduce your capital gains tax bill, and much of the strategy has to do with timing.

Strategies to Reduce Your Capital Gains Tax Liability

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once youve been matched, consult for free with no obligation.

Don’t Miss: Where Is My Arkansas State Tax Refund

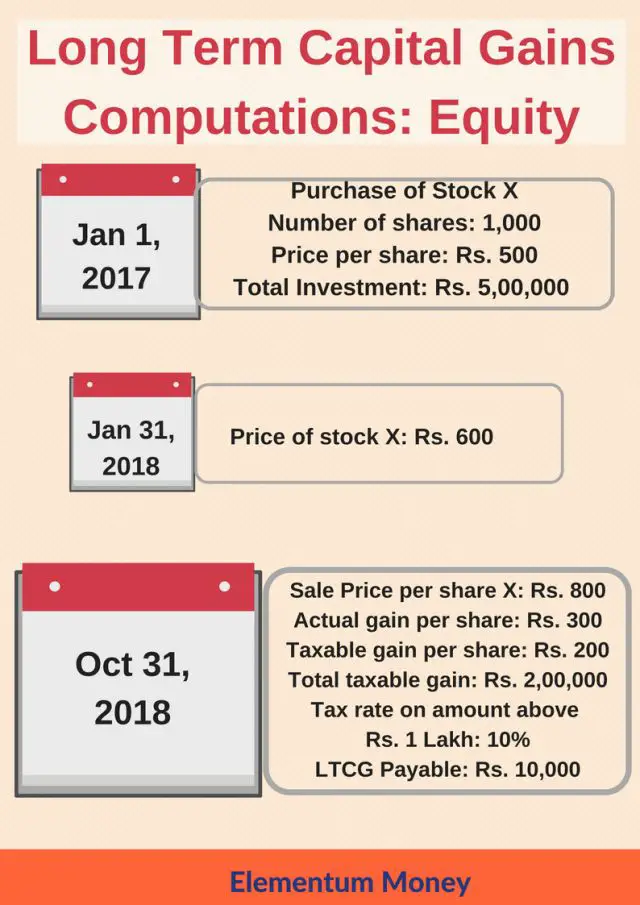

How Are Capital Gains Taxed

While the value of an asset can increase in each year that it is owned, the capital gain is taxed only when the asset is sold. For example, consider a taxpayer who bought 100 shares of stock for $10 each and sold them for $15 each . The increase in value of $500 is the amount of capital gains income realized by the taxpayer. If the sale occurs within a year of the purchase, these are considered short-term capital gains for tax purposes if more than a year after purchase, they are considered long-term gains. Under current state and federal law, these capital gains are reported and taxed as income in the year that they are realized.

The amount of capital gains varies by state, depending in large part on the states relative wealth.

Watch Your Holding Periods

Remember that an asset must be sold more than a year to the day after it was purchased in order for the sale to qualify for treatment as a long-term capital gain. If you are selling a security that was bought about a year ago, be sure to check the actual trade date of the purchase before you sell. You might be able to avoid its treatment as a short-term capital gain by waiting for only a few days.

These timing maneuvers matter more with large trades than small ones, of course. The same applies if you are in a higher tax bracket rather than a lower one.

Also Check: Can You Refile Your Taxes

How To Avoid Capital Gains Tax

There are several strategies to reduce your total capital gains tax:

Capital Gains Dividends And Interest Income Tax

This Bulletin is superseded by PS 92-3

The Connecticut General Assembly recently amended the statutes concerning the taxation of capital gain income. These changes are effective for income years beginning on or after January 1, 1987. Because Long-Term Capital Gains are now reported at 100% on the Individual Federal Income Tax Return, a 60% deduction will be allowed for gains on sales or exchanges of capital assets held over 6 months on the CONNECTICUT TAX RETURN. This adjustment will be calculated on the schedule provided.

P.A. 87-84 reduces the penalty for late filing to 10% of the amount of tax due on Capital Gains, Dividends and Interest Income. There is no $50 minimum penalty. This change was effective July 1, 1987 and applies to all returns filed on or after that date.

A resident may be subject to a tax on the gains from the sale or exchange of capital assets irrespective of the amount of the Federal Adjusted Gross Income. The tax rate remains 7%. Taxpayers 65 years of age or older whose Federal Adjusted Gross Income exclusive of Social Security, Tier 1 Railroad Retirement and Capital Gain is less than $10,000 will not be subject to the tax and need not file a return. A taxpayer whose Federal Adjusted Gross Income is below the amount required to file a Federal Form 1040 need not file or pay the Capital Gains, Dividends and Interest Income Tax.

| CONNECTICUT |

| $78,000 | 6% |

Read Also: How To Get Tax Id Number For Llc

Tax Tips For Selling Your House In Pennsylvania

By Jon Keeney

Are you worried about the tax consequences for selling a Pennsylvania house?

When you sell real estate it can often mean that youre going to have proceeds from the sale. As you may have heard though, the government can take a very big percentage of that. Sometimes its such a big amount that the tax liability and implications can determine whether or not you should sell your home.

The first step is to PLAN. Depending on what time of year you sell your home will depend on how much time you have until your taxes are due. Taxes must be paid by April 15th. If you dont make sure that you save enough of the proceeds from the sale, you may be unable to pay the amount of taxes that are owed to the government.

Here were going to try and lay out some tips for selling your house in Pennsylvania which include how to qualify for a Capital Gains Tax Exemption, how to make sure you deduct all applicable selling costs, how to know if youre going to have a tax liability to pay, and who to contact with specific questions. Please note that we suggest always consulting with a Certified Public Account for any tax advice!

What Is Good About Reducing The Capital Gains Tax Rate

Proponents of a low rate on capital gains argue that it is a great incentive to save money and invest it in stocks and bonds. That increased investment fuels growth in the economy. Businesses have the money to expand and innovate, creating more jobs.

They also point out that investors are using after-tax income to buy those assets. The money they use to buy stocks or bonds has already been taxed as ordinary income, and adding a capital gains tax is double taxation.

You May Like: How Is The Earned Income Tax Credit Calculated

Rules For Married Couples

Either spouse can meet the ownership test. For example, its okay if you owned the home for two years but only added your husband when you were married six months ago. Then, you will pass the ownership test with flying colors.

However, when it comes to the use test, both partners have to pass. The good news is if you were unwed and living together for a period that equals two years, the IRS will allow you to pass. Nevertheless, if that isnt the case, you wont get the tax exclusion unless you wait until he meets the two-year mark too.

Keep in mind the two-year eligibility rule when getting to know your spouse. Remember, you are only able to sell a home once every two years. Therefore, if your new spouse sold a home in the past two years, it will prohibit you from being able to sell until their two-year time span expires.

Ways To Boost State Revenues From Capital Gains

The remaining 41 states and the District of Columbia, which currently tax capital gains at the same rate as ordinary income, should resist cutting these taxes and instead raise them to generate revenue they can invest in broadly shared prosperity. They have several options:

Raise the capital gains income tax rate. States could simply levy a higher rate on capital gains income than on income from wages, salaries, and other sources, or raise the rate just on short-term capital gains.

Eliminate stepped-up basis. Under current state and federal law, people who inherit assets such as stocks, bonds, or real estate pay no taxes on any appreciation of those assets that occurred before they inherited them. As a result, a large share of capital gains is never taxed.

For example, consider a taxpayer who bought 100 shares of stock for $10 each and held them until their death, when the value had risen to $50 per share. They left them to their daughter, who sold them a number of years later, after the value had risen to $55 per share. Under current law, the daughters taxable capital gains would reflect the $5-per-share increase that occurred while she owned the stock, not the $45-per-share increase that occurred since their mother bought it.

| TABLE 1 |

|---|

Massachusetts General Laws Chapter 29, Section 5G, .

Institute on Taxation and Economic Policy estimate, November 2018.

Also Check: When Will The Irs Start Accepting 2021 Tax Returns