Can I Get These Tax Credits

You should be able to get the Earned Income Tax Credit if you worked full-time or part-time in 2019, you have a Social Security Number and:

- In 2019, you were between the ages of 25 and 64, you did not have any children living with you, and you earned less than $15,570.

- In 2019, you had one child living with you and you earned less than $41,094

- In 2019, you had two children living with you and you earned less than $46,703.

- In 2019, you had three or more children living with you and you earned less than $50,162.

Those are the amounts for single adults. If you are married and filing jointly the amount is higher. See all the numbers on the IRS website.

What Is The Earned Income Tax Credit

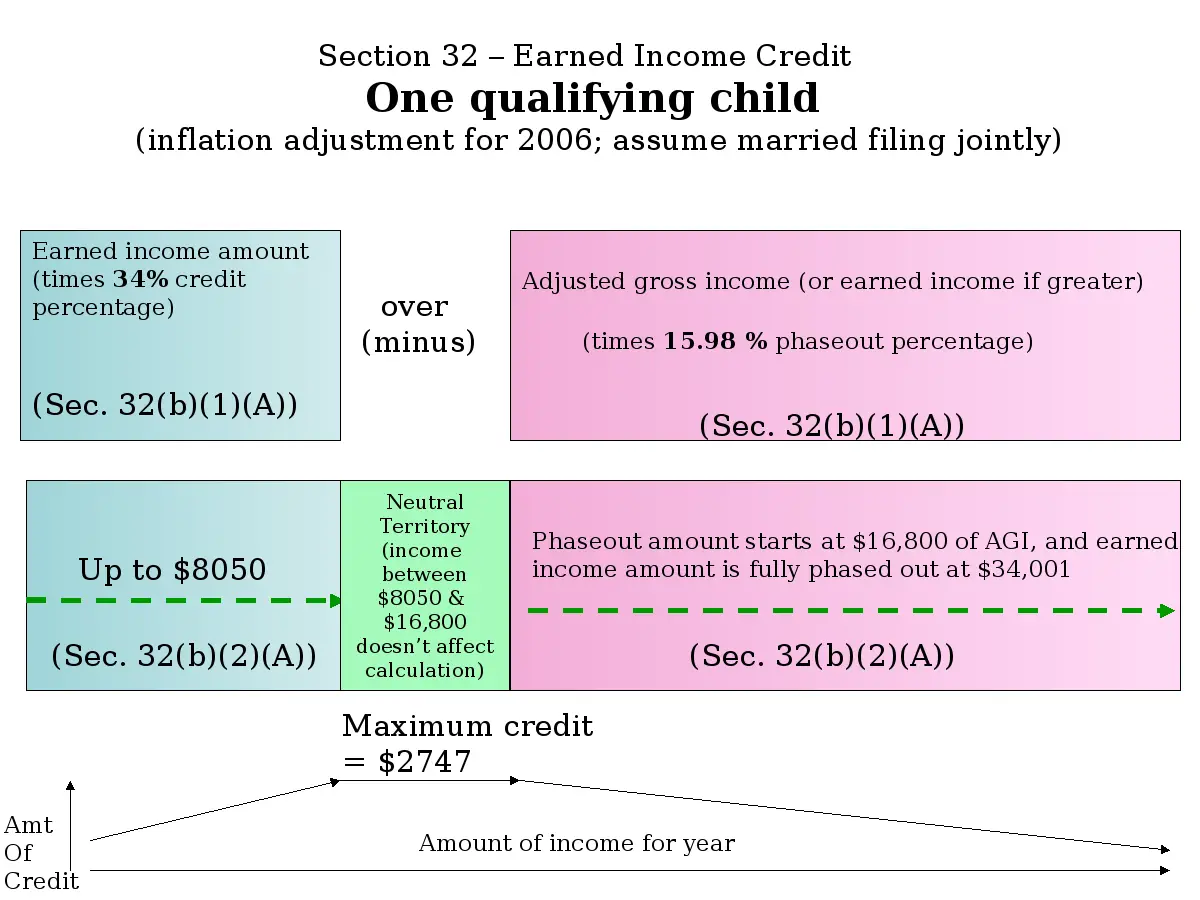

The Earned Income Tax Credit, or the EITC or EIC, is a refundable tax credit for low- and moderate-income workers. In 2021, the earned income credit ranges from $1,502 to $6,728 depending on tax-filing status, income and number of children. People without kids can qualify.

If you fall within the guidelines for the credit, be sure to claim it on your return when you do your taxes And if you didnt claim the earned income credit when you filed your taxes in the last three years but you think you qualified for it, the IRS encourages you to let it know so you can get that money back.

The $1.9 trillion American Rescue Plan Act changed some of the rules around the EITC. These changes are noted below.

Schedule Eic Line By Line

Start by writing your name at the top of the form. Lines 1 through 3 are for the names, Social Security numbers , and dates of birth for each qualifying child. To prevent filing issues, write your childrenâs names as they appear on their Social Security cards.

Line 4 has two parts. Line 4a asks whether your child is under age 24. If they are, you donât need to do anything on Line 4b. If your child is 24 or older, you need to check a box on Line 4b to say whether or not the child has a disability.

Write the childâs relationship to you on Line 5.

Line 6 requires you to write how many months out of the past year the child lived with you.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Read Also: Efstatus.taxact 2014

Kids And The Earned Income Tax Credit

If you claim one or more children as part of your earned income credit, each must pass certain tests to qualify:

-

The child can be your son, daughter, adopted child, stepchild, foster child or grandchild. The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children .

-

The child must be under 19 at the end of the year and younger than you or your spouse if you’re filing jointly, OR the child must be under 24 if he or she was a full-time student. There’s no age limit for kids who are permanently and totally disabled.

-

The child must have lived with you or your spouse in the United States for more than half the year.

How To Fill Out The Lookback On Your Tax Return

When filing your own taxes, how you fill out the lookback on your tax return will depend on the tax software youre using. There will be two main steps. First, identify where the lookback option is, and second, enter your 2019 earned income that you found earlier.

1. Find the lookback option.

There are a couple ways the tax software will prompt the lookback. Most tax software will ask you if you want to use your 2019 income in the tax credits section. Here are examples of how it may appear . For any tax software, look for phrases like use last years earned income, 2019 earned income or coronavirus tax relief on the page.

A less common way you may be asked about the lookback is wishes to elect to use their 2019 earned income to figure their 2020 earned income credit and/or child tax credit. If you see this option on a checklist, check the box. Look for 2019 earned income and 2020 earned income tax credit. The following image is from MyFreeTaxes and TaxSlayer.

2. Enter your 2019 earned income. Once you check the box, youll need to enter your 2019 earned income.

Most tax software will automatically calculate which year will give you a higher refund from the EITC and ACTC .

If you use TurboTax, the software will give you instructions for how to figure out which years income to use.

Recommended Reading: Is Past Year Tax Legit

States Offer Earned Income Credits

If you qualify for a federal credit, you might also be entitled to a state earned income tax credit in 29 states, Puerto Rico, and Washington, DC. State requirements often mirror federal requirements, with some exceptions. There are online tools you can use to learn more about your state.7

Many states calculate their earned income tax credit benefits as a straight percent of the federal credit from 3% in Montana to 125% in South Carolina. In California, whose differences include lower age limits , someone making under $30,000 a year could receive a state credit of up to $1,626 to $3,027, if they have one to three or more children, and $243 if they have none.8 Some local governments, such as New York City, also offer earned income tax credits.9 A New York City resident within the federal income limits, married filing jointly with three or more children, could combine federal, state, and local credits to be eligible for up to almost $9,000.

Qualifying for the federal earned income tax credit might also indicate that you qualify for child tax credits and others. Check out What Is the Child Tax Credit? and What Is the Childcare Tax Credit?. Its worth your time, since the IRS allows you to combine these credits.

Also helpful: Calculators and free tax preparation help10 are available online and in person, from the IRS and some state governments. Some tax software packages also include the earned income tax credit.

Facts About The Earned Income Tax Credit

OVERVIEW

Many qualified taxpayers overlook the Earned Income Tax Credit , potentially missing out on thousands of dollars at tax time. Here are 5 facts every taxpayer should know about the EITC.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

For many Americans, it can be difficult to know which tax credits they qualify for and why. But tax credits are worth having because they provide meaningful savings on a filers overall tax contribution and, in some cases, lead to an increased tax refund.

One of the most beneficial and refundable tax credits for families with low or moderate incomes is the Earned Income Tax Credit .

The Consolidated Appropriations Act was signed into law on December 27, 2020 as a stimulus measure to provide relief to those affected by the pandemic. For tax year 2020, The CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit as well as the Earned Income Tax Credit . For 2021, you can use either your 2019 or 2021 income based on whichever one provides the highest credit amount.

Here are five facts about the EITC all taxpayers should know.

Also Check: How To Get Tax Preparer License

Eligibility Is Limited To Low

The 2021 general eligibility rules for the EITC are:

- Taxpayers must file as individuals or married filing jointly.

- If married, you, your spouse and your qualifying children must have valid Social Security numbers.

- You must also be at least 19 or older with no upper age limit. However, if you are at least a part-time student then you must be at least 24 years old. Qualifying former foster children and homeless youth must be at least 18 years old.

Although the EITC typically is considered a credit for low-income filers, there are many variations of income, filing status and number of qualifying dependents that affect eligibility. For example:

- In 2021, a married couple with three children and adjusted gross income of $57,414 or less could receive up to $6,728.

- An qualifying individual that has no children may receive up to $1,502.

It’s recommended that all filers explore their eligibility for receiving the EITC each year. According to the Internal Revenue Service, the average amount credited in 2018 was $2,488.

There Is Both A California Earned Income Tax Credit And A Federal Earned Income Tax Credit

If you have low income and work, you may qualify for CalEITC and/or the federal EITC. These credits give you a refund or reduce your tax owed.

You may qualify for the CalEITC if:

- Youre at least 18 years old or have a qualifying child

- You have earned income of $30,000 or less

The amount of CalEITC you get depends on your household status, income, and family size.

No Social Security number? No problem! For the first time, taxpayers with an ITIN Individual Taxpayer Identification Number are eligible for the CalEITC and the YCTC when paying their 2020 taxes.

Number of qualifying children

As a parent, you may qualify for other credits, too, such as the federal Child Tax Credit .

Note: ITIN holders only qualify for the CalEITC and the state YCTC, not the federal EITC or CTC.

Good to know: It does not work to add up the maximum CalEITC, YCTC and federal EITC to get the maximum amount you can get between all three credits in total, because the credits phase in and out at different income levels. Use our CalEITC calculator to see if you qualify and estimate the amount of your credit.

Was I eligible last year? Did you know you can amend tax returns up to three years back if you find out you are eligible for tax credits you didnt originally claim? Good news you can still get this refundable credit. Review the chart below to see if you may be eligible and how much you may have qualified for in 2019.

Number of qualifying children

Read Also: Can Home Improvement Be Tax Deductible

Free Tax Preparation Services

The IRS works with national partners, community-based coalitions and thousands of local partners and governments. These partnerships provide free EITC tax return preparation and tax help and tax education.

If you make $57,000 a year or less in 2020, you may qualify for free access to tax return preparation services available at more than 13,000 community volunteer tax assistance sites.

The IRS provides free basic tax return preparation services to qualified individuals through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs:

- People who generally make $57,000 or less

- Persons with disabilities

- Limited English-speaking taxpayers

If you made $72,000 or less in 2020, you can use brand name software products through IRSs Free File and electronically file your return to claim your EITC. Visit www.IRS.gov to access the software.

How Much Is The Earned Income Tax Credit

The amount of the EITC depends on your income and how many children you have. For 2021, the maximum earned income tax credit amount you can get is

-

$543 if you have no qualifying children

-

$3,618 if you have one qualifying child

-

$5,980 if you have two qualifying children

-

$6,728 if you have three or more qualifying children

The amount of the EITC depends on your income and how many children you have. For 2020, the maximum earned income tax credit amount you can get is

-

$538 if you have no qualifying children

-

$3,584 if you have one qualifying child

-

$5,920 if you have two qualifying children

-

$6,660 if you have three or more qualifying children

Recommended Reading: How Can I Make Payments For My Taxes

Claiming The Earned Income Tax Credit

If a worker wants to take advantage of the EITC, they must file taxes and have earned some income to claim the credit. Keep in mind that workers cannot claim the EITC if they file Form 2555 for foreign earned income, or Form 2555-EZ for foreign earned income exclusions. Applicants must U.S. citizens or residents, and have a valid social security number issued on or before their tax return due date.

To estimate the amount of your credit, you can use the worksheets included with the instructions for Forms 1040. If you need assistance, you can use the EITC assistant provided by the IRS.

What Would You Do With Extra Money

The California Earned Income Tax Credit , along with a similar federal credit, can result in hundreds or even thousands of extra dollars.

California residents who made less than $30,000 may be eligible for up to $3,027 depending on income and family size.

The amount of CalEITC you may be eligible for depends on how much money you earn from work. Use our calculator to find out how much money you could get back.

NEW for 2020 tax returns: The CalEITC has been expanded to taxpayers that use an Individual Taxpayer Identification Number .

Children in families receiving the tax credits do better in school, are likelier to attend college, and can be expected to earn more as adults.

Don’t Miss: When Do You Do Tax Returns

Adjusted Gross Income And Qualifying Children

For a child to be considered a qualifying child under EITC, several requirements must be met:

- Relationship: The child must be your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of these .

- Residence: Generally, the child must live in the same place as you for more than half the year and have a valid Social Security number.

- Age: At the end of the tax year, the child must be under 19. Or, if attending school full-time, the child must be under 24. The only exception is for children who are permanently and totally disabled. If your child is permanently and totally disabled, the child can be any age, even an adult.

According to the IRS, a person is considered permanently and totally disabled if their condition is expected to last continuously for at least one year or is expected to result in death, and if they cannot perform any Substantial Gainful Activity . For tax year 2021, this means they cannot earn more than $1,310 per month .

Note: Qualifying children can only be used by one family member to claim an EITC.

If you dont have any qualifying children, the maximum adjusted gross income you can have and still qualify for an EITC is $21,430 .

With one qualifying child, your AGI can be up to $42,158 . With two or more qualifying children, you can have an AGI of up to $47,915 . And with three or more qualifying children, you can have an AGI of up to $51,464 .

Determine The Qualifying Children

Based on your filing status, different income levels determine if you qualify for the EIC. They depend on the number of qualifying children you have. For a child to qualify, they must have a close relationship with you. For example, a child can be your biological daughter or son, adopted, a foster child, a sibling, a stepchild, or the descendant of a sibling or stepchild. The children must be under 19 years of age or 24 years old if they’re a full-time student and have lived with you for more than half the year.

For example, the maximum qualifying earned income credit can be:

- No child: $510

- Three or more children: $6,318

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

You May Qualify Forcash Back

If you earned less than $57,000, you may be eligible to claim up to $6,600 in federal EITC. And if you earned less than $30,000, you may also be eligible for up to $3,027 in California EITC.

Eligible families must file their tax returns in order to claim the federal and state EITC a benefit for working people who have low to moderate income.

A tax credit means more money in your pocket. It reduces the amount of tax you owe and may also give you a refund. Families may receive hundreds, and sometimes thousands, of dollars between these two credits! Thats money you can use for rent, school tuition, utilities, groceries, and other expenses.

Claiming Children For The Eitc

If you claim children as part of your EITC, they must pass three tests to be a qualifying child:

You May Like: Is Plasma Money Taxable

The Bipartisan Policy Center Debt Reduction Task Force

The Bipartisan Policy Center Debt Reduction Task Force restructured provisions benefiting low-income taxpayers and families with children in its 2010 report, Restoring Americas Future. The task forces goals were to simplify and make more progressive provisions benefiting low-income taxpayers, while also reducing complexity in the tax-filing process. The report cites a number of reasons to do so aside from simplicity, including that the EITC can both create a marriage penalty and can discourage work among those with incomes in the phase-out range.

The task force proposed replacing low-income tax provisions with two separate provisions: a universal child credit and an earnings credit. The universal child credit would provide $1,600 per child, indexed to changes in the Consumer Price Index. Taxpayers would file for the credit with each additional child thereafter, receipt of the credit would be automatic until the children reach adulthood, as long as they reside in the household and attend school. The earnings credit would be provided to working individuals through automatic adjustments made to withholding . The credit would not phase out as the Bipartisan Policy Center argues, this would avoid the marriage penalty and the work disincentive.