Exemption From Washington Paid Family And Medical Leave Program

Self employed individuals, federal employees, federally recognized tribes and people who work temporarily in Washington may be exempt from the states Paid Family and Medical Leave Program. Read more about Washingtons Paid Family and Leave Medical Leave Program.

Learn how to locate or obtain an EIN.

Equal Opportunity Employment In Washington State

There are several Washington state laws that protect workers from discrimination and other unfair employment practices in the workforce. It is illegal to discriminate against or engage in unfair employment practices because of an individuals:

- HIV, AIDS, or Hepatitis C status

- National origin

- Trained service animal or guide dog use

- Whistleblower status

- Opposition to a discriminatory practice

New York Tax Changes Effective January 1 2023

New Yorks budget for fiscal year 2023, enacted in April 2022, accelerates income tax rate reductions originally passed in 2016 for middle-income earners. Under S. 8009, rate reductions originally scheduled for 2025 will take effect two years earlier than planned, bringing the rate on income between $13,900 and $80,650 and between $27,900 and $161,550 to 5.5 percent and bringing the rate on income between $80,650 and $215,400 and between $161,500 and $323,200 to 6 percent. For tax year 2022, the tax rates on those levels of income are 5.85 and 6.25 percent, respectively.

Additionally, New York is set to resume collection of its motor fuel excise tax, state sales tax on fuel, and Metropolitan Commuter Transportation District sales tax on motor fuel and diesel motor fuel on January 1, 2023. The suspension of those fuel taxes provided a price reduction of 16 cents per gallon since June 1, 2022.

Don’t Miss: How To File An Oregon Tax Extension

Washington Payroll & Other State Resources

Hopefully, this guide has provided a solid foundation to aid your business in handling Washington payroll taxes. While withholding, paying, and reporting payroll taxes can be a bit tedious, theyre necessary for any business that prioritizes tax compliance.

However, payroll taxes are the least of burgeoning business owners worries. Just getting started or need funding for your business?

Weve also got an in-depth guide to Washingtons best small business loans and financing options. This guide takes a deep dive into financing options for small businesses in the Evergreen state, including loans, borrower requirements, and what to look for in a good business financing option.

Washington Sales & Use Tax

Washington states sales and use tax rate is 6.5% plus any applicable local sales tax rates. Local sales tax rates vary by location, so you can use Washingtons tax rate lookup tool to determine your sales tax liability.

If your business delivers items to customers in-store, the sales tax rate is based on the stores location. However, if you deliver or ship items elsewhere in the state, the sales tax rate depends on the items final destination.

Don’t Miss: How To Pay Estimated Taxes

Connecticut Tax Changes Effective January 1 2023

Beginning January 1, Connecticut will utilize a vehicle miles traveled tax for large commercial trucks as a result of H.B. 6688, enacted in June 2022. Specifically, taxpayers will pay between 2.5 and 17.5 cents per mile for every mile traveled in the state.

Additionally, Connecticuts gas tax holiday expires at the start of the new year. The state plans to phase in the 25-cent gas tax at five cents per month for five months.

Missouri Tax Changes Effective January 1 2023

In October 2022, Missouri legislators passed S.B. 3, a bill to expedite planned individual income tax rate reductions and replace existing tax triggers with triggers that reduce the top marginal rate further and faster than planned in previous legislation enacted in 2014 and 2021. Effective January 1, Missouris top marginal individual income tax rate will be reduced from 5.3 to 4.95 percent, and the amount of income that is exempt from Missouris individual income tax rates will increase from $100 to $1,000. Existing triggers seek to eventually reduce the top rate to 4.5 percent.

Additionally, Missouris economic nexus law for remote sales tax collections will take effect on January 1. As a result of the enactment of S.B. 153 in June 2021, the state will require remote sellers and marketplace facilitators with more than $100,000 in annual sales into Missouri to collect Missouris state and local sales tax. Missouri is the final state with a sales tax to put these requirements into place.

Also Check: How To Know How Much Taxes You Owe

In Washington Some Taxes Are Exempt

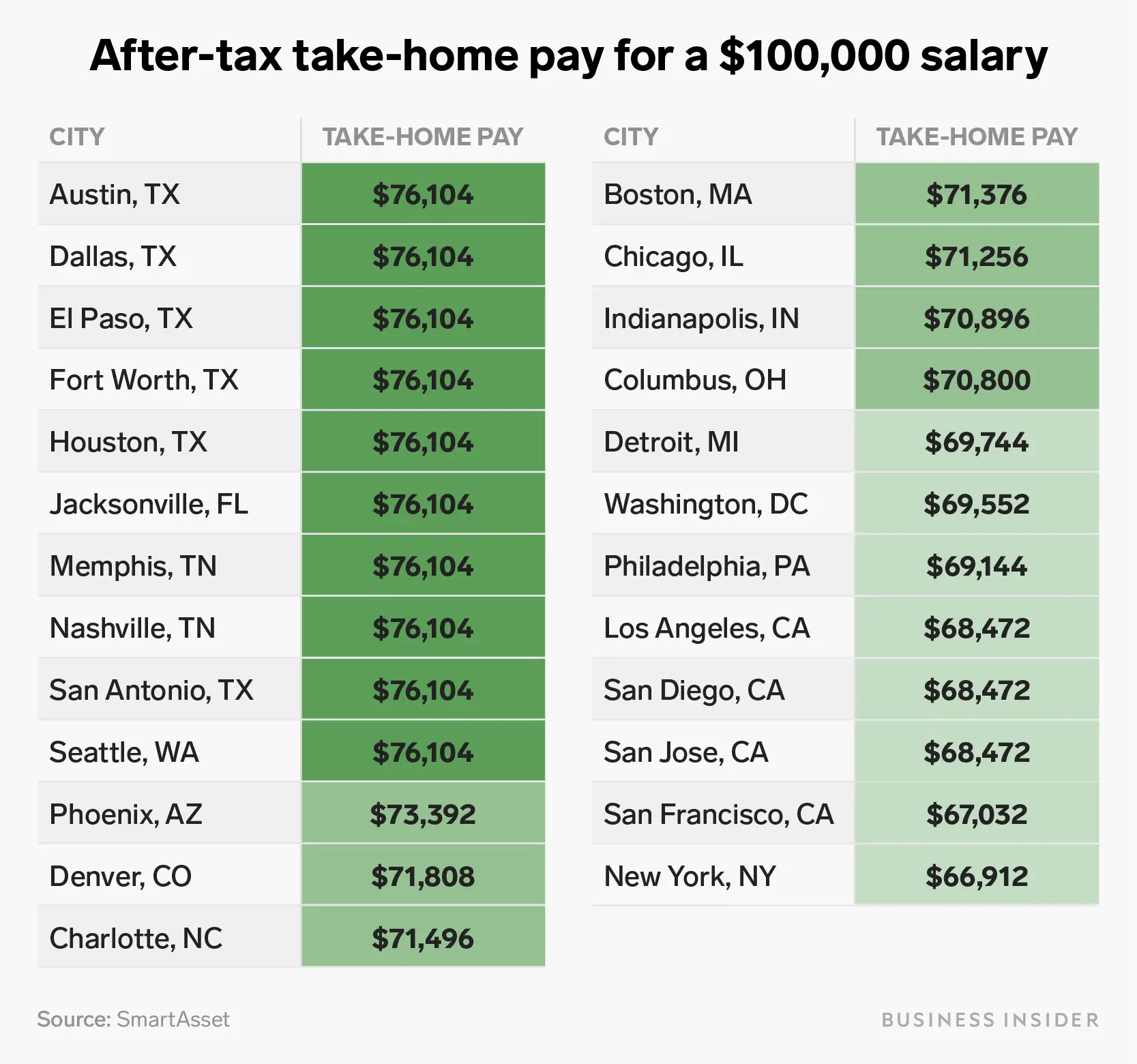

Taxes can vary greatly depending on where and who is required to file. And when taxes are deducted from your paycheck, they can be even more variable.

Thats why many people wonder what taxes are deducted from their paycheck, when working in Washington because, unlike in other states, several taxes dont apply to local workers.

Corporate Income Tax And Other Business Tax Changes

Four statesArkansas, Nebraska, New Hampshire, and Pennsylvaniahave corporate income tax rate reductions taking effect.

One state, Oklahoma, will offer permanent 100 percent bonus depreciation despite the federal governments phasedown to 80 percent bonus depreciation under Section 168.

One state, Vermont, will repeal its throwback rule.

Two states, Louisiana and North Carolina, will make their capital stock taxes less burdensome.

Recommended Reading: How Does Unemployment Tax Work

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 2021 filing season based on the Trump Tax Plan.

How Accounting Cs Calculates The Fli Premium

- If a client wishes to pay all of the employee portion of the premium, mark the Employer pays full employee PFML share checkbox in the Payroll Taxes tab of the Setup > Clients screen.

- If the client is an employer with fewer than 50 employees and chooses not to pay the employer portion of the premium, you can mark the Wage exempt checkbox for the employer portion of the premium in the Payroll Taxes tab of the Setup > Clients screen.

Read Also: How To File Back Taxes Without Records

Maine Tax Changes Effective January 1 2023

Beginning January 1, 2023, the sales tax exemption for residential electricity will be expanded for eligible customers enrolled in either a low-income assistance program administered by the Maine State Housing Authority or in an arrearage management program administered by electric transmission and distribution utilities. The current exemption was limited to the first 750 kilowatt hours of residential electricity per month.

How Can I Estimate Payroll Costs

- To calculate the cost of Washington states Paid Family and Medical Leave Benefit, use the Employment Security Departments calculator.

- For employees:

Read Also: Can You Take Pictures Of Receipts For Taxes

Washington Paid Family & Medical Leave Worksheet

We have provided Form WA-PFML Worksheet , which you can use as a source for manual data entry of employee’s Washington FLI information on the SecureAccess website, or to create an electronic file that you can upload to the same website.

Prior to filing the forms electronically, you will need to add the PFML Number to the Additional Information dialog .

Notes

- The PFML number is formatted as C######### .

- In most cases the 9 digits of the PFML number following the letter C are the first 9 digits of the client’s Unified Business Identification number.

When checks have been processed and the PFML number has been entered, you can process the forms in the Actions > Process Payroll Tax Forms and then create the electronic files in the Actions > Process Electronic Forms screen.

What Is The Minimum Pay Frequency In Washington

Unless national law requires a more regular timeline, you must pay workers at least once a month. If you pay monthly, you should pay hourly wages from the first to the 24th of the month at the end of the month. After that, the remaining wages become a part of the following paycheck.

Overtime: If you are unable to compute overtime in time to meet the usual payday, you should set up a second pay period for overtime compensation.

Read Also: Where Can I Do My Taxes For Free

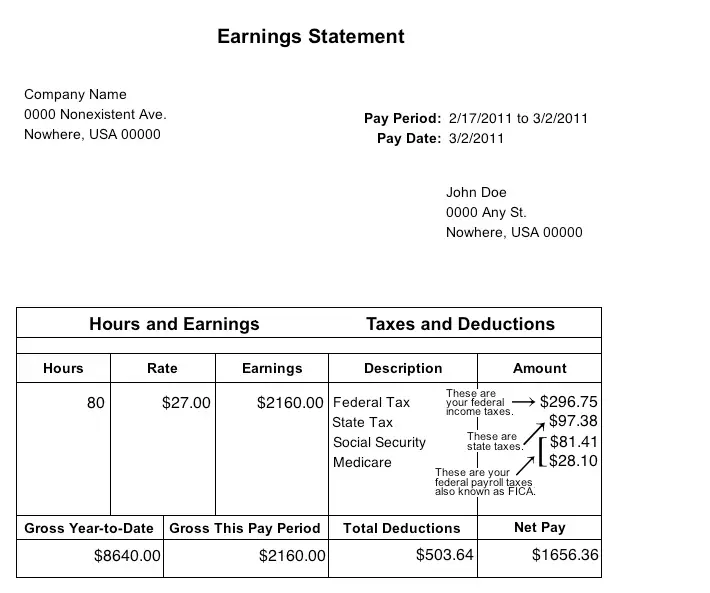

Calculate Gross Wages For All Employees

An employees gross wages are their earnings before payroll taxes are taken out. Gross wages may be calculated differently depending on whether an employee is paid a salary or on an hourly basis.

Typically, salaried employees earn a set amount throughout the calendar year, regardless of hours worked. Calculating gross wages for salaried employees is as simple as dividing their salary by the number of pay periods per year.

For example, if an employee earns $96,000 annually and is paid twice monthly , they would earn $4,000 per pay period.

Hourly workers may have more variety in their gross earnings because they are paid based on the hours theyve worked. To calculate an hourly workers gross earnings, multiply the number of hours worked by their hourly wage.

For example, an employee earning $32/hour working 80 hours per pay period would earn $2,560 per pay period.

Supplemental earnings, such as tips, commissions, overtime, bonuses, and more, need to be added to employee gross earnings. These earnings are typically subject to tax and must also be reported as income.

Florida State Income Tax

Florida has a population of over 21 million and is famous for its miles of beautiful beaches. The median household income is $52,594 .

Brief summary of Florida state income tax:

- zero state income tax

Florida tax year starts from July 01 the year before to June 30 the current year. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Recommended Reading: Capital Gains Tax On Primary Residence

Read Also: How To Determine Tax Liability

Compile A List Of Washington Payroll Taxes

As there are so many federal and state payroll taxes to calculate, its best to start with a complete list of the payroll taxes youll be working with. Heres a quick refresher of the most common Washington state payroll taxes and their rates:

- Federal Income Taxes: Ranging from 10%-30% of taxable income withheld

- FUTA Tax: 6% of the first $7,000 paid to an employee each year paid out-of-pocket

- Washington UI Tax: Up to 8.03% on the first $62,500 paid to an employee each year, paid out-of-pocket

- Social Security Tax: 6.2% withheld and 6.2% paid out-of-pocket up to the $147,000 taxable wage base

- Medicare Tax: 1.45% withholding and 1.45% paid out-of-pocket

- Additional Medicare Tax: Additional 0.09% withheld from taxable employee income over $200,000 earned

- Washington Paid Family and Medical Leave: 0.6% of taxable employee income withheld up to the $147,000 taxable wage base

- WA Cares Fund Contributions: 0.58% of taxable income withheld up to the taxable wage base

Top 5 States With The Highest Tax Burden

1. Hawaii: 26.7% on median income of $78,0842. Maryland: 25.2% on median income of $81,8683. Massachusetts: 24.9% on median income of $77,3784. Oregon: 24.7% on median income of $59,3935. Connecticut: 24.6% on median income of $76,106

One insight from our visualization is how low-income states generally see lower tax burdens. Mississippi, West Virginia and Arkansas are among the poorest states in the country, and consequently residents in each state pay less than 20% in total taxes. On the other hand, high-income states typically pay a greater percentage of their income in taxes. Maryland and Hawaii are among the top 3 highest income states, and they both pay over 25% in taxes. Thats because progressive tax systems require high-income earners to pay more, expressed as a percentage of income, than low-income earners. Of course, how much individual states are getting back from the federal government is also unequal.

Whats your impression of the relative size of the tax burden where you live? Do you think you are getting a fair bargain for your money, or not? Let us know in the comments.

Do you need insurance for your business? Don’t worry, we’ve got you covered.

You May Like: Do You Have To Pay Taxes On Home Sale

Exemption From Federal Unemployment Tax

Certain types of income may not be subject to Federal Unemployment Tax . Review Publication 15 and Publication 15-A to determine whether this exemption applies to your business. The IRS Small Business and Self-Employed Website also defines how this exemption applies to S Corporation employees, shareholders and corporate officers.

Best Practices For Filing Payroll And Income Taxes

Whether you manage it yourself, have a staff member to help or outsource the task, its important to put enough resources into tax compliance to do it right. Errors in determining the amount owed, or delays in making payments or filing returns, could lead to fines and other financial penalties that your business cant afford. Small-business owners can ensure that their business expenses remain manageable and their taxes are paid on time with these best practices:

Read Also: Who Is Exempt From Filing Taxes

Is It Better To Owe Taxes Or Get A Refund

The best decision for your financial health is to optimize your withholding so you do not receive a substantial refund. In fact, you should consider planning your withholding so you owe the government when you file your taxes. As long as you stay within limits, you wont owe the government any interest or fees.

Read Also: Big Spring Federal Credit Union

A Complete Guide To Washington Payroll Taxes

When small company owners envision their firms expanding, becoming more lucrative, and requiring the assistance of more workers, they often envision all of the fantastic things that will occur due to that expansion. Building a corporate culture, boosting earnings, and getting new clients are all wonderful aspects of being an entrepreneur.

However, payroll taxes aren’t one of the most thrilling aspects.

Indeed, knowing payroll taxes and then establishing an efficient payroll tax administration process is one of the tiresome aspects of employing your first worker.

Despite Washington not having state taxes, it still has a slew of payroll laws. For example, you would need to add a specific authorization to your company’s file to hire minors.

The minimum wage is higher than in other states, and Seattle and SeaTac have their regulations governing the minimum wage. As a result, the most strenuous aspect of payroll is onboarding. However, it’s simple to finish once you’ve set up your employee to follow the laws and guidelines.

So, if you’re searching for a short and easy-to-understand introduction to payroll, you’ve come to the right spot.

Table of Content

Let’s start!

Also Check: How Much Will I Make After Taxes California

State New Hire Reporting

If you are hiring employees for the first time, you need to refile your business license application with the state. Then the Employment Security Department will get you the information to set up your state unemployment tax account and the L& I will contact you to start your workers compensation insurance account.

You must report new employees within 20 days of hire. To report, you need the employees W-4, birth date, and hire date.

Additional Deductions On Florida Paychecks

In addition to federal taxes, Florida employers can make other deductions. This income goes toward services like health insurance and retirement planning. These deductions apply before taxes, so they lower an employees total taxable income.

The most common pre-tax deductions include:

- Court-ordered garnishments such as alimony, child support, outstanding loans, and back taxes

- Commuter benefits

Note: Our calculator can only account for federal and state deductions. As a result, pre-tax deductions do not factor into our estimated paychecks.

Don’t Miss: Where Can You File Taxes Online For Free

Operating A Business In Washington: Heres What You Need To Know About Payroll Tax

Business owners in Washington should understand that Washington is a no personal income tax state. It joins the ranks of these other states that do not have a state income tax: Nevada, Wyoming, South Dakota, Texas, Florida, Alaska, and Tennessee.

Though there is no personal income tax in Washington, youll need to pay and withhold federal payroll taxes and pay state unemployment tax.

Washington unemployment tax

To help workers who have lost their jobs through no fault of their own, Washington employers must pay unemployment tax. For 2022, the first $62,500 of each employees wage is taxed for unemployment. Rates vary based on industry and the history of claims paid to former workers.