Nanny Taxes Youre Responsible For Paying

The nanny tax isnt just Social Security and Medicare taxesreferred to as “FICA taxes“that are normally split evenly between an employer and their employee. It also includes federal income tax withholding, although you dont have to contribute to this. It takes into account the federal unemployment tax as well.

How Do You Make Tax Payments

When you file your 2022 federal income tax return in 2023, attach Schedule H, Household Employment Taxes. Use this Schedule, discussed further below, to figure your household employment taxes. You will add the federal employment taxes on the wages you pay to your household employee in 2022, less any advance earned income credit payments you make to the employee, to your income tax. The amount you owe with your return is due to the IRS by April 15, 2023.

You can avoid owing tax with your return if you pay enough federal income tax before you file to cover the employment taxes for your household employee, as well as your income tax. If you are employed, you can ask your employer to withhold more federal income tax from your wages in 2022. If you get a pension or annuity, you can ask for more federal income tax withholding from your benefits. Or you can make estimated tax payments for 2022 to the IRS, or increase your payments if you already make them.

I Thought A Nanny Was An Independent Contractor And Could Take Care Of Her Own Taxes Is This True

The IRS classifies nannies and most other household employees as employees of the families for whom they work.

The difference between employees and independent contractors hinges on the amount of control one has over the worker. The IRS created a 20-point test to determine control and has ruled that household workers should be treated as employees. As the employer, you tell your nanny what hours to work, you give her direction on how to do her job, she uses your tools , you determine how much she will be paid and you hand her a paycheck at the end of the week.

An independent contractor comes with their own tools, they tell you when they will be there and they determine the fee they will charge for their services. You can petition the IRS using Form SS-8 if you disagree with the IRS classification a ruling determining if your nanny is an independent contractor may take up to six months or more.

Also Check: 1040paytax.com

What If I Am In A Nanny Share

In a nanny share where multiple families hire one caregiver to care for all children out of one of the familys homes the nanny is considered an employee of each family. They will receive a paycheck from each family on payday and a W-2 from each family at the end of the year. Learn more about how to set up a nanny share and understand taxes and payroll.

What Are The Expected Tax Costs

Employer payroll taxes normally range between 9%-11% of wages, depending on your state . When you catch-up with a previous year, it will be higher, roughly 17%, because the employer pays both employer + employee social security and Medicare and both sides of state taxes too .

Employees will also need to pay income tax on their wages. While we only handle the payroll, we know on the other end that many household employees owe little if they qualify for tax credits like the earned income tax credit , child tax credit and others. While every situation is different, household employees often get a refund while they build up their social security and Medicare credits. If the employee has already filed their taxes this year, its easy to file an amendment so they can get the benefits that come with the new W-2.

What about penalties? The IRS will give you a break if this is the first year you owe taxes on a household employee. Just make sure you pay the taxes by the time you file your personal taxes. However, your state might assess a late penalty for not paying on time. We have seen penalties range from $150/quarter to as little as $15/quarter, depending on your state.

Recommended Reading: Www.1040paytax.com Official Site

Paid Holidays And Vacation

In this section of the pay stub, I keep track of the amount of paid holidays and vacation. Regarding paid holidays, I agree with the nanny every year what holidays will be paid and send her an email to make sure we have the details in writing. In 2019, we paid for 5 holidays. I handle the agreement for paid vacations similarly.

Can I Give My Nanny A W

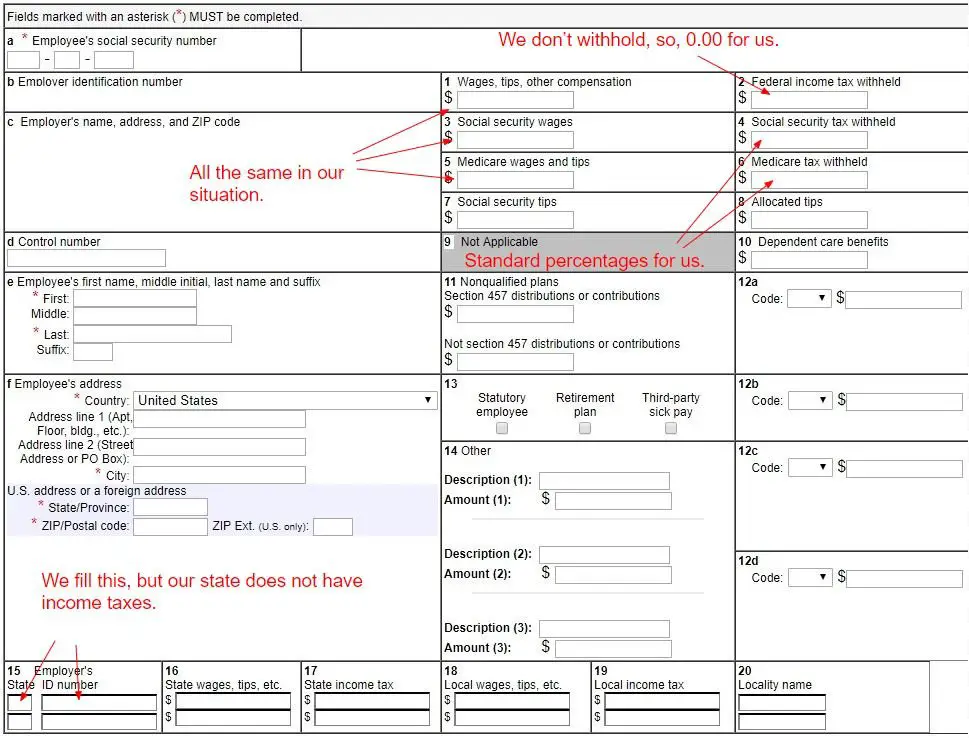

Complete year-end tax forms: You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. The Social Security Administration requires you to file Form W-3 and Form W-2 Copy A. You need to prepare a Schedule H and file it with your federal income tax return.

Read Also: Doordash 1099 Example

Federal Income Tax Withholding

The IRS requires you to pay income taxes throughout the year as you earn income, not just at the tax filing deadline. In most cases, employers do this by withholding money from your paychecks for taxes and sending it to the IRS on your behalf.

Unfortunately, household employers aren’t required to do this, so you could end up with a big tax bill at the end of the year if you don’t set aside money. Learn about making estimated quarterly tax payments to avoid a big tax headache when you file.

What Taxes Are Owed When Employing A Nanny

You will owe 7.65 percent of your nannys cash wages in FICA taxes . You are also required to withhold the same amount from your employees pay and remit both shares to the IRS.

On top of FICA taxes, you will pay six percent in federal unemployment taxes on the first $7,000 in cash wages. This is an employer-only tax. You will likely owe state unemployment as well. However, you may be able to take a credit against your federal unemployment taxes and reduce that rate to 0.6 percent.

While you are not required to withhold federal income tax from your nannys pay, it may be a good idea, so they are not stuck with their entire tax obligation when they file their return.

The easiest way to remit federal taxes both employer and employee shares is to make quarterly payments using Form 1040-ES.

IRS Publication 926 , as well as our Nanny Tax Guide, are excellent resources to learn about your responsibilities as a household employer.

Read Also: Efstatus.taxact.com.

Do I Need To Have A Written Contract With My Employee

California household employers are required to provide all household employees with a at the time of hire. You are required to complete the form and have your employee sign two copies one for their records and one for the employees records.

You are not required by law to have a full written employment agreement with your nanny or household employee. Still, it is a really good idea to have a written employment agreement with your employee.

A written employment agreement spells out the obligations of both parties, including hours, compensation, duties, benefits and PTO. This is really important if the relationship doesnt work out, and there is ever a dispute. Just as important, it helps you discuss the important issues with your employee at the outset. This way you make sure you have a good relationship and understanding before you even start.

If you decide to go this route, weve put together a Sample Nanny Contract. This should give you a good idea of the issues that are usually covered.

Yearly Federal Income Tax Declaration

If you have household employees, you typically need to file Schedule H — called “Household Employment Taxes” — with your yearly federal income tax declaration. Official instructions are available from the IRS. What you need to do might depend on your concrete personal situation.

You can find more information here.

I am using TurboTax for my wife’s and my own federal income tax declaration, and I was able to complete the necessary forms with it.

Also, remember that the amount you owe the IRS might drastically increase when you withhold federal income taxes for your nanny. As mentioned here, you typically are not required to withhold. However, if you do, you might run the risk that the IRS will charge you with a fine if you owe too much money with you federal income tax declaration. To avoid this, consider increasing the amount of money your employer withholds from your income or paying estimated taxes through other means. This is explained in more detail here.

Recommended Reading: Employer Tax Identification Number Lookup

What If You Do Not Know Your Nannys Sensitive Information

If you ever looked at a form 2441, you probably noticed that the first part deals with details about the nanny or the organization that took care of the child. This is considered an expanded line one where you must put the name, the address, and the social security or the employer identification number of the caregiver. There are many situations where such information is not readily accessible. If you ended your relationship with a temporary nanny before collecting such information, for instance, you may find yourself struggling to get the necessary data.

Luckily, the IRS will still let you submit the form and claim eligible expenses. The only caveat is that you must prove that you did your due diligence when trying to collect the information. A few simple ways to do so is to showcase a scanned copy of the nannys invoice, W-4, or some other identification. Then, attach documentation showing that, while unsuccessfully, you at least attempted reaching out to the person or organization. Their failure to give you the data is going to open them up to liability as well, which is why most caregivers ensure that they stay compliant.

Asking For More Federal Income Tax Withholding

If you are employed and want more federal income tax withheld from your wages to cover the employment taxes for your household employee, give your employer a new Form W-4, Employee’s Withholding Allowance Certificate.

If you get a pension or annuity and want more federal income tax withheld to cover the employment taxes for your household employee, give the payer a new Form W-4P, Withholding Certificate for Pension or Annuity Payments .

You May Like: Highest Paying Plasma Donation Center Near Me

Employee Wages Taxes Adjustments And Net Pay

This section is the heart of the payroll spreadsheet. The good news is that once you have set up your nannyâs hourly pay rate and the tax rates, most of this section will be automatically calculated by Excel. Letâs go over the fields one-by-one:

Claiming Public Transit Passes

You can offer your nanny or caregiver one of two forms of compensation for public transit passes. Both forms of compensation must be filed differently with the CRA:

Read Also: How To Protest Property Taxes In Harris County

Nine Reasons Why This Is Good For You:

You’ll stay legally compliant and will have the documentation to prove it. Any employee, whether paid legally or not, can make a claim for unemployment.

2021 has brought the American Rescue Plan Act, offering a serious tax REFUND for up to $8,000 if you hired a nanny/caregiver so you can work.

You are an attorney, doctor, government employee, high-level employee or licensed to work in the regulated finance industry, and its critical you stay above board for your career.

You elected to use a pre-tax FSA for dependent care through your company, and the only way to get the tax savings is to pay the employment taxes. If you have FSA money put aside but unused during COVID, you can roll it over to 2021. The Dependent Care FSA tax break usually is limited to enrollment once during the year, however COVID-19 has re-opened enrollment for this benefit. Enroll now if your company has this!

COVID-19 is a life event trigger for re-opening enrollment in the U.S. health insurance exchanges through August 15th, 2021. The American Rescue Plan will help well over a million uninsured Americans gain coverage. Uninsured employees who have verifiable income could qualify!

Your employee needs verifiable income for basics like applying for a loan or renting an apartment.

Your employee needs the safety nets that come with paying taxes: Unemployment, Social Security and Medicare, and in some states disability and paid family leave.

It’s the ethical thing to do and you’ll sleep better.

Can Household Employees Qualify For Tax Credits

If you work as a household employee, you may qualify for a special tax credit for low-to-moderate-income workers, the Earned Income Credit . This credit can lower your taxes and may result in a refund. The EIC has specific qualifications and income limits, so you’ll have to do some research to see if you’re eligible.

Household employers, on the other hand, can qualify for the Child and Dependent Care Credit.

For 2020, this credit can reduce the cost of child care expenses from hiring a nanny and can be worth as much as 20% to 35% of up to $3,000 of child care or similar costs for a child under 13, or up to $6,000 for two or more dependents.

For 2021, the American Rescue Plan brings significant changes to the amount and way that the child and dependent care tax credit can be claimed. The plan increases the amount of expense eligible for the credit, relaxes the credit reduction due to income levels, and also makes it fully refundable. This means that, unlike in other years, you can still get the credit even if you dont owe taxes.

For tax year 2021 :

- The amount of qualifying expenses increases from $3,000 to $8,000 for one qualifying person and from $6,000 to $16,000 for two or more qualifying individuals

- The percentage of qualifying expenses eligible for the credit increases from 35% to 50%

- The beginning of the reduction of the credit is increased from $15,000 to $125,000 of adjusted gross income .

You May Like: Paying Taxes For Doordash

How Do I Issue A 1099 To A Nanny

You do not need to issue a W-2 or a 1099-MISC Compensation form to her. She has to give you her Social Security Number or Employer Identification Number and the dollar amount you paid her, so you can complete Form 2441, Child and Dependent Care Expenses IRS.gov, on your personal income tax return.

What About Earned Income Credit What Must I Do

Certain workers can take the earned income credit on their federal income tax return. This credit reduces their tax or allows them to receive a payment from the IRS if they do not owe tax. You must give your household employee a notice about the EIC if you agree to withhold federal income tax from the employee’s wages and the income tax withholding tables show that no tax should be withheld. Even if not required, you are encouraged to give the employee a notice about the EIC if his or her 2022 wages are less than $59,187.

The employee’s copy of the IRS 2022 Form W-2,Wage and Tax Statement has a statement about the EIC on the back. If you give your employee that copy by January 31, 2022 , you do not have to give the employee any other notice about the EIC.

Read Also: Federal Tax Id Reverse Lookup