Simplify Tax Time With Quickbooks Online

Self-employed folks may feel extra layers of stress around tax time because their finances can be rather complicated, with income from multiple sources, for example. Quickbooks Online is a practical tool that simplifies tax preparation for the self-employed.

With Quickbooks Online, self-employed folks can get real-time estimates on their quarterly taxes, plus handy filing deadline reminders. This helps ensure youre paying your quarterly estimated taxes on time and accurately, removing much of the confusion of tax season.

Theyll automatically track your income and expenses and help you find all of your eligible tax deductions. Using Quickbooks Online can be illuminating for an entrepreneur because theyll automatically update your income and expenses to reflect how much youre truly bringing home. Their tax estimates show you an accurate picture of your finances.

For self-employed people and side hustlers who do any driving required for work, Quickbooks Online provides automatic business mileage tracking. It takes the pain out of tracking business mileage, as well as keeping your various driving categories separate.

The Simple version of Quickbooks Online is ideal for a small business owner or someone with a side hustle. There are also a couple of more expensive versions in case you need more robust services.

Related:Get the Most from Your 2022 Mileage Tax Deduction

Information On Stimulus Payments

Economic Impact Payment or the Recovery Rebate Credit

Three rounds of the Economic Impact Payments were issued with 2020 and 2021 federal tax returns.

- The first and second rounds of Economic Impact Payments were issued in 2020 and early 2021 These were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return.

- The third round of Economic Impact Payments were between March 2021 and December 2021. These payments, including the plus-up payments, were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return.

Most eligible people have already received the payments. However, people who are missing stimulus payments should review the information on the IRS webpage to determine their eligibility and whether they need to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Getting Ready to File

For more information on how to get yourself ready to prepare your taxes, check out 2021 tips from the IRS.

Tax Credits

The Earned Income Tax Credit is a refundable tax credit for working individuals and families with low to moderate income, particularly those with children. Find out if you qualify. The IRS recently updated their refundable tax credit webpage. The Advance Child Tax Credit was a credit amount paid in advance monthly payments in 2021.

Videos

Check out IRS videos, including those in alternative languages.

Free Tax Return Preparation For Qualifying Taxpayers

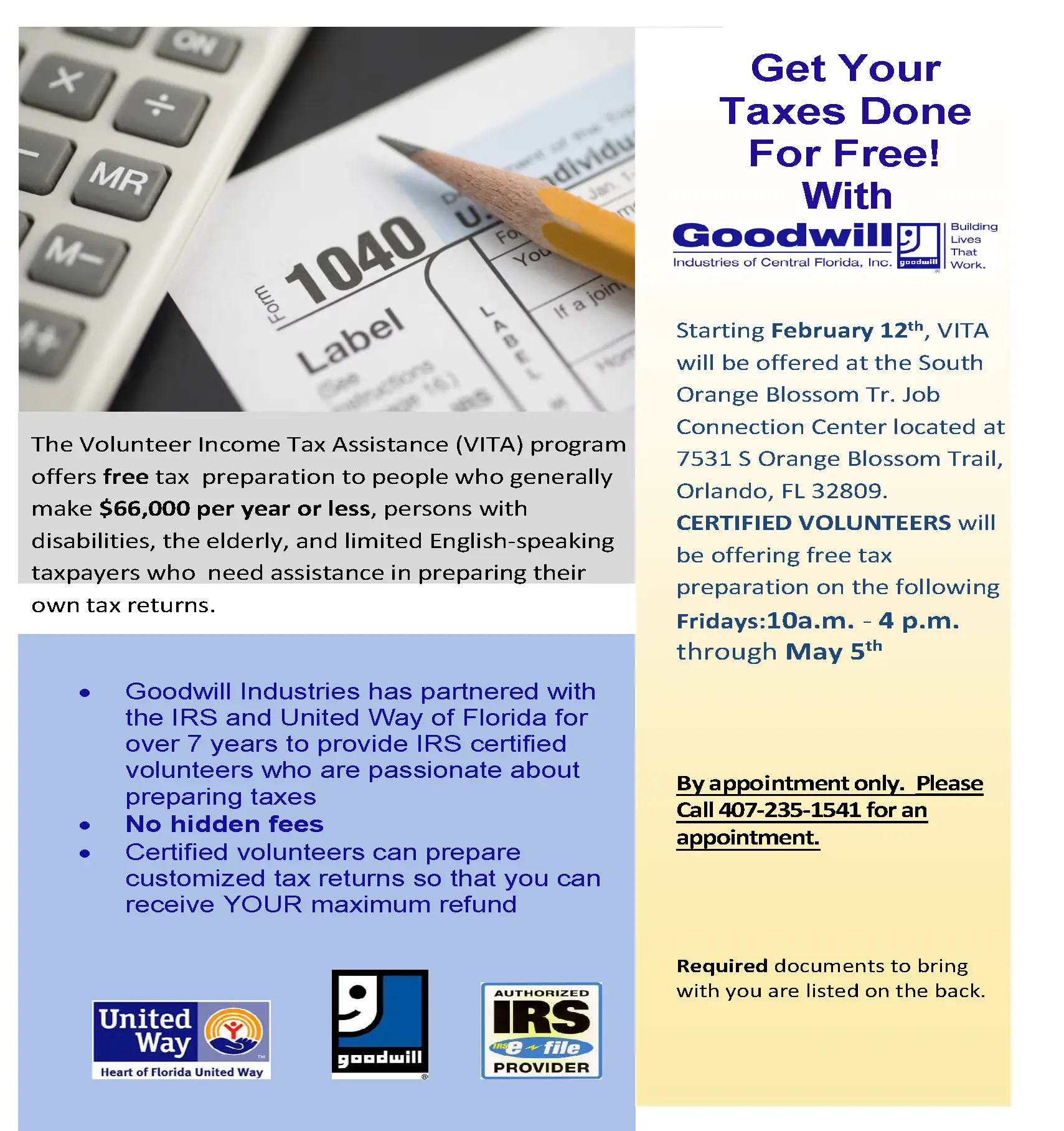

The IRS’s Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs offer free basic tax return preparation to qualified individuals.

The VITA program has operated for over 50 years. VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $58,000 or less

- Persons with disabilities and

- Limited English-speaking taxpayers

In addition to VITA, the TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

While the IRS manages the VITA and TCE programs, the VITA/TCE sites are operated by IRS partners and staffed by volunteers who want to make a difference in their communities. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

Recommended Reading: How To File Past Years Taxes

Why Pay A Cpa

That being said, going to a flesh-and-blood tax professional may be the best option for many taxpayers. Thats because a professional CPA can help you navigate the difficult tax questions like business structure, tax planning moves, etc. that pop up throughout the year.

Software has a harder time with this. You cant have lunch with software to discuss your small business.

CPAs are usually the most expensive option, but youre paying for someone to help you with a complex tax situation or simply to give you that extra assurance.

Check Out: Get a Quality CPA to Prepare Your Taxes

Free Online Tax Software

Online free tax preparation offers a convenient and reliable way to file your taxes.

If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software.

MyFreeTaxes is an easy online tool that helps you file your taxes for free. The site offers free step-by-step guidance to filing taxes as well as help through an online chat. Tax filing is free for both federal and state tax filing.

MyFreeTaxes offers a broader range of tax forms than most VITA sites. However, you cannot use this site if you have self-employment income. If youre not comfortable using the website on your own, ask someone you trust to help you.

Another free online option is Free File Alliance, a suite of programs in partnership with IRS. You can find Free File programs on the IRS website. If you choose to use one of these programs, read the fine print carefully. Each program has slightly different criteria for their software. In addition, some companies offer free state tax returns, while others dont.

Also Check: What Happens If You Cannot Pay Your Property Taxes

Who Is Eligible For Irs Free File

IRS Free File is a partnership between the IRS and a nonprofit organization called the Free File Alliance. IRS Free File provides access to free tax preparation software from several tax-prep companies, including major brands. You must have an adjusted gross income of $73,000 or less to qualify for IRS Free File . IRS Free File providers include providers such as TaxAct and TaxSlayer.

Which Option Is Best For You

My honest and short answer is that it depends. For most of us, choosing online tax prep software will work perfectly well. Most people who have used online software will tell you it is very intuitive and thorough. If youre debating about a deduction, the software will walk you through the pros and cons. If you arent even sure of which forms you need, the software will explain. The process is incredibly comprehensive and educational.

However, if you simply feel more comfortable going to a licensed tax professional in person, theres nothing wrong with that.

That said, there are plenty of options that make it easy to file your taxes online. The point is that filing online is the way to go if you dont have an extremely complex financial situation. Remember that you can go through the process of preparing your taxes with an online software and if you arent satisfied when it comes time to fileyou dont have to pay! You can take the information and walk into an H& R Block or have a tax professional complete it for you.

The bottom line is that the more complex your financial situation is the more likely it is that you should use a professional, like a CPA, to help you with tax planning and filing your taxes. For the rest of us, filing online is the way to go.

Don’t Miss: Why Have I Not Gotten My Federal Tax Return

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

To Qualify For The Ev Discount Take These Steps

The $7,500 tax credit was actually easier to earn before the Inflation Reduction Act, as the new rules have reduced the number of electric vehicles that are eligible for the tax credit.

That said, the path to an EV tax credit does exist, as long as drivers abide by the Inflation Reduction Act rule.

Get the paperwork for the claim from the purchase of a new or used electric vehicle, said Automotive Aspects Inc. sector analyst Lauren Fix. Then submit the paperwork with your tax return at the end of the year.

Check with your accountant to make sure you are eligible and then check with the dealer to see if the vehicle you choose is built in the U.S.

Your best bet is to buy before the end of the year, Fix said. The rules get stricter in 2023.

Also Check: How Do I Pay My State Taxes Online

How Late Can I File My Taxes

Asked by: Adella Littel

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. Filing this form gives you until to file a return. If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day.

You Can Get More When You File

When filing your taxes, you will get the full amount of Child Tax Credit, even if you received less in monthly payments last year than you may have been eligible for.

You will be able claim the full amount of any remaining Child Tax Credit benefits you are eligible for against any 2021 tax liability you owe and receive any leftover amount as a refund payment.

Any amount of monthly Child Tax Credit payments received last year will reduce the amount of remaining Child Tax Credit benefit you are eligible for when tax filing.

You May Like: When Is The Last Day You Can File Taxes

Read Also: How Do I Find What My Property Taxes Are

Proof Of Your Identity And Tax Status

If someone else is doing your taxes, you will need to show them your drivers license or state ID. If you are married and filing a joint return, both you and your spouse need to be there while the person is doing your taxes. You and your spouse need to sign the return before it’s filed.

If you are doing your taxes yourself, you need Social Security numbers or Individual Taxpayer Identification Numbers for yourself, your spouse, and your dependents.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Recommended Reading: How To Get An Advance On Your Taxes

Choosing A Tax Professional

If you need to pay someone to prepare your taxes, make sure they have the appropriate level of skill, education, and expertise to accurately prepare your return. The IRS website has great resources to help you:

Determine what kind of tax preparer you need Check a preparers credentials File a complaint about a tax preparer

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Don’t Miss: What Is Tax Free Weekend

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be covered opinions as described in Circular 230.

- PreSDDSpare, E-file, and Print

Dont Miss: What Is 1040 Sr Tax Form

Free Income Tax Preparation

Our branch offices are available to serve you , in-person or virtually. We will prepare your Maryland tax return and electronically transmit it for you free of charge at any of our taxpayer services offices.

To take advantage of this service, you must have your completed federal return, all W-2 statements and supporting documents and a picture ID with you, for scheduled in-person appointments.

Free Income Tax Preparation is available by appointment only in our branch offices. All scheduled appointments will be seen Monday-Friday between the hours of 8:30 a.m. to 4:30 p.m. Please click one of these links to schedule your appointment.

For all virtual appointments, please click on this link, virtual Appointments.

For all in-person appointments, please click on this link, in-person appointments.

Free Maryland Income Tax assistance is available over the phone by contacting Taxpayer Services at 410-260-7980 from Central Maryland or 1-800-MD-TAXES from elsewhere. The Comptrollers Office no longer accepts payments at branch office locations. Payments should be mailed to:

Comptroller of Maryland

Also Check: When Is Tax Refund 2021

How Do I Choose The Right Tax Preparation Method

If you dont feel comfortable using tax software or just want live support, free in-person or virtual tax preparation is your best option. You may be able to find tax support from your local free tax site or Code for Americas Get Your Refund service.

If you feel comfortable filing your taxes with minimal support, free online filing services like MyFreeTaxes or Free File Alliance may provide what you need.

If you have self-employment income or make more money than the income limits for certain free tax filing programs, you can find a paid tax preparer or paid tax software. For paid tax software, use NerdWallets best tax software chart to compare options and find the best choice for your specific tax situation.

If you prefer in-person paid assistance, make sure to research your options first. Unfortunately, the tax industry is not regulated, so be careful when looking for assistance. Although many paid preparers are honest, some preparers take advantage of their clients by not disclosing their fees or offering refund anticipation products.

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

Also Check: How To Estimate Income Tax

Don’t Miss: How Much Is Georgia State Tax

Electronically File Your Arizona 2021 Income Tax Returns For Free

Free File Alliance is a nonprofit coalition of industry-leading tax software companies partnered with ADOR and the IRS to provide free electronic tax services. Free File is the fast, safe and free way to do your tax return online.

Individuals who meet certain criteria can get assistance with income tax filing. Taxpayers can file for free if they meet the following criteria:

Dont Miss: What Happens If You File Your Taxes One Day Late

Volunteer Income Tax Assistance And Tax Counseling For The Elderly Programs

The IRS sponsors the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs. The VITA Program generally offers free tax help to people who generally make $56,000 or less, persons with disabilities, the elderly, and taxpayers with limited English who need assistance in preparing their tax returns. The TCE program gives priority to seniors age 60 years and older.

To learn about these programs and eligibility, visit the IRS website. Locate VITA and TCE assistance sites near you.

Interested In Becoming A Volunteer?These tax assistance programs are only successful with the help of volunteers willing to give their time and expertise to help taxpayers eligible for these free services. If you are interested in volunteering, please contact the program that interests you.AARP Tax-Aide Program

Read Also: How Does Child Tax Credit Work 2021