Irs Electronic Free File For Federal Returns

You may qualify to electronically file your federal return for free by using IRS Free File Some of the companies participating in the IRS Free File service will file your Maryland return electronically for free as well. No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services. Keep in mind that your Maryland return begins with your federal adjusted gross income, so you must prepare your federal return first before you can prepare your Maryland return.

Generally, you are required to file a Maryland income tax return if:

- You are or were a Maryland resident

- You are required to file a federal income tax return and

- Your Maryland gross income equals or exceeds the level listed below for your filing status. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status. Dependent taxpayers must take into account both their additions to and subtractions from income to determine their gross income.

For more information, see the instructions in the and nonresident tax booklet.

Filing Requirements for 2021 Tax Year

|

Filing Status |

|

| One spouse 65 or older | $ 26,450 |

| $ 26,450 |

Your income tax return is due July 15, 2022.

Security Of Personal Information

We accept responsibility for the security of information once we receive it. We take precautions to ensure that there is no unauthorized access to your data, and ensure the confidentiality of data you send using NETFILE. We use sophisticated security and encryption to protect this website and your personal information.

We are also responsible for making sure personal and financial information is sent in an encrypted format between your computer and our servers. This ensures that computer hackers and other Internet users cant view or alter the data you send to us.

Tax software companies whose products are certified for NETFILE are not representatives of the CRA. You are not obliged to send personal information directly to the tax software company when you ask for software assistance. Email is not a secure method of communication. Sending personal information by email is a big concern and increases the risk of identity theft.

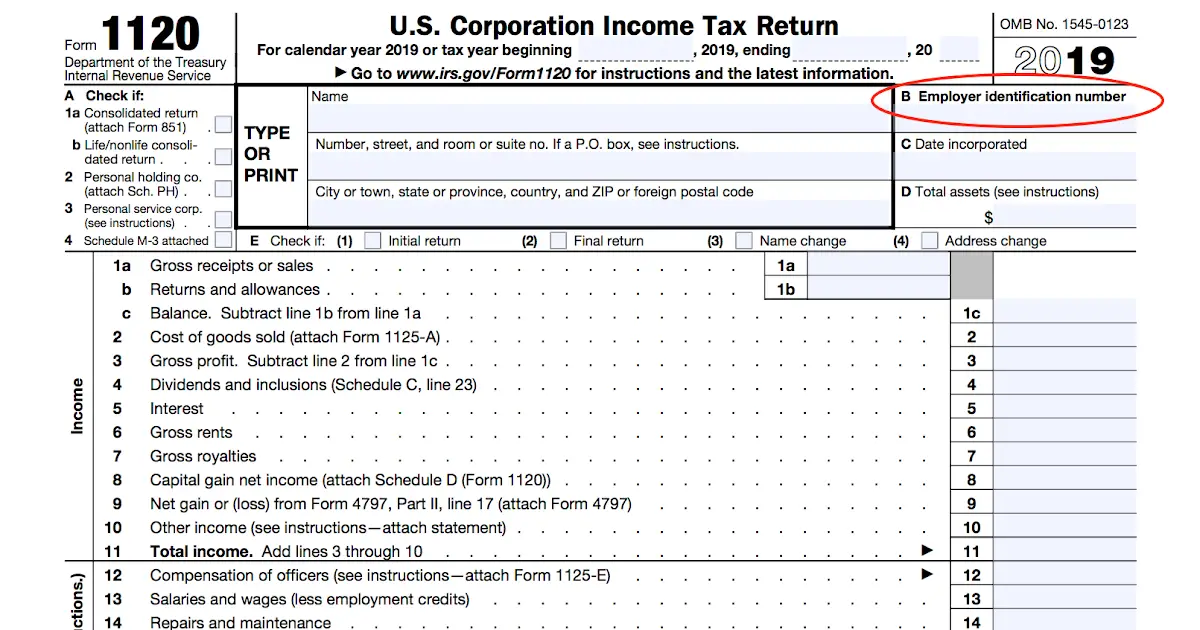

Corporation Income Tax Return

All resident corporations have to file a corporation income tax return every tax year even if there is no tax payable. This includes:

- non-profit organizations

- tax-exempt corporations

- inactive corporations

If you have incorporated your business or are considering incorporating to provide services to another company, visit: Personal Services Business.

Most corporations can file their return electronically using the Internet. It is mandatory for certain corporations with annual gross revenues that exceed $1 million.

Non-resident corporations have to file a T2 return in certain situations. See Who has to file a corporation income tax return.

We provide two different T2 returns:

- T2 Corporation Income Tax Return This is a nine-page return that can be used by any corporation

- T2 Short Return This is a two-page return plus one schedule

See Guide T4012, T2 Corporation Income Tax Guide to check if you are eligible to use the T2 Short Return.

Recommended Reading: Do Retired People File Taxes

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Do I Need To File Even If Im Not Required To By Filing Status Age And Income Level

In some cases, yesyou will still need to le a tax return if any of the following apply:

- You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

- Repayment of the First-Time Homebuyer Credit.

- You received a distribution from a health savings account, Archer MSA, or Medicare Advantage MSA.

- You had at least $400 in self-employment income.

- You earned $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare taxes.

- You received an advance payment of the Premium Tax Credit for health insurance bought from a health insurance marketplace. You should receive Form 1095-A with the amount of the advance payments.

- Advance payments of the Health Coverage Tax Credit were made for you, your spouse or a dependent. You should receive Form 1099-H with the amount of the advance payments.

- You are required to file Form 965-A for an elected installment payment.

- You are claimed as a dependent, but your income exceeded the filing requirement threshold.

Read Also: Where’s My Unemployment Tax Refund

Income Tax Returns: An Overview

The Income Tax Act was incorporated in 1961 and dealt with salaried individuals or self-employed individuals. According to the Income Tax Act, Indian taxpayers must disclose their salaries and pay the applicable tax amount. The assessee has to pay the applicable tax amount and file his Returns by submitting the Income Tax Returns Form, also known as ITR Form, to the Income Tax Department. In any case, you cannot miss the ITR filing if you fall under the taxable bracket. If you fail to pay your income tax on time, you may invite legal hassles.You have to declare your exact income in a Financial Year in the ITR. A Financial Year in India starts from 1st April and ends on 31st March of the following year. If you earn more than the exemption limit, you must pay income tax. Some sections like Section 80C, 80D, 80TTB under which rebates on tax can be claimed. However, if your overall income is more than the exemption limit, then filing of ITR is mandatory. The table below shows the exemption limits for ITR.

|

Age of Assessee |

|

|---|---|

|

More than 80 years |

INR 5,00,000 |

If you belong to any of the below groups, you are liable to pay tax and file returns. These are some of the indicators only:

When You Have To File Income Taxes

If your income falls below taxable levels, the IRS generally doesn’t need to hear from you. Those levels are revised each year for single filers, married people filing jointly, and heads of household.

Any income made above those levels has to be reported on a personal income tax return.

If you don’t file your 2020 taxes, you might lose out on tax credits you’re owed. The American Rescue Plan has unleashed a number of generous payouts and credits for families to offset the financial harm wrought by the COVID-19 pandemic. A family of four will receive a total of $8,200 more in payments and tax credits if their income is below certain levels.

- If you don’t owe the government and the government doesn’t owe you, you might not be required to file.

- Your taxable income includes not just wages but savings account interest, Social Security payments, and many other possible sources.

- If you don’t file you could miss out on some tax credits designed especially for lower-income Americans.

You May Like: How Can You Pay Your State Taxes Online

When You May Want To Submit A Tax Return To Claim A Tax Refund

With all the above being said, there are years when you might not be required to file a tax return but may want to. If you have federal taxes withheld from your paycheck, the only way you can receive a tax refund when too much was withheld is if you file a tax return.

- For example, if you are a single taxpayer whos only income is earnings of $2,500 from a job, with $300 withheld for federal tax, then you are entitled to a refund for the entire $300 since you earned less than the standard deduction.

- The IRS doesn’t automatically issue refunds without a tax return. So if you want to claim a tax refund then you should file a tax return.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Why You Might Want To File A Tax Return Anyway

If your income falls below the minimum income requirements, you might want to file a return if it will earn you a tax refund. This would be the case if you had any taxes withheld from your income, such as withholding on wages or retirement plan distributions, so you overpaid your taxes, because the income falls below these filing thresholds. No tax would be due, and you’d be entitled to a refund of the money that was withheld.

Filing could also generate a tax refund if you’re eligible for one or more of the other refundable tax credits, such as the Earned Income Credit. You’d have to file a tax return to calculate and claim the credit, and to request a refund from the IRS.

You might also want to file a return if you have beenor think you might bea victim of identity theft. Filing a return puts the IRS on notice as to what your true income was for the year, and it prevents a thief from filing a false tax return using your name and Social Security number.

Don’t Miss: How To Pay Unemployment Tax

Request A Copy Of Previously Filed Tax Returns

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature. If you are requesting a copy of a joint return, include the information for both taxpayers and their signatures.

Mailing address:

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

Recommended Reading: When Is The Tax Filing Deadline For 2021

Do You Have To File A Return

File a return for 2021 if:

- You have to pay tax for the year

- You want to claim a refund

- You want to claim the Canada workers benefit or you received CWB advance payments in the year

- You or your spouse or common-law partner want to begin or continue receiving credits and benefits such as:

- guaranteed income supplement

Note

If you have a spouse or common-law partner, they also have to file a return. For more information, see Booklet T4114, Canada Child Benefit and related federal, provincial, and territorial programs, and Guide RC4210, GST/HST Credit.

What If I Only Receive Social Security Benefits

In most cases, if you only receive Social Security benefits you wouldn’t have any taxable income and wouldn’t need to file a tax return.

One catch with Social Security benefits is if you are married but file a separate tax return from your spouse who you lived with during the year. Then you will always have to include at least some of your Social Security benefits in your taxable income to see if it is greater than your standard deduction. If your taxable income is greater than you standard deduction, you would need to file a return.

Also Check: How Much Should I Put Aside For Taxes 1099

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRA’s website for filing deadlines.

The Premium Tax Credit

If your income is between 100% and 400% of the federal poverty line, the PTC will reimburse the amount you spent on monthly premiums for health insurance purchased through the Health Insurance Marketplace. These federal poverty line thresholds are actually higher than the minimum amount needed to file a tax return. However, if you received unemployment compensation for any week beginning during 2021, your household income is automatically considered to be 133% of the federal poverty line and therefore qualifies you for the credit.

To claim it, you must file a federal income tax return and attach Form 8962. More information about claiming this credit can be found here.

Recommended Reading: When Are Federal Taxes Due In Texas

What If Im Self

As a small business owner, you may be required to file additional returns, such as those for payroll and GST/HST remittances and withholdings. Failure to meet the CRAs payroll obligations results in penalties and interest there are several types of penalties for payroll accounts. Failure to deduct can result in a penalty of 10% for the first failure, and will go up to 20% with any additional failures. Late filing or non-payment penalties start at 3% and will go up to 20%.

Send A Paper Return By Mail

If you are mailing someone elses paper return

If you prepare other peoples returns, mail each persons return in a separate envelope. However, if you file returns for more than one year for the same person, put them all in one envelope.

Also Check: How To Deduct Office Space On Taxes

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Recommended Reading: How To Check Last Year Tax Return

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Read Also: What Is The Tax Rate For Federal Income Tax

Is It Mandatory To File Itr For Salaried Employees

Filing the ITR Returns on time is mandatory for salaried employees in India. Some people think that since they have paid tax , they are not required to file ITR. One should understand that paying income tax and filing ITR are two different liabilities. You have to provide information about your income by filing ITR before the due date. Even if you arent earning a taxable income, you should file an ITR for better results.

Tax Filing Deadline For Individual Tax Returns

The tax filing deadline for your 2021 tax return is May 2, 2022.

The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by April 30 of every year. If April 30 falls on a weekend, the CRA extends the deadline to the following business day.

If you want to file early, the CRA will open its NETFILE service on February 21st to electronically receive submitted returns

Mailed responses must be received or postmarked by the due date, and electronically submitted returns must be submitted by midnight local time of the date they are due.

Don’t Miss: How Much To Withhold For Self Employment Taxes

Q1 What If A Salaried Employee Does Not File Itr

Salaried employees should file ITR timely to avoid legal hassles. If you dont file ITR on time, you have to pay penalty charges and interest charges. If an individual continues to ignore ITR, the Income Tax Department may estimate your income on the basis of certain parameters and impose tax liabilities on you. Also, a notice will be served to you for an explanation regarding the non-payment of income tax. Not to forget, you will face problems in getting loans, credit cards, VISA, and many other benefits.

New Mexicos Law Says Every Person Who Has Income From New Mexico Sources And Who Is Required To File A Federal Income Tax Return Must File A Personal Income Tax Return In New Mexico

You must also file a New Mexico return if you want to claim:

- a refund of New Mexico state income tax withheld from your pay, or

- New Mexico rebates or credits.

Nonresidents, including foreign nationals and those who reside in states that do not have income taxes, must file when they have both a federal filing requirement and income from any New Mexico source whatsoever.

A member of the military who was a resident of New Mexico at the time of enlistment and has not changed the state of residency must file a New Mexico income tax return.

The income of members of an Indian nation, tribe or pueblo who work or live on lands outside the Indian nation tribe or pueblo of which they are members are subject to New Mexico income tax.

You May Like: Where Do I Pay Property Taxes