Irs Issues Another 430000 Refunds For Adjustments Related To Unemployment Compensation

IR-2021-212, November 1, 2021

WASHINGTON The Internal Revenue Service recently sent approximately 430,000 refunds totaling more than $510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

The IRS efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended tax return. So far, the IRS has identified over 16 million taxpayers who may be eligible for the adjustment. Some will receive refunds, while others will have the overpayment applied to taxes due or other debts.

The American Rescue Plan Act of 2021, enacted in March, excluded the first $10,200 in unemployment compensation per taxpayer paid in 2020. The $10,200 is the amount excluded when calculating one’s adjusted gross income it is not the amount of refund. The exclusion applied to individuals and married couples whose modified adjusted gross income was less than $150,000.

Earlier this year, the IRS began its review of tax returns filed prior to the enactment of ARPA to identify the excludible unemployment compensation. To date, the IRS has issued over 11.7 million refunds totaling $14.4 billion. This latest batch of corrections affected over 519,000 returns, with 430,000 taxpayers receiving refunds averaging about $1,189.

See the 2020 Unemployment Compensation Exclusion FAQs for more information, including details on filing an amended return.

Timeline For Unemployment Tax Refunds

With the latest batch of payments in July, the IRS has now issued more than 8.7 million unemployment compensation refunds totaling over $10 billion. The IRS announced it was doing the recalculations in phases, starting with single filers with no dependents and then for those who are married and filing jointly. The first batch of these supplemental refunds went to those with the least complicated returns in early summer, and batches are supposed to continue for more complicated returns, which could take longer to process.

According to an igotmyrefund.com forum and another discussion on , some taxpayers who filed as head of household or as married with dependents started receiving their IRS money in July or getting updates on their transcript with dates in August and September. No other official news from the IRS has been issued regarding payment schedule.

Millions Still In Line For Unemployment Tax Refunds

Since May, the IRS has issued more than 8.7 million unemployment compensation tax refunds totaling $10 billion. More than 4 million taxpayers are still in line.

getty

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 1.5 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. For this round, the average refund is $1,686 direct deposit refunds started going out Wednesday, and paper checks today.

Still waiting for your refund? An estimated 13 million taxpayers are due unemployment compensation tax refunds. Since May, the IRS has issued more than 8.7 million unemployment compensation tax refunds totaling $10 billion. That means more than 4 million taxpayers are still in line.

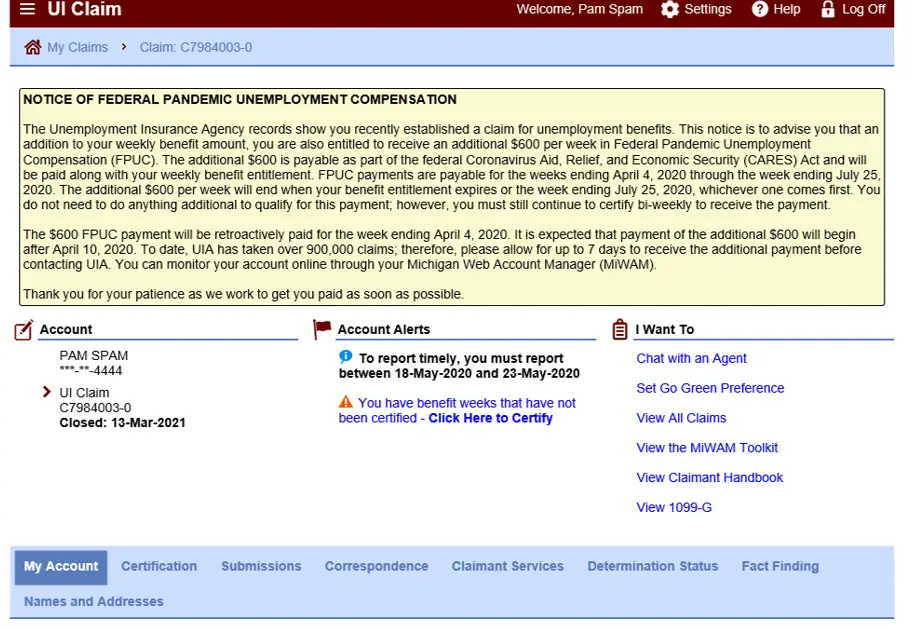

Why the special unemployment benefits tax refunds? In the March 11th Covid-relief American Rescue Plan, Congress made up to $10,200 of 2020 unemployment benefits nontaxable for individuals and married couples whose modified adjusted gross income was less than $150,000. Generally, unemployment benefits are taxable, including basic state benefits as well as the extra $600 weekly CARES Act federal pandemic benefits. The unemployment tax break was welcome news to many folks. The problem: A lot of taxpayers already had filed their 2020 tax return before Congress put in the retroactive tax break. Thats made things messy.

Further Reading:

You May Like: Csl Plasma Taxable

Q3 Will The Irs Send A Letter Or Notice If They Make Changes To My Unemployment Compensation

A3. Yes. We will send a notice when your account is corrected for the unemployment compensation exclusion. The notice will be mailed to the address we have on file for you. Usually, a notice of adjustment is received within 30 days of when the correction is made. Please keep this notice for your records.

Should You Call The Irs

Expect delays if you mailed a paper return, had to respond to an IRS inquiry about your e-filed return, claimed an incorrect Recovery Rebate Credit amount or used 2019 income to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- Wheres My Refund tells you to contact the IRS

Do not file a second tax return.

Paycheck Checkup: you can use the IRS Tax Withholding Estimator to help make sure your withholding is right for 2021.

Also Check: Is Doordash 1099

How Do I Determine The Unemployment Refund Amount

Because you didnt know the exact refund amount youre going to receive when the unemployment compensation is factored in your federal income tax return, you have to calculate it yourself. The easiest way to do this is by figuring out your taxable income by not adding the unemployment compensation exclusion youre eligible for and then tax liability. Lastly, compare it with your total tax payments and see how much is your total tax refund. You can then subtract the initial refund you received and find the difference to come up with the unemployment refund. Although this might take some work, take a look at the original copy of your federal income tax return for guidance.

Although this takes some work, it may not be worth it as the majority of the payments have arrived. Give the process a couple of days and youll receive your tax refund direct deposited into your bank account you provided with the IRS.

What To Do If You’re Still Waiting On Your Refund

It’s best to locate your tax transcript or try to track your refund using the Where’s My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Here’s the best number to call: 1-800-829-1040.

Read Also: Ein Number Lookup Irs

What The 2020 Unemployment Tax Break Is About

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

If the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAXREF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

Tax Transcript Codes: 971 846 776 290

Some taxpayers whove accessed their transcripts report seeing different tax codes, including 971 , 846 and 776 . Others are seeing code 290 along with Additional Tax Assessed and a $0.00 amount. Since these codes could be issued in a variety of instances, including for stimulus checks and other tax refunds or adjustments, its best to consult the IRS or a tax professional about your personalized transcript.

You May Like: Do You Have To Report Plasma Donations On Taxes

Million Unemployment Refunds Are Coming: Irs Timeline Tax Transcripts And More

The IRS has sent more than 8.7 million unemployment tax refunds.

Have you been waiting on your unemployment refund? If so, weve got good news for you: The IRS announced last week its disbursing another round of 1.5 million total refunds via direct deposit and by paper check. Some are reporting on social media that theyve received IRS updates on their tax transcripts with pending refund dates in late July and early August. But many other taxpayers say they havent received any money or clues that its on the way.

This is what we know. The first $10,200 of 2020 jobless benefits, or $20,400 for married couples filing jointly, was made nontaxable income by the American Rescue Plan. Taxpayers who filed their returns before the bill was passed in March are now eligible for an adjustment and a possible refund, which the IRS is supposed to issue automatically sometime this summer. On average, taxpayers can expect to receive $1,686, though it could be more or less, depending on individual factors.

Recommended Reading: Can You File Bankruptcy On Unemployment Overpayment

What To Know About The Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

As the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAX REF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

Recommended Reading: How To File Doordash Taxes

How To Call The Irs If You’re Waiting On A Refund

It’s best to locate your tax transcript or try to track your refund using the Where’s My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Here’s the best number to call: 1-800-829-1040.

What Else To Know About Unemployment Tax Refunds

The IRS has provided some information on its website about taxes and unemployment compensation. But were still unclear on the exact timeline for payments, which banks get direct deposits first or who to contact at the IRS if theres a problem with your refund.

Some states, but not all, are adopting the unemployment exemption for 2020 state income tax returns. Because some get full tax unemployment benefits and others dont, you might have to do some digging to see if the unemployment tax break will apply to your state income taxes. This chart by the tax preparation service H& R Block could give some clues, along with this state-by-state guide by Kiplinger.

Learn smart gadget and internet tips and tricks with our entertaining and ingenious how-tos.

Here is information about the child tax credit for up to $3,600 per child and details on who qualifies.

Recommended Reading: 1040paytax Review

If I Paid Taxes On Unemployment Benefits Will I Get A Refund

Congress made up to a $10,200 in jobless benefits payment in 2020 tax-free for people earning less than $150,000 a year. People might get a refund if they filed their returns with the IRS before Congress passed the law exempting a portion of unemployment payments from tax.

The IRS started issuing jobless tax refunds in May. As of July, the IRS had refunded more than $10 billion to some 9 million taxpayers. The IRS is expected to continue releasing the refunds throughout 2021.

Irs Issued 430000 More Unemployment Tax Refunds What To Know

After waiting three months, thousands of taxpayers finally received the money they were owed for the unemployment tax break.

The IRS has sent 8.7 million unemployment compensation refunds so far.

After more than three months since the IRS last sent adjustments on 2020 tax returns, the agency finally issued 430,000 refunds on Monday to those who qualify for the unemployment tax break. In total, over 11.7 million refunds have been issued, totaling $14.4 billion. The IRS says it plans to issue another batch by the end of the year.

Heres a summary of what those refunds are about: The first $10,200 of 2020 jobless benefits was made nontaxable income by the American Rescue Plan in March, so taxpayers who filed their returns before the legislation and paid taxes on those benefits are due money back.

Well tell you how to access your IRS tax transcript and why you should look out for an IRS TREAS 310 transaction on your bank statement. If youre a parent receiving the child tax credit this year, check out how it could affect your taxes in 2022. This story has been updated recently.

You May Like: How To File Taxes From Doordash

How And When Do I Get The Unemployment Tax Refund

People started seeing the refunds hit their bank accounts in May of this year. They continued through the summer.

The more complex returns took longer to process.

4 million refunds had been sent by the middle of July.

Those receiving the refunds by check mostly saw them after July 16.

More checks and direct deposits were sent at the end of July, and no payments were announced for Aug., Sept., or Oct.

Payments were sent in Nov. though, another 430,000 to be exact.

Another batch has been announced, but not when or how many.

Letters are sent to filers on behalf of the IRS to let them know a return was corrected.

The letters go out within 30 days of a correction.

There is no tool to track it, but you can check your tax transcript with your online account through the IRS.

Choose the federal tax option and the 2020 Account Transcript.

If you see a Refund issued then youll likely see a refund soon.

Unemployment Tax Refund Still Missing You Can Do A Status Check

Early last month, the IRS did release nearly three million refunds and said it would disburse the next batch in mid-June. However, that has not happened.

It already has been known for months that the Internal Revenue Service is struggling to stay on its timeline for promptly issuing to eligible Americans the various payments from tax refunds to coronavirusstimulus checks.

But it has been particularly frustrating for those individuals who are still waiting for their refunds from 2020 unemployment benefits. Early last month, the IRS did release nearly three million refunds and said it would disburse the next batch in mid-June. However, that has not happened.

The IRS plans to issue the next set of refunds in mid-June, the agency noted in its release. The review of returns and processing corrections will continue during the summer as the IRS continues to review the simplest returns and then turns to more complex returns.

For those individuals who received unemployment benefits last year, they were likely mailed a 1099-G form from their respective state unemployment insurance agency. This particular document should detail how much unemployment was received and how much, if any, was taken out for taxes.

One way to know whether the refund has been issued is to wait for a letter that the IRS is currently sending out to taxpayers.

Unemployment benefits are generally treated as taxable income, according to the IRS.

Don’t Miss: How To Appeal Property Taxes Cook County

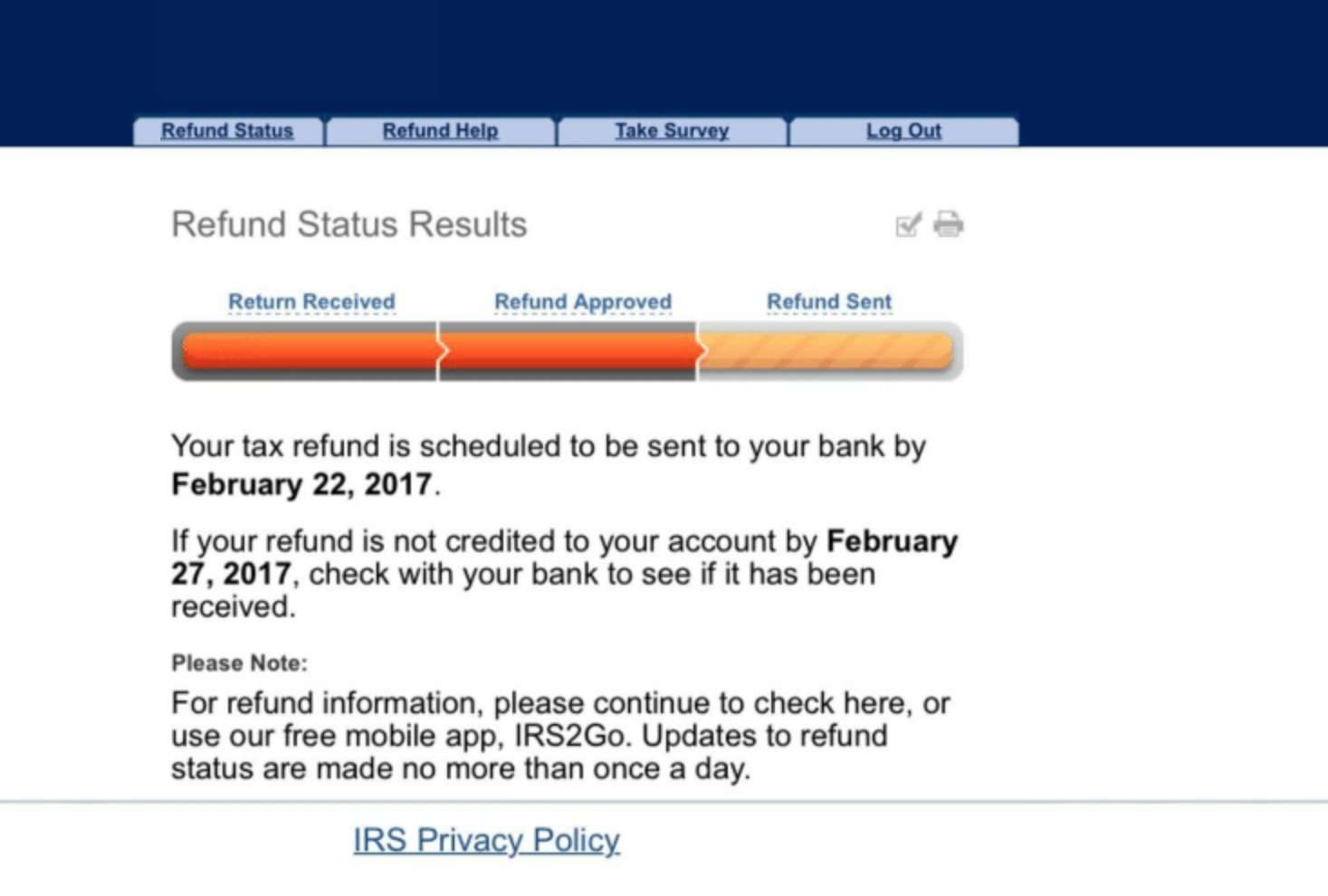

How To Use Tax Refund Trackers And Access Your Tax Transcript

The first way to get clues about your refund is to try the IRS online tracker applications: The Wheres My Refund tool can be accessed here. If you filed an amended return, you can check the Amended Return Status tool.

If those tools dont provide information on the status of your unemployment tax refund, another way to see if the IRS processed your refund is by viewing your tax records online. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Heres how to check your tax transcript online:

1. Visit IRS.gov and log in to your account. If you havent opened an account with the IRS, this will take some time as youll have to take multiple steps to confirm your identity.

2. Once logged in to your account, youll see the Account Home page. Click View Tax Records.

3. On the next page, click the Get Transcript button.

4. Here youll see a drop-down menu asking the reason you need a transcript. Select Federal Tax and leave the Customer File Number field empty. Click the Go button.

5. The following page will show a Return Transcript, Records of Account Transcript, Account Transcript and Wage & IncomeTranscript for the last four years. Youll want the 2020 Account Transcript.

6. This will open a PDF of your transcript: Focus on the Transactions section. What youre looking for is an entry listed as Refund issued, and it should have a date in late May or June.