The Exclusive Use Test

Broadly speaking, you must be able to show that a portion of your home is your principal place of business, and that this space is regularly and exclusively used for conducting business. If you do not have a dedicated space for business in your home, you are not allowed to take the home office deduction. The IRS refers to this as the exclusive use test.

For instance, a spare room in your home that is only used as your business office can be claimed for the home office deduction. However, a bedroom or living room where you work on business tasks cannot be claimed, because you use those spaces for other personal purposes.

There are exceptions to the “exclusive use” test, including businesses that store inventory or product samples or use their home as a daycare facility.

Additionally, you must be a registered business owner or independent contractor to take the home office deduction. You cannot take the home office deduction if you simply work from home as an employee of a business.

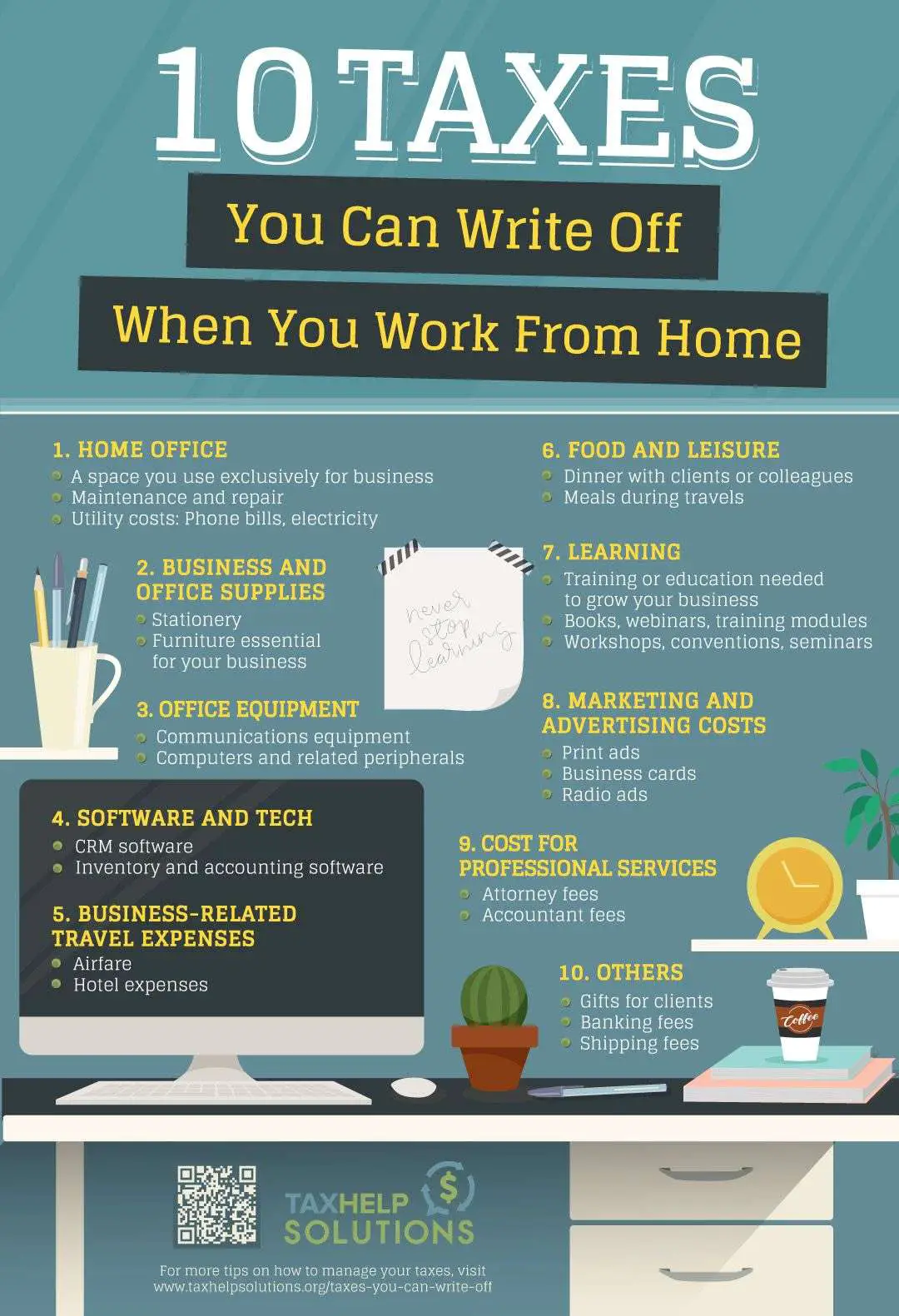

A Simple Guide To Small Business Write Offs

Business write offs are deductions from a businesss earnings. For income tax purposes, write offs are business expenses that get subtracted from revenue to find your total taxable revenue. For example, a freelance interior designer can claim car mileage as a tax deduction since they travel to meet with clients.

There can be some confusion when it comes to what you can or cant claim as a business write off. But the good news is that its fairly simple to understand when you have the right information. Heres a simple guide to small business write offs.

In this article, well cover:

What Can I Write Off On My Taxes For 2021

There are dozens of tax deductions and credits that can help lower your tax bill. Some of the more common deductions include those for mortgage interest, retirement plan contributions, HSA contributions, student loan interest, charitable contributions, medical and dental expenses, gambling losses, and state and local taxes.

Common credits include the child tax credit, earned income tax credit, child and dependent care credit, saver’s credit, foreign tax credit, American opportunity credit, lifetime learning credit, and premium tax credit.

Read Also: Do You Have To File Taxes For Doordash

What Are Ordinary And Necessary Expenses

What kind of business expenses count as tax deductions? The IRS says that an expense must be both âordinaryâ and ânecessaryâ to be deductible.

How are those terms defined?

An ordinary expense is normal for your industry.

A necessary expense is âhelpful and appropriateâ for your industry.

This means an expense has to be directly related to your business and essential to running it.

For example, the web hosting fees for maintaining your companyâs website are both ordinary and necessary. Whatever your industry, you need an online presence in todayâs digital era to advertise and connect with clients. Well-maintained websites arenât free.

Industry practices matter. If you run a kayak school, the kayaks you purchase for children to learn in are both ordinary and necessary .

But if youâre a lawyer and you buy a kayak to âtake clients outâ it doesnât count, because you donât need a kayak to practice law. Make sense?

Likewise, a private chef uses a fancy blender to make food for her clients, but an accountant who buys the same blender to make smoothies for the waiting area doesnât have that justification.

Thereâs no hard and fast list covering every industry, but the IRS does tend to audit small business owners who claim interesting deductions, so playing by the rules is strongly advised.

How Do Tax Write Offs Work The Basics

If your business runs from home there are things such as mortgage interest, state taxes or self employment costs, amongst others.

Therefore it is smart to itemize all of your expenses and costs.

In regards to this, tax preparation software, or a fantastic tax preparer, might help you navigate the labyrinth of tax breaks.

Nevertheless, it can help comprehend how do tax write offs work if you want to save on paying the high fees of a tax lawyer each year.

as you go throughout the year, ideally amassing invoices in route.

Read Also: Is Doordash Taxed

Expenses Of Going Into Business

Once you’re running a business, expenses such as advertising, utilities, office supplies, and repairs can be deducted as current business expensesbut not before you open your doors for business. The costs of getting a business started are capital expenses, and you may deduct $5,000 the first year you’re in business any remainder must be deducted in equal amounts over the next 15 years .

If you expect your business to make a profit immediately, you might be able to work around this rule by delaying paying some bills until after you’re in business or by doing a small amount of business just to officially start. However, if, like many businesses, you’ll suffer losses during the first few years of operation, you might be better off taking the deduction over five years, so you’ll have some profits to offset.

What Are Eligible Expenses

According to the tax code, the expense must be ordinary and necessary for carrying on the business.

Now, the tax law does not specifically define what ordinary and necessary means.

Therefore, it is up to you to determine what expenses qualify as ordinary and necessary for your business.

Now, the IRS does attempt to define this in a publication.

According to the publication, an ordinary expense is one that is common and accepted in your business or trade.

And a necessary expense is one that is helpful or appropriate for your trade or business.

For example, an ordinary and necessary expense for a car dealership might be buying car parts.

While for our accounting firm, it might be technology and software. Surely, we couldnt deduct car tools for our accounting business.

Maybe if those car tools were being applied to a vehicle that was being used for business, then sure.

But the idea is that you cant just start buying anything and writing it off. Thats when you can start getting into some big trouble with the IRS.

Read Also: Do You Have To Pay Taxes On Plasma Donation Money

What Home Expenses Can You Write Off

There are certain expenses taxpayers can deduct. They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. Taxpayers must meet specific requirements to claim home expenses as a deduction. Even then, the deductible amount of these types of expenses may be limited.

How You Can Deduct Business Expenses From Your Taxes

The IRS states that business expenses must be both ordinary and necessary to be valid as tax-deductible. This means that the expenses should be common and reasonable for your business industry. They must also be necessary for the running of your business.

Necessary doesnt always mean that your business could not operate without the expense though. Expenses that arise from something helpful to your business can also count.

Business expenses do not include personal expenses or capital expenses in the context of tax write-offs.

Sole proprietors and single-owner LLCs will record their deductions on Schedule C while S corporations will record their deductions on Form 1120S.

Also Check: Doordash Pay Calculator

Is It Better To Claim 1 Or 0

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. … If your income exceeds $1000 you could end up paying taxes at the end of the tax year.

Use Our List To Create A Small Business Tax Deductions Checklist For Your 2022 Tax Return

Now that you know about some of the most common small business tax deductions, you can use our checklist to ensure youre taking advantage of all these potential deductions this tax season. Also, there are more business deductions out there if you do your research, and its always a good idea to consult with a professional for tax advice . Similarly, you should also make a list of non-deductible business expenses so you are full aware what you cant deduct.

You May Like: Does Doordash Send You A 1099

First Job Moving Expenses

Heads up all you recent college grads! If you moved more than 50 miles to take your first job, you can deduct the cost to get you and your stuff to your new location.

The write-offs include 16.5 cents per mile for driving your own car and any parking fees or tolls. You can take this write off even when you dont itemize.

Books And Legal And Professional Fees

Business books, including those that help you do without legal and tax professionals, are fully deductible as a cost of doing business.

Fees you pay to lawyers, tax professionals, or consultants generally can be deducted in the year incurred. But if the work clearly relates to future years, they must be deducted over the life of the benefit you get from the lawyer or other professional.

You May Like: Can I Write Off Mileage For Doordash

What Are Some Itemized Tax Write Offs

There are eight common expenses that qualify for itemized tax write-offs. These are mortgage interest, payment for certain taxes, self-employment expenses, home office expenses, medical and dental expenses, charitable giving, salaries paid by sole proprietors to their kids, and casualty and theft losses.

The Itemized Method requires that you keep receipts and supporting documents as proof of claimable expenses. However, you dont need to submit these receipts to the IRS on the day that you file your income tax return. Theres a possibility that you could later be audited, though. So keep your receipts handy and well-filed.

Work From Home Make Sure You Claim These Expenses

If you use your home for business whether youre a contractor, sole trader, in partnership or own a company you can claim a portion of household expenses. You can claim 100% of expenses that are solely for business purposes, eg a business phone line. For the rest, you can claim the proportion of your house that you use for work.

In this example, the house is 100 square metres and the office 10 square metres 10% of the total area. So the owner can claim 10% of expenses not solely for business, eg a power bill. Whatever you claim, remember to keep a record of each item.

- Landline phone costs:

- 50% if thats how much you use for business purposes.

- 100% if its for business use only.

Also Check: Pay Taxes On Plasma Donation

What Is A Tax Deduction

A tax deduction is an item you can subtract from your taxable income to lower the amount of taxes you owe. You can choose the standard deductiona single deduction at a fixed amountor itemize deductions on Schedule A of your income tax return.

If the value of your itemized expenses is greater than the standard deduction for your filing status, it makes sense to itemize. Allowable itemized deductions include mortgage interest, charitable gifts, unreimbursed medical expenses, and state and local taxes.

How Much Tax Write Off For Donations Can I Avail Of

The Tax Cuts and Jobs Act of 2017 increased the allowable deduction for charitable contributions which may be in cash, property, or other goods valued at their fair market prices. Taxpayers can now contribute up to 60% of adjusted gross income, provided they give to a qualified tax-exempt organization.

Also Check: Http Efstatus.taxact.com

How Much Are Tax Write

The amount that a tax write-off is worth depends on several factors surrounding the deduction or credit. Many tax deductions and credits have limits that are prescribed by the tax provisions and the limits can depend on several factors like your filing status, income, and dependents.

In some situations, the amount you can write-off may be limited based on your adjusted gross income such as student loan deduction which begins to phase out with income over $70,000 as a single person or $140,000 for married filing joint couples for 2020.

In some cases, its possible that taking the tax write-off would not be to your benefit. Say your total itemized deductions are less than the standard deduction amount for your filing status, it would be in your best interest to choose the standard deduction instead. Fortunately, when you file with TurboTax, it eliminates the guessing game and figures out which option will benefit you the most based on your entries.

What Not To Do

Dont let the tax addiction get to you. What I mean is, dont go spending all of your profits thinking that you are going to cut your tax bill and avoid paying the money on tax.

With this thinking, most people make the mistake of saving 25 pennies, but losing the whole dollar .

It doesnt make sense.

Unless you are making smart decisions to re-invest into the growth of your business or finances.

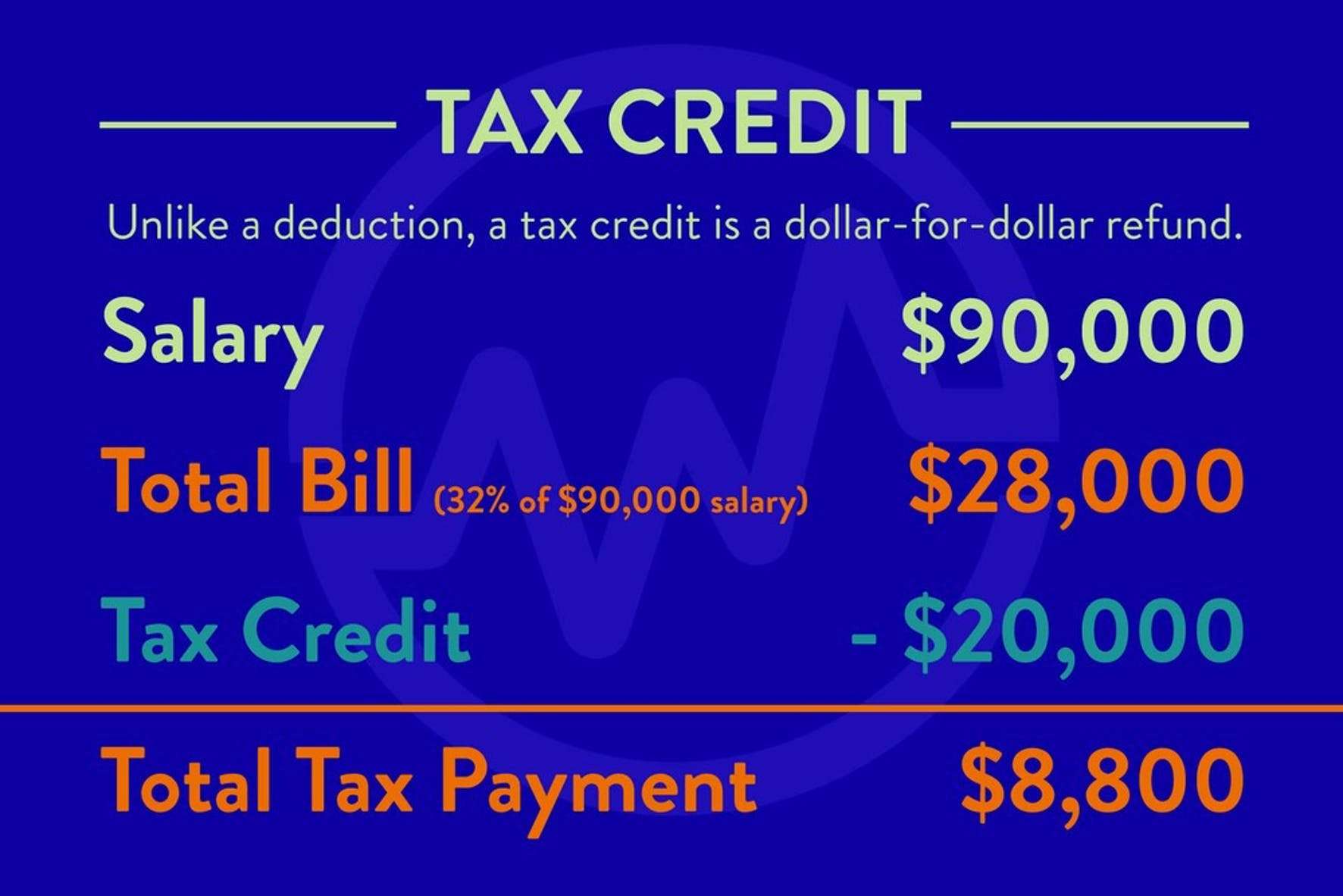

At the hierarchy of tax breaks, credits provide you the maximum bang for your dollar.

The largest categories for credits include retirement, property, children, education and energy efficiency.

These are examples of what you can do to illustrate how do tax write offs work:

Also Check: How Do I Get My Doordash 1099

Situation #: A Business Owner Takes A Trip For Pleasure But Has A 30

Is the whole trip deductible because of your business meeting? No. The IRS says that your travel expenses are deductible if the primary purpose is business, even if some portion of the trip is for pleasure, Raffensperger says. Since the meeting was only 30 minutes, and not the sole purpose of the trip, the entire trip isnt deductible, but Raffensperger says you can write off the mileage for your travel. Under current tax laws, you get 56 cents per mile.

How To Claim Work Expenses On Your Taxes: Choose A Deduction

Before you start going through every line item of every receipt, you may want to save yourself the trouble and figure out which you’ll take: the standard deduction or the itemized deduction.

Standard deduction: The standard deduction is an all-encompassing flat rate, no questions asked. For tax year 2021, the flat rate is $12,550 for single filers and those married filing separately. The rate is $25,100 for married filing jointly. Taking this route is much easier than itemizing.

Itemized deduction: If you want to claim work expenses, medical payments, charitable contributions or other expenses, you’ll use the itemized deduction. It’s more time-consuming than the standardized deduction — and you’ll need proof of the expenses you wish to deduct.

If you’re going to claim and itemize your work expenses, you’ll need to complete Schedule A of Form 1040. You need to have sufficient proof for each itemized expense, which means tracking down receipts. If your standard deduction is greater than the sum of your itemized deductions, save yourself the trouble and take the flat-rate.

A direct deposit of news and advice to help you make the smartest decisions with your money.

Also Check: How To Get Your 1099 From Doordash

Continuing Education And Training Expenses

You may be able to deduct the cost of ongoing education and training expenses if they are relevant to your business, says McGrant. “During the pandemic, self-employed people use the time to learn more about their businesses by taking additional classes online or enrolling in a program.”

But if the pandemic has made you consider switching careers, you can’t deduct training that trains you for a new career. In addition, “the classes must be work-related education expenses during the year to qualify. You cannot write off a class you enrolled in for pottery if your business is graphic design,” McGrant says.

However, she points out that if you are eligible, there are several expenses that can be deducted, meaning not just the fee for the course itself. “If eligible, you may be able to deduct such expenses as tuition, books, supplies, fees, and transportation costs.”

What Is A Tax Write Off And How Does It Work

Tax write offs are concessions given by the government to taxpayers so they can claim specific expenses as deductions from the amount of taxes they have to pay. Taxpayers can avail of certain tax write offs, more commonly referred to as deductions, if they meet certain criteria. These can be claimed regardless of whether one chooses to file his income tax return via the Itemized Method or decides to avail of the Fixed Standard Deduction.

Don’t Miss: Look Up Employer Ein Number

Popular Tax Deductions And Tax Credits For Individuals

There are hundreds of deductions and credits out there. Here’s a drop-down list of some common ones, as well as links to our other content that will help you learn more.

Deduct up to $2,500 from your taxable income if you paid interest on your student loans.

This lets you claim all of the first $2,000 you spent on tuition, books, equipment and school fees but not living expenses or transportation plus 25% of the next $2,000, for a total of $2,500.

You can claim 20% of the first $10,000 you paid toward tuition and fees, for a maximum of $2,000. Like the American Opportunity Tax Credit, the Lifetime Learning Credit doesnt count living expenses or transportation as eligible expenses. You can claim books or supplies needed for coursework.

Generally, its up to 35% of up to $3,000 of day care and similar costs for a child under 13, a spouse or parent unable to care for themselves, or another dependent so you can work and up to $6,000 of expenses for two or more dependents. In 2021, it’s up to 50% of $8,000 of expenses for one dependent or $16,000 for two or more dependents.

This could get you up to $2,000 per child and $500 for a non-child dependent in 2020 and up to $3,600 per child in 2021.

For the 2020 tax year, this item covers up to $14,300 in adoption costs per child. In 2021, it’s $14,440.

In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income for the tax year.