Using Your Tax Credit

You can use all, some, or none of your premium tax credit in advance to lower your monthly premium. For example:

- Save money now and get the financial help in advance to lower your monthly premiums. Note: any expanded tax credits you are eligible for through the American Rescue Plan but were not able to collect in advance will be provided to you by way of your tax return.

- Save money later and wait until you file your federal taxes to get a premium tax credit added to your tax refund.

Understanding The Advanced Premium Tax Credit

The advanced premium tax credit is a credit in the Patient Protection and Affordable Care Act , also referred to colloquially as Obamacare, which was signed into law on March 23, 2010, by President Barack Obama.

The tax credits are not like regular tax credits that must be calculated and applied to the taxpayers tax liability and either refunded or used to reduce liability when taxes are filed for the previous year.

In contrast, the Advanced Premium Tax Credit is calculated and sent directly from the government to the health insurance companies that insure individuals who are eligible for the credit. The individual gets a discount on monthly premium payments in the amount of the tax credit. Anyone eligible for this tax credit receives an amount determined by income.

Those who make more will receive a smaller credit and a smaller monthly discount, while those with less income will receive larger credits and a larger discount on healthcare premiums. Because this tax credit is a direct payment, individuals who receive it do not have to pay the full amount of their monthly health insurance premium up front, but can pay the discounted amount.

Taxpayers get a discount on the monthly premium payments in the amount of the tax credit.

The American Rescue Plan Act of 2021 removes the cap on income for the advanced premium tax credit for 2021 and 2022. The act limits the premiums for these plans to 8.5% of the payers modified adjusted gross income on the top-end .

How Do You Know If You Get The Advance Premium Tax Credit

When you apply for health insurance at Healthcare.gov or your state marketplace, youll find out whether you qualify for the advance premium tax credit based on your estimated income. Youll also see how much youll need to pay in premiums after the credit is applied to the cost of the policies available in your area.

Also Check: How To Appeal Property Taxes In Cook County

How Do I Get My Advance Premium Tax Credit

Claiming your Advance Premium Tax Credit is relatively simple, but here are the things you need to keep in mind about the process:

- You will need to submit Form 8962 with your regular tax return, which can be done either electronically or by mail.

- This form allows you to submit details about your income, family size, type of health insurance, and other important information to determine the amount of credit for which you are eligible.

- This information is used to claim your premium credit and reconcile, or adjust, the amount you will receive based on changes to your finances from the previous year.

You will also need to file a full tax return in order to get the Advance Premium Tax Credit, even if your income or other circumstances would otherwise not require you to do so.

Tax Refunds Can Be Affected

Unless youre a salaried employee, its not always easy to predict how much youll make in a year.

The same can be said if youre underemployed, unemployed, self-employed or if you work seasonally.

In that case, you likely estimated your gross income when you applied for health insurance through the marketplace.

When you file your 2020 income tax return, you need to reconcile the amount of tax credit you received with the amount you should have collected based on your actual income for the year. This process can easily be completed through TaxActs filing software.

If your reconciliation results in a bigger tax credit than you received, you overestimated your income. The higher you estimate your income, the less credit you are likely to receive.

When this occurs, the difference is included as part of your refund or as a reduction of your total income tax bill.

Of course, the opposite can be true too. If you underestimated your income and qualified for less credit than you used, you may have to pay back some of the credit.

Also Check: Employer Tax Identification Number Lookup

Reconciliation And Repayment Of Premium Tax Credit

When you prepare your taxes, youll have to reconcile the advance that was paid to your insurance company. Figure this with the actual amount of the premium tax credit youre eligible for.

This is necessary since there can be a difference between the advance and your actual premium tax credit.

So, if the amount of premium tax credit youre eligible for is less than the advance you received, well do one of these for you:

- Subtract the difference from your refund

- Add the difference to your balance due

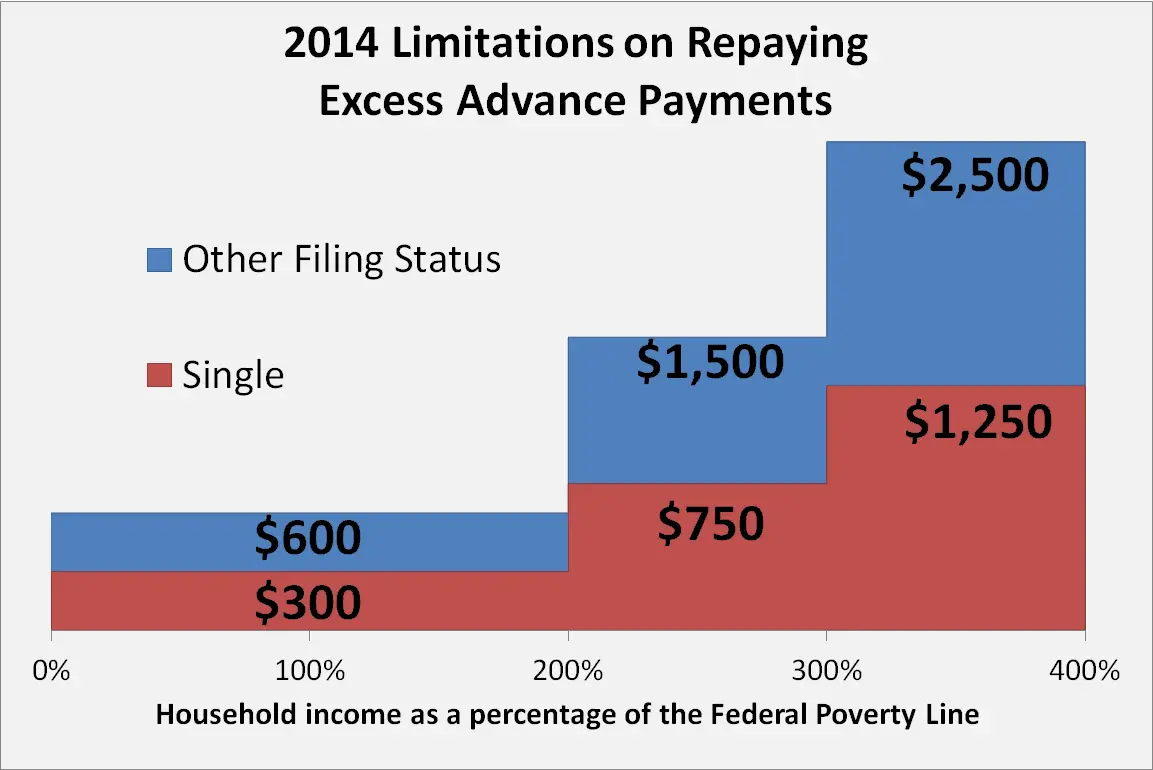

- Keep in mind that the difference is subject to certain caps.

However, if the amount of premium tax credit youre eligible for is more than the advance you received, well do one of these:

- Add the difference to your refund

- Subtract it from your balance due

Why do I have to do this?

The advance premium tax credit is based on your estimated income for the year and your family size. However, your income can change since its only an estimate, and your family size can also change. After the end of the year, when you prepare your taxes, we calculate the premium tax credit based on your actual household income.

When theres a difference in these amounts, you either get a credit on your return, or youll need to repay some or all of the excess you received.

And if your household income is less than 400% of the federal poverty level, the amount youll need to repay will be limited.

How can I avoid it?

To report a life change, visit www.healthcare.gov.

Related Topics

What Is The Cost

The greatest thing about CuraDebt is the way theyve priced their service. They dont charge upfront fees. Only pay when youve paid each of your debts.

They also do not charge high charges either. In the average, youll need to pay between 20 and 20 percent of the debt that you settled through them.

On average, this type of industry can charge anywhere between 15 and 25 percentage.

In addition, customers can expect to pay off their debts in between 2 and 4 years. But, it also differs in relation to the amount you save per month.

Additionally, they claim that you can save up to 30% when you factor in their fees in your equation.

However, the claim may depend on your situation. Some customers have even talked about saving between 50% and 80%.

Read Also: Www.myillinoistax

Who Qualifies For The Aptc

People who buy health insurance through Healthcare.gov or their state insurance marketplace can qualify for the advance premium tax credit based on their income.

You arent eligible for the credit if you can be claimed as a dependent on another persons tax return or if you use the married filing separately filing status. You also cant receive this credit if you get health insurance in another way, such as Medicare or through your job.

How To Qualify For The Advance Premium Tax Credit

To qualify for the advance premium tax credit, you must have health insurance coverage through Healthcare.gov or your state insurance marketplace. You cant be claimed as a dependent on another persons tax return.

You also arent eligible if you file your tax return using the status of married filing separately. You additionally cant receive this tax credit if you get your health insurance through your employer.

In the past, you could only qualify for the tax credit if your income was less than 400% of the federal poverty level. However, the American Rescue Plan Act of 2021 eliminated that income cap for 2021 and 2022. The size of the tax credit still varies based on your income, but you may receive a tax credit even at higher income levels.

The lower your income, the larger the tax credit. If you received any unemployment compensation in 2021, you can also receive a larger tax credit for the year.

Read Also: Louisiana Paycheck Tax Calculator

What Factors Affect An Enrollee’s Premium Tax Credit

Premium tax credit eligibility depends on income . Although the rules are different in 2021 and 2022, its normally available to people with income between 100 percent and 400 percent of the federal poverty level, although the lower bound in most states, is actually 138 percent of the federal poverty level, due to Medicaid expansion .

For 2021 and 2022, the income cap for premium tax credit eligibility does not apply. So depending on the cost of the benchmark plan relative to a households income, some people can qualify for a premium tax credit in 2021 and 2022 even with an income well above 400% of the poverty level. This is due to the American Rescue Plan, which was enacted in March 2021 to address the ongoing COVID pandemic. Under the new law, premium tax credit eligibility for people over 400% of the poverty level is based on keeping the cost of the benchmark plan at no more than 8.5% of household income, and this is retroactive to January 2021. So for 2021 and 2022, there is no income limit for subsidy eligibility instead, it depends on what percentage of your income youd otherwise have to pay for the benchmark plan.

Because premium tax credits are usually paid in advance, they are reconciled against your actual income when the year is over. This means enrollees who underestimate their income may have to pay back a large portion of their subsidy or all of it when filing their taxes.

What Is The Credit For Small Employer Health Insurance Premiums

If your small business pays for health insurance for its employees , you may be eligible to claim a credit for some of the costs related to the employee coverage. To encourage business owners and non-profit organizations to provide health insurance benefits for their employees, the federal government offers a tax credit to partially offset the cost of premiums for eligible small employers.

If you are eligible for this credit, you can claim it by completing Form 8941, Credit for Small Employer Health Insurance Premiums and submitting the form with your tax return.

To qualify for the credit your business or tax-exempt organization must:

- Have fewer than 25 full-time equivalent employees

- Pay average wages that are under the inflation-indexed annual rate set by the IRS

- Offer a qualified health plan for employees through the Small Business Health Options Program Marketplace

- Pay at least half the cost of employee-only health care coverage for each employee

Important: You can only claimthe small employer health insurance credit for a two-year period, and those two years must be consecutive.

You May Like: Is Plasma Donation Taxable

Confirm Your Health Insurance Premium Assistance

The Advanced Premium Tax Credit is a tax credit to lower your monthly health insurance premium. When you enrolled, you were asked to estimate your expected income for the year. If you qualified for a premium tax credit based on your estimate, you can use that amount to lower your premium.

If you qualified for the APTC, you have just 30 days to send in proof that you qualify. If you miss the deadline, you will lose your chance for lower premiums for the rest of 2021.

Please call 713.295.6704 today for help with confirming your health insurance premium assistance.

Eligibility Requirements For The Premium Tax Credit

You must meet all of the following criteria to qualify for the premium tax credit:

- You must get your health care coverage through the Marketplace

- You can’t be eligible for health care coverage through alternative options such as your employer or the government

- Your income needs to fall within a certain range

- Another person can’t claim you as a dependent on their return

- You must file a joint return if you’re married

Changes in income and family size may affect your eligibility, so report these to the Marketplace to ensure you receive the appropriate tax credit. The premium tax credit program uses the federal poverty line to determine the income ranges that qualify you for the credit.

The U.S. Department of Health and Human Services reports the annual federal poverty levels, which vary depending on whether you live in the contiguous 48 states and the District of Columbia, Hawaii, or Alaska.

The range is 100% to 400% of the federal poverty line amount for the size of your family for the current tax year.

For example, an individual earning between $12,880 and $51,520 in 2021 meets the income criteria to qualify, while a family of four qualifies with household earnings between $26,500 and $106,000.

Even if your income makes you eligible, you must meet the other qualification criteria as well. You’ll use Form 8962 to determine your full eligibility to claim the premium tax credit.

Recommended Reading: Tax Lien Investing California

What Tax Forms Do You Need To Claim A Premium Tax Credit

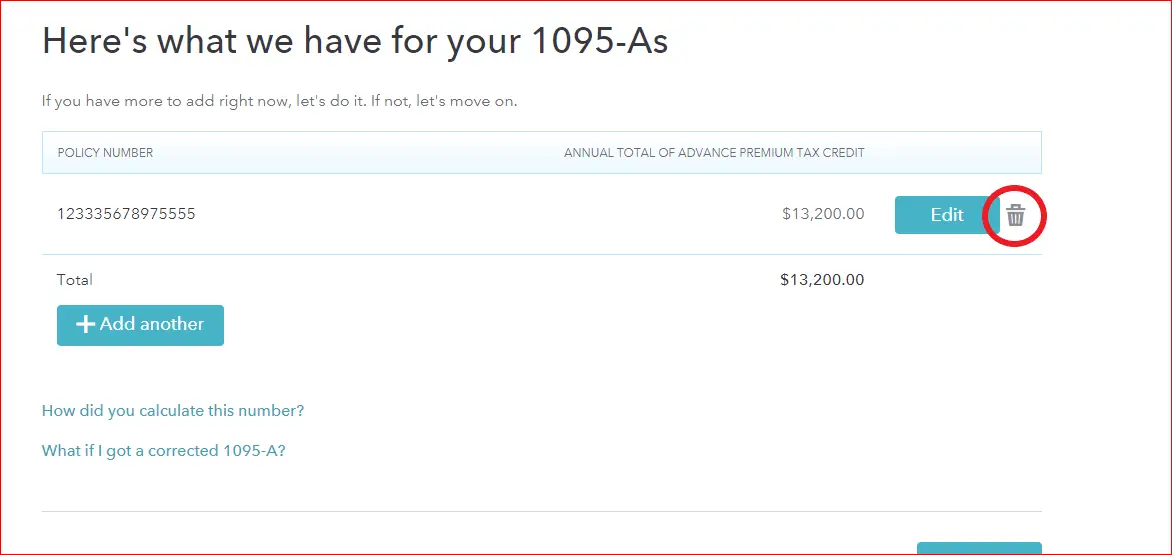

You will need Form 1095-A, Health Insurance Marketplace Statement and Form 8962, Premium Tax Credit to claim the premium tax credit.

You should receive Form 1095-A, Health Insurance Marketplace Statement by January 31. This form is usually sent in the mail by the health insurance marketplace. If you have trouble finding your 1095-A, you can sign in to your HealthCare.gov account.

Your 1095-A includes the following information:

-

Monthly premiums paid by you or family members

-

Information about your insurance policy

-

Monthly advance payment of premium tax credits paid on your behalf

-

Total of premium tax credits used

-

Number of people in your household covered by a health insurance marketplace plan

Review Form 1095-A for accuracy. This form will help you reconcile premiums paid with premium tax credits used. If you received too much, you will have to pay back any excess premium subsidy you received.

Use Form 1095-A to complete Form 8962, Premium Tax Credit . You should submit this form with your tax return to claim the premium tax credit. You are also required to complete this form if you or a family member received APTC during the year. Download Form 8962 from the IRS website for the tax filing year you are claiming the premium tax credit for.

Advance Payments Of The Premium Tax Credit

When you enroll in coverage and request financial assistance, the Marketplace will estimate the amount of the premium tax credit you will be allowed for the year of coverage. To make this estimate, the Marketplace uses information you provide about:

- Your family composition

- Your household income

- Whether those you are enrolling are eligible for other non-Marketplace coverage

Based on the estimate from the Marketplace, you can choose to have all, some, or none of your estimated credit paid in advance directly to your insurance company on your behalf. These payments which are called advance payments of the premium tax credit or advance credit payments lower what you pay out-of-pocket for your monthly premiums.

If you do not get advance credit payments, you will be responsible for paying the full monthly premium.

You May Like: How Much Tax For Doordash

How Did The Elimination Of Federal Funding For Cost

In late 2017, the federal government stopped reimbursing insurers for providing cost-sharing reductions which lower co-pays, deductibles, and other out-of-pocket expenses in silver plans.

Silver plan enrollees with incomes below 250% of the poverty line are legally entitled to CSRs regardless of whether the government reimburses insurers for providing them. As a result, insurers in most states began incorporating the costs of providing CSRs into all silver plans. This practice is called Silver loading, and it increases the premium subsidies available to all enrollees.

A few states have required insurers to incorporate costs from CSRs using a different method called broad loading which did not significantly increase premium subsidies for enrollees in those states.

About Private Insurance Tax Credit

Advance Payment of Premium Tax Credit was created under the Affordable Care Act to assist taxpayers with insurance premiums, and provides financial assistance to ensure individuals have access to health coverage. Consumers may shop for a qualified health plan using their tax credit. The APTC or tax credit is paid monthly to their health insurance provider to assist with monthly premium costs.

APTC can only be used with qualifying health insurance plans purchased through Your Health Idaho , Idaho’s Health Insurance Exchange. The amount of the tax credit is based on the individuals estimated modified adjusted gross income for the year. When tax filers file their income taxes, a reconciliation takes place based on the actual income that is reported for their household. Visit the apply page for eligibility requirements.

Your Health Idaho is the only place where Idahoans can receive a tax credit to help offset the monthly cost of health insurance coverage. Some Idahoans may also qualify for cost-sharing reductions, which lower out-of-pocket costs for things like co-payments and prescriptions.

If you need help along the way, certified agents, brokers, and enrollment counselors are available to help you free of charge. Find free help in your area.

To provide you with the best service, your determination and management of benefits will depend on which benefits you receive.

Read Also: When Do You Do Tax Returns

Tax Credits For Health Insurance Premiums

Health insurance is often one of the largest household expenses. It can also be one of the most expensive employee benefits for small businesses to provide. To help protect against costs becoming prohibitive there are tax credits and deductions avaible to individuals, self-employed taxpayers and qualifying small businesses.