How Can I See If My Taxes Were Filed Or Not

When was the last time my texis been done

wrote:

When was the last time my texis been done

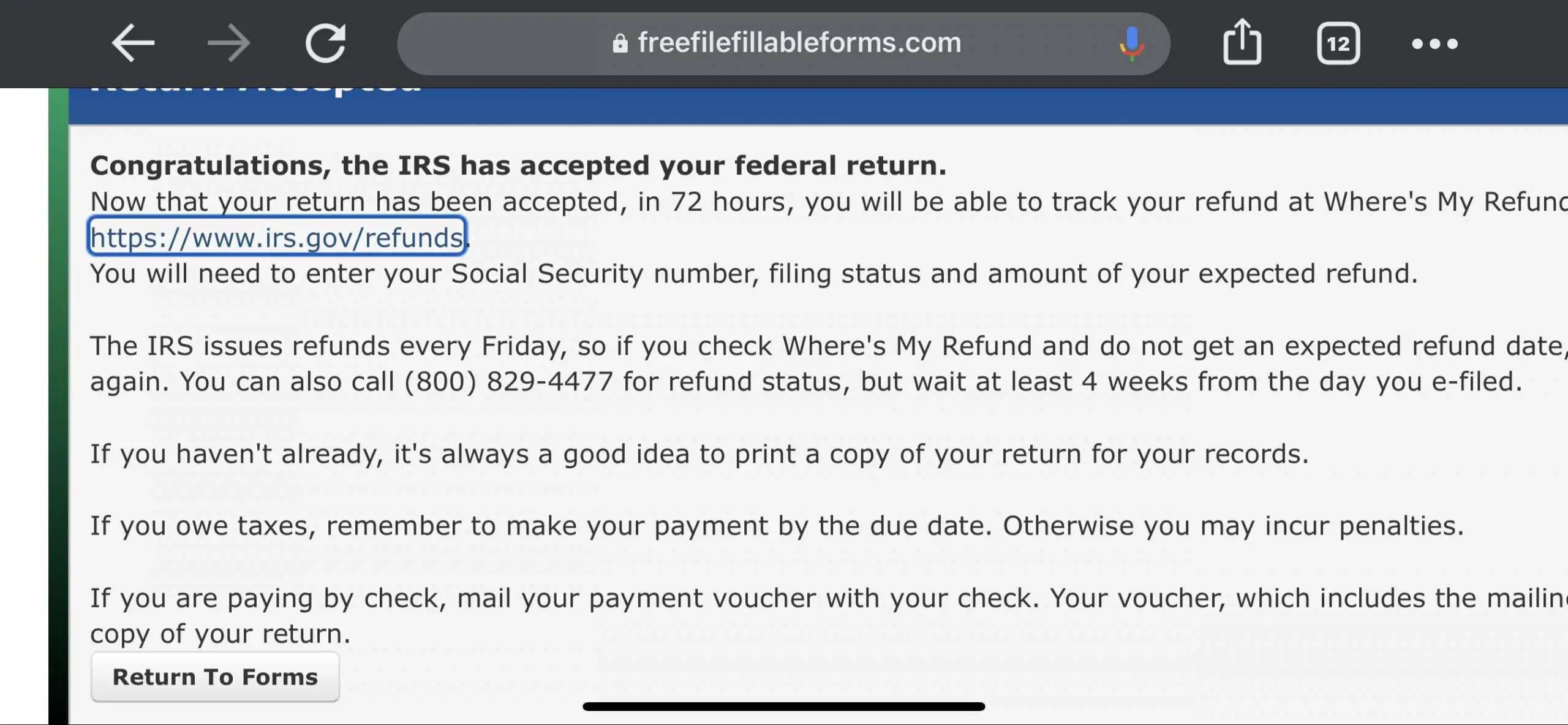

To check the status of an e-filed return, open up your desktop product or log into your TurboTax Online Account. You can find your status within the TurboTax product.If accepted by the IRS use the federal tax refund website to check the refund status – If accepted by the state use this TurboTax support FAQ to check the state tax refund status –

Some Tax Refunds May Be Delayed In 2021

In addition to the delays we outlined above, if you claimed the Earned Income Tax Credit and the Additional Child Tax Credit , your tax refund may also be delayed. If you claimed these credits, the IRS started to issue these tax refunds the first week of March if you claimed these credits.

Your financial institution may also play a role in when you receive your refund. Since some banks do not process financial transactions during the weekends or holidays, you may experience a delay in processing. If you opt to receive your tax refund by paper check, use our tax refund schedule to determine when you can expect to receive your refund.

Finally, you can expect your tax refund to be delayed if you filed an amended tax return. The IRS processes amended tax returns from three weeks up to 16 weeks after receipt. You can check the status of your amended tax return here.

Refund Delays Due To Fraud

Another thing that could affect your IRS tax refund status is fraudulent activity on your Social Security number. You likely wont even be aware of this until you file. Identity theft has become a persistent problem with the IRS, even though the agency has put protections in place to keep taxpayers safe.

Fraudulent tax activity happens when someone uses your Social Security number to file a return and get access to your refund. If this happens, the IRS may notice it in advance and send a letter alerting you to it, but often the agency will find out when you try to file your own return, and they already have one filed on your behalf.

To prevent tax filing fraud, do your best to safeguard your Social Security number. Try to avoid using it as an identifier or including it on forms you submit non-securely.

If you work as an independent contractor, consider obtaining an Employer ID Number that you can use when filling out Form W-9 to perform work for someone. You can get an EIN in a matter of minutes on the IRS website and any taxes paid will be connected to your Social Security number without having to give that information to random third parties.

Read More:What Happens If You Don’t File Taxes?

Read Also: Doordash Payable 1099

Better To File Now Even If You Cant Pay

Some people avoid filing taxes because they cant afford to pay the tax bill. However, you should always file on time, even if you cant pay all of the taxes due. If you wait, youll be faced with a late filing penalty which is just one more thing youll have to pay. The failure-to-file penalty is 5 percent per month based on the amount of tax you owe.

If you are unable to pay your tax bill quickly, the IRS has payment installment plans. Approval of an installment plan is automatic if you owe $25,000 or less, can prove you cannot pay the total amount you owe at the time its due, and are able to pay off the tax in three years or less. In addition, you or your spouse cant have had an installment agreement with the IRS in the past five years.

You May Like: Best Taxes Company

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

See how our return process works:

You May Like: Efstatus.taxact

What Are The Penalties For A Late Tax

The government wants every penny it is owed and wants it in good time. As such, there are penalties for filing a late tax return if you have an unpaid tax balance.

If you are getting a refund or your tax balance is zero, there are no penalties for sending in your return after the deadline date.

The penalties for filing your income tax and benefit return late when you owe the Canada Revenue Agency are as follows:

The Irs Suspects Identity Theft

If the IRS flags a tax return for having a possible chance of identity theft, the agency will hold your refund until your identity is verified. When that occurs, you’ll likely receive a 5071C letter that provides instructions for proving your identity. If your tax return is legitimate, don’t panic — an IRS letter doesn’t mean there is proof of identity theft, merely a suspicion.

Taxpayers can verify their identity on the IRS website, which currently requires creating an ID.me account, or by calling a dedicated phone number listed on the IRS letter. If those methods fail, you’ll need to schedule an in-person appointment at a local IRS office.

One method for avoiding identity-theft-related delays is to create an “Identity Protection PIN” or IP-PIN. This unique six-digit ID is known only to you and the IRS and prevents anyone else from filing a return in your name. The IP PIN will only last for one year — you’ll need to create a new one next tax season if you want the same level of identity protection. You’ll need an ID.me account to create an IP PIN online, although it is possible to acquire an IP PIN using IRS Form 15227 and a telephone interview or in-person appointment.

Read Also: How To Get Tax Information From Doordash

Your Tax Return Has Errors Or Is Incomplete

When you file your tax return, it’s important to cross-check any information you’ve included to make sure it’s accurate. For instance, don’t mix up the numbers of state taxes withheld with federal taxes withheld. Before you submit your taxes to the IRS, simply take a second look to fix any potential errors and make sure you’ve filled out each field.

Also, if you received child tax credit payments last year, make sure the amount on Letter 6419 matches the amount you received. If an incorrect amount is entered, the IRS will need to further review your tax return, which the agency says will result in an “extensive delay.”

Note that if there’s a problem that needs to be fixed after you submit your return, the IRS will first try to proceed without contacting you. That means it could be days or weeks before you know there’s a problem.

Your Banking Information Is Incorrect

Have you changed bank accounts since you last filed your taxes? If so, pay close attention to what the direct deposit information says when submitting your return this year. If you accidentally forget to update it with your new direct deposit details, your refund will be sent back to the IRS. This will likely result in a paper check being mailed to your house, which could take several weeks longer to arrive.

Recommended Reading: Do I Have To File Taxes For Doordash

Common Reasons That May Cause Delays

- We found a math error on your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return. Please respond quickly so we can continue processing your return.

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund.

Finding Your Return Status

If you used a professional tax preparer who is an authorized IRS e-file provider, they should be able to tell you when your return was received and accepted by the IRS. All authorized e-file providers have a direct link to the IRS. Any information they give you on the status of your return should be current and accurate.

If you used an online commercial tax preparation service like TaxSlayer, TurboTax or Tax Act, they have automated systems to keep you informed. For example, TurboTax sends you an email that tells you your tax return was submitted and another one shortly after that tells you its been accepted or rejected. They also have tools so you can check on the status of your return at any time. You just need to enter a few pieces of information. For example, with TurboTax, you just enter your Social Security number and ZIP code.

Regardless of what method you used to e-file your tax return, if you have a refund coming, you can also use one of the IRSs refund tracking apps to find out if theyve received your e-filed tax return. Their mobile app is called IRS2Go. Their online app is called Wheres My Refund? They both give three responses: return received, refund approved and refund sent.

Read Also: How Do You File Taxes With Doordash

How To Check Your Tax Refund Status

OVERVIEW

The IRS has made it easy to check the status of your income tax return online with their “Where’s My Refund” web page.

If you are anxiously awaiting your refund check to arrive or have it deposited into your checking account, theres no reason for it to remain a mystery. The IRS has an online tool called Wheres My Refund? that allows you to check the status of your refund. After providing some personal information, you can find out when it will arrive.

TurboTax also has a Where’s My Refund Tracking guide that explains each step of the efiling process and how to check the status of your federal tax refund.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Read Also: Efstatus.taxact 2014

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get you your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you are receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity. Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider. Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

Read Also: How Much Is Doordash Taxes

Income Tax Refund Information

You can check the status of your current year refund online, or by calling the automated line at 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us at to check on your refund. Remember to include your name, Social Security number and refund amount in your e-mail request.

If you’re expecting a tax refund and want it quickly, file electronically – instead of using a paper return.

If you choose direct deposit, we will transfer your refund to your bank account within a few days from the date your return is accepted and processed.

Electronic filers

We usually process electronically filed tax returns the same day that the return is transmitted to us.

If you filed electronically through a professional tax preparer and haven’t received your refund check our online system. If not there, call your preparer to make sure that your return was transmitted to us and on what date. If sufficient time has passed from that date, call our Refund line.

Paper filers

Paper returns take approximately 30 days to process. Keep in mind that acknowledgment of the receipt of your return takes place when your return has processed and appears in our computer system.

Typically, a refund can also be delayed when the return contains:

- Math errors.

- Missing entries in the required sections.

- An amount claimed for estimated taxes paid that doesn’t correspond with the amount we have on file.

Check cashing services

Splitting your Direct Deposit

Irs Predicted Turnaround Times

Before you start checking the IRS Refund Status page, it can help to understand how long you can expect to wait for your refund. According to the IRS, nine out of 10 refunds are issued within 21 days of a return being filed. This turnaround time doesnt apply to the estimated 10 percentof taxpayers who mail their returns in since those take significantly longer to process.

But as youre wondering how to find out if a tax return was filed, its important to know that some things can slow your refund down. In 2017, for instance, the IRS was under a mandate to not issue refunds for the Earned Income Tax Credit until mid-February. For those who filed in January, that meant a slightly longer wait than they might have expected otherwise. Since this can vary from year to year, the 21-day turnaround can easily change without taxpayers being aware of it.

Don’t Miss: Federal Tax Return Irs

How To Check The Status Of Your Refund

The fastest way to get an update on your refund is through the “Where’s My Refund?” online tool or by using the IRS2Go app. The portal shows three steps of the process: return receipt, refund approved and refund sent, with an estimated deposit date.

You can see the status 24 hours after the IRS receives your electronic filing or four weeks after mailing your paper return. The agency updates the portal daily, typically overnight.

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

Read Also: Efstatus.taxact 2015

Overview Of Basic Irs Filing Requirements

You are only required to file a tax return if you meet specific requirements in a given tax year. The most common reason people need to file is when they earn over the income filing threshold. For the 2018 tax year, these amounts were as follows:

These amounts changed with the passage of the Tax Cuts and Jobs Act and have fluctuated over the years. Youll need to find the income filing threshold for the appropriate tax year to determine if you had a filing requirement. For example, use the 2016 income filing threshold to decide whether or not you should have filed a tax return in 2016.

You may still need to file a return even when you earn less than the filing threshold amount. Some other reasons you may need to file include the following:

You must file your tax return by the deadline set by the IRS each year, typically around April 15th.