C Minimum Franchise Tax

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law. The minimum franchise tax, as indicated below, must be paid whether the corporation is active, inactive, operates at a loss, or files a return for a short period of less than 12 months.

- Domestic qualified inactive gold or quicksilver mining corporations: $25

- All other corporations subject to franchise tax : $800

A combined group filing a single return must pay at least the minimum franchise tax for each corporation in the group that is subject to franchise tax.

A corporation that incorporated or qualified through the California SOS to do business in California, is not subject to the minimum franchise tax for its first taxable year and will compute its tax liability by multiplying its state net income by the appropriate tax rate. The corporation will become subject to minimum franchise tax beginning in its second taxable year. This does not apply to corporations that are not qualified by the California SOS, or reorganize solely to avoid payment of their minimum franchise tax.

There is no minimum franchise tax for the following entities:

Deployed Military Exemption

For the purposes of this exemption:

âOperates at a lossâ means negative net income as defined in R& TC Section 24341.

Schedule A Taxes Deducted

Enter the nature of the tax, the taxing authority, the total tax, and the amount of the tax that is not deductible for California purposes on Form 100, Side 4, Schedule A.

If the corporation is using the California computation method to compute the net income, enter the difference of column and column on Schedule F, line 17.

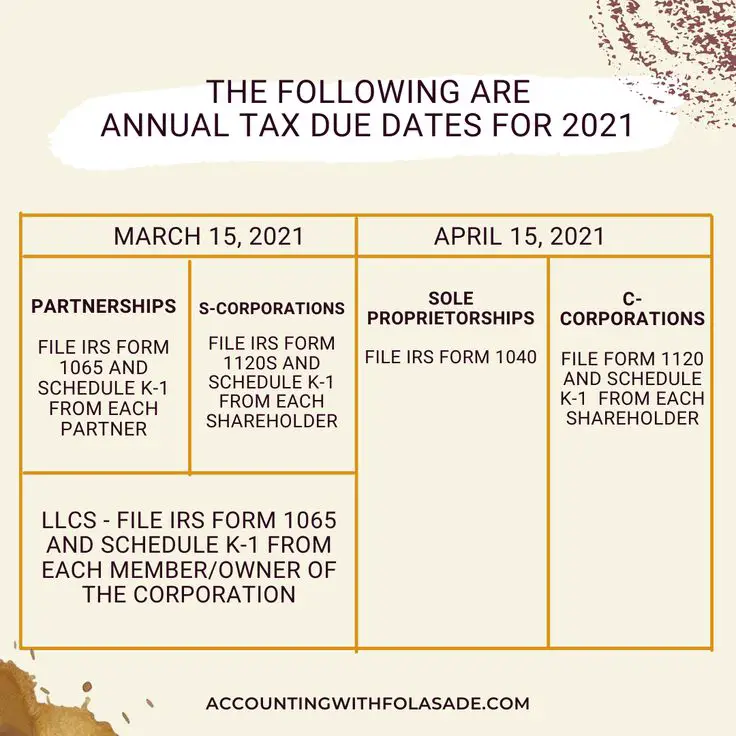

When Are Corporate Taxes Due Tax Return Deadlines 2021

When reviewing the 2020 tax dates , its important to keep in mind some critical changes to the 2021 tax due dates. We created a summary of due dates to answer common questions from your clients including, when are business taxes due, when is LLC tax return due, and when are small business taxes due?

Important: Its always recommended to check the IRS website for the most up-to-date information on tax due dates. The dates below are from the most recent IRS data released October 6, 2020. 2020 was a lesson in remaining flexible and expecting changes, so keep your firm and clients safe by checking in regularly with the IRS.

Updates and Reminders for 2021

You May Like: How Do I Pay State Taxes

What If You Miss A Deadline

You’ll probably be hit with a financial penalty, such as an extra interest charge, if you don’t submit a tax return and make any payment that is due by its appropriate deadline. There are two main penalties you may face:

- Failure-to-file penalty:This penalty for 1040 returns is 5% of the tax due per month as of tax year 2021, up to a cap of 25% overall, with additional fees piling up after 60 days.

- Failure-to-paypenalty: This penalty is 0.5% for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

If both are penalties are applied, the failure-to-file penalty will be reduced by the failure-to-pay penalty amount for that month. If you are on a payment plan, the failure-to-pay penalty is reduced to 0.25% per month during that payment plan schedule. If you don’t pay the taxes you owe within 10 days of receiving a notice from the IRS that says the agency intends to levy, then the failure-to-pay penalty is 1% per month.

Generally, interest accrues on any unpaid tax from the due date of the return until the date of payment in full. To avoid fees and required payments, the IRS recommends you should file your return as soon as possible if you miss a deadline.

Are Inheritance Taxes Due On The Date Of Death Or When The Inheritance Is Received

While some states do impose an inheritance tax, the federal government only imposes an estate tax. Estate taxes are imposed on the estate itself rather than on the individuals inheriting assets from the estate. Estate taxes aren’t necessarily imposed on the date of death, but they will have been assessed by the time an heir officially receives assets.

Also Check: Can I Do My Taxes Next Year

These Colors Correspond With The Calendar Above:

S-Corporation and Partnership should submit all supporting documents

If your company operates on a calendar year, this date should serve as your companys deadline to allow your accountant time to prepare your taxes for the March 15 deadline.

C-Corporation and Individuals should submit their tax documents

If your company operates on a calendar year, now would be a good time to submit your documents to your accountant so they have enough time to prepare your return.

S-Corporation and Partnership income tax returns due

If your company operates on a calendar year, you need to either file your tax return or extension by this date.

C-Corporation and Individual income tax returns due

If your company operates on a calendar year. View Form 1120-W, Estimated Tax for Corporations. The Individual Tax Return Extension Form for Tax Year 2021 is also due on this day.

1st-quarter 2022 estimated tax payment due

If youre self-employed or have other income that requires you to pay quarterly estimated taxes, get your Form 1040-ES postmarked by this date.

Last day to make a 2021 IRA contributionIf you havent already funded your retirement account for 2021, do so by April 18, 2022. Thats the deadline for a contribution to a traditional IRA, deductible or not, and a Roth IRA. However, if you have a Keogh, SEP, or other eligible plan and you get a filing extension to October 15, 2022, you can wait until then to put 2021 money into those accounts.

Llc And Partnership Tax Return And Payments

15th day of the 3rd month after the close of your tax year.

Extended filing due date

15th day of the 10th month after the close of your tax year.

Annual tax

You’re not required to pay an annual tax.

Annual fee

You’re not required to pay the annual fee.

Forms

15th day of the 3rd month after the close of your tax year.

Extended due date

15th day of the 10th month after the close of your tax year.

Annual tax

Your annual tax amount is $800.

Due date: 15th day of the 3rd month after the close of your tax year.

Annual fee

Youâre not required to pay the annual fee.

Forms

15th day of the 3rd month after the close of your tax year.

Extended due date

15th day of the 10th month after the close of your tax year.

Annual tax

Your annual tax amount is $800.

Due date: 15th day of the 3rd month after the close of your tax year.

Annual fee

Youâre not required to pay the annual fee.

Forms

15th day of the 3rd month after the close of your tax year.

Extended due date

15th day of the 10th month after the close of your tax year.

Annual tax

Your annual tax amount is $800.

Due date: 15th day of the 3rd month after the close of your tax year.

Annual fee

You’re not required to pay the annual fee.

Forms

15th day of the 3rd month after the close of your tax year.

Extended due date

15th day of the 10th month after the close of your tax year.

Annual tax

Your annual tax amount is $800.

Due date: 15th day of the 4th month after the beginning of your tax year.

Annual fee

Forms

Extended filing due date

Read Also: Do Seniors Have To File Taxes

Start Planning To File For 2021 Today And Save Time And Money

Business owners know there are many ways to save on taxes, but it takes a certain degree of planning to capture all that opportunity cost. A calendar of your critical tax deadlines is a huge step toward being compliant and avoiding late fees and penalties. inDinero can help you build a comprehensive strategy.

Quick Note: This article is provided for informational purposes only, and is not legal, financial, accounting, or tax advice. You should consult appropriate professionals for advice on your specific situation. inDinero assumes no liability for actions taken in reliance upon the information contained herein.

What If You Miss The Final Oct 17 Filing Deadline

If you miss the final filing deadline, the IRS will charge you a failure-to-file penalty. As mentioned above, it’s 5% and up to 25% of the amount owed. However, the fee is retroactive. Steven J. Weil, Ph.D., enrolled agent and president and tax manager of RMS Accounting, says, The penalties start accruing from the original due date in April, not October 17.

Copyright 2022 U.S. News & World Report

Recommended Reading: Does North Carolina Tax Retirement Income

Line 1 Through Line 43

Note: Do not include IRC Section 965 and 951A amounts.

Line 1 â Net income before state adjustments

Corporations using the federal reconciliation method to figure net income must:

- Transfer the amount from federal Form 1120, line 28, to Form 100, Side 1, line 1 and attach a copy of the federal return and all pertinent supporting schedules or copy the information from federal Form 1120, Page 1, onto Form 100, Side 4, Schedule F and transfer the amount from Schedule F, line 30, to Form 100, Side 1, line 1.

- Then, complete Form 100, Side 1 and Side 2, line 2 through line 16, State Adjustments.

Corporations using the California computation method to figure net income must transfer the amount from Form 100, Side 4, Schedule F, line 30, to Side 1, line 1. Complete Form 100, Side 1 and Side 2, line 2 through line 16, only if applicable.

Line 2 through Line 16 â State adjustments

To figure net income for California purposes, corporations using the federal reconciliation method must enter California adjustments to the federal net income on line 2 through line 16. If a specific line for the adjustment is not on Form 100, corporations must enter the adjustment on line 8, Other additions, or line 15, Other deductions, and attach a schedule that explains the adjustment.

Line 2 and Line 3 â Taxes not deductible

The LLC fee is not a tax, R& TC Section 17942 therefore, it is deductible. Do not include any part of an LLC fee on line 2 or line 3.

Line 5 â Net California capital gain

J Alternative Minimum Tax

Corporations that claim certain types of deductions, exclusions, and credits may be subject to California AMT. To compute California AMT, corporations must complete California Schedule P , Alternative Minimum Tax and Credit Limitations â Corporations. See Schedule P , included in this booklet, for more information.

You May Like: Is Turbo Tax Fixing The Stimulus Problem

Does This Tax Relief Measure Cover Anything Else

The new February 15, 2023, deadline also includes quarterly estimated income tax payments originally due January 17, 2023, as well as the excise tax and quarterly payroll returns originally due on October 31, 2022, and January 31, 2023. If your business had an original or extended due date, you also have more timeincluding calendar-year corporations whose 2021 extensions expire October 17, 2022. Tax-exempt organizations with 2021 calendar-year returns with extensions expiring November 15, 2022, are also eligible for the Hurricane Ian extension.

For detailed information surrounding penalties on payroll and excise tax deposits, please visit the IRS disaster relief section of their website.

Whats The Deadline To Pay Your Taxes

Even if you successfully apply for an extension, the payment deadlines donât change. The penalty for late payment is 0.5% of the taxes owed each month compared to 5% for late filing. Regardless of whether you can pay your small business taxes, it always pays off to file on time.

If youâre sending your return via snail mail, the IRS considers your return âon timeâ if itâs addressed correctly, has enough postage, and is in the mail before the end of business on your filing deadline. Otherwise, you can e-file your return before midnight on your tax filing deadline day.

If youâre self-employed, your business probably pays taxes in four sums throughout the year, rather than on one day. These are called estimated tax payments and you can think of them as a prepayment of your income and self-employment taxes . The due dates for these 2022 payments are April 18, June 15, September 15, and January 16 .

If youâd rather have someone else handle your bookkeeping and federal income tax filing, check out Bench.

Weâll set you up with a dedicated team of bookkeepers and a tax team to provide year round tax advice and file your taxes for you. With these teams, youâll have a tax planning session to ensure you are more prepared for next year. Weâll take both headachesâbookkeeping and taxesâoff your hands, for good.

Don’t Miss: How To File An Extension On Tax Return

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:287.614allows an extension of time for filing the combined corporation income and franchise tax return not to exceed seven months from the date the return is due. All extension requests must be made electronically on or before the returns due date. The returns due date is May 15th for calendar year filers, and the 15th day of the fifth month following the close of the taxable year for fiscal year filers. Extension requests received after the returns due date or on paper will not be honored. An extension may be requested in the following manner:

Requesting the extensions electronically through the Bulk Extension Filing application or the Online Extension Filing application on LDR’s web site

Filing an extension request electronically by calling 225-922-3270 or 888-829-3071. For an extension request, select option #3, then select option #2. Taxpayers will need the Corporations LA account number to request the extension or

Requesting the extensions electronically through tax preparation software that supports the electronic filing of the Louisiana Application for Extension to File Corporation Income and Franchise Tax.

S Corporation And Partnership Tax Returns Due

Business owners filing taxes for an S corporation or partnership have less time to do their taxes. March 15 is the deadline to file your S corporation tax return or Partnership return . If youâre an S corporation, see our full guide on S corp taxes and deadlines.

Note that S corporations and Partnerships do not pay taxes on their income. That tax is paid on the individual incomes of the shareholders or partners, respectively.

March 15 is also the deadline to file for an extension for S corp and partnership tax returns.

Forms:

Don’t Miss: What Is The Best Tax Relief Company

Adjustment Of Overpayment Of Estimated Income Tax

Revised Statute 47:287.656 allows corporations to file an application for an adjustment of an overpayment of its estimated income tax for a taxable year. The application must be filed after the close of the taxable year and on or before the 15th day of the fourth month thereafter, and before the tax return is filed. However, no application will be allowed unless the adjustment amount is at least ten percent of the corporations estimated tax amount and more than $500. This application for an adjustment of overpayment of estimated income tax does not represent a claim for credit or refund. There is no application form for this adjustment. However, the request should include the following information:

The estimated income tax paid by the corporation during the taxable year.

Amount that the corporation estimates its income tax liability is for the taxable year.

Amount of the adjustment.

Other pertinent information.

Within 45 days of the date that an application for an adjustment is filed, the adjustment will be allowed or disallowed if it is determined that the application contains material omissions or errors. If the adjustment is allowed, the secretary may credit the amount of the adjustment against any other tax liability owed by the corporation and refund the remainder.

When To Consider The Tax Extension For Your 2020 Business Taxes

An extension only applies to the deadline for filing your return, NOT paying any taxes youll owe. So, what are some reasons for asking for an extension on filing your return?

Extending your return deadline doesnt need to be a stressful decision. It should help eliminate stress!

For C Corporations, Partnerships, and S Corporations, youll use Form 7004 to request a six-month extension individuals use Form 4868. For nonprofits, you can request a six-month extension using Form 8868.

Before you make any decisions, be sure to talk about it with your tax preparer. They may have a reason not to extend.

Recommended Reading: How To Find Out If You Owe Back Taxes

Did Your Business Have Any Foreign Relationships Or Activities During 2020

If you have overseas shareholders, missing the filing deadline for foreign fillers got very pricey a few years ago. New tax laws went into effect in 2017 that made filing late 250% more expensive. So please file your Form 5472 on time to avoid a $25,000 per 30-day period per required shareholder penalty.

Here’s What You Need To Know:

- Different types of businesses must file with the IRS on different schedules

- Requesting an extension doesnt guarantee that it will be granted

- Stay in compliance by meeting non-payment filing deadlines

Its that time of year again: businesses are putting together their tax filing and payment plans for 2021. While April 15 is the most recognizable tax due date, there are many other dates small and medium-sized businesses should mark on their calendar to assure they are compliant with all filing requirements.

Businesses must pay taxes in several categories. The Internal Revenue Service at the federal level collects income and payroll taxes. Most states also collect business income tax or taxes on gross receipts.

The District of Columbia and 44 states levy corporate taxes. Ohio, Nevada, Texas, and Washington base their business taxes on gross receipts. Only South Dakota and Wyoming have no corporate income tax or gross receipts tax for 2020. Generally, states follow federal guidelines for tax due dates: on April 15 annual federal taxes are due and typically also in each state. Check with your states Department of Revenue for additional deadlines.

Here are key tax filing dates to remember for 2021.

Recommended Reading: How Much Taxes Will Be Taken Out