We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once you return to the processing stage, your return may be selected for additional review before completing processing.

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

When Uncle Sam Screws Up: What To Do If The Irs Lost Your Tax Return

Unfortunately, a missing or inaccurate tax return refund can be really difficult to track down. Long wait times on the phone and the inability to simply text Uncle Sam to get the issue resolved can mean waiting weeks, months, even over a year to get your money back. Here is what you can do to make sure a lost refund ends up in the hands of its rightful owner as quickly as possible.

If the IRS lost your tax return, refunded the wrong amount, or just never sends your refund, no problem!

Simply call em up, let them know you havent received your funds, and watch as the missing money magically appears in your bank account.

Right?

Unfortunately, a missing or inaccurate tax return refund can be really difficult to track down. Long wait times on the phone and the inability to simply text Uncle Sam can mean waiting weeks, months, even over a year to get your money back.

Here is what you can do to make sure a lost refund ends up in the hands of its rightful owner as quickly as possible.

Read Also: Does Doordash Tax Tips

You Didn’t Properly Enter Your Stimulus Payments

In 2021, most Americans received a third stimulus check payment related to the COVID-19 pandemic. While that money is non-taxable, it needs to be reconciled on your tax return if you are claiming the recovery rebate credit.

In recent testimony to the House Ways and Means Committee, IRS Commissioner Charles P. Retting said that in 2020, the IRS “received far more than 10 million returns” where taxpayers failed to properly reconcile their stimulus payments with the amounts entered for their recovery rebate credits. Those returns require a manual review and create lengthy delays.

If you plan to claim the recovery rebate credit on your tax return, learn how to avoid this error using IRS Letter 6475 or your online IRS account.

To get a prompt tax refund, be sure to enter your advance child tax payments correctly.

Cmo Revisar El Estado De Su Reembolso De Impuestos Federales

Use la herramienta ¿Dónde está mi reembolso? o la aplicación móvil IRS2Go para verificar su reembolso en Internet. Estos sistemas se actualizan una vez cada 24 horas y son las formas más rápidas y fáciles de rastrear su reembolso.

Puede llamar al IRS para verificar el estado de su reembolso. Sin embargo, la asistencia telefónica en vivo del IRS es extremadamente limitada en este momento. Los tiempos de espera para hablar con un representante pueden ser largos. Pero puede evitar la espera utilizando el sistema telefónico automatizado. Siga las instricciones del mensaje cuando llame.

Read Also: How To Calculate Taxes For Doordash

How To Track Your Refund

In order to use “Wheres My Refund” at IRS.gov, you’d need to provide your Social Security number or Individual Taxpayer Identification Number, your filing status and the “exact whole dollar amount of the expected refund.”

You’d find your refund amount on Line 35a of the 1040 for the 2021 tax year.

The earliest that you could check the status of your refund is within 24 hours after the IRS has received an e-filed return or four weeks after the taxpayer mails a paper return.

The refund tool updates once daily, the IRS notes, “so there’s no need to check more often.”

The IRS said taxpayers without access to a computer can call the IRS Refund Hotline at 800-829-1954.

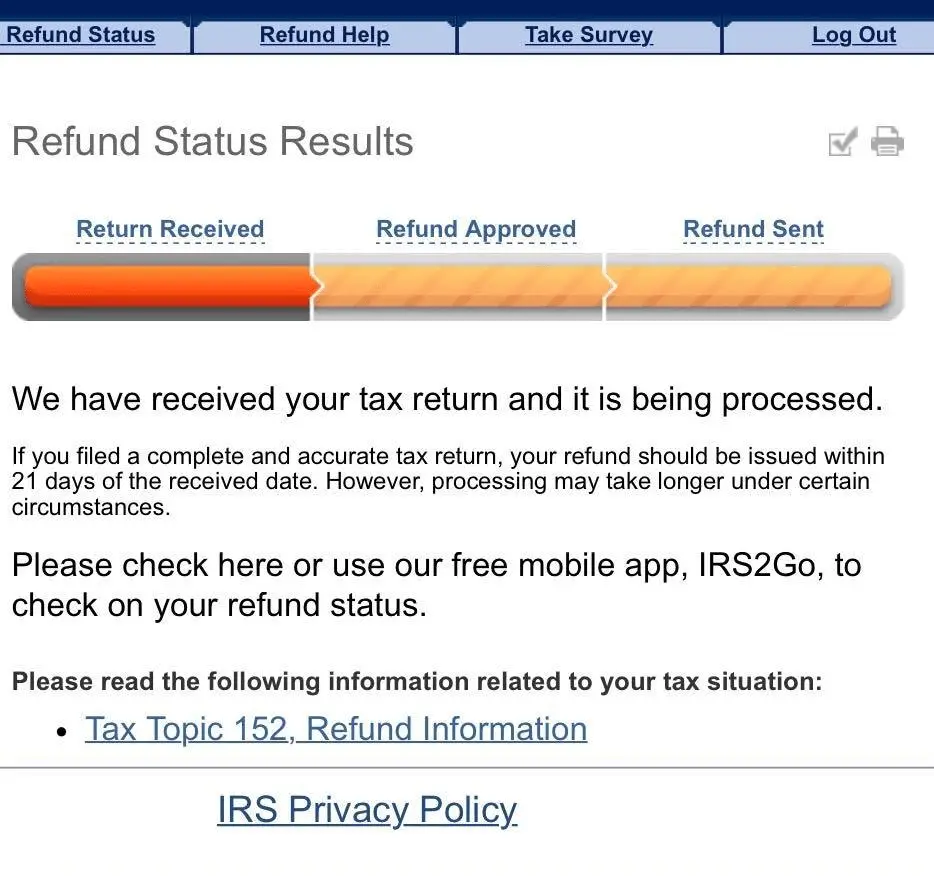

The “Where’s My Refund” online tool receives information from different sources. The refund tracker bar can tell you whether the return has been received, whether the refund was approved and whether the refund was issued or sent.

The IRS said the tool can give the user information for one of more than 120 unique refund status situations.

Tax experts note that some taxpayers will see a notice saying there’s “no record found.” But that can mean the return is still being processed.

Again, you can face more confusion with a paper return, which has to be entered into the system by an IRS employee and will face extra long delays this tax season.

The “Where’s My Refund” information also is available via the IRS2Go app for mobile devices. Information is available in English and Spanish.

Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

To receive a notification when your refund is issued and other electronic communications about your income tax refund see Request electronic communications from the department.

You May Like: Do You Have To Pay Taxes Working For Doordash

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2020 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day time frame if your tax return involves either of those tax credits. In fact, the IRS is informing those who claim these credits that they will most likely receive their refunds in early March, assuming they filed their returns on January 24 or close to that date.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

With reporting by the Associated Press.

You May Like: Is Doordash Taxable

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors, such as incorrect Recovery Rebate Credit

- Is incomplete

- Needs further review in general

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q& A below.

- Includes a Form 8379, Injured Spouse Allocation PDF, which could take up to 14 weeks to process

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return. If were still processing your return or correcting an error, neither Wheres My Refund? or our phone representatives will be able to provide you with your specific refund date. Please check Wheres My Refund? for updated information on your refund.

Recommended Reading: Do You Have To File Taxes For Doordash

Getting Refunds Within 21 Days Of Filing

If all goes well, though, taxpayers who e-file can receive their refunds via direct deposit as quickly as one week after filing based on previous years’ processing time, according to trade publication CPA Advisor.

It’s important to note that processing time typically slows down as the tax season gets underway and the IRS handles more returns, the publication added.

In the meantime, tax experts say there are some steps that taxpayers can take to help ensure a quick tax refund, which is even more important this year given that the IRS is starting with a backlog. National Taxpayer Advocate Erin M. Collins issued a report to Congress in January that warned she is “deeply concerned about the upcoming filing season” given the backlog, among other issues.

“The first thing you know if you are going to cook a meal, you have to have the kitchen cleaned up from the last meal,” said Mark W. Everson, vice chairman at Alliantgroup and former Commissioner of the IRS. “It just snowballs into a terrible situation.”

Delays in processing tax returns count as one of the agency’s most pressing problems, Collins said in her report, which described an agency in crisis.

Americans are hearing the message: Potential IRS processing delays ranked second among the three top concerns of people who are expecting a refund from the IRS this year, according to a Bankrate.com poll of almost 2,500 people released February 22.

How To Contact The Irs If You Haven’t Received Your Refund

- In most cases, you’ll get your tax refund within 21 days of e-filing, though it can take longer.

- Check the status of your return online, then call the IRS if there seems to be a problem.

- Be prepared to follow up, too, because the IRS isn’t necessarily keeping track of your case.

- See Personal Finance Insider’s picks for best tax software »

I am a money nerd. I love adding the finishing touches to my tax return and generating pages that neatly summarize my income for a year. Some years, that also comes with the good news that a tax refund is headed my way.

I wasn’t sure what to expect for 2018, the first filing year under the new rules of a major tax overhaul. My results were much better than expected, but my refund was months late. I had to hunt down the steps to follow if your refund doesn’t show up as planned.

In most cases, taxpayers can expect to get their refund within 21 days of filing. If it has been longer, follow these steps to track down your refund.

Don’t Miss: Does Doordash Do Taxes

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Reason #1 Irs Taking Your Refund

When the IRS issues refunds, it mainly takes or reduces refunds when taxpayers have debts to pay. Here are the two most common situations:

You owe federal taxes, and you havent paid:

If the IRS took your refund to pay federal taxes you owe, youll know it a few weeks after you file your return. Youll get IRS notice CP49,Overpayment Applied to Taxes Owed. If you dont think you owed what the IRS says you owed, the only thing you can do is file an amended return to correct the tax or contest any extra tax the IRS charged you .

You owe other debts, and you havent paid:

The Treasury Offset Program allows the IRS to take or reduce your refund if you owe other types of debts, including non-tax debts, such as:

- Past-due child support

- State taxes

- Unemployment compensation repayments

The IRS cant answer questions or resolve disputes related to TOP debts. Taxpayers should call TOP at 304-3107 for answers.

Spouses who arent responsible can get their part of the refund

If you filed jointly with your spouse, and the IRS took your full refund for your spouses debts, you can get your portion of the refund. File an injured spouse claim using Form 8379, Injured Spouse Allocation.

Recommended Reading: Opi Plasma Center

When Are Taxes Due

For most years, the deadline to submit your tax return and pay your tax bill is April 15. But for your 2020 taxes, it was pushed back about a month to May 17, 2021 due to the Coronavirus pandemic. Theres currently no such plan in place for the 2021 tax year, for which youll file in early 2022.

If you still cant meet the tax filing deadline for the upcoming year, you can file for an extension. But the sooner you file, the sooner you can receive your tax refund.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

You May Like: Efstatus.taxact 2014

Why Is My Tax Return Less

One of the more common reasons why your tax refund may be less is because you earned more money last year than you remember, as compared to 2020 most people worked more hours, while some could have either got a pay rise or changed jobs, which could have seen an improvement in your salary.

Another reason why some people have received a smaller tax refund than they were expecting is because of the expanded Child Tax Credit program, as families received half of the 3,000 or 3,600 dollar amount in the second half of 2021.

“Most of the people that I’m seeing are getting slightly lower refunds, but it’s mainly due to the advance child tax payments received,” said Antonio Brown, a CPA in Flint and member of the Michigan Board of Accountancy.

“If the taxpayer received half of the full tax credit in advance, that means the rest of the credit will appear on the tax return as a 1,500 or 1,800 dollar refundable tax credit.”

As Brown explains, his clients’ tax refunds are about 19 percent or so less compared to last year, but he has stressed that they might actually be better off now than then.

“I have to remind the client that they received half of the credit in advance, so actually, in most scenarios, they came out better,” Brown stated.

Whats Next: When Will I Get My Tax Refund

Once youve resolved all the problems related to your returns, you enter the next worrying stage: When will I get my tax refund? No wonder why everyone hates dealing with taxes.

Honestly, theres nothing much you can do apart from waiting to hear from the IRS. According to the IRS, most tax refunds are issued within 21 days, while some may take longer if the return requires further review, which may be prompted by the following issues::

- Your return includes errors

- Your return is incomplete.

- Your return is affected by identity theft or fraud.

The IRS will contact you by mail if extra information is needed to process your tax return.

To track and stay updated about the process of your refund, consider one of the following methods:

- Visit Wheres My Refund?: enter your Social Security number or individual taxpayer identification number , filing status, and the exact amount of your refund to check your refund status.

- Download the IRSs mobile app IRS2go: prepare the same above-mentioned personal information details to track your refund.

Recommended Reading: How To Protest Property Taxes In Harris County