Step : Figure The Tax Withholding Amount

To recap from the previous page, the adjusted annual wages are $69,400.

Lets look at the tax table found on page 6 of IRS Pub 15-T.

Note there are actually six different tables on this page. The one you use depends on the employees filing status, the version of the W-4 they are using, and whether they have checked the multiple jobs box in Step 2 of their new W-4 . Since our example is using the new W-4 and has the Step 2 box unchecked, were going to use the middle table in the left column.

- Looking in the Single or Married Filing Separately table, the employees taxable wages of $69,400 fall between the range of $44,475 to $90,325 . See the highlighted row above.

- We can see in Column C, at least $4,664 in FIT needs withheld for the year. The $4,664 is a total of the following:

- 10% on wages between $3,950 and $13,900

- 12% on wages between $13,900 and $44,475

Here is what the worksheet would look like:

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee choose to claim, the less federal tax their employer deducted from their pay.

Withholding allowances are no longer used on the 2020 W-4 form.

What Is The Income Tax Rate For 2020

The federal income tax has seven tax rates for 2020: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The amount of federal income tax an employee owes depends on their income level and filing status, for example, whether theyre single or married, or the head of a household. You can find your 2019 and 2020 federal income tax rate based on your filing status by using the IRS income tax rates and brackets.

RELATED ARTICLES

You May Like: How Does Doordash Affect Taxes

Where Does Income Tax Expense Go On The Income Statement

Companies can choose to use different formats for their income statements. Most organizations use either the single-step income statement or the multi-step income statement. On the single-step income statement, the company presents all its revenue on one line and all its expenses on anotherâthere’s no itemization. On the multi-step income statement, the business accounts for each stream of revenue and specific expense on its own line. Companies only list income tax expense on a multi-step income statement. Traditionally, this is the last expense listed, just above the “bottom line” or net income total.

Caution For Employers Using Software Programs In

For Canada Pension Plan purposes, contributions are not calculated from the first dollar of pensionable earnings. Instead, they are calculated using the amount of pensionable earnings minus a basic exemption amount that is based on the period of employment.

As of 2019, the Canada Pension Plan is being enhanced over a 7 year phase-in. For more information, go to Canada Pension Plan Enhancement.

If used improperly, some payroll software programs, in-house payroll programs, and bookkeeping methods can calculate unwarranted or incorrect refunds of CPP contributions for both employees and employers. The improper calculations treat all employment as if it were full-year employment, which incorrectly reduces both the employee’s and employer’s contributions.

For example, when a part-year employee does not qualify for the full annual exemption, a program may indicate that the employer should report a CPP overdeduction in box 22 Income tax deducted of the T4 slip. This may result in an unwarranted refund of tax to the employee when the employee files his or her income tax and benefit return.

When employees receive refunds for CPP overdeductions, their pensionable service is adversely affected. This could affect their CPP income when they retire. In addition, employers who report such overdeductions receive a credit they are not entitled to because the employee worked for them for less than 12 months.

Don’t Miss: Doordash How Much Should I Set Aside For Taxes

Local Income Tax Withholding

Cities and local communities may also have an income tax, and your employer will withhold these taxes as well. The rules and rates vary from one local community to another. Knowing if your paycheck includes withheld local taxes is crucial to avoid unpleasant surprises when the time for filing your taxes come.

Local income tax is taxed per jurisdiction. If you work or live in a city or community that levies the tax, then your wages will be taxed.

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Don’t Miss: How To Get A 1099 From Doordash

How Are Bonuses Taxed

So, the conversation might go something like this.

Your boss: Merry Christmas. Heres a $1,000 bonus!

You: Woo-hoo! Lets make it rain dollar bills!

Uncle Sam: Not so fast.

If youve ever gotten a bonus, youve been there, right? After taxes, that $1,000 drops to $780.

So, whats the deal? Are bonuses taxed higher than your regular paycheck? Well, it seems that way . . . but not really.

As with any income, you have to pay state and federal taxes on your bonuses. But since theyre considered supplemental wages by the IRS, bonuses are subject to a flat 22% withholding rate, no matter which tax bracket youre in. Many employers opt to withhold 22% of your bonus, but there are actually two methods for withholding. Well talk about that next.

State And Local Taxes

Depending on the state you live in, you may have to pay state and/or local income taxes. There are currently seven states that do not impose a state income tax, including Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

Generally, state and local taxes are lower than federal income taxes and go toward the state government. Each state and local government has its own tax rates, which means the amount you pay can vary. Fortunately, the IRS allows taxpayers to claim a deduction on their federal tax return for the amount they paid in state income tax.

If you recall, Hectors bakery is located in the sunny state of California. California has one of the highest state income tax rates in the country. There are nine tax rates in California, starting at 1% and going up to 12.3%. Similar to calculating federal income taxes, taxpayers have to make adjustments to their gross income to get to their adjusted gross income. Adjustments are made by taking certain tax deductions and credits into consideration. You will then use your states tax rates to determine how much state income tax you owe.

Also Check: Doordash Take Out Taxes

Federal Insurance Contributions Act Withholding

FICA taxes are Social Security and Medicare taxes and are withheld in each paycheck you receive unless youre exempt. This happens even when there are no other withholdings. Your employer withholds 6.2% of your gross earnings for social security up to USD$142,600 in 2021. The total Social Security tax is 12.4%.

The employer only withholds 6.2% of your gross salary from your paycheck and pays the other 6.2% as the employer contribution. As for the Medicare taxes, this pays for expenses for Medicare beneficiaries. The employer withholds 1.45% of your gross income and pays an additional 1.45% as an employer contribution to Medicare.

Even though theres no annual limit like the one on Social Security tax, individuals earning over USD$200,000 annually are subject to an additional 0.9% tax.

Step : Additional Fit Withholding

The last step in manually calculating FIT is to add any additional withholding to the FIT per pay amount.

- If an employee is using the new W-4, they would indicate this in Step 4c.

- If the employee is using the old W-4, they would indicate this in Line 6.

This amount is already in terms of each pay period, so theres no need to divide by the number of pay periods.

The extra withholding amount is simply added to the FIT per pay amount.

So for example, if Marthas FIT per pay is $236.44 and she wants an additional $20 per pay withheld, her FIT per pay would be $256.44.

Recommended Reading: How Much Should I Save For Taxes Doordash

How Is Tax Calculated On Hand Salary

As a result of calculating take home salary, see Income Tax and Tax of the employees contributions to the employees personal pension fund . Gross Salary has two components: Cost to Company and Employers Provincial Family Contribution . Basic salary multiplied by 15/26 * Dearness allowance less allowance equals bonus.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Also Check: What Home Improvement Expenses Are Tax Deductible

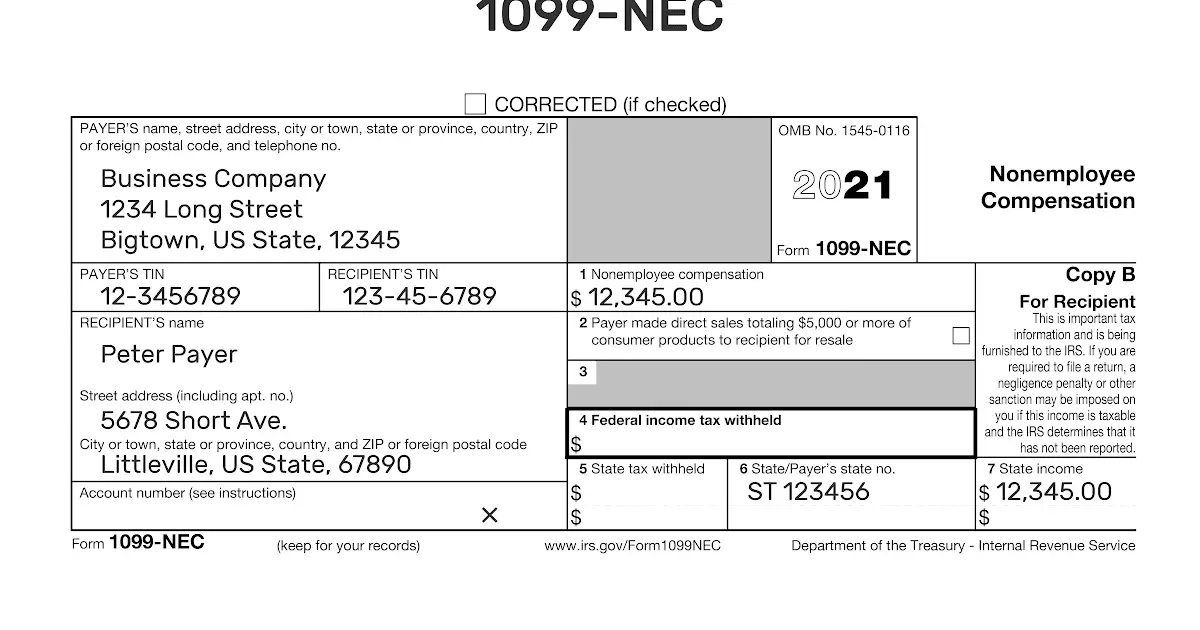

Tax Deductions And Lowering Your Self

Using a self employment expense tracker and finding tax deductions are critical to reducing your tax bill. From car expenses to your home office and even your computer, there’s a good chance you can knock a few thousand bucks off your tax bill if you’re smart about claiming write-offs.

Check out our self-employment tax deductions explorer for a complete list of all the different kinds of write-offs you might be eligible for, based on the type of work you do.

Note: The calculation above doesn’t take tax deductions into account. If you want to see your tax bill after deductions, just subtract your annual business expenses from your 1099 income input field.

How You Can Affect Your Vermont Paycheck

You cant escape your income taxes, but you can take steps to change how much of your income taxes you pay each paycheck. One of the simplest ways to do this is by adjusting your withholdings when you file your W-4. If you want even more control over your tax withholding, you can also specify a dollar amount for your employer to withhold. For example, if you want your employer to withhold an additional $20 from each paycheck, you can write $20 on the appropriate line of your W-4. While that might mean smaller paychecks now, this practice could save you money come tax time.

Besides manually switching up your withholdings, you can also impact your paycheck by lowering your overall taxable income. You can do this by contributing to pre-tax retirement accounts, like a 401, or to a Health Savings Account or Flexible Spending Account . This means smaller paychecks, but because the contributions go in pre-tax, you wind up keeping more of your money.

Read Also: Calculate Doordash Taxes

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Payroll Taxes: Where To Start

Now that you know what payroll taxes are, where do you start? As a small business owner, there are numerous taxes you are responsible for paying. Some taxes for small business owners include:

- Payroll taxes

- Property taxes

- Dividend taxes

Employers arent the only ones responsible for paying taxes, either. Employees also have to contribute their fair share, including payroll taxes and federal and state income taxes.

Read Also: How To Get A License To Do Taxes

Identify All Your Taxable Income

Taxable income, particularly for businesses and corporations, is often complex and layered. Most companies have options regarding how they track and categorize their taxable income, particularly in regards to depreciation on their profits. It’s advisable to consult a professional tax expert, like a CPA or tax attorney, to help identify all taxable income expenses for your organization.

What Is The Percentage Of Federal Income Tax Withheld

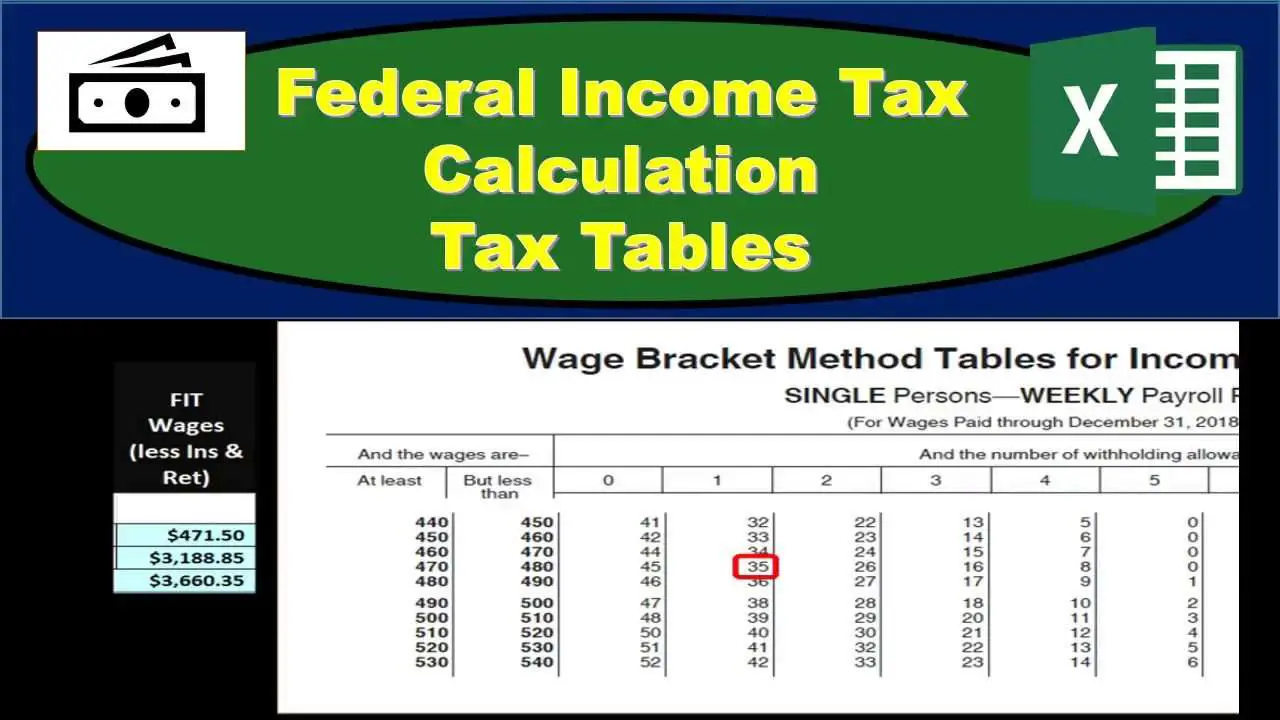

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

Also Check: Doordash Taxes 2021

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Recommended Reading: How To Do Taxes On Doordash