Repeat After Us: Ordinary And Necessary

As a gig worker, youre an independent contractorwell, for now. That makes you a bona fide business owner, able to deduct related expenses that the IRS deems ordinary and necessary. Deductions, also known as write-offs, lower your taxable income, ergo your tax bill.

So, a weekly $20 car wash to keep your ride looking spiffy? Thats deductible. But $700 Louis Vuitton shades to uphold your reputation as the bougiest Uber driver in the city? Thats a no on the deduction, but Id like to ride with you.

An easy-to-miss deduction: the business use of your smartphone. If your phone bill totaled $500 last year, and you used it half of the time for ridesharing, you can deduct $250.

Other common deductible rideshare driver expenses are:

- Vehicle expenses

- Wagons for big grocery deliveries

- Water bottles for riders

- Music subscriptions for rider enjoyment

Jaz, 29, is a full-time gig worker who drives for Uber, Uber Eats, Lyft, DoorDash, Postmates, you get the idea, and documents it all on her YouTube channel. She told Morning Brew that she uses QuickBooks to keep track of her business expenses.

I stay organized because I need to know on a weekly basis what Im making, Jaz said. Is this even still profitable for me? Does it even make sense for me to continue to do this? Being intentional about what you want from the gig economy is important.

What Uber Doesnt Track

At bare minimum, you can write off all the miles that Uber tracks for you. But online miles that the app reports might end up seeming low to you.

If you rely on Uber for your deductible miles, youâll probably end up underreporting â and overpaying on your taxes. Some of your âofflineâ miles, after all, may still be tax-deductible.

For example, the app may not account for miles you drove to rides that ended up being canceled. You might also leave the app off when you drive to a grocery store to pick up passenger goodies, like mints and water bottles. Since youâre buying supplies for work, those miles are tax-deductible, even though you werenât on your way to a passenger.

Because Uber tends to undercount your tax-deductible miles, most experienced drivers keep their own, separate mileage records, using a mileage log or mileage tracker app.

Forgot to do this? Donât worry â there are still ways to claim your work miles.

Do Uber Drivers Need To Pay Estimated Taxes

Self-employed people are not allowed to wait until April 15 to pay all the income and self-employment taxes they owe for the prior year. Instead, they are required to prepay their taxes by making estimated tax payments to the IRS four times per year.

You must pay estimated taxes if you expect to owe at least $1,000 in federal tax for the year from your ride-sharing business. You’ll probably need to earn a profit of at least $5,000 or $6,000 from your business to owe this much tax.

The IRS imposes modest interest penalties if you don’t pay enough estimated tax. To avoid the penalties, you must pay at least the smaller of:

- 90 percent of your total tax due for the current year

- 100 percent of the tax you paid the previous year or 110 percent if you’re a high-income taxpayer

High-income taxpayers-those with adjusted gross income of more than $150,000 -must pay 110 percent of their prior year’s income tax.

Recommended Reading: How Do Taxes For Doordash Work

Record Odometer At End Of Tax Year

At the end of the tax year, the taxpayer should record the ending odometer reading. This figure is used in conjunction with the odometer reading at the beginning of the year to calculate the total miles driven in the car for the year. The information, including what percentage of miles driven were for business purposes, is required on Form 2106.

Deductions For Mobile Phone Expenses

Your smartphone is essential to your business, so naturally its expenses are deductible. This can include:

- The cost of the phone itself

- The billing charges of your carrier

- And any accessories that are essential to your business, such as chargers, mounts, and cradles

As with your car, you’re only allowed to deduct the portion of your smartphone expenses that are related to your business use. For that reason, many Uber driver-partners purchase a new phone and dedicate it solely to their business. That way, 100% of all costs associated with that phone are deductible from their taxes.

Don’t Miss: How Do You Report Plasma Donations On Taxes

Drivers Arent Prepared When They Start Filing

One of the many reasons people procrastinate in filing their taxes is that it feels like it will take forever to complete, when in reality, you can finish the entire process in under an houras long as youre prepared.

Theres no worse feeling than starting to file your taxes, and realizing you dont have a key document thats needed in order to finish.

Before you start the filing process, make sure you have all of the relevant documents and information in front of you! If youre a Stride member, your exported reports will organize your deductions for you.

How To Track Those Miles

Understanding what miles you can track is huge. In 2021, every mile you can claim knocks 56 cents off your taxable income. In 2022, that mileage allowance jumps to $0.58. With the hundreds or thousands of miles that we can drive, that’s a great thing for your bank account.

However, it’s important to know how to track them.

The Internal Revenue Service requires a detailed record. An IRS-compliant report has to have four things on it.

- The date of the trip

- How many miles you drove

- Where you went

- The business purpose of the trip

It’s important that you develop a system that works for you, that accurately tracks all those miles, and that meets the IRS requirements. Continue reading as we go into more detail about how to track miles.

Don’t Miss: 1040paytax Review

How To File Taxes As A Ride

Ride-share drivers, independent contractors, and other self-employed people likely have more complicated taxes than regular W-2 employees. Thatâs because throughout the year you need to keep track of your profits and losses, business expenses, and any estimated tax payments you make. And if you also have separate retirement accounts or health insurance plans, youâre probably just adding more forms to your return.

Consider These Common Uber Driver Deductions

Tax deductions are recorded expenses that reduce the amount of taxable income that you pay dues on. Independent contractors have the option of choosing a standard deduction or itemizing their deductions. Itemized deductions are individual costs associated with operating as a partner through Uber. Some of the most common deductions that Uber drivers can take advantage of include:

Don’t Miss: Doordash Tax Filing

Calculate Your Gross Income From Rideshare Driving

You may receive two 1099 forms from Uber or Lyft, but not always.

-

Form 1099-K. You should receive a 1099-K if you had more than 200 rides and generated over $20,000 in customer payments.

-

Form 1099-NEC. If you make more than $600 in non-driving income, such as bonuses, referral fees, and other awards, you may receive a 1099-NEC for this income.

Even if your income from Uber and Lyft doesnât rise to the level of receiving a 1099 form, you still need to report your income to the IRS. So go into your driver dashboard and download your income details for the year.

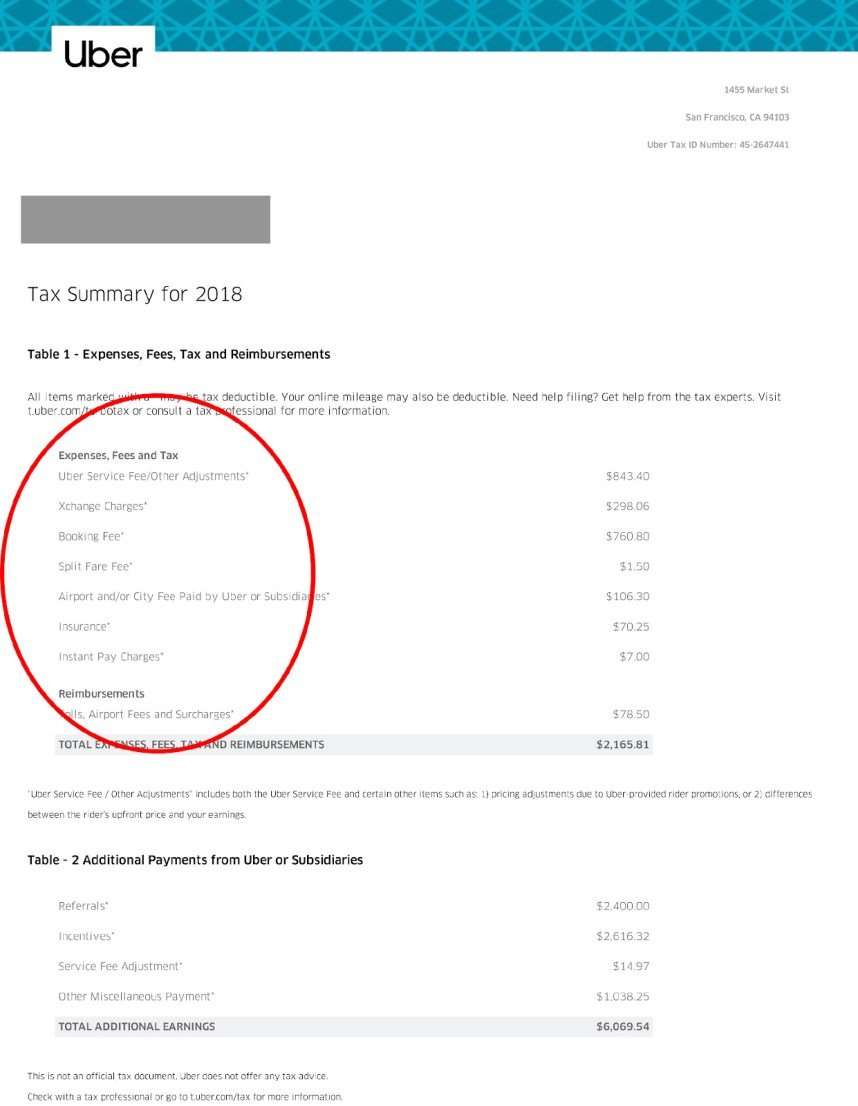

These forms will typically report a higher income than what you actually received. This is because it reports the total of what your customers paid before Uber or Lyft takes their fees. These fees are tax deductible as a business expense.

Your gross income from rideshare driving goes on Line 1 in Part I of Schedule C. If you drove for both Uber and Lyft during the year, you donât need to complete two separate forms. Just add the income from both rideshare companies together and include the total on one schedule.

Advertising Does Not Equal Business Miles

There’s always that person who says just put a Doordash sticker on your car and now you can claim every mile because you’re advertising.

Don’t listen to them. It’s a great way to get nailed in an audit.

About the only way you could get by with that is if you were one of those people who operated a mobile billboard. That only works when the advertising is the entire business model. If your main business purpose is strictly advertising, you might have a case.

But sticking ads on your car doesn’t allow you to claim extra miles. The IRS makes that pretty clear.

Putting display material that advertises your business on your car doesnt change the use of your car from personal use to business use. If you use this car for commuting or other personal uses, you still cant deduct your expenses for those uses.

That looks like a pretty solid no to me.

Read Also: How To File Taxes For Doordash

Claiming A Deduction For Business Use Of Your Car

There are two ways to claim a deduction for business use of your car:

- Cents per kilometre:

- Claim 72c per kilometre from 1 July 2020 or 68c per kilometre for earlier years.

- You can only claim for 5,000 kms using this method, even if you have travelled more than this.

- This method is only available for distances up to 5,000km. Even if you cover more than 5,000 kms business, you can only claim up to 5,000 kms using this method.

How To Claim Your Lost Miles

Luckily, as a rideshare or delivery driver you have some pretty detailed records of where youre driving and for what reasons. These records can be used to fill in the other deductible business miles that werent recorded by your rideshare app.

For example, lets assume youre an Uber driver who started driving in March, but who hasnt kept a mileage log for the first half of your rideshare business.

Read Also: How To Pay Taxes As A Doordash Driver

Its Always Tax Season In The Gig Economy

An underrated perk of being a W-2 employee: Your employer is required to withhold a portion of each paycheck for federal, state, and payroll taxes. Rideshare drivers, who are independent contractors, dont have the same luxury and must make sure theyre regularly paying their taxes.

Like all other business owners, drivers are responsible for making an estimated tax payment two weeks after the end of each quarter. You can either use accounting software or a tool like this to calculate the estimated payment.

You can avoid making quarterly payments if you have a job that withholds income taxes from your paycheck . Using the IRS withholding estimator as a guide, ask your employer to raise your withholdings to cover taxes owed on the driving hustle.

Got all that? For some further reading, head over to this guide on your options for filing taxes as a gig worker.

File under: The best tax help around. H& R Block are the tax season specialists who can help you make tax season easier than ever. Whether you take the DIY approach and do everything on your smartphone, or use one of Blocks tax pros, they have you covered. However, whenever, and wherever you work with Block, theyll get you the refund you deserve. Learn how Block has your back this tax season right here.

What Is The Best Way To Track Your Miles

The best way to track miles is whatever method works best for you.

That seems like a vague answer, doesn’t it? That’s because everyone is different. What works for me may not work for you. There are three main ways that you can track miles:

- A manual log, hand written or using a spreadsheet, where you record your odometer reading at the start and end of every trip

- Using a free GPS mileage tracker program like Hurdlr where manually begin recording at the start of each trip, and manually stop recording at the end.

- A paid GPS mileage tracker program like Hurdlr’s subscription plan or Triplog which can sense when your car is moving and automatically begin and end recording. .

I’ve always tracked manually. I’ve found that it’s far more accurate, and I capture every mile that I’m driving. The downside is, if you are the type to forget to write down your odometer readings, you can lose out on a lot of miles this way.

If you are prone to forget to record your readings, you might be better off with a paid program. You’re less likely to lose trips that way. There can be accuracy issues, because the auto start apps often don’t start recording until you’ve driven a little ways. Also, phone app GPS just sometimes has a way of glitching and parts of your trip could be lost.

It all depends on which fits you best. We go into a lot more detail with examples in this article on how to track miles.

Also Check: How Much Do You Pay In Taxes For Doordash

A Driver Of Uber Is Getting His Pay Through A Card

In this case, if a driver of Uber is getting his pay through a card or if his gross income is more than twenty thousand dollars, then this form is essential for him. If the driver has accepted more than 200 trips, then Uber will send this form by January 31st.

Uber provides this form which is provided by IRS. It is an official document, and all the details are with Uber as well as with IRS. In the case of Uber, even if you earn a little less from $20,000 but accepted 200 rides still will have to receive this form.

Mileage Depreciation For Sharing Economy

When choosing the best way to go about accounting for your business vehicle expenses you have several options IRS mileage reimbursement or calculate the actual car expenses. The IRS mileage reimbursement is the most simple and easiest way to deduct your car expenses. However, tracking your actual expenses might save you more.

Depreciation allows you to span your deduction over the course of the useful life of your asset. As far as cars are concerned, the useful life is usually about 5 years or so. The basic formula to calculate depreciation is,

÷ Useful Life

For example, if you purchased a new car for $20,000 and you estimated the salvage value at $10,000, and you plan to use the vehicle for 5 years, you would have a depreciation amount of $2,000 per year.

Read Also: Efstatus Taxact Com 2016

How Do You Calculate Your Gas Expense

UberBlackPr1nce said:How do you determine how much money you make per fill up?I can usually net 460-600 dollars before my next fill up it’ll cost me about 50 bucks to fill up.How do you guys calculate your profit verse gas expense?

NuberUber said:This is an easy one. Next time you fill up reset your odometer. When your gas tank is empty again you will know around how many miles you can drive on a tank of gas. Then divide what you paid for your gas by the number of miles to find out how many miles you got to the gallon. You can take it a bit further and then deduce how much you made versus how much you spent on gas.Gas prices move around and as I am driving, I am always looking for the best price for a fill up. Sadly, I am usually too busy to stop until I am on fumes, but I try to remember to go back to these places to save a bit more and add profit. I am so happy that gas is currently under $2 in our area. I can fill up my car for ~$25 and it usually lasts me 350-420 miles depending on my driving. As you can see, it is a very small part of my expenses since my car gets very good gas milage.

UberBlackPr1nce said:How do you determine how much money you make per fill up?I can usually net 460-600 dollars before my next fill up it’ll cost me about 50 bucks to fill up.How do you guys calculate your profit verse gas expense?

Gas Sure Mileage Maybe Candy Possibly

You might wonder if you can deduct these thing if youre a rideshare driver for a company like Uber or Lyft. Great news: youre self-employed and may qualify to deduct a number of expenses related to your work. But which ones? And what forms should you use?

Deductions can reduce your tax burden, so its important to know which forms you need, how to fill them out and how to maximize your savings. Here are some tips that could help.

Read Also: Does Doordash Take Taxes Out

Get Ready For The New Year

After youve filed your return, youll want to take steps to ensure that youre recording your mileage, fuel costs, and toll charges throughout the next year to make taxes easier. Keeping a notepad to record mileage in your vehicle along with a folder to save any receipts you get for business-related expenses can save you tons of time and stress when tax season rolls around again.