Can I File An Income Tax Return If I Dont Have Any Income

Filing a tax return is always important, so you have to make sure you do it before the deadline. But what is the procedure when you didnt have any income last year?

The good news is that you are not forced to file a return if you didnt get any income the last tax year. Every single year, there are some minimum income requirements imposed by the IRS they change annually depending on your tax status or inflation. So, your requirements can change based on whether you file jointly, youre married but filing separately, youre single, and so on. So, a tax return is not mandatory if you have no income. Still, you may want to do it regardless, because there are some huge reasons for this.

Filing despite getting no income the last tax year will allow you to claim some refundable tax credits, which can then offer you some tax refund. This applies even if you dont have a job. Therefore, it is possible for you to qualify for the Additional Child Tax Credit or the Earned Income Tax Credit. They are both refundable tax credits.

Besides, you can also file if you earned very little income last year. This makes it possible for you to recover taxes that were withheld from the last time you paid. It is a scenario that occurs when you had a job, but only for a small part of the last year. However, it is also possible in cases when a person goes to college and has very little income. Thus, filing a return will give the individual the opportunity to use the American Opportunity credit.

Filing A State Income Tax Return

The State of California requires an annual report of income, and assesses tax on the same type of income that is taxed by the federal government. However, unlike the federal government, California does not require an annual tax report from those who made less than the minimum filing requirement or had no income at all. Individuals who earned less than the minimum filing requirement do not have to file. Visit the Filing Requirements section of the California Franchise Tax Board for more information.

If you do not have a filing requirement but had state taxes withheld from your income, you will need to file a California tax return in order to receive any refund.

If you made income in another state and would like to know about that state’s filing requirements, please click here.

How Can I Get My Tax Return For 5 Years

To use this tool, you must create an account on the IRS website and verify your identity to access it. Once you have done this, you will have access to the transcription system. The wage and income statement shows what has been reported to the tax authorities over the years and is generally available over the past five years.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

How Do I Submit Form 8843

Form 8843 is typically attached to an income tax return.

If, however, you have NO income and are ONLY filing Form 8843, you can use Glacier Tax Prep to generate the 8843 form:

Department of the TreasuryUSA

Each individual who has NO income and files ONLY a Form 8843 MUST send the form in a separate envelope. Do not include more than one Form 8843 per envelope.

For example, Juanita Garcia is present in the U.S. under F-1 immigration status with her husband and 3 year old daughter . Juanita is the only person in the family who received U.S. source income during the tax year. Therefore, Juanita will file an income tax return with Form 8843 attached. Juanitas husband will file Form 8843 and mail in a separate envelope. Juanita must complete a Form 8843 for her daughter and must submit her daughters Form 8843 in a separate envelope.

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Recommended Reading: Where’s My Tax Refund Ga

Filing Taxes For Small Business With No Income

Do I have to file business taxes if my business made no money? This is the question you came here to answer.

And we have answers.

But, your responsibilities for filing taxes for small business with no income depends on your company structure.

The different types of company structure include:

- Sole proprietorship

Read on to learn what form each type of structure files and whether you must file it with the IRS in years without income.

When Your Child Should File

Your child should file a federal income tax return even though it isn’t required for the reasons above, if:

- Incomes taxes were withheld from earnings

- They qualify for the earned income credit

- They owe recapture taxes

- They want to open an IRA

- You want your child to gain the educational experience of filing taxes.

In the first two cases, the main reason for filing would be to obtain a refund if one is due. The others are income dependent or based on taking advantage of an opportunity to begin saving for retirement or to begin learning about personal finance.

You May Like: Buying Tax Liens California

Filing For Educational Purposes

Filing income taxes can teach children how the U.S. tax system works while helping them create sound filing habits for later in life. In some cases, it also can help children start saving money or earning benefits for the future as noted above.

Even if your child doesn’t qualify for a refund, wants to earn Social Security credits, or opens a retirement account, learning how the tax system works is important enough to justify the effort.

Requirements For Llcs Treated As Partnerships

You dont have to file a federal business return when theres no business activity in your inactive LLC taxed as a partnership.

LLCs treated as partnerships report their business activity on Form 1065. As a pass-through entity, partnerships pay taxes through each owners personal return, not at the company level.

Still, an LLC taxed as a partnership files information return Form 1065 to relay earnings, deductible business expenses, and credits to the IRS. Since partnerships file information returns, theyre not considered disregarded entities like businesses taxed as sole proprietorships.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

No Income: Do You Still Need To File Your Taxes

There are many reasons why some Canadians might not have had an income last year. Stay-at-home parents, job loss, and injury are just a few of the potential scenarios that prevent people from earning an income. But the question, is if you’re one of these Canadians, does that mean you get to skip filing your taxes this year? Interestingly enough, the answer isn’t a simple yes or no. Most people in Canada will have to file a tax return, even if they made no income. However, to make it easy for you, here is a list from the government, specifying when you have to file your taxes.

As you can see, there probably aren’t a lot of Canadians who don’t fit these criteria. In other words, you probably have to file your taxes this year.

Consider the benefits

Even if you’d rather not file your taxes, consider all the tax benefits in that list. With zero income, you can also still cash in on tax breaks and credits. For instance, the child tax benefit is available for most Canadian parents regardless of employment status. That’s a significant amount of money each month that could make a real difference to your finances.

You can also claim things like medical expenses, educational expenses, and child care expenses. The more expenses you can write off, the greater chance you’ll get a refund. Or, if you’re out of work due to a disability, there are also disability deductions and credits that earn you some cold, hard cash.

It’s easier to file!

****

The Easier Way To File And Pay Your Quarterly Itr

Lets admit it. The computations and filling up of forms can be quite tedious. The submission of attachments are a nightmare, too !

Fortunately, there is Taxumo, a web-based tax filing app that lets you skip the manual computing of tax dues and accomplishing of BIR form 1701Q. Instead, you would only need to enter your income and expenses, and you get your tax dues auto-calculated in real-time.

The BIR form 1701Q is also auto-generated so theres no need to manually fill out and print forms. The best part is that with a click of a button, you could submit your taxes online through the app. Taxumo also submits the attachments for you!

You can watch our webinar on how you can file Form 1701Q online through Taxumo below:

Read Also: Www.1040paytax.com Official Site

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

How Can I File An Older Tax Return

Once you have all the tax information at your fingertips, or anything you can collect, you should download the old tax forms from the IRS website. Another option is to buy tax software for the years you need to report. You cannot file a previous tax return using the tax forms and instructions for the current year.

You May Like: Where’s My Tax Refund Ga

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Benefits Of Filing Your Taxes Even If You Have No Income

Aside from the aforementioned reasons to file a tax return, there are many benefits that you can capitalize on by filing a tax return despite not having a job. Filing your tax return will make you eligible for certain tax credits that you wouldnt be able to get unless you file it. Here are some of the tax benefits that you can get if you file your tax return.

Canada Child Benefit

Its no secret that raising a child can be expensive. But if you file your taxes, you may be eligible for the CCB benefit. This benefit is a tax-free credit that is paid out each month. You could receive up to $563.75 per month for each child you have that is under 6 years old and $475.66 per month for each child between 6 and 17.

Check out these tax tips for low-income earners.

GST/HST Credit

The Goods and Services Tax or Harmonized Sales Tax is a tax-free for individuals and families with a low income. Individuals can receive up to $451, while families and couples can receive up to $592. If you have a child under 19, you can receive an additional $155 per child.

Check out these additional tax credits and deductions for parents.

Ontario Trillium Benefit

Depending on the province you live in you may be eligible for other provincial tax credits such as the Ontario Trillium Benefit. This benefit includes 3 types of tax-free payments which is meant to help low-to-medium income families with energy costs as well as property and sales tax. The three benefits included are:

School Credits

Read Also: How To Get Tax Preparer License

When To Call In Extra Help

Some people are simply old pros when it comes to filing their taxes. But, if you just dont have the time to figure everything out, theres no harm in calling in reinforcements.

Online NETFILE-certified programs can make filing your return quick and easy. Or, if your taxes are complicated, you can hire an accountant. An accountant may be able to suggest other expenses you can claim on your return, which is why its crucial to save all your receipts.

If an accountant isnt in your budget and you dont want to file online, many communities offer no-charge tax return consulting sessions. Some schools and community centres may even offer simple tax help.

If you make a modest income, you may be eligible for one of the CRAs free tax clinics theyre virtual this year.

Although tax filing was extended last year due to the COVID-19 pandemic, the deadline remains on schedule this tax season. Still, the CRA understands the extraordinary circumstance stemming from 2020, including emergency and recovery benefits, work from home credits, and other financial challenges that will make filing a return difficult this year. Visit the CRA website to learn more about the tax accommodations and assistance available.

Dont forget, the deadline to file your taxes is April 30, 2021!

How Much Do You Need To Make To File Taxes

Filing your federal income taxes can be a chore. If you earned little to no income over the course of a year, though, its a chore you may be able to avoid. Depending on your circumstances and your level of income, you may not need to file a federal income tax return. Even if youre not required to file, you may want to anyway in some circumstances.

TL DR

Whether or not you need to file your federal income taxes depends on your income, age and filing status.

Don’t Miss: Turbo Tax 1099q

Age And Status Requirements For Dependents

Being claimed as a dependent on someone elses taxes changes the rules a bit, and it does not rule out the possibility that you will still be required to file. If you are an adult, working dependent, you will likely be required to file your own return.

| Under 65 | $12,400 earned | |

| Single Dependents | 65 or older OR blind | $14,050 earned |

| Single Dependents | 65 or older AND blind | $15,700 earned |

| Under 65 | $12,400earned OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions. | |

| 65 or older OR blind | $13,700earned income OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions | |

| 65 or older AND blind | $15,000earned OR Your gross income was at least $5 andyour spouse files a separate return and itemizes deductions |

What Are The Attachments Required For Filing

Here are the documents youll need to prepare:

Don’t Miss: How To Buy Tax Lien Properties In California

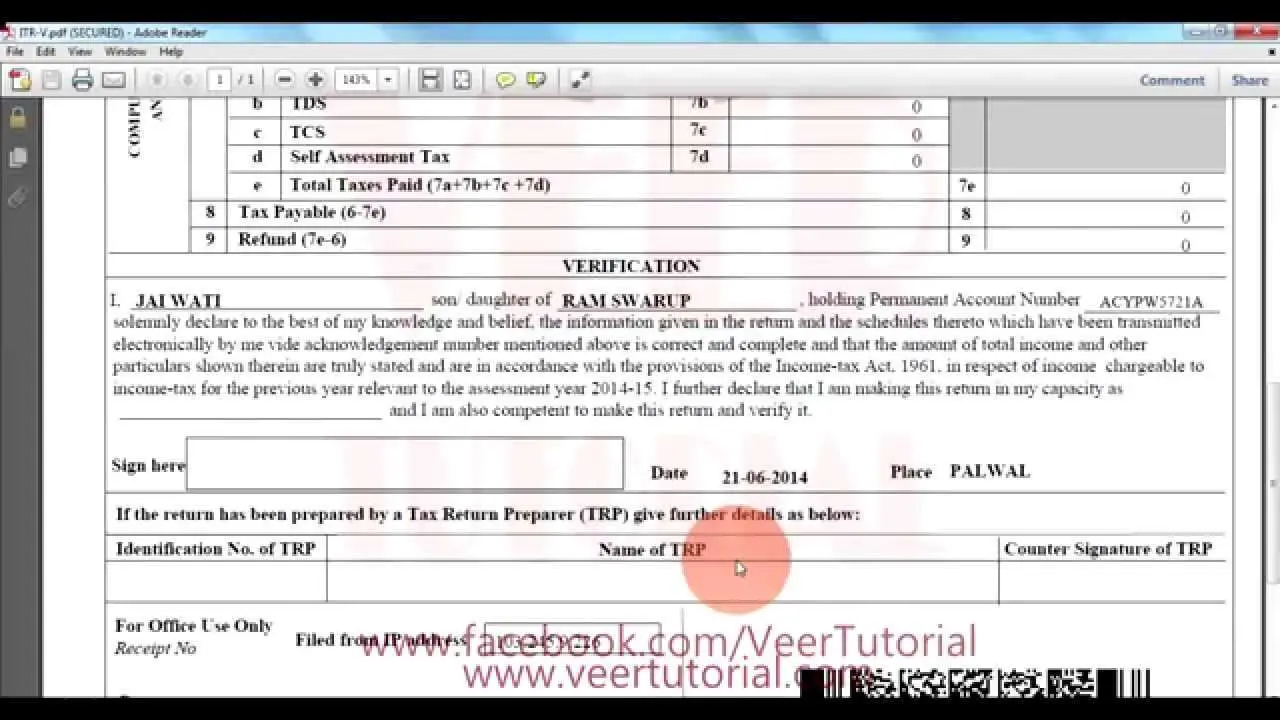

How To File A Zero Income Tax Return

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.There are 10 references cited in this article, which can be found at the bottom of the page. This article has been viewed 56,348 times.

Generally, you are not required to file a tax return with the IRS if your income is below the taxable threshold. However, even if you had no income for the year, you may want to file a return if you are eligible for refundable tax credits. If you’re filing a tax return with zero income, you can use the IRS’s Free File system to avoid preparation fees.XTrustworthy SourceInternal Revenue ServiceU.S. government agency in charge of managing the Federal Tax CodeGo to source

Where Do I File My Bir Form 1701q

First, you must file your income tax return first using eBIR Forms and print out copies of the form . After that, submit the forms to any Authorized Agent Bank located within the territorial jurisdiction of your Revenue District Office. Present your accomplished BIR form 1701Q with the requirements and your payment. The teller of the AAB or the RDO officer will give you a copy of your stamped and validated form.

For No Payment returns, you only have to attach the required documents to your BIR form 1701Q. You will also receive a copy of your stamped and validated form.

If your place doesnt have any AABs, you can file this directly with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer of the RDO.

Recommended Reading: Buying Tax Liens In California

When Your Child Must File

In 2018 and 2019, certain children were taxed using the estate and trust tax brackets, but in 2020, for income above a certain level, the tax rate of the parents will be used. Four tests determine whether a dependent child must file a federal income tax return. A child who meets any one of these tests in 2020 must file:

- If the child only has unearned income above $1,100

- If the child only has earned income above $12,400

- If the child has both earned any unearned income, and the child’s gross income is greater than either $12,400 or their earned income plus $350, whichever is less.

- The child’s net earnings from self-employment are $400 or more

Additional rules apply for children who are blind, who owe Social Security and Medicare taxes on tips or wages not reported to or withheld by the employer, or who receive wages from churches exempt from employer Social Security and Medicare taxes.

If filing a return is required by the first test above and the child has no other income besides unearned income, you can avoid a separate filing for your child by making an election described later in this article.

Four tests determine whether or not a dependent child must file an income tax return with the IRS.