Ten States With The Lowest Sales Tax Rates In The Us

Sales tax is collected at the state level in forty-five states and in the District of Columbia. New Hampshire, Oregon, Montana, Alaska, and Delaware, otherwise known as the NOMAD states, are the only states that do not have a state-level sales tax, although some local levels in Alaska do impose a sales tax.

Sales tax rates vary significantly from state to state. Below is a list of the ten states with the lowest average combined state and local sales tax rates across the US.

Right off the bat, we have a 4-way tie for spot #10, which puts the first four states in a tie for #7:

The Role Of Competition In Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicagos 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. At one time, Delaware actually used its highway welcome sign to remind motorists that Delaware is the Home of Tax-Free Shopping.

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

What Is The Difference Between Sales Taxes And Excise Taxes

Sales taxes and excise taxes are both types of consumption tax. Unlike sales taxes, which apply broadly to most goods, excise taxes only apply to specific products such as tobacco, alcohol, and gasoline. These are often known as “sin taxes” because they are typically levied on goods considered socially harmful.

Also Check: How To Get Tax Preparer License

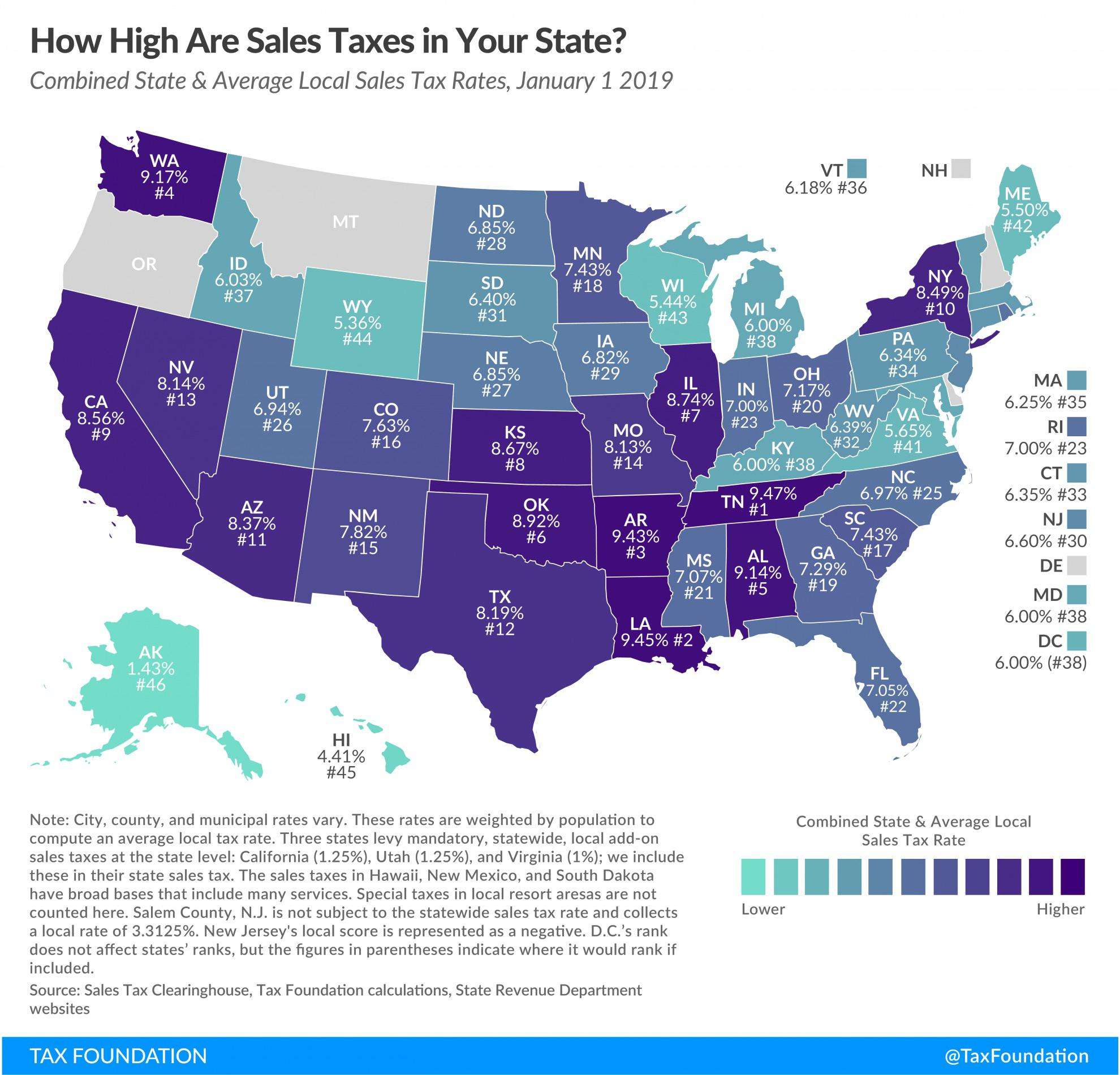

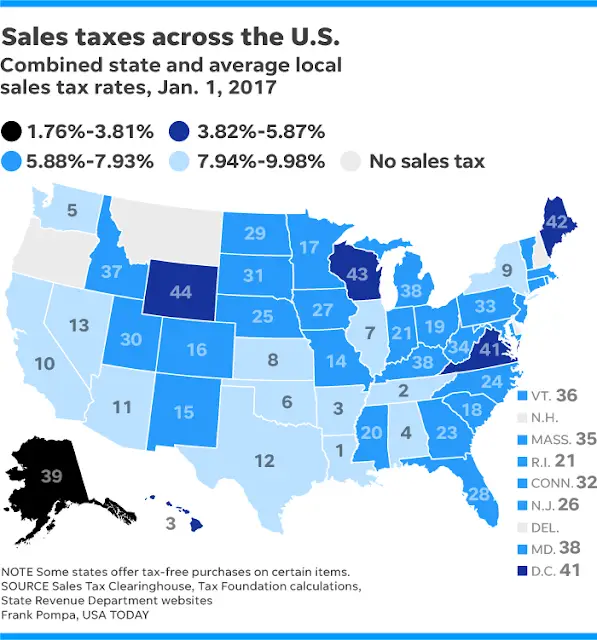

Combined State And Local Sales Tax Rates

Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of these, Alaska allows localities to charge local sales taxes.

The five states with the highest average combined state and local sales tax rates are Louisiana , Tennessee , Arkansas , Washington , and Alabama . The five states with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

States With The Highest & Lowest Tax Rates

John S Kiernan, Managing EditorMar 9, 2021

Tax season can be stressful for the millions of Americans who owe money to Uncle Sam. Every year, the average U.S. household pays over $8,800 in federal income taxes, according to the Bureau of Labor Statistics. And while were all faced with that same obligation, there is significant difference when it comes to state and local taxes. Taxpayers in the most tax-expensive states, for instance, pay three times more than those in the cheapest states.

Surprisingly, though, low income taxes dont always mean low taxes as a whole. For example, while the state of Washingtons citizens dont pay income tax, they still end up spending over 8% of their annual income on sales and excise taxes. Texas residents also dont pay income tax, but spend 1.8% of their income on real estate taxes, one of the highest rates in the country. Compare these to California, where residents owe almost 5% of their income in sales and excise taxes, and just 0.76% in real estate tax.

| $9,200 | 47 |

Don’t Miss: Www.1040paytax.com

Stay Informed On Sales And Use Tax

Join the Sales Tax Institute mailing list and get updates on the latest news, tips, and trainings for sales and use tax.

By submitting this form you are agreeing to join the Sales Tax Institutes mailing list so the Sales Tax Institute can send you email notifications including our monthly newsletter, monthly sales tax tips digest, information about upcoming courses and sales tax resources. Submitting this form will add your email to our mailing list. We will never share or sell your info. to view our privacy policy.

What Is Property Tax

Property taxes are taxes paid by property owners. The owners can be individuals or legal entities, such as corporations or other types of businesses. The amount of tax to be paid is assessed by the local government where the property is located. Well talk about how the tax is calculated in the next section.

Although property tax usually alludes to real estate, some states also assess property tax on other types of personal property, such as cars and boats. Property taxes are a key source of income for local governments. They are used to fund municipal projects such as schools, road improvements, parks and recreation, and public transportation.

Also Check: How Much Does H& r Block Charge For Doing Taxes

Where Taxes Are The Lowest

With one tiny exception, the states with the lowest tax burdens in WalletHubs ranking are out west. But they rose to the top of the list by different means.

Alaska, the state with the lowest taxes for locals, has no income tax and very low sales taxes . Wyoming has low rest estate taxes and no income tax. Nevada also ranks low for real estate and income taxes. Montana has the second lowest sales tax rate in the country.

And the lone easterner? Delaware lands on this best list by virtue of very low real estate and sales taxes, although income taxes there are actually on the high side.

| Overal rank | |

| Nevada | 8.20% |

Note: Effective total state and local tax rate based on a U.S. household with an annual income of $58,082 a home worth $193,500 a car valued at $24,350 and annual spending of a household earning the median U.S. income.

The 3 Primary State Tax Types

All states collect tax revenue. They have a government to run, after all. Most states charge income tax, sales tax, and property tax, while a few states only impose two out of these three .

Each state charges different rates for each tax type. One of the best analyses of state tax burden data is from WalletHub. It converts each states property and sales taxes to a percentage of the typical taxpayers income, enabling you to compare apples to apples by considering the total percentage of taxpayer income collected by each state.

But first, its worth pausing to explain each of the primary tax types.

Also Check: How Do I Get My Pin For My Taxes

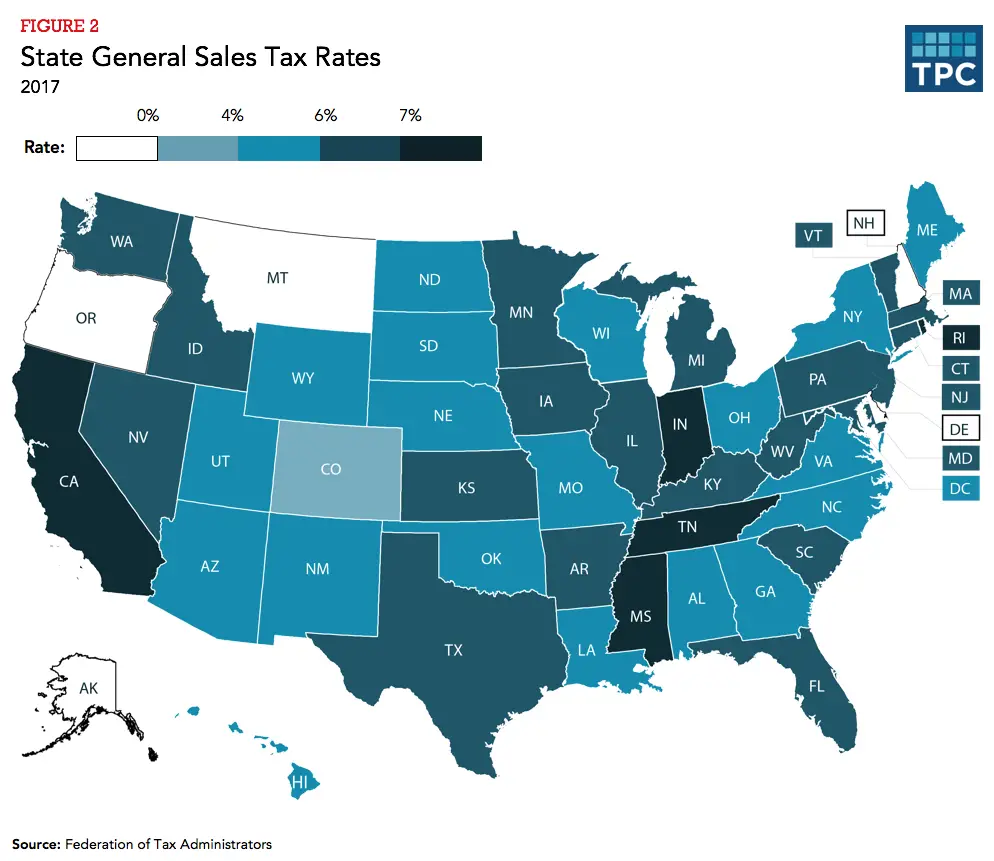

State Sales Tax Rates

California has the highest state-level sales tax rate, at 7.25 percent. Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee. The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2.9 percent. Five states follow with 4 percent rates: Alabama, Georgia, Hawaii, New York, and Wyoming.

No state rates have changed since April 2019, when Utahs state-collected rate increased from 5.95 percent to 6.1 percent.

Can I Get A Sales Tax Credit For My Trade

In many states, you can get a sales tax credit based on the value of your trade-in. Depending on the amount of your appraisal, you may be able to get more money trading to the dealership than selling your car on your own.

We’ve created a calculator that will tell you the tax credit amount and help you determine whether it’s better to trade-in to the dealership or to sell your car privately.

Tax information and rates are subject to change, please be sure to verify with your local DMV.

Recommended Reading: Does Contributing To Roth Ira Reduce Taxes

What Purchases Are Taxed

Most of these states with low sales tax rates exempt food items and many other necessary purchases as well, such as prescription drugs and clothing. But some states have separate, higher taxes for certain purchases like tobacco, alcoholic beverages, and gasoline.

New Hampshire will get you if you purchase tobacco products therea pack of 20 cigarettes will cost you an extra $1.78 as of 2020, and a pack of 25 cigarettes has a tax rate of $2.23 per package.

You can take heart if you live in Wyoming, however. The state had the lowest excise tax on beer in the country at just $0.02 per gallon as of 2020.

Combined Sales And Income Tax Leaders

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2020 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

According to the foundation, the top five states with the highest state and local tax combinations are:

- New York 12.7%

- Illinois 11.0%

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Recommended Reading: Is Past Year Tax Legit

Home Property Tax Average Per State

State

There are many factors that go into ones formula to decide the best place to retire, or the best place to move to, because we each have our own individual notions of what that is.

However, near the top of the list of factors or concerns should be property tax, income tax, and sales tax. Also, nearly just as important, do not forget to research the fiscal situation of the state, city, or town that you are contemplating moving to. There are many of these that are themselves on the verge of bankruptcy. They will be the first to raise your taxes.

Lowest To Highest Taxes By State

Wondering which U.S. State may be better to live in regarding their taxes and tax burden? While we cannot escape taxes, we can make decisions which will minimize our overall State tax burden, depending on each of our own financial situations and objectives.

In this article, we will address property tax, income tax, and sales tax.

Lets say you are planning to retire, and/or move out of your State. Among the many things that you will consider in your selection process may be picking a tax friendlier region.

The debt burden of many cities, counties, states, and the federal government are being stressed. There is little doubt that taxes, including State taxes will be on the increase as governments look for more revenue.

Regarding the three primary sources of revenue from State taxes , your own personal situation and preferences will weight each of these differently. For example, if you are retired or soon to retire, the income tax of a given State may be less important to you than say, the property tax of the county or town since your income may be relatively low . However your property taxes will always be there and will continue to rise over time.

Here are a few State tax statistics from a number of sources including RetirementLiving.com, Wikipedia, Census.gov/govs/statetax, State Government Tax Collections 2009, and the TaxFoundation.org.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

When Local Taxes Are Added In

Thirty-eight states allow local-level sales taxes. Among those that do, Hawaii, Wisconsin, Wyoming, and Maine all trail behind Alaska as having the lowest combined rates. Hawaii logs in at 4.44%, Wisconsin at 5.46%, Wyoming at 5.34%, and Maine at 5.50%.

The combined state and local rates reach a whopping 9.53% in some areas of Tennesseethe highest combined rate in the country.

Also among the five highest combined state and local taxes are Arkansas at 9.47%, Louisiana at 9.52%, Alabama at 9.22%, and Washington at 9.21%, all as of 2020.

Residents of Colorado Springs, Colorado voted to increase their city sales tax to 3.12% effective 2016 to help pay for highway and road maintenance, but Colorado still remains on the short list of low-taxed states overall.

State & Local Tax Breakdown

All effective tax rates shown below were calculated as a percentage of the mean third quintile U.S. income of $63,218 and based on the characteristics of the Median U.S. Household*.

|

State |

|---|

| 15.01% |

*Assumes Median U.S. Household has an income equal to $63,218 owns a home valued at $217,500 owns a car valued at $24,970 and spends annually an amount equal to the spending of a household earning the median U.S. income.

You May Like: How To Buy Tax Lien Properties In California

Which State Has Lowest Sales Tax

stateslowest sales taxtaxes

. Subsequently, one may also ask, which state in the US has the lowest sales tax?

Oregon, Montana, New Hampshire, Delaware and Alaska have no statewide sales taxes. The five states with the lowest average combined state and local rates are Alaska , Hawaii , Wyoming , Wisconsin and Maine .

Also, which state has the highest sales taxes? The five states with the highest average combined state and local sales tax rates are Tennessee , Louisiana , Arkansas , Washington , and Alabama . No state rates have changed since July 2018, when Louisiana’s declined from 5.0 to 4.45 percent.

Herein, what state has the lowest sales tax 2019?

The five states with the lowest average combined rates are Alaska , Hawaii , Wyoming , Wisconsin , and Maine .

What is the lowest state tax?

| Overall Rank |

|---|

Which States Have The Lowest Taxes

Ready to move somewhere more affordable? In addition to housing, food and healthcare costs, its important to factor in state taxes when assessing a places overall cost of living. While easy to overlook, taxes can be a significant expense. The three most common types of taxes that many states impose on residents are personal income tax, sales tax and real property tax. Money derived from these taxes fund important services, such as public schools and infrastructure development. While necessary, these expenses can quickly add up come tax season.

Fortunately for anyone hoping to save money, not every state government imposes high taxes. In fact, several states do not impose certain taxes at all on residents. Those living in tax-expensive states, on the other hand, may have a harder time saving money. In fact, as WalletHub points out, taxpayers who live in states with high taxes pay three times more than those in the cheapest states.

If youre looking to save money without having to lift a finger, consider moving to one of the U.S. states with the lowest taxes. For a look at which states impose low to no taxes on residents, take a look at our overview below.

Also Check: How To Look Up Employer Tax Id Number

Where Taxes Hit The Hardest

The highest-tax states made the list for steep taxes pretty much across the board. Thats especially true when it comes to real estate taxes.

Illinois, the state with the heftiest local tax burden in WalletHubs ranking, has the second highest real estate taxes in the nation . Connecticut, Pennsylvania, New York, and Nebraska all rank in the top 12 based on their real estate taxes.

Pennsylvania also has the third highest income tax rate for locals New York lands only four places back.

| Overall rank |

What Tax Rate Do I Use

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent. You will be required to collect both state and local sales and use taxes. For information about the tax rate for a specific area, see Local Sales and Use Tax Rates on our sales and use tax web page.

For information on collecting and reporting local sales and use tax, see 94-105, Local Sales and Use Tax Collection A Guide for Sellers For a list of local tax rates, see Texas Sales and Use Tax Rates. We also provide tax rate cards for all combined tax rates.

Sales and use taxes are collected at the same rate. See Purchases/Use Tax for additional information.

Also Check: How Can I Make Payments For My Taxes

Exemptions From State Sales Taxes

Many states that have a sales taxes exempt food, but Alabama, Hawaii, Idaho, Kansas, Mississippi, Oklahoma, and South Dakota do include food items in their state sales taxes.

Some states charge a lesser sales tax on food items as of 2020, including:

- Arkansas: .125%

- Vermont

- Virginia

Clothing is exempt from state sales taxes in a few states, mainly in the Northeast. These include Massachusetts, Minnesota, New Jersey, New York, Pennsylvania, Vermont, and Rhode Island.

Several states also offer sales tax holidays and weekends.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: How To Get Tax Preparer License