Home Office Deduction Prorates Home Expenses

Although everyone uses the shorthand “home office deduction” to refer to amounts that you can claim if you operate your business from your home, it is important to realize that the home office deduction is actually many deductions for different types of expenses. Among these expenses are a prorated amount of your:

- home mortgage interest

- utility bills

- home repairs and

- depreciation.

The common denominator among these deductions is that the IRS has devised a single test to determine whether you qualify for all of them. If your working space doesn’t meet the “home office” tests, these expenses are either non-deductible personal expenses or deductible only as itemized deductions

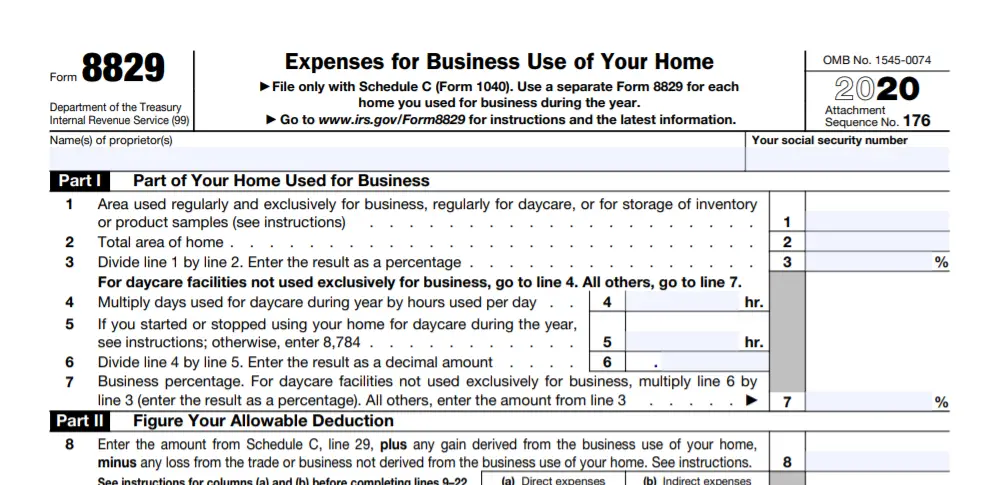

The portion of expenses that are tied to your home office are totaled up and reported on IRS Form 8829, Expenses for Business Use of Your Home.

How To Calculate Your Home Office Deduction

There are two ways to calculate your home office deduction:

-

The simplified method doesnât require you to have a detailed record of your expenses, but the maximum available deduction is $1,500.

-

The regular method allows you to deduct the value of your exact expenses, but you need to have more detailed receipts and records of your spending.

Note that for both methods, the value of your deduction cannot exceed the gross income from your business.

Will The Government Expand Eligibility Now That More People Are Working From Home Due To Covid

Not likely. If the government wants to enhance its relief efforts for people grappling with the economic fallout of the pandemic, there are plenty of other levers to pull. “If the pandemic continues on and large volumes of taxpayers continue to work remotely, it is likely that other tax changes might be proposed, including a possible tax break related to that activity,” says Steber.

Also Check: Form Acd-31015

Can I Switch Back And Forth Between The Two Options From Year To Year

You can use the simplified method in one year and the actual-expenses method in a later year. In this case, you must calculate the depreciation deduction for the later year. Keep in mind that the requirements for who qualifies for the home office deduction doesnt change based on which deduction method you use.

Principal Place Of Your Business

You must show that you use your home as your principal place of business. If you conduct business at a location outside of your home, but also use your home substantially and regularly to conduct business, you may qualify for a home office deduction.

For example, if you have in-person meetings with patients, clients, or customers in your home in the normal course of your business, even though you also carry on business at another location, you can deduct your expenses for the part of your home used exclusively and regularly for business.

You can deduct expenses for a separate free-standing structure, such as a studio, garage, or barn, if you use it exclusively and regularly for your business. The structure does not have to be your principal place of business or the only place where you meet patients, clients, or customers.

Generally, deductions for a home office are based on the percentage of your home devoted to business use. So, if you use a whole room or part of a room for conducting your business, you need to figure out the percentage of your home devoted to your business activities.

If the use of the home office is merely appropriate and helpful, you cannot deduct expenses for the business use of your home.

For a full explanation of tax deductions for your home office refer to Publication 587, Business Use of Your Home. In this publication you will find:

The rules in the publication apply to individuals.

Recommended Reading: 1040paytax.com Legitimate

Employees Are Out Of Luck

If you’re an employee working from home last year, I’m sorry to say that you can’t deduct any of your related expenses on the tax return you must file this year.

Before 2018, you could claim an itemized deduction for unreimbursed business expenses, including expenses for the business use of part of your home if they exceeded 2% of your adjusted gross income. However, this deduction was eliminated by the 2017 tax reform law.

Calculating The Deduction: Actual

The home office deduction is computed by categorizing the direct vs. indirect business expenses of operating the home and allocating them on Form 8829, Expenses for Business Use of Your Home. Direct expenses can be fully deducted. For instance, the costs of carpeting and painting the home office room are 100% deductible. Indirect expenses are allocated pro rata between business and personal use. Any reasonable method can be used. Ratios based on square footage are most common, but the number of rooms used for business vs. personal use has been allowed as well ). Indirect expenses include real estate taxes, mortgage interest, rent, utilities, insurance, depreciation, maintenance, and repairs.

The Sec. 164 limitation on the deduction of state and local taxes introduced by the TCJA does not affect the amount of real estate taxes that can be deducted as part of home office expenses. As was the case before passage of the TCJA, the business use portion of the tax is calculated by multiplying the full amount of the real estate taxes by the business use percentage, and the business use portion is deductible under Sec. 280A. The individual portion of the real estate taxes is combined with the taxpayer’s other state and local taxes to determine whether the taxpayer’s individual deduction for state and local taxes is limited to $10,000. The business portion of the real estate taxes is deductible whether the taxpayer itemizes or takes the standard deduction.

You May Like: Doordash Calculator

What Is Regular Use

There’s no specific definition of what constitutes regular use. Clearly, if you use an otherwise empty room only occasionally and its use is incidental to your business, you’d fail this test. If you work in the home office a few hours or so each day, however, you might pass. This test is applied to the facts and circumstances of each case the IRS challenges.

TurboTax Tip: If you’re an employee of another company but also have your own part-time business based in your home, you can pass the home office test even if you spend much more time at the office where you work as an employee.

Exceptions To The Home Office Deduction

There are sometimes exceptions to the home office rules. For instance, in-home daycare businesses dont have to meet the exclusive use test. To qualify for that exception, you must meet two different requirements:

- You provide daycare for children, people 65 years or older, or people who are physically or mentally unable to care for themselves

- You must have a license, certification, registration, or approval as a daycare center under state law

The IRS provides another exception for those who use their homes to store business inventory or product samples. To qualify for this exception and claim the home office deduction, you must meet all of the following requirements:

- You sell your products at wholesale or retail as your business

- You keep the inventory or samples in your home for business use

- Your home is your only business location

- You regularly use the storage space for business purposes

- You use an area that is separately identifiable as suitable for storage

You May Like: How To Get A License To Do Taxes

Partner’s Home Office Deduction

Owners of partnership interests can also deduct home office expenses on their individual Form 1040, U.S. Individual Income Tax Return. If the expense is of the type the partner is expected to pay without reimbursement, the partner can deduct the expense on Schedule E, Supplemental Income and Loss, as “unreimbursed partner expense” . Per Schedule E instructions, UPE should be reported on a separate line of the section reporting partnership loss, along with the name of the partnership, a description of the amount, and the notation “UPE.” Form 8829 can be used to determine the appropriate deduction, but the form itself does not need to be filed.

The IRS takes the position that partnership expenses are not deductible on an individual return unless the partnership agreement expressly states that the partner is required to pay the expense personally see also Technical Advice Memos 9316003 and 9330004). Take care to ensure that the partnership agreement includes language that each partner or member is required to pay for home office and other partnership expenses without reimbursement. Of course, the taxpayer should also have adequate substantiation of the expenses.

Unlike the sole proprietor’s home office deduction, UPE can be deducted if it exceeds the income reported through the Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. . UPE is deductible against both federal income tax and self-employment tax.

Are There Downsides To The Home Office Deduction

The major drawback isn’t specific to the deduction itself — but rather the dreaded self-employment tax. If you work for yourself or own your own small business, you’ll be taxed at a rate of 15.3% on the first $142,800 of your combined wages, tips and net earnings. And the threshold is low: If you earned $400 or more from self-employment during 2020, you’re on the hook for paying this tax.

If you want to plunge into the weeds of claiming the home office deduction , check out IRS Form 8829. But any good tax software package will walk you through the process of claiming the office home office deduction — and a host of other tax deductions — including those related to health insurance premiums and retirement savings. And there are more details about the specifics, including exactly how to calculate your home office deduction, on the IRS website.

Don’t Miss: Does Doordash Provide W2

The Definition Of A Home Office

To be considered a home office, the area must be used regularly and exclusively for your self-employed business. The office space must be your primary place of business or a separate structure used in connection with your business.

There is no requirement that your home office needs to be partitioned off from other areas with a wall or additional barrier. For example, if you have a desk in the corner of your living room where you conduct your business, you can still qualify for the deduction provided you dont also use that specific area of your home for personal use.

A Place To Meet Patients Clients Or Customers

Using part of a home as a place to meet clients allows more flexibility, and it can be deducted even if there is another principal place of business. For example, if a self-employed attorney meets clients at home two days a week but works out of another office the other three days, the home office qualifies for a deduction . Use of the home to meet with patients, clients, or customers must be “substantial and integral” to the business ). Videoconferencing or occasional meetings are likely not enough.

Also Check: Where Can I Amend My Taxes For Free

Calculating The Deductible Portion Of Your Indirect Expenses

If you are claiming indirect expenses under the actual expense method, you can deduct the “business use percentage” of many common homeowner expenses. The business use percentage is based on the portion of your home that is actually used for your business. For example, if you own a 2,000-square foot home and use 200 square feet of it to operate your business, you are using 10% of your home for your business .

Once you know your business use percent for your home, you know the percentage of home expenses that you can attribute to your business. To continue with the example above, if you are using 10% of your home for business and pay $3,000 in real estate taxes each year, you can deduct 10% of that amount as a business expense, or $300. Usually, you can deduct at least a percentage of these common household expenses:

- Home depreciation, property taxes, and mortgage interest

- Utilities

Tax Terms Related To Home Businesses

Exclusive use means you must use the specific space only for business purposes. The space can be part of a room and it doesnt have to be physically marked off to qualify. You dont have to meet the exclusive-use rule if you use that part of your home for storing inventory or product samples, or for a daycare facility.

Regular use means you use that space on a regular basis, not just occasionally or incidentally. For example, if you use space as a home office where you go every month to pay bills, thats regular use. But using it only once a year to prepare your tax return probably wouldnt apply.

Trade use or business use means use for activities that produce income from selling goods or services. Nonprofits wouldnt qualify for this deduction, nor would hobby businesses that dont make a profit.

To be your principal place of business, your home office must be:

- Used regularly and exclusively for administrative or management activities, and,

- You use no other location these activities

If you do business in several locations consider:

- The relative importance of the activities in each place, and

- The amount of time spent at each place.

Partners in partnership businesses may be able to deduct business use of home expenses if the partnership doesnt reimburse them for these expenses. The total from each partners calculations goes on these three tax forms schedules E, SE, and K-1.

Also Check: Doordash Tax 1099

How To Document Your Work Space

Its really important to always have detailed records as good reference and proof of your home office being exclusively used for work for your tax return. You may not have access to this same space if youre questioned several years down the road.

To record your office space, here are things to capture in case youre questioned about your deduction.

Take pictures or video of the area and how you only use the space for work.

A good idea is to take pictures or video of the door or partition that shows the separation of your work space and your living spaces. This is helpful to show proof of the separation of spaces so the IRS agent can see that when you open the door or partition youre entering your work space and youre going to work. By closing the door or curtain, this shows that when you leave your office space, you leave work.

Make sure to save these photos or video with the rest of your tax return files for proof of your home office deduction later if you need it.

Who Can Take The Home Office Deduction

Not every self-employed person with a home office will qualify for the home office deduction. There are two basic requirements to qualify.

Also Check: Doordash File Taxes

Which Method Should I Use To Calculate My Home Office Deduction

The simplified method can make it easier for you to claim the deduction but might not provide you with the biggest deduction. TurboTax makes it easy to determine if you qualify and how much you can write off by asking you simple questions about your unique tax situation. TurboTax has you covered whether your tax situation is simple or complex. Well help you find every deduction you qualify for and get you every dollar you deserve.

TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Perfect for independent contractors and small businesses. Well search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions.

If You Worked From Home Last Year Whether You Can Claim The Home Office Deduction On Your Tax Return May Depend On Your Employment Status

Like millions of other Americans, you may have worked from home a lot last year because Covid forced your office to close. Sure, you saved money on commuting costs, work clothes and lunches, but there are other unreimbursed expenses that drained your wallet. For instance, you probably had to pay for printer paper and ink, note pads, and other office supplies. Plus, your electric and other utility bills were likely higher since you were at home all day. And maybe you had to upgrade your Wi-Fi, too. Wouldn’t it be nice if you could claim a tax deduction for your home office expenses on your 2021 tax return?

Well, maybe you can. Some people can deduct their business-related expenses, and there’s something called the “home office deduction” that lets you write off expenses for the business use of your home. Whether or not you can claim these tax breaks depends on your employment status.

Don’t Miss: Do Doordash Take Out Taxes