Adjust Gross Pay For Social Security Wages

Now that you have gross wages, take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

IRS Publication 15 has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal income tax withholding.

To calculate Federal Income Tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15: Employer’s Tax Guide). Make sure you have the table for the correct year.

Starting January 1, 2020, use the new IRS Publication 15-T that includes the tax tables for the new W-4 form. It also includes tables for the old W-4 form for employees who haven’t changed their withholding since January 1, 2020.

Try Out Our Mock Payroll Calculator For Salaried Employees

Do you take a do-it-yourself approach to small business payroll? If so, its helpful to have various free payroll estimator tools at your disposal.

Our free salary paycheck calculator can help you and your employees estimate their paycheck ahead of time. Enter the required information into the form to instantly get your results.

You can also use the calculator to calculate hypothetical raises, adjustments in retirement contributions, new dependents, and changes to health insurance premiums.

In addition to our free salary paycheck calculator, our payroll calculators page contains an hourly paycheck calculator, among many others.

Total Up Your Tax Withholding

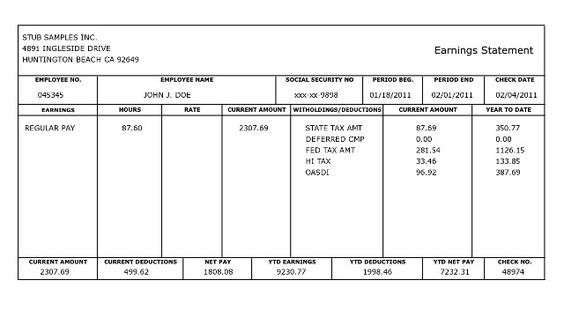

Lets start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Lets say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

If youre single, this is pretty easy. If youre and both of you work, calculate your spouses tax withholding too. In this example, well assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

Then add the two together to get your total household tax withholding.

Recommended Reading: How To Appeal Property Taxes Cook County

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee choose to claim, the less federal tax their employer deducted from their pay.

Withholding allowances are no longer used on the 2020 W-4 form.

What’s New As Of January 1 2022

The major changes made to this guide since the last edition are outlined.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2022. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022.

For 2022, employers can use a Federal Basic Personal Amounts of $14,398 for all employees.

The federal income tax thresholds have been indexed for 2022.

The federal Canada Employment Amount has been indexed to $1,287 for 2022.

The Ontario income thresholds, personal amounts, surtax thresholds and tax reduction amounts have been indexed for 2022.

Also Check: Paying Taxes On Doordash

What Are Payroll Taxes

When a person works for a company full-time, both the worker and the employer are subjected to a variety of taxes. These taxes are known as Payroll Taxes. The employer withholds these amounts from the workers paychecks, and submits them along with the companys contributions, to the government. The implementation of these taxes, and their withholding, are required by law.

Payroll taxes can include the following:

- Federal income taxes

- State and local income taxes

- Social Security and Medicare taxes

- Federal Unemployment Tax Act

- State Unemployment Tax Act

- State Disability Insurance

- Workers Compensation

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

You May Like: Appeal Property Tax Cook County

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

Adp In New York City Ny Area Salaries

The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Just keep in mind that only $500 in an FSA will roll over from year to year. If you contribute more than that and then dont use it, youre out of luck. Remember, calculate your taxes for your net pay bonus before you spend it. With our bonus check tax calculator, you can see your net bonus before you start planning your next purchase. And, when you leave a job, you may receive your check on the last day youve worked or on the last regular pay date for the pay period. There are no federal laws mandating exactly when the last check must be issued, although some states specify that you must be paid immediately.

The arrival of December can leave you excited for not only the winter holidays but also the potential of a work bonus. While some employers will surprise you with one, others will let you know a few weeks in advance that youre receiving additional funds due to your performance. Topia Compass calculates tax exposure by gathering and analyzing expense transactions, travel bookings, timesheets, real-time physical presence data, and personnel records from enterprise systems. It then feeds the relevant calculations into various systems and processes, including payroll providers such as ADP to ensure accurate and timely non-resident payroll withholding.

Don’t Miss: Wheres My Refund Ga State

Do Sole Proprietors Pay Payroll Taxes

Self-employed individuals must also pay their federal and state taxes, along with social security and Medicare . The differences are:

- Self-employed individuals pay the full amount once per year, when filing their personal income tax returns.

- Self-employed individuals have to pay the full amounts themselves. Because they are self-employed, there is no employer to share the costs with.

It is advisable that self-employed individuals put aside a certain percentage of their small business earnings throughout the year, so that they are prepared and capable of paying the taxes owed, at tax time.

How Much Tax Is Taken Out Of A Paycheck

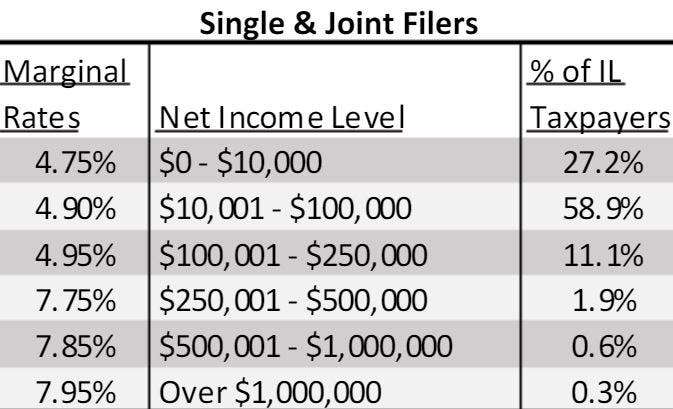

This varies from person to person and location to location. For example, the more money you earn, the more you pay in taxes. Additionally, state income tax rates vary.

Take these steps to determine how much tax is taken out of a paycheck:

- Review current tax brackets to calculate federal income tax.

- Calculate Federal Insurance Contribution Act taxes using this years Medicare.

- Determine if state income tax and local income tax apply.

- Divide the sum of all taxes by your gross pay.

These steps will leave you with the percentage of taxes deducted from your paycheck.

Also Check: How Much Do I Pay In Taxes For Doordash

When To Change How Much Tax Is Withheld From Your Pension

When you are working, you can change the amount of tax withheld from your paycheck each year. In retirement, you can do that, too. When your tax situation changes, you will want to adjust your tax withholding.

For example, your first year of retirement you may have a salary for part of the year, and you may have a spouse who is still working, so you may need to withhold a larger amount in taxes from your pension for that year. In subsequent years, your income may change, which means you should adjust your tax withholding.

The following events may trigger a need to change your tax withholding in retirement:

- Your spouse stops working.

- You or a spouse take on part-time work.

- You pay off a mortgage or take on a mortgage.

- You have a large amount of taxable capital gains from the sale of a property, mutual funds, or stock.

- You take withdrawals from an IRA or 401 account.

- You and/or a spouse start Social Security benefits.

- You reach age 72 , and required IRA distributions begin.

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

You May Like: Pastyeartax.com Review

How Do You Calculate Annual Income

To calculate your annual salary, multiply the gross pay before taxes by the number of pay periods in the year.

For example, if you earn $2,000/week, your annual income is calculated by taking $2,000 x 52 weeks for a total salary of $104,000.

Note: your pay frequency may differ, such as if youre paid bi-weekly, semi-monthly, or monthly.

Experiment with the paycheck calculator above to answer these questions among others while also pinpointing any changes you can make to boost your take-home pay and improve your personal finances.

SurePayroll, Inc. and its subsidiaries assume no liability and make no warranties on or for the information contained on these state payroll pages. The information presented is intended for reference only and is neither tax nor legal advice. Consult a professional tax, legal or other advisor to verify this information and determine if and/or how it may apply to your particular situation.

Why Do You Need To Adjust Your Tax Withholding

Dave recommends adjusting your withholding so you break even at tax time. In other words, you dont send the IRS a big check, and you dont get a huge refund back either.

IRS data shows that the average tax refund for the 2019 tax season was $2,725.1 So, lets say you got paid every two weeks and received the average refund. That means you shouldve had an extra $105 in every paycheck last year! Think of what you could do with $200 or more each month!

And if you went through a major life change over the past year that might impact how much you owe in taxesyou got married, bought a house, or welcomed a baby into the worldits a good idea to take a fresh look at your tax withholding and make any adjustments.

You May Like: Ccao Certified Final 2020 Assessed Value

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

What Is The Percentage Of Federal Taxes Taken Out Of A Paycheck

There is no universal federal income tax percentage that is applied to everyone. This is because all employees are required to fill out a W-4 form , when hired at a company. The information an employee provides on this form, such as marital status, or number of children and dependents, along with the employees gross salary, will determine the amount of federal income taxes taken off of an employees check. There are seven different income tax brackets.

The other federal taxes do have standard amounts, they are as follows:

Also Check: How To Do Taxes For Door Dash

California Median Household Income

| 2011 | $57,287 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

Payroll Deductions Online Calculator

For your 2022 payroll deductions, you can use our Payroll Deductions Online Calculator . The online calculator makes it easier to calculate payroll deductions. PDOC is available at canada.ca/pdoc.

PDOC calculates payroll deductions for the most common pay periods, as well as the applicable province or territory. The calculation is based on exact salary figures.

You May Like: Do You Pay Taxes On Plasma Donations

How Much In Taxes Should I Withhold From My Pension

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

When you start a pension, you can choose to have federal and state taxes withheld from your monthly checks. The goal is to withhold enough taxes that you won’t owe much money when you file your tax return. You don’t want to get a large refund, either, unless you like lending money to Uncle Sam.

If you choose not to have any taxes withheld, and you underpay your taxes, you could end up owing taxes plus an underpayment penalty. To avoid those fates, you’ll want to estimate your income for the year and set your tax withholding appropriately.

What Small Business Owners Need To Know For Payroll

All of the information above can apply to both business owners and employees. For example, as a small business owner, if youre asked how much federal tax is taken out of my paycheck by employees, youll have a better understanding to explain the process. Additionally, if youre asking this question for your personal paychecks youll also know. If youre one of the small business owners following a DIY approach to payroll, you really need to know the above information.

To handle payroll on your own, make sure that youre getting Form W-4 from employees during onboarding. Additionally, youll want employees to verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season. From there, payroll calculators will be your friend. Payroll calculators can help you calculate what payroll will be for salaried employees and contractors.

Don’t Miss: Do You Have To File Taxes With Doordash

How To Take Taxes Out Of Your Employees’ Paychecks

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.There are 18 references cited in this article, which can be found at the bottom of the page. This article has been viewed 15,048 times.

If you are an employer who has one or more employees, you will most likely be required to withhold various taxes from every employee’s paycheck. To set up your withholding procedures, you will need to apply for tax identification numbers with your state department of revenue and the Internal Revenue Service . When it comes time to withhold taxes, you will generally withhold state and federal income tax as well as federal social security and Medicare taxes. You may also be required to withhold other taxes periodically . In addition to withholding funds from every employee’s paycheck, you are also required to deposit those funds with your state and federal government periodically. Finally, either quarterly or once a year, you will be required to file a return as an employer.