How Do I File My Taxes Online

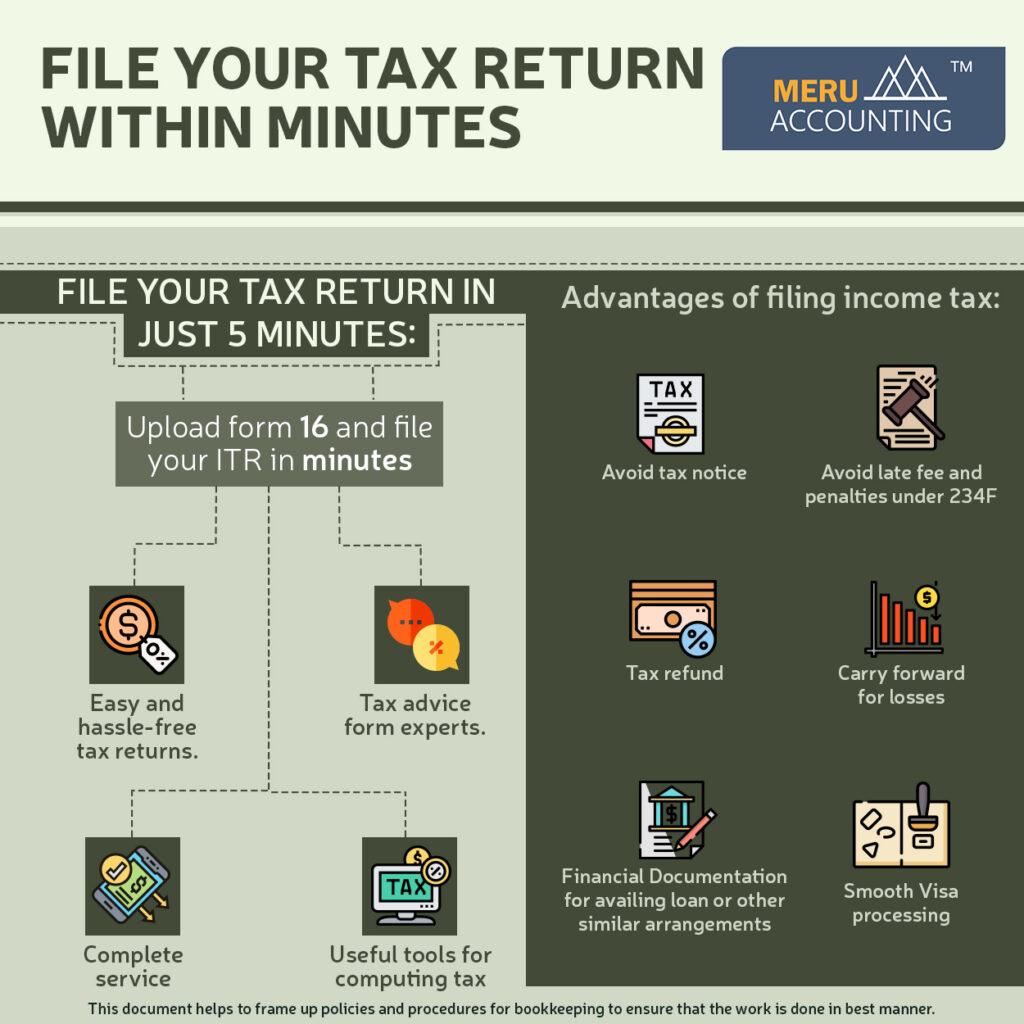

Filing your taxes with TurboTax Free is quick and easy. First youll be asked to set up a profile and follow a simple process to find all the credits and deductions youre entitled to. With the CRAs Auto-fill my return, you can also import your tax info directly from the CRA. This service pulls info from your income slips , government benefit slips, RRSP receipts, and unused tuition credits. All the relevant info will be populated from these forms into your tax return saving you time and effort.

If you decide not to use CRAs Auto-fill my return service, or if you have additional info to enter that isnt captured through the import, you can find all the forms you need quickly and easily through TurboTaxs search feature.

You can also easily look for all the credits and deductions that apply to you using the search bar in TurboTax Free. If youre not sure where to start, heres a list of common credits, deductions, and expenses you may be eligible for:

Once youve entered all your info for the year and youre ready to file, our software will guide you through the steps to NETFILE your return online or print and mail your return. Well also give you step-by-step instructions on how to pay the CRA if you owe taxes.

Undelivered Federal Tax Refund Checks

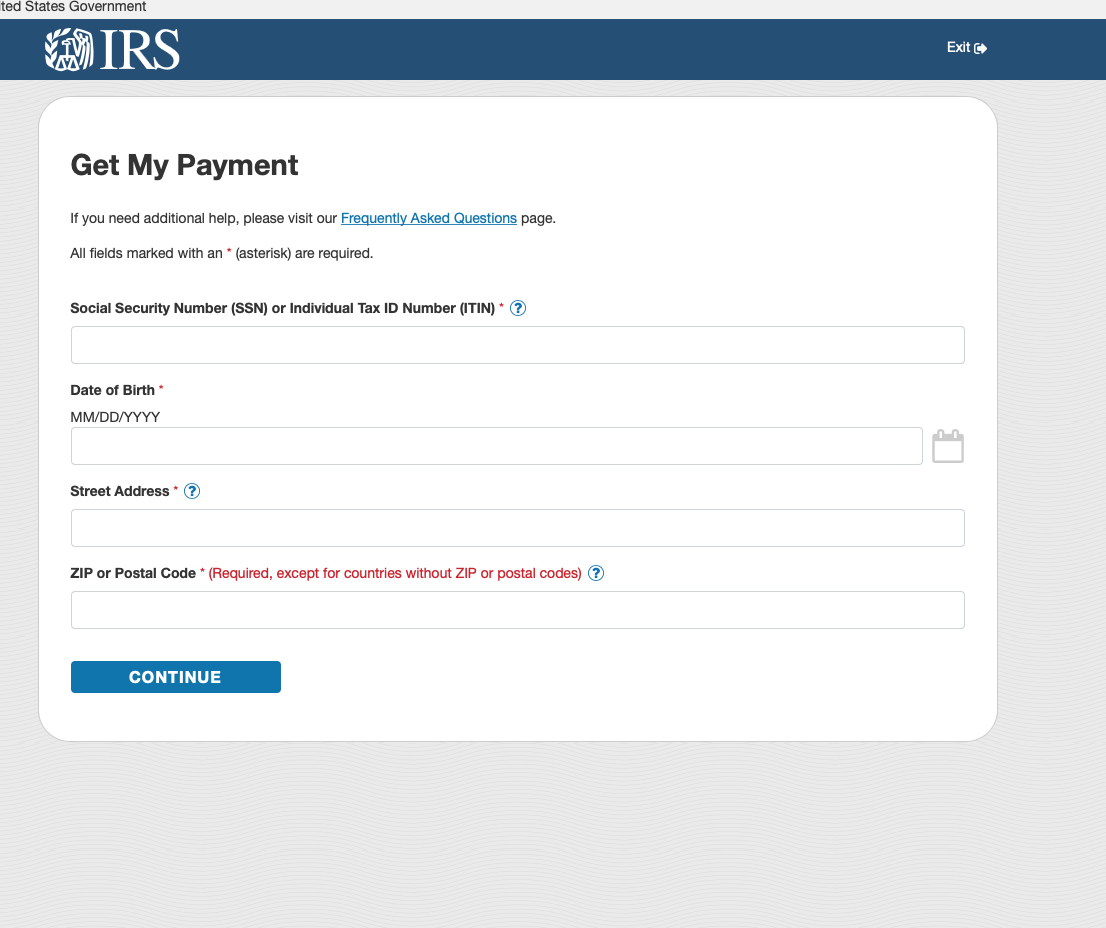

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

What Should I Expect When Filing Taxes Online

Filing taxes online should be a quicker process than completing your return by hand. If you have a simple tax situation, you shouldnt expect to spend a long time preparing your tax return.

For example, if you only have W-2 income and claim the standard deduction, your tax return shouldnt take long to prepare, review, and e-file.

On the other hand, if you have a more complex tax situation, you may still need to enter a good amount of data manually, especially if you are itemizing your deductions or claiming certain tax credits.

For example, if you have several investment and bank accounts, work for yourself, have rental property, claim tax credits, or need to account for the Alternative Minimum Tax , your tax return may take a while longer to prepare.

Tax software can assist with handling these finer details and also provide objective explanations on the impacts of taking certain tax positions. Should you need help, several tax software packages offer to connect you with a qualified tax professional to answer questions, guide you through preparing your return, and check for any missed deductions or credits you might qualify for.

You May Like: How To Pay My State Taxes Online

Youre Requesting Injured Spouse Relief

Youre considered an injured spouse if you were supposed to receive a tax refund but didnt because it was garnished to pay for your spouses debt.

However, you may qualify for injured spouse relief, which is getting your tax refund back, only if you file jointly with your spouse and youre not legally obligated for any of that debt yourself.

You can use Form 8379 to request injured spouse relief. If you want to request it and you havent filed your joint tax return yet, you can file them at the same time via e-file. If you want to submit it but youve already filed your joint tax return, thats when you must print out Form 8379 and mail it to the IRS.

Tax Tips For Avoiding E

OVERVIEW

The Internal Revenue Service can reject your e-filing for a wide range of reasons. However, if you implement some basic tips, you may be able to avoid unnecessary e-file rejections.

Sometimes the most frustrating part of preparing your tax return is dealing with unsuccessful attempts to e-file. E-filing your return instead of mailing definitely has some benefits, especially receiving your refund much faster. The Internal Revenue Service can reject your e-filing for a wide range of reasons, which means youll need to figure out what went wrong and try again. However, if you implement some basic tips, you may be able to avoid unnecessary e-file rejections.

You May Like: 1040paytaxcom

You May Like: How Do I Amend My Tax Return

If You Need Help With Your Return

If you are unable to get help filling out your North Carolina return, you can contact a service center for assistance or call toll-free at 1-877-252-3052. Your federal return must be completed before we can assist you in filling out your North Carolina return.

If you are disabled, have a low income, or are a senior citizen, income tax returns can be prepared free of charge through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. For location and dates of assistance call the Internal Revenue Service toll-free at 1-800-829-1040.

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

Recommended Reading: Can You File Your Taxes For Free With Turbotax

Detroit Individual Income Tax

- As a direct debit with your return when supported by the software or

- Mail form 5122, City Income Tax E-file Payment Voucher with your payment after you e-file your City of Detroit Income Tax Return. Do not use this voucher to make any other payments to the Michigan Department of Treasury.

Note: Do not use the Michigan Individual Income Tax e-Payments service to make a payment for your City of Detroit Income Tax Return.

Make your check payable to the State of Michigan Detroit. Print the tax year, CITY-V and the last four digits of your Social Security number on the check. If paying on behalf of another filer, write the filers name and the last four digits of the filers Social Security number on the check. For accurate processing of your payment, do not combine this payment with any other payments.

Place both items separately in an envelope and mail to:

Michigan Department of Treasury

File and pay a paper return

For a tax due return, make your check payable to the State of Michigan Detroit and print the last four digits of your Social Security number on the check.

Place both items separately in an envelope and mail to:

Michigan Department of Treasury

Recommended Reading: How Much Do I Take Home After Tax

Please Note The Following When Sending Mail To The Colorado Department Of Revenue:

Certified Mail, Express Mail & Courier Services

Although these mailing methods give the option to receive proof of delivery, sending forms or payments by certified mail, express mail or a courier service may delay processing. Sending forms and payments by first class standard mail via the U.S. Postal Service ensures the fastest processing time.

Proper Postage on the Envelope

Addressing the Envelope

Double Check the Mailing Address

Don’t Miss: How To Pay Retail Sales Tax Online

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

What Is The Fastest Way To File Taxes

The fastest way to file taxes is online. IRSs e-file system enabled 122 million taxpayers to file their returns electronically last tax year. According to the IRS, e-Filed returns not only offer better accuracy. They also provide better security and faster refunds.

With TurboTax, you can do your taxes, your way. Do it yourself, get expert help, or hand it off start to finish lets get your taxes done right.

You May Like: When Do Child Tax Credits Start

Send A Paper Return By Mail

If you are mailing someone elses paper return

If you prepare other peoples returns, mail each persons return in a separate envelope. However, if you file returns for more than one year for the same person, put them all in one envelope.

Filing Paper Returns Or Payments By Mail

If you do not prefer to e-file, you have the option to file your return using a paper form and related schedules. Most forms are available as fillable PDFs, allowing you to type in the information. Typed characters make processing go more smoothly because the forms can be read more accurately by the Departments scanners.

When you are ready to print the form, be sure to follow the printing instructions carefully to ensure our scanners can read and process your form. Printing the form in a different format slows processing.

You May Like: What States Have The Lowest Sales Tax

Receiving A Paper Income Tax Return

We will send to you the relevant paper Income Tax Return between Feb to Mar each year if you are required to file an Income Tax Return.

If you are certain that you have to file, but did not receive a notification from us by 15 Mar, please contact us.

Please submit your paper tax return by 15 Apr.

do not need

Tax resident individuals should receive:

Also Check: Www Aztaxes Net

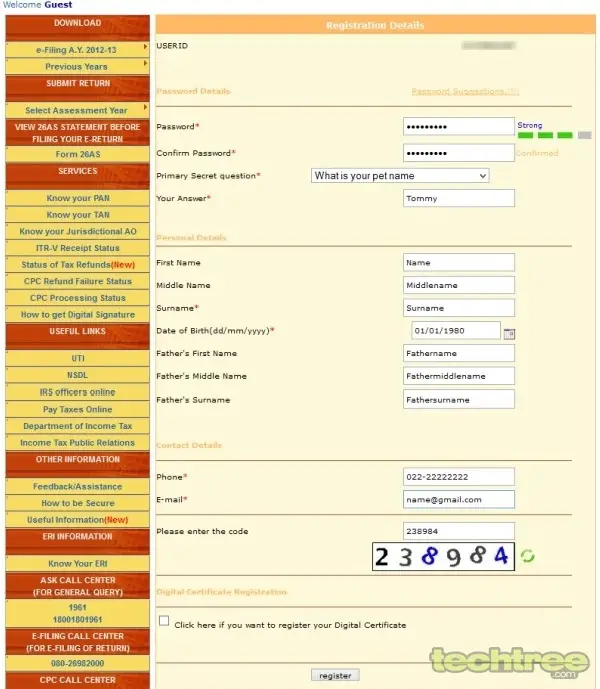

How To File Your Return

For accurate and efficient processing, the Department strongly recommends taxpayers use an electronic eFile option to file their returns.

For taxpayers filing using paper forms, you should send us…

- Your North Carolina income tax return .

- Federal forms W-2 and 1099 showing the amount of North Carolina tax withheld as reported on Form D-400, Line 20.

- Federal Form 1099-R if you claimed a Bailey retirement deduction on Form D-400 Schedule S, Line 21.

- Form D-400 Schedule S if you added items to federal adjusted gross income on Form D-400, Line 7, or you deducted items from federal adjusted gross income on Form D-400, Line 9.

- Form D-400 Schedule A if you deducted N.C. itemized deductions on Form D-400, Line 11.

- Form D-400 Schedule PN if you entered a taxable percentage on Form D-400, Line 13.

- Form D-400 Schedule PN-1 if you entered an amount on Form D-400 Schedule PN, Part B, Line 17e or Line 19h.

- Form D-400TC and, if applicable, Form NC-478 and Form NC-Rehab if you claimed a tax credit on Form D-400, Line 16.

- A copy of the tax return you filed in another state or country if you claimed a tax credit for tax paid to another state or country on Form D-400TC, Line 7a.

- A copy of your federal tax return unless your federal return reflects a North Carolina address.

- Other required North Carolina forms or supporting schedules.

Don’t Miss: What Form Do I Give An Independent Contractor For Taxes

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Don’t Miss: Where To Find Tax Forms

Elements Of Addressing And Preparing Domestic Mail

All mailable articles shipped within the United States must comply with an array of standards published in the USPS Domestic Mail Manual . Before addressing the mailpiece, one must first comply with the various mailability standards relating to attributes of the actual mailpiece such as: minimum/maximum dimensions and weight, acceptable mailing containers, proper mailpiece sealing/closure, utilization of various markings, and restrictions relating to various hazardous and restricted materials, as well as others articulated in § 601 of the DMM.

The USPS specifies the following key elements when preparing the face of a mailpiece:

- Example

What Tax Forms Do I Need For Online Tax Filing

Consider creating a folder for your tax return at the beginning of a tax year. Then, put any important tax information you receive in that folder until you’re ready to file your tax returns.

Most of these forms will show up after the end of a tax year in January or early February. However, some forms may show up even later. It’s important to wait until you receive all of the forms you’re expecting before you file your tax return or you may leave out an important item. Once you have all of your forms needed to prepare your tax return, consider working on it sooner than later as there are good reasons to file your tax return early.

Common forms to look out for include:

These forms might be mailed to you or you may be able to access them online. If you haven’t received your W-2, check with your employer, or even with the IRS. Some online tax filing software can import your W-2 electronically and even notify you when your W-2 is available.

Check your tax information from last year to see if you received the same forms this year. If you’re missing something, check to see if you no longer need that information. For instance, you won’t receive a Form 1099-INT if you closed your bank account that issued it last year.

You May Like: How Much Should I Put Aside For Taxes 1099

What Do I Need To Mail A Tax Return

It is recommended that you include copies of Forms W-2s, 1099s, and other income documents at the front of Form 1040. With the US Postal Service services option for tracking your delivery, you should send out your Returns with your tax return. By doing so, you ensure that your Tax Return is received by the IRS.

Alternatives To Sending Your Tax Return By Mail

The easiest way to file your tax return is to do it online. If you use a professional tax preparation service, such as H& R Block, they will be able to Efile your return directly to the government. This way, you can get your refund in about a week. You also have peace of mind knowing that your tax return will be optimized and checked for accuracy.

Recommended Reading: What Does Tax Abatement Mean