Consumer’s Use Tax For Businesses

The consumer’s use tax applies to tangible items used, consumed, or stored in Virginia when the Virginia sales or use tax was not paid at the time of purchase. The use tax is computed on the cost price of the property, which is the total amount for which the property was purchased, including any services that are a part of the purchase, valued in money or otherwise, and includes any amount for which credit is given the purchaser or lessee by the seller.

Returns are due on the 20th day of the month after the filing period. You dont have to file for any periods that you dont owe tax. File by including the taxable items on your regular sales tax return, or you can file using the eForm ST-7.

The Complexity Of Sales Tax

Sales taxes are, frankly, a mess. There are many taxing localities involved, each with its own tax rate and list of taxable products and services. If you have a tax presence in different states, you may have to collect different taxes on different items. And if you sell online, trying to figure out if you have to collect sales tax from customers in many states becomes almost impossible to manage.

To help you sort this out, this article contains the steps and decisions you will need to go through in order to collect, report, and pay sales taxes on the products or services you sell. Here are the main steps in the process of preparing to collect, report, and pay sales taxes.

Origin Versus Destination Sales Tax

In calculating your sales tax youll deal with the important difference of destination states versus origin states. Although in the past most states have tended to be destination-based, the rise of ecommerce has seen a shift to origin-based sales tax, which allows the state the product is shipped from to retain more of the tax revenue collected by businesses operating in that state.

Don’t Miss: Turbo Tax 1099q

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Sales Tax 101 For Online Sellers

OVERVIEW

Most people are familiar with sales taxthat extra percentage stores collect from customers in many states. If you own a store in a state that collects a sales tax, you must add state and local sales taxes to the customer’s total bill, collect it and send it off to the local tax authority. But if you sell your products online, you mayor may nothave similar sales-tax-collection duties.

Recommended Reading: How Can I Make Payments For My Taxes

Determine Your Requirement To Collect Sales Taxes In A State Or States

Your requirement as a business to collect sales taxes from your customers depends on these factors:

- If you are a taxable entity in your state

- If the products or services you sell are taxable in that state

- If you sell online, you will need to look up the specific requirements for collecting sales taxes as an online seller in each state.

Determine Where You Have Sales Tax Nexus

The first job for online sellers is to understand U.S. sales tax laws and how they apply to your business.

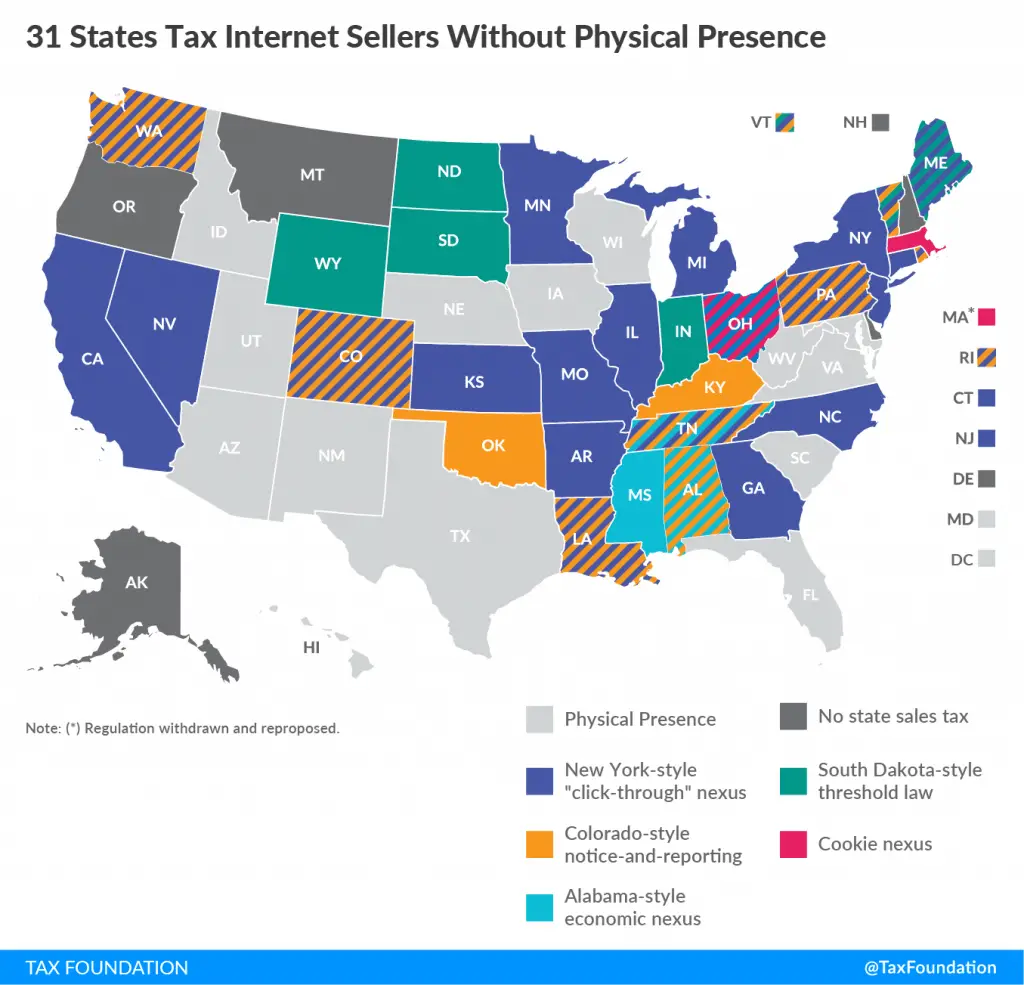

As I mentioned above, 45 states impose sales taxes. The states without sales tax are Alaska, Delaware, Montana, New Hampshire, and Oregon. Among states with sales tax, all but two, Florida and Missouri, currently require remote sellers to collect and remit sales tax.

Alaska is a nuanced case. While the state has no sales tax, many local jurisdictions in Alaska impose sales taxes, and the state recently passed a uniform code requiring remote sellers to begin collecting them in 2020.

Since states are still adapting to the changes caused by the Wayfair decision, you’ll have to examine current requirements for remote sellers in each state where you have sales to ensure compliance.

SSTGB provides resources to help you sort through state requirements for remote sellers.

To understand your sales tax nexus nationwide, consider the following:

Recommended Reading: Www Michigan Gov Collectionseservice

Line 3 Tax Payable For Own Use

Enter the amount of RST owing on taxable goods or services that you used in your business and that you purchased without paying RST.

This includes items you:

- took from your inventory for your own use

- manufactured for your own use

- brought into Ontario for your own use

- purchased tax-exempt in error

If you are a manufacturing contractor, you will use Line 3 to report the RST you owe on the cost of goods manufactured for use in real property contracts. For further information, please refer to RST Guide 401 – Manufacturing Contractors.

NOTE: Line 3 will never be a negative amount that reduces your RST payable. It will be a 0 or an additional amount of RST owing.

Collecting Sales Taxes For Online Sales

If you have an online business, including an online auction business , you may be wondering if you must collect sales tax for online transactions. The simple answer comes in two parts:

- You must charge sales tax if you sell online to customers who are located in your state. This hasn’t changed.

- Your state may also require you to charge sales tax to customers outside your state .

A recent Supreme Court ruling puts the individual states in charge of online sales to customers located outside the state. The decision, called S. Dakota v. Wayfair, increased the ability of states to require internet sellers who sold a “significant quantity” of business within the state to charge sales tax and pay those taxes to the state.

Many of the states currently taxing online sales have an exemption for small sellers. This exemption typically doesn’t requiring sales taxes for businesses that have less than $100,000 in annual sales or fewer than 200 transactions a year.

The Sales Tax Institute has several guides showing which states charge sales tax on internet transactions. One guide shows states with economic nexus and the other guide shows remote seller nexus. Some states are included on both charts. The guides are updated periodically.

You May Like: What Does Locality Mean On Taxes

File Your Return And Remit Sales Tax

After collecting sales tax, youll need to file a return with the states youve collected for, and turn over the taxes to them. This is also referred to as remitting sales tax. One important thing to note is that if you are registered to collect tax in a state, but make no sales for a given period, you should still file a $0 return, to avoid being penalized for not filing.

But when it comes to filing schedules, things get complicated each state makes their own rules, so they all have a different schedule for when sales tax returns must be filed. For many states, the requirement to file monthly, quarterly, or annually, depends on your average monthly tax liability.

The bottom line is, if you are handling your own sales tax and youre starting to have nexus in multiple states, set up a system of due dates and reminders for each.

Retail Sales Tax Refunds

You can get a refund of RST that has been:

- incorrectly charged on insurance premiums or benefit plans

- paid in error when transferring a vehicle at a ServiceOntario centre.

Complete and send a refund application form to the Ministry of Finance within four years from the date the RST was paid. With your completed application, include all supporting documents and proof that RST was paid.

- Retail Sales Tax Act, and

- Tobacco Tax Act.

The Clearance Certificate indicates that all taxes, penalties and interest collectable or payable by you, the seller, have been paid or that satisfactory arrangements have been made for such payment or for securing such payment.

A purchaser that fails to obtain a copy of the Clearance Certificate from the seller could be liable for any taxes, penalties and interest owing by the seller at the time of the sale.

The requirements apply to sellers who held or who were required to hold a permit under the Retail Sales Tax Act on or before June 30, 2010, as well as to sellers who, at any time after June 30, 2010, hold or are required to hold a permit under the Retail Sales Tax Act.

All requests for Clearance Certificates must be made in writing, at least two weeks before the sale takes place, and signed by the seller or the seller’s authorized representative.

The request should be sent by fax to 905 4364474 or by mail to:

Ministry of Finance 33 King Street West PO Box 627 Oshawa ON L1H 8H5

Recommended Reading: Prontotaxclass

Collect And Remit Sales Taxes

Each state has its own process for remitting sales taxes. Taxes are commonly submitted monthly, although some states may allow quarterly filing. In states where you collect sales tax, consider the following:

- Use software: Look for an e-commerce CMS and small business tax software built to simplify sales tax collection, reporting, and remittance. Features for looking up applicable rates and calculating sales tax automatically are essential.

- Train employees: Make sure your employees understand how to handle sales tax for remote sales. Many states provide resources to help such as this sales tax training page from Colorado, which includes videos and webinars.

Specified Vehicles Purchased From Gst/hst Registrants In Canada Or Vehicles Brought Into Ontario From Outside Canada

RST does not apply to a specified vehicle that is purchased from a GST/HST registrant in Ontario or elsewhere in Canada on or after July 1, 2010. RST also does not apply when a specified vehicle is brought into Ontario from outside Canada.

For information on the obligation to pay the federal and provincial portions of the HST, please contact the Canada Revenue Agency at 1 800 9595525.

Read on: Specified Vehicles or GST/HST and motor vehicles

Read Also: How Much Does H& r Block Charge To Do Taxes

How To Deal With Sales Tax As A Remote Seller

If you are doing business as an ecommerce seller, your first step is to determine whether you have nexus in any states. If your sales are still small, you may be able to do this yourself.

The basic steps are:

- Determine where you have sales tax nexus

- Register for the appropriate sales tax permit.

- Choose and implement a service or software to automate tax collection and calculation.

- Track due dates and file sales tax returns according to each states schedule.

What Are Some Common Compliance Pitfalls For Small Businesses

Managing your tax obligations isnt easy and non-compliance unintentional or not can result in serious consequences for your business. Knowing some common compliance pitfalls ensures that you wont be surprised by an unexpected sales tax obligation.

- Falling behind. Falling behind on sales tax legislative updates in various states is a concern for many small business owners. And if youre doing business in multiple states, it can be a monumental task to make sure you know about and understand tax legislation when it gets passed.

- Breaking down rates. Inability to break down rates required by a tax jurisdiction can also be an issue. Sales tax rates include the state rate, plus any local or other taxing jurisdiction at the point of sale. Knowing how to navigate the increasingly dense tax rates, and the ability to track and ensure compliance across your business, is critical to success.

- Understanding nexus. Neglecting to collect tax where you have nexus will quickly become a problem. The first step is understanding and identifying where and when you have a nexus and how that will affect the amount of tax you must remit to the individual state.

- Exemption certificates. Failing to collect exemption certificates on exempt sales is a common problem. In most cases, asking for an exemption certificate immediately is the best course. But it does cause extra work for both you and your customer. However, having the completed forms is necessary and expected during an audit.

You May Like: How To Correct State Tax Return

Collect Sales Taxes From Customers

After you have received your sales tax permit, you can begin collecting sales tax from customers. You must show the tax amount separately, so the customer can see the amount of the tax this typically isn’t a problem, since most sales receipts are programmed to show the amounts. If you are selling online, your “shopping cart” page will show the sales tax calculation. You will need to program the computer for the applicable sales tax amount or amounts or start using the services of an online sales tax service.

Overview: What Is Sales Tax

Sales tax is a tax levied on the sale of certain goods and services. Sales taxes are charged by 45 states and many local governments, and theyre generally collected and remitted by the seller.

When sales taxes aren’t collected by the seller, which has often been the case with interstate sales, state and local governments generally require their residents to pay use taxes on the purchases. Use taxes are simply sales taxes remitted directly by the consumer instead of the retailer.

For example, say you live in Philadelphia, where sales are subject to a 6% state tax plus a 2% county tax. You go online and buy $10,000 of furniture from an online store in Oregon. At checkout, you realize that Oregon has no sales tax. You might be excited, thinking you just saved yourself 8%.

But you know what they say about death and taxes. The state of Pennsylvania and Delaware County are going to expect you to pay that 8% back in use taxes.

Businesses are expected to pay use taxes on their untaxed purchases when filing sales and use tax returns. Consumers are also expected to report untaxed sales and pay use taxes on them through their annual state tax returns.

Also Check: How Much Does H & R Block Charge For Taxes

What Is Ecommerce Sales Tax

Lets start with the basics of ecommerce sales tax.

Sales tax is a small percentage of a sale tacked on to that sale by an online retailer.

Sales tax is a consumption tax, meaning that consumers only pay sales tax on taxable items they buy at retail.

45 U.S. states and Washington D.C. all have a sales tax.

On top of this, most of those states allow local areas such as cities, counties and other special taxing districts to have a sales tax.

Thats why you may see local areas, such as Rhinebeck, New York, that have an odd amount of combined sales tax.

Here are all the components of the Rhinebeck, NY sales tax rate:

Sales tax is governed at the state level. There is no national sales tax law in the U.S.

Because of this, online sellers may find themselves dealing with quite different sales tax laws and rules when dealing with sales tax in the different U.S. states.

Check On Sales Tax Exemptions

In some instances, the products you are selling may be exempt from sales taxes. Some products, like food and prescription medications, may be exempt from sales tax check with your state if you think your products might be exempt.

You may also want to look into getting a sales tax certificate if you buy products for resale. The process of getting this exemption certificate and the requirements are different for each state, and it applies to

- Products purchased for resale and raw materials

- Some non-profits in some states

If someone wants to buy from you and says they are a “reseller” or that they are buying for “resale,” they need to show you a valid reseller’s permit. Make sure to keep a copy of this permit in case you are questioned by state sales tax agents.

Also Check: What Does H& r Block Charge

Line 2 Tax Collectable Sales

Determine your total tax collectable on sales during the reporting period and then deduct from that amount the eligible compensation calculated and previously reported at line 5. The result of this calculation must then be entered on line 2 . Even if you have not yet collected the RST, you still have to report all RST charged to your customers during the filing period. If you have no RST to report, enter 0 on Line 2.

Sales & Use Tax In California

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration and pay the state’s sales tax, which applies to all retail sales of goods and merchandise except those salesspecifically exempted by law. The use tax generally applies to the storage, use, or other consumption in Californiaof goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchasesshipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate,and any district tax rate that may be in effect.

State sales and use taxes provide revenue to the state’s General Fund, to cities and counties through specific statefund allocations, and to other local jurisdictions.

Also Check: Can Home Improvement Be Tax Deductible