Unable To Cash Check Abroad

The IRS has issued guidance that if you opted for a physical check and are unable to cash it, the payment will be credited back to your account, but cannot be reissued as a direct deposit. If the IRS receives your payment back, you would need to claim the recovery rebate credit when you file your 2020 tax return , if eligible based on your 2020 filing. The IRS can only deposit to a U.S. affiliated bank account.

Note – please review our article on how to cash IRS checks abroad before returning the check to the IRS

To return the paper check:

Your Bank Account Number

When you file your taxes, make sure you use your current banking information if you would like your payment through direct deposit.

Typically, you’ll receive this payment using the refund option you select on your tax return. If you received an advanced refund through your tax service provider or paid your tax preparation fees using your refund, you’ll receive your payment by check in the mail.

Will You Lose Your Stimulus Money If You Dont File A Tax Return Before The 2021 Deadline

The answer is yes, and no. If you cant file your 2020 tax return by 17 May, you can ask for an automatic tax filing extension to buy time until 15 October. This will give you more time but delay any payment that you could receive. Regardless, you will have to file to get any stimulus money that might be due to you.

The IRS gives taxpayers three years to claim a tax refund from the filing date set the year the tax return was supposed to be filed, or the date that the taxpayer filed that year. If you owe money that is not the case and you could face fines and penalties for not filing on-time.

The #IRS urges anyone experiencing homelessness who has a smartphone or access to a computer to take advantage of #IRSFreeFile to claim the 2020 Recovery Rebate Credit and other tax benefits.

IRSnews May 11, 2021

The IRS announced that they are looking for over 1.3 million Americans who are owed a tax refund for 2017. Because the filing deadline was extended this year, they got a break and will have until 17 May but after that the government will hold on to the money for good. This would be the case for the stimulus payments as well three to four years from now if a taxpayer doesnt owe any taxes for 2020 or 2021 but instead were owed money. Since the stimulus payments are an advanced payment on a refundable credit, if the money has not paid out it can be claimed as a tax refund.

But best not to leave for tomorrow what you can do today.

Read Also: How Much Time To File Taxes

Keeping Track Of The California Earned Income Tax Credit

For the first time ever, undocumented workers will also be eligible for the California Earned Income Tax Credit this year. This rebate for Californians who earn up to $30,000 can provide as much as $3,027 depending on the number of children you have.

This will also be included in your state taxes. Qualifying for the EITC means you qualify for the Golden State Stimulus, López said. Households that get the state EITC will also be eligible for that one-time $600 pandemic stimulus payment.

But to be eligible, make sure you include the California Earned Income Tax Credit FTB 3514 form in your filing, or make sure to ask your tax preparer. Learn more about organizations offering free tax assistance in the Bay Area here.

In the case of families with mixed status, where the head of household is undocumented and the spouse or children have a legal immigration status, that is not an obstacle any more to receive the California EITC. If the taxpayer has a valid ITIN number and makes under $30,000, they should qualify, López pointed out.

While ITIN holders qualify for the California EITC, they still are ineligible for the federal earned income tax credit.

López also highlighted how important it is to distinguish between government aid like stimulus checks and rebates and taxable benefits like unemployment.

What You’re Automatically Eligible For When You File

The first step can sometimes be the hardest. But if you dont file your taxes on time, you may miss out on the money you’re entitled to, regardless of your income.

The goal of the $600 checks is to help those facing the greatest economic challenges due to COVID-19, said Yolanda López, financial capability coordinator with the Unity Council, a nonprofit organization in Oakland that offers free tax assistance.

By simply filing your taxes you will then be eligible to receive this aid through direct deposit to the account you used when filing your taxes, or will be sent as a physical check to the address provided in your filing, López added.

Not reporting your earnings may also put you at risk of missing out on everything you could receive from the third stimulus package.

The federal government calculates your eligibility based on your most recent tax filing. So if you didn’t file your 2020 taxes before the most recent stimulus was signed by President Biden on March 11, your eligibility will be calculated based on your 2019 earnings. So if you made more than $75,000 in 2019 but less than that in 2020 you may not qualify for these checks, despite seeing your income drop during the pandemic.

But if you didn’t receive a check from the first or second stimulus packages even though you may have qualified, you can claim these payments in your taxes through something called a Recovery Rebate Credit. The IRS provides instructions on how to include this credit in your taxes .

Read Also: How To Appeal Property Taxes Cook County

How To Get Your Stimulus Payments When You File Your Tax Return

Some of your friends or relatives have received two COVID-19 relief/ stimulus payments in the past year. And a third may be on the way soon.

If you havent received anything yet and believe you should have, dont fret. You will be able to recoup your money when you file your income tax return in the weeks ahead.

Heres what you need to know about past payments and the next one thats expected:

-

People who were eligible but didnt receive either the first or second round of what are called economic impact payments will be able to recoup their money when they file their 2020 tax returns in the coming weeks or months. On tax materials, people will see the economic impact payments referred to as the recovery rebate credit on Form 1040 or Form 1040-SR because the payments are technically an advance payment of the RRC.

-

Remember you may be eligible for payments based on your 2020 income, even if you werent eligible based on your 2019 return.

The IRS cannot correct or issue additional payments based on your 2020 income until you file your 2020 tax return in 2021, the IRS says. The IRS used your 2019 tax return to determine your eligibility and calculated any Economic Impact Payment. If you dont get an Economic Impact Payment in 2020 or you dont receive the maximum amount, you may be eligible to claim the Recovery Rebate Credit when you file your 2020 federal income tax return in 2021.

How To Get Your Stimulus Check

Using stimulus funds can help you manage your entire financial picture, including getting a handle on The guide helps you understand if you are eligible in these cases:

- If you havent filed federal taxes or have no income

- If you dont have a bank account or a pre-paid debit card

- If you have moved since you last filed taxes

- If you receive Social Security Benefits

- If youve already filed taxes and are signed up for direct deposit

The vast majority of Americans will be eligible to receive a third stimulus check from the federal government. Even if you have no income, you are still eligible but need to take action.

Read Also: Where’s My Tax Refund Ga

What If I Receive Social Security Or Supplemental Security Income

Not everyone needs to file to get a stimulus payment. If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check, depending on how you normally receive your Social Security income.

If you receive Supplemental Security Income , you will automatically receive a stimulus payment with no further action needed. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive their SSI benefits.

Many People Who Do Not File Taxes Think Theycannot File Taxes And Thuscannot Access Irs Benefits

Single adults earning less than $12,400 and married couples earning less than $24,800 are generally not required to file federal taxes, but would need to file returns regardless if they want to access stimulus checks , EITC, and/or CTC they are entitled to. This population likely comprises an outright majority of those missing out on refundable tax credits. IRS messaging to them has been consistent: even if you are not required to file, you should file if you want to receive these funds.

Our interviews suggest that such guidance is inconsistent with how low-income families think about tax filing. Many of our interviewees did not view tax filing as something you can choose to do or not do rather, they saw it as something you are either required to do or, otherwise, should not do. The idea that you might choose to file even without a filing requirement did not compute:

It just depends if I work. Like last year, I didnt work so I didnt file 2020 According to the IRS, you dont need to file because like whats the point. If I work, I file. If I dont, I dont. Jenna, stay at home parent and part-time social media contractor

Usually I file. Its just that year I didnt make enough I guess, and I didnt file… I didnt think I would get nothing back.Yolanda, truck stop cook

The idea that those who dont earn enough money cannot get IRS benefits was often thought to apply specifically to stimulus checks :

You May Like: How Can I Make Payments For My Taxes

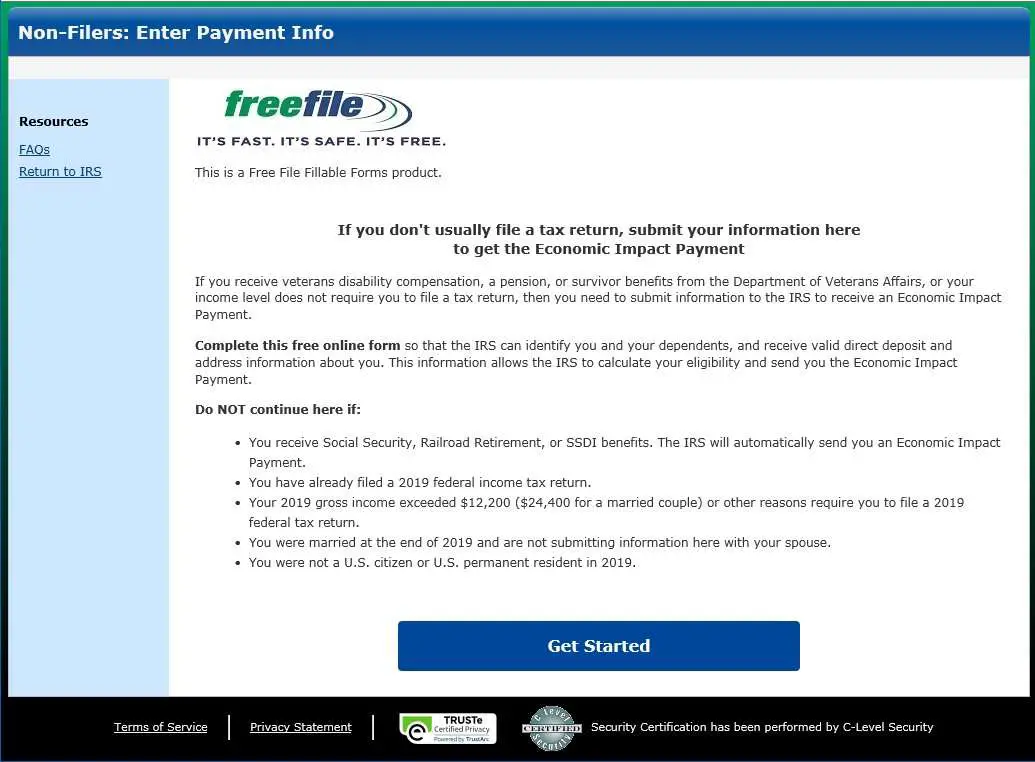

Go To The Irs Free File Website

Head to the IRS Free File website, where youll find a number of online tools that let you file a return for free. These tools will ask you a few questions to choose the right filing status for you and determine whether you can claim anyone as a dependent.

You can also fill out the forms yourself online, or even print them out and mail them. Trust us, though: Its way easier to do this using one of the free filing tools.

How Do I Update My Direct Deposit Information With The Irs To Receive My Stimulus Check

The IRS wont have your direct deposit information if you didnt provide it on your 2018 or 2019 tax returns, but you can use the IRS Get My Payment tool to check your payment status and confirm your payment type . If the IRS already has your direct deposit information and IRS Get My Payment tool shows your payment as pending or processed, you cannot use the tool to change your direct deposit information.

Don’t Miss: How To Buy Tax Lien Properties In California

What Is The Stimulus Check

As part of the $2.2 trillion CARES Act, the federal government will issue payments – by check or direct deposit – to millions of income-qualified Americans. This is what we mean by “stimulus check.” The purpose of the payments is to help people cover basic necessities at a time when many have been told to stay home and have lost income.

How To Claim Your Second Stimulus Payment On Your Tax Return

Despite initial delays, a majority of the $600 stimulus payments were issued to eligible Americans. As of Jan. 8, the IRS said it had issued over 100 million payments via direct deposit an additional 8 million were issued by mail as a prepaid debit card and paper checks were mailed up to the deadline.

Still, many Americans will need to claim the Recovery Rebate Credit on their 2020 tax return to receive their payment. This applies to many people who see a Payment Status #2 Not Available message using the IRS Get My Payment tracker, non-filers, and those who didnt receive the full payment for which theyre eligible due to financial changes in 2020 .

Your tax return is also an opportunity to claim any amount youre eligible for but didnt receive from the first round of $1,200 stimulus payments following the CARES Act last spring. The return will include a worksheet you can use to determine any amount youre eligible to claim using the Recovery Rebate Credit.

Read Also: Do You Have To Pay Taxes On Plasma Donations

When Will I Receive The Money

Press briefings have indicated 3 weeks if the IRS is able to do direct deposit. Paper checks will inevitably take longer, especially for those residing abroad.

After the payment is paid, the IRS will mail a letter to the taxpayers last known address within 15 days. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If unsure if it is legitimate, please visit IRS.gov first.

The IRS just released a tool to check payment status . Importantly – if the IRS has your information on file, you cannot update the direct deposit info. Update: the direct deposit information can only be updated via filing the 2020 tax return. Get My Payment tool no longer offers the option to update bank details.

- Check payment status

- Confirm payment type: direct deposit or check

- Enter bank account information for direct deposit if direct deposit information is not on file and payment has not yet been mailed.

What If I Dont Have A Permanent Address

You can receive monthly Child Tax Credit payments even if you dont have a permanent address. You can list a trusted address where you would like to temporarily receive your monthly checks, such as the address of a friend, relative, or trusted service provider like a shelter, drop-in day center, or transitional housing program.

Also Check: When Do You Do Tax Returns

Will I Lose Out If I Cant Sign Up In Time To Get A Payment On July 15

No. Everyone who signs up and is eligible will receive the full Child Tax Credit benefits they are owed. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign up in time for monthly payments in 2021, you will receive the full benefit when you file your taxes in 2022.

Simplified Tax Returns For Non

Some Americans who are not required to file a federal income tax return still do so to qualify for state or local government benefits. These people often have no income, but they need a federal return that is more detailed than the simplified return described above. However, people with an adjusted gross income of zero are not able to file electronic returns due to tax software and return processing parameters. The second type of simplified return addresses this problem. It’s only for electronically filed returns, though.

For this type of simplified return, a zero AGI filer must enter $1 for Lines 2b , 7b , and 8b . For all other lines, follow the form instructions for Form 1040 or Form 1040-SR. You must also provide your IP PIN, if you have one, and sign the return under penalties of perjury. You can also add the paid preparer information if applicable at the bottom of page 2.

If the form is e-filed before October 15, 2020, you’ll get your stimulus payment by December 31, 2020.

Also Check: Amended Tax Return Online Free

What Is A Recovery Rebate Credit Will It Change The Amount You Receive

A Recovery Rebate Credit is a tax credit that will either increase the amount of your tax refund or decrease the amount of tax you owe, based on how much of your stimulus funds the IRS still owes you.

File for your missing money from the first and/or second stimulus on the 2020 Form 1040 or Form 1040-SR. The tax return instructions include a worksheet to figure out the amount of any Recovery Rebate Credit for which you’re eligible, according to the IRS. However, this worksheet requires you to know the amounts of your stimulus payments. CNET’s stimulus check calculators for the second and first payments can provide an estimate.

Find out the IRS’ official total for you in two ways:

- IRS letters: You should have received IRS Notice 1444 for the first stimulus payment, and you should receive Notice1444-B for the second. Hold onto those letters, because you’ll need the information for the Recovery Rebate Credit worksheet or any tax preparation software you use. If you lost the letters, here’s what to do.

- Your online tax account: In the coming weeks, if you have an account on IRS.gov/account, you’ll be able to log in and see the amounts of the stimulus payments you were allotted.