Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

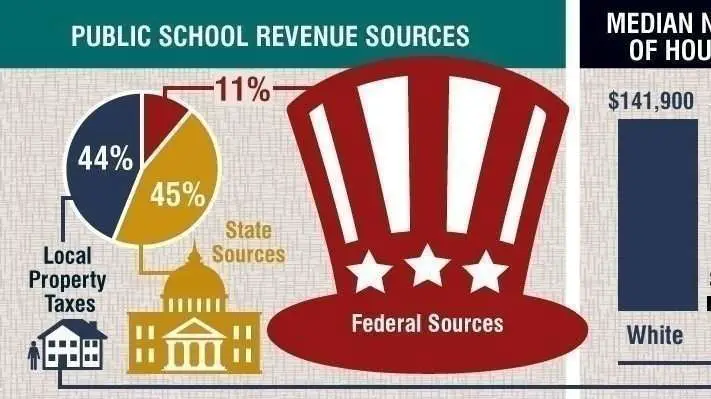

North Carolina Property Taxes By County

You can choose any county from our list of North Carolina counties for detailed information on that county’s property tax, and the contact information for the county tax assessor’s office. Alternatively, you can find your county on the North Carolina property tax map found at the top of this page. Hint: Press Ctrl+F to search for your county’s name

Median Property Taxes In North Carolina By County

How To File Your North Carolina State Tax Return

You have multiple options for filing and paying your North Carolina state taxes.

- E-file and pay through the Department of Revenue website. Youll need to create an account.

- including the D-400, North Carolinas equivalent of the federal 1040 through the DOR website. You can complete and mail these forms to N.C. Dept. of Revenue, P.O. Box R, Raleigh, NC 27634-0001 if youre due a refund, or to N.C. Dept. of Revenue, P.O. Box 25000, Raleigh, NC 27640-0640 if you are not due a refund.

- E-file through an approved software provider, like , which never charges to file your federal and single-state tax returns. Other providers may charge fees, so be sure to review terms, conditions and costs before choosing a provider.

Also Check: When Do We Start Filing Taxes 2021

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

North Carolina Tax Deductions

Income tax deductions are expenses that can be deducted from your gross pre-tax income. Using deductions is an excellent way to reduce your North Carolina income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and North Carolina tax returns. For details on specific deductions available in North Carolina, see the list of North Carolina income tax deductions.

Read Also: How Much Time To File Taxes

Register With The Department Of Revenue

Apart from your EIN, you also need to establish a North Carolina withholding tax account with the North Carolina Department of Revenue . You set up your account by registering your business with the DOR using Form NC-BR, Business Registration Application for Income Tax Withholding, Sales and Use Tax, and Machinery and Equipment Tax. You can submit Form NC-BR online or by regular mail. If you register online you’ll receive your withholding tax number instantly. If you register by mail, you should receive your number within 10 days. There is no fee to register your business with the DOR.

Deductions You Can Itemize

For the 2019 tax year, North Carolina filers have access to several itemized tax deductions.

- Qualified mortgage interest and real estate property taxes: You can deduct up to $20,000 in qualified mortgage interest and real estate property taxes.

- Charitable contributions: North Carolina generally follows federal tax code regulations on deducting charitable contributions.

- Medical and dental expenses: The state follows federal tax code for rules governing deductions for medical and dental expenses.

- Claim of right deduction: If you reported and paid taxes on income in a previous year, and then had to pay that income back, you may be able to take a deduction for all or part of the repaid income.

You May Like: Oregon Tax Preparer License Renewal

How To File Your Return

For accurate and efficient processing, the Department strongly recommends taxpayers use an electronic eFile option to file their returns.

For taxpayers filing using paper forms, you should send us…

- Your North Carolina income tax return .

- Federal forms W-2 and 1099 showing the amount of North Carolina tax withheld as reported on Form D-400, Line 20.

- Federal Form 1099-R if you claimed a Bailey retirement deduction on Form D-400 Schedule S, Line 21.

- Form D-400 Schedule S if you added items to federal adjusted gross income on Form D-400, Line 7, or you deducted items from federal adjusted gross income on Form D-400, Line 9.

- Form D-400 Schedule A if you deducted N.C. itemized deductions on Form D-400, Line 11.

- Form D-400 Schedule PN if you entered a taxable percentage on Form D-400, Line 13.

- Form D-400 Schedule PN-1 if you entered an amount on Form D-400 Schedule PN, Part B, Line 17e or Line 19h.

- Form D-400TC and, if applicable, Form NC-478 and Form NC-Rehab if you claimed a tax credit on Form D-400, Line 16.

- A copy of the tax return you filed in another state or country if you claimed a tax credit for tax paid to another state or country on Form D-400TC, Line 7a.

- A copy of your federal tax return unless your federal return reflects a North Carolina address.

- Other required North Carolina forms or supporting schedules.

Overview Of North Carolina Taxes

North Carolina now has a flat state income tax rate of 5.25%. The average effective property tax rate for the state is below the national average. There is a statewide sales tax and each county levies an additional tax.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 – 2021 filing season.

You May Like: How Much Is Payroll Tax In Louisiana

Special Tax Extensions For Winter Storm Victims

The IRS is giving victims of the winter storms in Texas, Oklahoma and Louisiana until June 15, 2021 to file taxes and make tax payments. The May 17 filing and payment extension relief does not affect this special consideration.

The following states are also offering relief to winter storm victims:

- Idaho is offering relief to the entire states of Texas and Oklahoma through June 14.

- Indiana is extending certain tax deadlines to residents of Texas, Louisiana and Oklahoma who were impacted by severe winter storms to June 15.

- Louisiana is granting automatic filing and payment extensions to eligible taxpayers in Louisiana and Texas to June 15.

- New Jersey taxpayers impacted by Texas storms have until June 15 to file their New Jersey tax returns and submit payments, including 2021 estimated payments. Affected taxpayers must write in black ink “Presidential Disaster Relief Area” at the top center of their New Jersey tax return and/or their payment.

- Oklahoma announced a payment deadline extension until June 15 for both 2020 taxes and 2021 estimated income taxes. Return due dates are not extended. Late penalties and interest for taxes owed will be waived up to $25,000.

- Texas extended its tax due date to June 15.

When Are Nc State Tax Payments Due

the State individual income tax return remains . impose penalties on individuals who file and pay their income taxes after April 15, 2021, as long as they file and pay their tax on or before May 17, 2021.

- The North Carolina Department of Revenue is also extending until the filing deadline for North Carolina income and franchise tax returns otherwise due April 15. The NCDOR will also waive late payment penalties on income taxes originally due April 15, provided tax is paid by July 15.

Recommended Reading: Have My Taxes Been Accepted

Have New Employees Complete Withholding Tax Forms

All new employees for your business must complete a federal Form W-4 and also should complete the related North Carolina Form NC-4, Employee’s Withholding Allowance Certificate. If an employee does not provide a Form NC-4, you are required to withhold based on the employee being single with zero allowances. You can download blank Form NC-4s from the withholding tax forms section of the DOR website. You should keep the completed forms on file at your business and update them as necessary.

North Carolina Property Tax Rates

Property taxes are collected on a county level, and each county in North Carolina has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in North Carolina.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across North Carolina. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in North Carolina.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the North Carolina property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free North Carolina Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across North Carolina.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

will send you a bill detailing the exact amount of property tax you owe every year.

Also Check: Do I Need W2 To File Taxes

Make Scheduled Withholding Tax Payments

In North Carolina, there are three possible payment schedules for withholding taxes: semiweekly, monthly, or quarterly. Your payment schedule ultimately will depend on the average amount you withhhold from employee wages over time. The more you withhold, the more frequently you’ll need to make withholding tax payments.

The exact threshold dollar amounts for the different payment schedules, as well as other rules, may change over time, so you should check with the DOR at least once a year for the latest information.

Due dates for payments are:

- Semiweekly: Payments are due by Wednesday for amounts withheld on the preceding Wednesday, Thursday, or Friday, and by Friday for amounts withheld on the preceding Saturday, Sunday, Monday, or Tuesday. In general, you must pay the North Carolina tax at the same time you are required to pay the federal tax.

- Monthly: Payments are due by the 15th day of the month following the month in which the tax was withheld.

- Quarterly: Payments are due by the last day of the month following the end of the quarter.

If the payment is due on a weekend or holiday, the due date is extended to the next business day.

The DOR will send you a booklet of couponsalso sometimes called withholding returnsto use when making payments. Depending on your payment schedule you will use Form NC-5 or Form NC-5P . You can also make payments online through the DOR’s Electronic Services website.

North Carolina Unauthorized Substances Tax

According to North Carolina law, anyone who possesses an unauthorized substance, including marijuana, cocaine, moonshine, mash and illicit mixed beverages, will have the substances confiscated and must then pay an excise tax within 48 hours.

- Basketball legend Michael Jordan is from Wilmington, North Carolina, where he was famously cut from the varsity basketball team at Emsley A. Laney High School as a sophomore.

- North Carolina is one of the top states in the country that produces sweet potatoes.

Don’t Miss: Is Plasma Donation Taxable Income

Where To Send Your North Carolina Tax Return

| Express Delivery |

You can save time and money by electronically filing your North Carolina income tax directly with the . Benefits of e-Filing your North Carolina tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

To e-file your North Carolina and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

The two most popular tax software packages are H& R Block At Home, sold by the H& R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package.

Income Tax Deadlines And Due Dates

In the table below you will find the income tax return due dates by state for the 2020 tax year. We have included the Regular Due Date alongside the 2021 Due Date for each state in the list as a point of reference. Each calendar year the state income tax due date may differ from the Regular Due Date, because of a state recognized holiday, or the due date falls on a Saturday or Sunday, for example.

Most state income tax returns require income, adjustments, and credit amounts calculated on your Form 1040. For this reason, it’s important that you prepare your federal income tax forms in advance of trying to prepare your state income tax forms.

You May Like: Do You Have To Pay Taxes On Plasma Donations

The North Carolina Income Tax

North Carolina collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Unlike the Federal Income Tax, North Carolina’s state income tax does not provide couples filing jointly with expanded income tax brackets.

North Carolina’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below North Carolina’s %. You can learn more about how the North Carolina income tax compares to other states’ income taxes by visiting our map of income taxes by state.

Some states, including North Carolina, increase, but don’t double, all or some bracket widths for joint filers .

There are -594 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

Other States That Made Changes To Deadlines

- Alabamamade a sort of hybrid tax extension: The state will automatically waive late-payment penalties for payments remitted by May 17. However, interest on taxes owed will still accrue from April 15.

- Idaho introduced a bill to push its state income tax filing deadline back to May 17, but the legislature did not come to an agreement before adjourning March 19. The legislature reconvenes on April 6.

Also Check: Is Plasma Donation Money Taxable

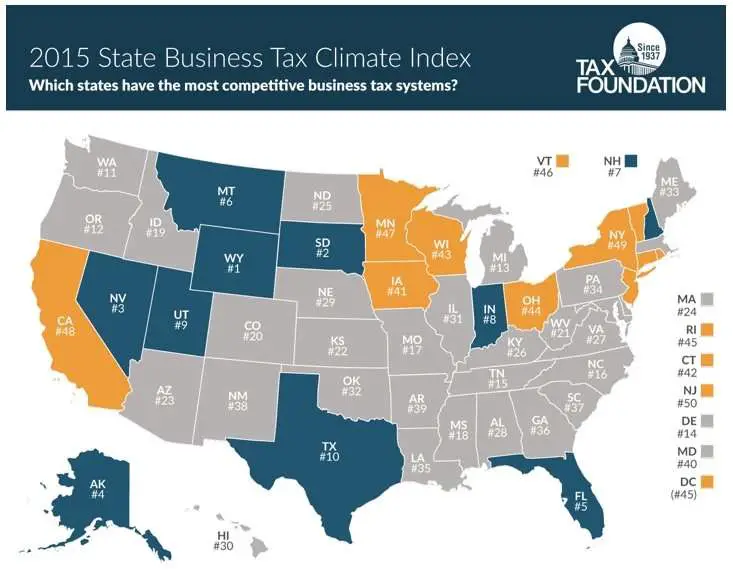

North Carolina Sales Tax

The base sales tax in North Carolina is 4.75%. In addition to that statewide rate, every county in North Carolina collects a separate sales tax, which ranges from 2% to 2.25% in most counties. In Durham and Orange counties specifically, there is an additional 0.5% tax which is used to fund the Research Triangle Regional Public Transportation Authority. In sum, that means sales tax rates in North Carolina range from 6.75% to 7.50%. Below are the sales tax rates for all the counties in North Carolina.

Five Most Common Forms Of North Carolina Business Entities

In the state of North Carolina, there are five primary business entities for owners to choose from, and depending on which one they choose, their taxes will often be affected. The five most common business types include:

For corporations that operate in multiple states, it is essential to be aware that various states may impose taxes for the property you have in that state or may even consider that location as the “nexus” of your business and therefore subject you to higher or additional taxes. Understanding the laws for each state in which you do business is vital to keep your tax burden from becoming too high.

If you need help with your corporation’s North Carolina S-corporation tax return, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Read Also: How Do I Protest My Property Taxes In Harris County

If You Need Help With Your Return

If you are unable to get help filling out your North Carolina return, you can contact a service center for assistance or call toll-free at 1-877-252-3052. Your federal return must be completed before we can assist you in filling out your North Carolina return.

If you are disabled, have a low income, or are a senior citizen, income tax returns can be prepared free of charge through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. For location and dates of assistance call the Internal Revenue Service toll-free at 1-800-829-1040.