Where Else Can I Get Help With My Taxes

You can find helpful and affordable assistance by choosing a provider from CNET’s roundup of the best tax software for 2022 or by talking to a qualified tax professional.

The IRS does offer additional free tax help, too. The Volunteer Income Tax Assistance program is designed to offer guidance to people who make less than $54,000 per year, have disabilities or have limited facility with English. And the Tax Counseling for the Elderly program specializes in tax issues that affect people who are 60 or older.

The IRS’ International Taxpayer Service Call Center remains available at 267-941-1000, Monday through Friday, 6 a.m. to 11 p.m. ET.

Is It Safe To File My Taxes Online

Maybe youre nervous about filing your taxes online. Rest assured that at TurboTax, security is built into everything we do. We use multi-factor authentication, data encryption, and data safeguards to make filing your taxes online safe. Learn more about security at TurboTax.

As well as ensuring that weve taken every security precaution in our products, TurboTax Free connects securely with the government through CRAs Auto-fill my return to import your data into your return and submits your electronic return if you file online through the CRAs NETFILE service. For an additional layer of security when you file online, learn about using the CRAs new NETFILE Access Code to authenticate your identity when you submit your taxes this year.

Remember These Tax Filing Dates

Apart from the opening date of tax-filing season, the IRS also outlined important closing dates.

You have until approximately Tuesday, April 15, to file your 2021 returns.

If you have tax software or work with a tax professional, it might be worth filing your returns now, or at least getting all the paperwork ready. Of course, these third parties are still subject to the same filing dates as everyone else, but having everything sorted will lead to a stress-free tax season.

Recommended Reading: Doordash Calculator

You Should Still File Your 2021 Return Even If You’re Awaiting Processing Of A Previous Tax Return

You don’t need to wait for your 2020 tax return to be fully processed to file a 2021 return.

According to the IRS, as of Dec. 3, 2021, nearly 169 million 2020 tax returns were processed — including all paper and electronic individual returns received prior to April 2021 that included a refund and did not have errors or need additional review.

“The IRS continues to reduce the inventory of prior-year individual tax returns that have not been fully processed,” Rettig said.

What Happens If I Have To Stop Working Or I Am Working Less

The federal government introduced some new measures to assist those that have had to stop working or have been laid off.

Canada Emergency Response Benefit : CERB provided a taxable benefit of $2,000 per month, for up to 28 weeks to qualifying individuals workers who lose their income as a result of the COVID-19 pandemic or earn less than $1,000 in a 4 week period. CERB was discontinued on Sep 26th, 2020 to be replaced with CRB.

Canada Recovery Benefit : CRB was put into effect on Sep 27th, 2020 and has similar eligibility criteria as CERB. Although it is a taxable benefit, CRA deducts 10% taxes at source which you can claim as a refundable credit on your tax return.

When you have a decrease in your income, this means that your taxable income is going down. Your taxable income is what determines what rate of tax is used to calculate how much tax you owe. Less employment income will mean less taxable income, and that will be indicated on your T4 slip. If you apply for CERB or CRB, the benefit will be added to your income increasing your tax liability. The CERB and CRB income will be reported on a T4A slip. CRA will withhold 10% taxes from your CRB earnings and none from your CERB, but this does not cover the first federal and provincial tax bracket. It is recommended to save some money on the side in case you are required to pay taxes when you file your income tax return.

__________

You May Like: Do You Have To Report Plasma Donations On Taxes

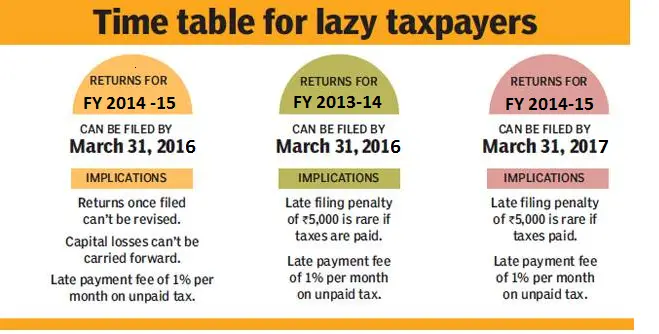

The Penalties For Filing Late

As a result of the COVID-19 pandemic, taxpayers were granted an extension for their 2019 taxes. However, the deadline to file 2020 personal income tax returns remains on course for the end of April:

- Return filing deadline:

If you have a balance owing on your tax return, you must pay the amounts by April 30, 2021, to avoid penalties and interest charges. However, some taxpayers may qualify for interest relief if they received COVID-19 benefits and meet the initiatives criteria. Still, taxpayers must file their returns by the deadline.

The CRA charges compound daily interest on any unpaid balances after the due date. If you have a balance owing from previous years, compound daily interest will continue to be charged on those sums. Additionally, the CRA charges interest on your penalties as well.

The interest rates the CRA charges can change every three months. For now, the CRA charges 5% on overdue taxes down 1% from the year before.

If you owe taxes and dont file your return by the deadline, the CRA will also charge you a late-filing penalty. The penalty is 5% of your 2020 balance owing, plus 1% of your balance owing for each full month that your return is late, to a maximum of 12 months.

However, you would also becharged interest compounded daily for overdue taxes and this rate changes every three months.

Key Information To Help Taxpayers

The IRS encourages people to use online resources before calling. Last filing season, as a result of COVID-era tax changes and broader pandemic challenges, the IRS phone systems received more than 145 million calls from January 1 May 17, more than four times more calls than in an average year. In addition to IRS.gov, the IRS has a variety of other free options available to help taxpayers, ranging from free assistance at Volunteer Income Tax Assistance and Tax Counseling for the Elderly locations across the country to the availability of the IRS Free File program.

“Our phone volumes continue to remain at record-setting levels,” Rettig said. “We urge people to check IRS.gov and establish an online account to help them access information more quickly. We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need.”

Last year’s average tax refund was more than $2,800. More than 160 million individual tax returns for the 2021 tax year are expected to be filed, with the vast majority of those coming before the traditional April tax deadline.

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. The IRS urges taxpayers and tax professionals to file electronically. To avoid delays in processing, people should avoid filing paper returns wherever possible.

Also Check: Do I Have To File Taxes For Doordash

Reporting Income In The Year You Leave

If you emigrate from Canada during the tax year, you must report any property holdings to the CRA if the fair market value of all the property you own is over $25,000 on the date you leave Canada. Please note this rule doesnt apply for personal-use property with a value under $10,000, bank deposits, pension plans, Registered Retirement Savings Accounts and deferred profit sharing plans.

Regardless of whether the above rule applies to you, you are required to complete Form T1161, List of Properties by an Emigrant of Canada. Filing T1161 is a requirement even if you dont need to file a tax return in the tax year you left Canada. Make sure you file the form before the April 30 tax filing deadline, otherwise youll face the same late filing penalties and interest as Canadian residents.

Canada Revenue Agency: Leaving Canada

The Longer You Wait The More Serious The Consequences

Once the IRS determines you should have filed a return and didnt, youll start hearing from them. Youll likely receive a notification letter from the IRS stating you will be penalized for not filing a return.

The IRS may also create a return for you. For example, if your employer reported wages, the IRS may create a tax return showing those wages. The catch? The IRS doesnt know about any deductions or other tax benefits you may deserve. They typically only know about your income, and unless you straighten things out, you could end up paying a lot more in taxes than you should.

If the IRS doesnt hear from you once youve been contacted, things can get more serious. Your bank may send you a notice indicating your money has been seized by the IRS. The agency may also put a lien against your property or garnish your wages. And, during all this time, interest and penalties are piling up, meaning the IRS can take more of your money.

Recommended Reading: Can Home Improvement Be Tax Deductible

Is Tax Filing Compulsory

It depends.

If you donât owe taxes to the government, you may not need to file a tax return. However, there are other reasons why you may need to file a return and they include if:

- You are expecting a tax refund. Duh! CRA wonât chase you around if you donât owe them. If you want whatâs yours i.e. tax refund, you better go get it!

- You are eligible for and want to collect government benefits including GST/HST credits, Canada Child Benefit, GIS or Allowance benefits.

- You have an open Home Buyersâ Plan or Lifelong Learning Plan account through your RRSP.

- You are contributing to the Canada Pension Plan .

There are a few other scenarios where a tax return filing is required even if you do not owe taxes. If in doubt, just file there are many ways to do it for cheap, or even free.

Failure To File Your Tax Returns For 2 Or More Years

If you fail to file your tax returns for 2 years or more, you may be issued with a summons to attend Court. On conviction in Court, you may be ordered to pay:

Failure to pay the penalty or fine to the Court may result in imprisonment of up to 6 months.

Read Also: Efstatus.taxact.com 2019

Negotiate Your Tax Bill

If your tax assessment is too high, you may be able to negotiate a better deal. Penalties may represent 25% of what you owe to the IRS. Getting these removed can make a real difference. File Form 843 to request an abatement of taxes, interest, penalties, fees, and additions to tax.

You might consider a Partial Payment Installment Agreement where the IRS agrees to accept less than the total you owe. The IRS will only agree to a PPIC if it’s clear that the monthly payments you can make will not cover your total taxes due for many years.

Another option to reduce your total tax liability is an offer in compromise . If the IRS accepts an OIC, it acts as an agreement between a taxpayer and the IRS to settle a taxpayer’s tax liabilities for less than the full amount owed. If you can fully pay your liability through an installment agreement or other means, you won’t generally qualify for an OIC.

Filing Your Income Tax And Benefit Return On Paper

Important notice

Remember to file by the deadline to avoid interruptions and delays to your benefit and credit payments including the Canada child benefit, GST/HST credit, related provincial and territorial benefit programs, child disability benefit, or guaranteed income supplement.

If you filed on paper last year, the Canada Revenue Agency will automatically mail you the 2021 income tax package by February 21, 2022.

The package you will receive includes:

- a letter from the Minister of National Revenue and the Commissioner of Revenue

- the Federal Income Tax and Benefit Guide

- an information guide for your province or territory

- two copies of the income tax and benefit return

- Form 428 for your provincial or territorial tax

- File my Return invitation letter and information sheet, if youre eligible for the service

- personalized inserts or forms, depending on your eligibility

- a return envelope

If you havent received your package by February 21, you can:

- view, download, and print the package from canada.ca/taxes-general-package

- order the package online at canada.ca/get-cra-forms

- order a package by calling the CRA at 1-855-330-3305

It can take up to 10 business days for publications and forms to arrive by mail.

For orders placed before February 14, 2022, your order will be mailed to you as soon as the 2021 tax products are printed and ready to ship.

Also Check: Do You Get Taxed On Doordash

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Failure To File Taxes

If you fail to file your tax returns on time you may be facing additional penalties and interest from the date your taxes were due. Failure to file or failure to pay tax could also be a crime. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

Under the Internal Revenue Code § 7201, any willful attempt to evade taxes can be punished by up to 5 years in prison and $250,000 in fines.

For most tax evasion violations, the government has a time limit to file criminal charges against you. If the IRS wants to pursue tax evasion or related charges, it must do so within six years, generally running from the date the unfiled return was due.

People may get behind on their taxes unintentionally. Perhaps there was a death in the family, or you suffered a serious illness. Whatever the reason, once you haven’t filed for several years, it can be tempting to continue letting it go. However, not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term.

You May Like: How To Do Taxes For Door Dash

Victims In Fema Disaster Areas: Mail Your Request For An Extension Of Time To File

Find out where to mail your form.

Need more time to prepare your federal tax return? This page provides information on how to apply for an extension of time to file. Please be aware that:

- An extension of time to file your return does not grant you any extension of time to pay your taxes.

- You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

- You must file your extension request no later than the regular due date of your return.

When Do I Get My Tax Refund

The answer to when will I get my tax refund depends from year to year.

Generally, the IRS has said that about 90% of refunds are issued within 21 days of when the return was received.

You can check on the status of your refund on the IRS website or at our Wheres My Refund page. Live updates will appear the same day e-file opens. Using this tool, you can easily track the progress of your return as it is processed.

Don’t Miss: Doordash Pay Calculator

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

What If I File For An Extension

Taxpayers requesting an extension will have until Oct. 17, 2022, to file their 2021 tax return.

Be aware that filing an extension doesn’t push back the deadline for when you need to pay the IRS: You still need to pay an estimate of what you owe by Apr. 18 to avoid late penalties. An extension just gives you more time to complete your tax return.

Read Also: Www.1040paytax.com Review

More From Smart Tax Planning:

Here’s a look at more tax-planning news.

Moreover, you may have to return part of the advance tax credit if 2021 adjusted gross income exceeds certain limits.

The phase-out begins for single parents over $75,000 or joint filers above $150,000. Families lose eligibility for the enhanced tax credit amounts over $95,000 for single filers and $170,000 for married couples filing together.

Help Filing Your Past Due Return

For filing help, call 1-800-829-1040 or 1-800-829-4059 for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 1-800-Tax-Form or 1-800-829-4059 for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Also Check: Efstatus.taxact.com Login