How To Identify Your Tax Bracket

How much tax you’ll pay is determined by where you live in Canada, and how much income you declare from all sources. Importantly, your provincial rate is determined by the province you are living in on December 31 of the tax year. So, if you move from Ontario to Nova Scotia in July, and you find yourself living in Nova Scotia on December 31, you would fall under the Nova Scotia provincial tax rates.

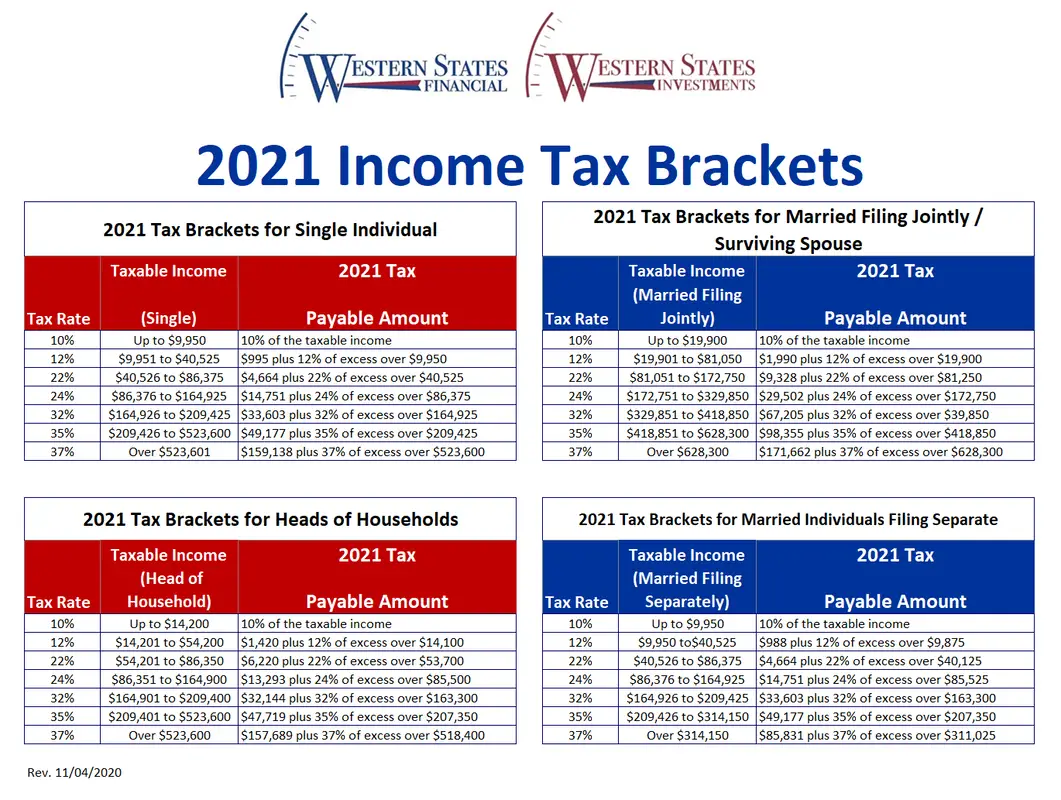

The Tax Items For Tax Year 2021 Of Greatest Interest To Most Taxpayers Include The Following Dollar Amounts:

- The standard deduction for married couples filing jointly for tax year 2021 rises to $25,100, up $300 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,550 for 2021, up $150, and for heads of households, the standard deduction will be $18,800 for tax year 2021, up $150.

- The personal exemption for tax year 2021 remains at 0, as it was for 2020 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

- For tax year 2021, the top tax rate remains 37% for individual single taxpayers with incomes greater than $523,600 . The other rates are:

- 35%, for incomes over $209,425

- 32% for incomes over $164,925

- 24% for incomes over $86,375

- 22% for incomes over $40,525

- 12% for incomes over $9,950 .

- The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less .

File Your Tax Return For Online

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Trade is offered by Canadian ShareOwner Investments Inc. , a registered investment dealer in each province and territory of Canada, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to activities undertaken by ShareOwner.

Wealthsimple Invest and Work are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Invest and Work accounts are held with ShareOwner.

Also Check: Employer Tax Identification Number Lookup

There Are Seven Different Federal Income Tax Brackets For Your 2021 Tax Return Each With Its Own Marginal Tax Rate Which Bracket You End Up In For 2021 Depends On Your Taxable Income

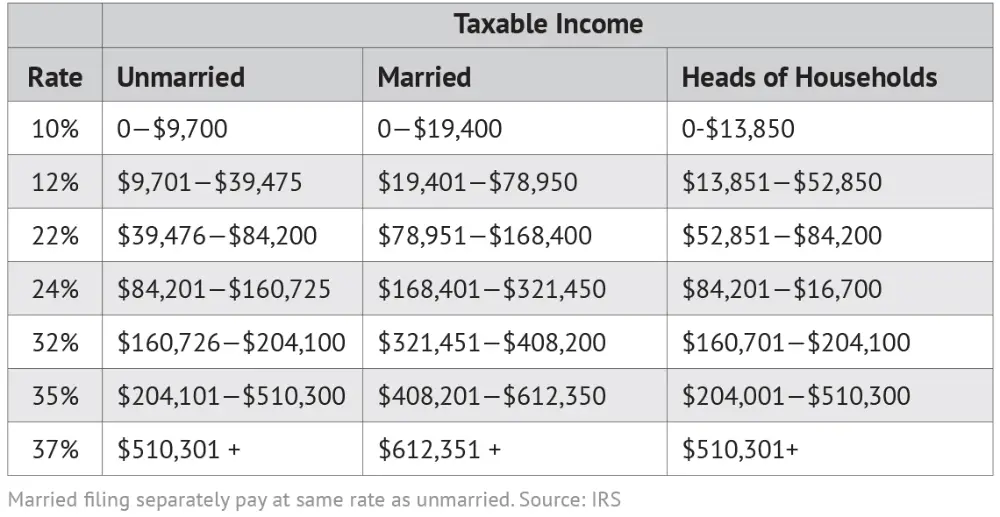

Smart taxpayers are planning ahead and already thinking about their next federal income tax return. For most Americans, that’s their return for the 2021 tax year which will be due on April 18, 2022 . Effective tax planning also requires an understanding of what’s new or changed from the previous tax year. When it comes to federal income tax rates and brackets, the tax rates themselves didn’t change from 2020 to 2021. There are still seven tax rates in effect for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the 2021 tax brackets were adjusted to account for inflation. That means you could wind up in a different tax bracket when you file your 2021 return than the bracket you were in for 2020 which also means you could be subject to a different tax rate on some of your 2021 income, too.

The 2021 and 2020 tax bracket ranges also differ depending on your filing status. For example, the 22% tax bracket for the 2021 tax year goes from $40,526 to $86,375 for single taxpayers, but it starts at $54,201 and ends at $86,350 for head-of-household filers.

So, now that you’re focused on your 2021 taxes, here are the tax brackets you’ll use when you file your tax return next year:

How To Calculate Your Tax Liability Using Brackets

So let’s say you’re an individual filer with adjusted gross income of $65,000 in 2021 and take the standard deduction of $12,550. That leaves taxable income of $52,450, putting you in the 22% bracket. But it doesn’t mean you pay 22% tax on all of your earnings. Instead, your income would be taxed taxed as follows:

- $9,950 taxed at 10%, resulting in $995 of income taxes

- The amount between $9,950 and $40,525 taxed at 12%, for a total tax of $3,669

- The amount between $40,525 and $52,450 taxed at 22%, for a total tax of $2,624

So putting it all together, your total income tax for the year would be $7,288.

The actual percentage you pay on the entirety of your taxable income is called the effective tax rate. You calculate your effective tax rate by dividing your total tax liability, $7,288, by your annual taxable income, $52,450. That’s an effective tax rate of 13.9%.

Note: Your effective tax rate is the actual percentage of taxes you pay overall. Your marginal tax rate is the highest tax rate your taxable income falls into.

Don’t Miss: Efstatus.taxact.xom

Here’s How 2021 Tax Brackets Actually Work

Here’s to dispelling the myths around how much you owe the government in taxes.

Tax brackets are one of the most commonly misunderstood aspects of taxes in America. News reports about taxes often do little to clear up those misunderstandings, sometimes making it seem that people are going to owe a much larger portion of their income to taxes than they actually do.

Tax brackets aren’t that difficult to understand, particularly if you can visualize a multi-tiered water fountain in your head. Let’s dive in.

Federal Tax Bracket Rates For 2021

The following are the federal tax rates for 2021 according to the Canada Revenue Agency :

- 15% on the first $49,020 of taxable income, and

- 20.5% on the portion of taxable income over $49,020 up to $98,040 and

- 26% on the portion of taxable income over $98,040 up to $151,978 and

- 29% on the portion of taxable income over $151,978 up to $216,511 and

- 33% of taxable income over $216,511

Read Also: 1040paytax

How Tax Brackets Add Up

In 2020, the IRS collected close to $3.5 trillion in Federal taxes paid by individuals and businesses individuals accounted for about 53.6% of that total.

The agency processed more than 240 million individual and business returns a whopping 81.3% of returns were filed electronically. Of roughly 148 million individual tax returns, 94.3% were e-filed.

Individuals and businesses claimed more than $736.2 billion in refunds. The vast majority of these totals more than $664 billion went to individuals.

Deductions Reduce How Much You Owe

If you have some tax deductions, that means that you’re pouring less money in the fountain to begin with, so you’re actually just pouring less money into the bottom bowl you can reach.

So, in the example above, if our $100,000 single income earner finds another $5,000 in deductions, that means that they’re going to just have $5,000 less in the 24% bowl. They’ll pay 24% on just $8,625 of their income, or $2,070. Their tax bill goes down by $1,200 because of that additional $5,000 deduction. So, tax deductions really impact your tax bill and can even sometimes bump you down to a lower tax bracket.

You May Like: Do You Have To Report Plasma Donations On Taxes

Federal Tax On Taxable Income Manual Calculation Chart

If your taxable income is $49,020 or less.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $49,020, but not more than $98,040.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $98,040, but not more than $151,978.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $151,978, but not more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

Capital Gains Tax Rates For 2021

Long-term capital gains tax rates for 2021 are as follows:

Long-term Capital Gains Tax Rates for 2021

| Rate | |

| $250,800+ | $473,750+ |

In 2021, capital gains tax rates for short term capital gains depend on income tax brackets, which also factor in filing status.

For 2021, short-term capital gains tax rates are as follows:

Short-Term Capital Gains Tax Rates for 2021

| Rate |

| $523,601+ |

You May Like: Does Doordash Send You A 1099

Ontario Federal Provicial And Territorial Tax Tables

The following tax data, rates and thresholds are used in the 2021 Ontario Tax Calculator, if you spot and error or would like additional tax calculations integrated into the 2021 Ontario Tax Calculator then please contact us.

-

Ontario Personal Income Tax Brackets and Tax Rates in 2021

| $0.00 – $45,142.00 |

How Are Capital Gains Calculated And Reported

To calculate capital gains, youll need your basis, or the cost of the asset when you paid for it.

Gains arent a guaranteed possibility, however. Investors may incur capital losses, meaning that the basis amount was more than the amount they eventually sold the asset for. Capital losses can be used to offset capital gains on taxes, but they must first offset capital gains of the same type.

Taxpayers who make sales during the tax year will have to report their gains and/or losses to the IRS on Form 1040, Schedule D, Capital Gains and Losses. They must first list all sales that result in these gains or losses on Form 8949, Sales and Other Dispositions of Capital Assets.

Don’t Miss: Federal Tax Id Reverse Lookup

How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest your property or state income taxes are high medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2021 tax year, due April 15, 2022

- Single filers: $12,550

- $12,550

- Heads of households: $18,800

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

Will I Owe More Taxes In 2021

The income taxes assessed in 2021 are no different. Income tax brackets, eligibility for certain tax deductions and credits, and the standard deduction will all adjust to reflect inflation. For most married couples filing jointly their standard deduction will rise to $25,100, up $300 from the prior year.

Don’t Miss: Tax Deductions Doordash

How Do Marginal Tax Rates Work

Your marginal tax rate is the highest rate of tax that you pay on an additional dollar of income.

For example, if your taxable income is $100,000 and you reside in Manitoba, your combined marginal tax rate is a whopping 43.40%. This means that you are paying 43.40 cents in taxes on every extra dollar you earn at this income level.

Before you lose your hat and go bonkers, your effective or average tax rate will actually be much lower, and for the example above, it is a much more palatable 28.77%.

Your average tax rate is based on the tiered bracket rates for both provincial and federal income taxes.

For a $100,000 taxable income in Manitoba in 2020, the following apply:

Federal Taxes

- Federal marginal tax rate: 26%

- Actual federal tax payable: $16,331

- Average federal tax rate: 16.33%

Provincial Taxes

- Provincial marginal tax rate: 17.40%

- Actual provincial tax payable: $12,440

- Average provncial tax rate: 12.44%

Combined provincial and federal taxes: $12,440 + $16,331 = $28,771.

- Average tax rate : 28.77%

This tax calculator by Thomson Reuters provides an easy-to-understand outlay of your marginal and average tax rates. It also gives you an idea of the tax rates applicable to capital gains and dividends.

One area where your marginal tax rate can be directly applied is in regards to your RRSP deduction.

In this scenario, you will have saved $4,340 in taxes for the year.

Why Is It Important To Know My Tax Bracket

If your marginal tax rate doesn’t tell you how much tax you’ll actually pay, why do you even need to know what it is? For one thing, it’s because you can only determine your effective tax rate by going through the machinations of figuring out your marginal tax rate and the resulting total tax liability.

Likewise, understanding which bracket you’re in helps you understand any implications of how changes in your earnings will affect your overall tax burden, says Sri Reddy, senior vice president of retirement & income solutions at Principal Financial Group. “Even a minimal pay increase could kick you up into a higher percentage of tax payment, as well as impact whether you qualify for things such as the child tax credit,” Reddy says.

Knowing your marginal tax bracket can also influence how you approach the available deductions, such as if you choose to use the standard deduction or itemize, and perhaps give a large lump sum to charity to reduce your taxable income, Reddy says.

Your marginal tax rate can also inform your other financial decisions. “We often find clients will calculate the amount to convert to Roth, how to contribute to a retirement plan, when to sell or hold long-term capital gains, and potentially how much to give to charity based on their tax bracket,” says David S. Elder, wealth manager and partner at Merit Financial Advisors.

Don’t Miss: Efstatus.taxact.com

Example Of Tax Calculation

Meet a fictional chap named John who lives in British Columbia. John has been contributing to a Wealthsimple RRSP to reduce his taxable income. After his RRSP contribution and other tax deductions and tax credits, he has taxable total income of $55,000. Here’s what his tax calculation might look like:

John’s Federal tax billThe first $49,020 is taxed at 15% , which works out to $7,353. He has $5,980 remaining, that amount will be taxed at a higher rate of 20.5% which works out to $1,225.9. This means his total federal tax owing is $7,353 + $1,225.9 = $8,578.9

John’s provincial tax bill Remember, John’s provincial rate is based on his province of residence as of December 31 of the calendar year. John’s first $42,184 will be taxed at 5.06%, which works out to $2,134.51. The remaining $12,816 will be taxed at 7.7% which works out to $986.83. His total provincial tax is $3,121.34.

John’s total tax billJohn’s combined federal and provincial taxes owing is $8,578.9 + $3,121.34 = $11,700.24.

Ontario 2022 And 2021 Personal Marginal Income Tax Rates

The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of1.024 .

The Ontario tax brackets and personal tax credit amounts are also increased for2022 by anindexation factor of 1.024, except for the $150,000 and $220,000 bracketamounts, which are not indexed for inflation.

The indexation factors, tax brackets and tax rates have been confirmed to Canada Revenue Agencyinformation.

Tax Tip: read the article Understanding the Tables of Personal Income Tax Rates,especially if you are trying to compare the rates below to the marginal taxrates in the Basic Tax Calculator.

Ontario Personal Income Tax Brackets and Tax Rates 2022 Taxable Income

You May Like: Protest Property Taxes In Harris County

How Will The Cra Changes Impact Your 2021 Income Tax Bill

I will show two scenarios to explain the tax implication of these changes.

Scenario one:

John works in a retail company and earned $50,000 in 2020. His company was significantly impacted by the pandemic. Hence, he got no hike in pay. His 2020 federal tax bill, without adjusting for any tax benefits, was $7,581. His 2021 federal tax bill will reduce by $27 to $7,554, because of the change in the income tax bracket.

If I include the BPA adjustment, Johns federal tax bill will reduce by $114 from $5,597 in 2020 to $5,483 in 2021.

Scenario two:

If I include the BPA adjustment, Wandas federal tax bill will increase by $911 from $5,597 in 2020 to $6,508 in 2021.

I only took the BPA tax credit for the ease of calculation. The more tax credits you apply, the more your tax bill will reduce.