More Tax Deductions For Uber Driver

Almost anything you spend on your ridesharing business will qualify as a tax-deductible business expense. This includes the business use of your car and mobile phone, but it can also include:

- Bottled water, snacks and amenities for customers

- Business taxes and licenses

- Freeway, highway, and bridge tolls

- Electronic toll transponder

- Tire inflator and pressure gauge

- Portable battery jump pack

- Roadside assistance plans

- Office supplies

Remember, with TurboTax Self Employed, well ask you simple questions and fill out all the right forms for you to maximize your tax deductions.

Uber does not offer tax advice. Please refer to TurboTax for additional information. Uber is not responsible for the products or services offered by third parties.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

What Expenses Does The Standard Mileage Deduction Cover

The standard mileage deduction covers the expenses necessary to keep your car running. This includes:

- Gas

- Insurance

- DMV fees

You can choose to track your actual car expenses separately and claim that amount instead of taking the standard mileage deduction. This requires you to keep track of all of your receipts and why they were necessary business expenses. In addition to saving that hassle, most people with consumer cars come out ahead taking the standard mileage rate.

No matter which method you choose, you need to keep mileage logs to prove that the miles you claim are appropriate business tax deductions.

Introduction To Income Taxes For Ride

In accordance with the rules and regulations outlined by the Canada Revenue Agency , Uber drivers, Uber Eats, Lyft, Skip the dishes or other ride-sharing drivers are self-employed and are required to file their Canadian income taxes as being self-employed. That means that in addition to the usual income tax forms, the Income Tax and Benefits Return, you will need to report your self-employed income on Form T2125, Statement of Business or Professional Activities.

You May Like: Doordash On Taxes

Deductions For Mobile Phone Expenses

Your smartphone is essential to your business, so naturally its expenses are deductible. This can include:

- The cost of the phone itself

- The billing charges of your carrier

- And any accessories that are essential to your business, such as chargers, mounts, and cradles

As with your car, you’re only allowed to deduct the portion of your smartphone expenses that are related to your business use. For that reason, many Uber driver-partners purchase a new phone and dedicate it solely to their business. That way, 100% of all costs associated with that phone are deductible from their taxes.

Concepts You Must Know To Understand Uber Eats Taxes

Posted on – Last updated: March 8, 2022

As an Amazon associate and affiliate for other products and services, I earn from qualifying purchases.

The beauty of delivering for Uber Eats is it’s pretty easy to make extra money quickly.

In fact, it’s so easy that all of a sudden, you realize you have to pay taxes on that money.

What’s the big deal about taxes? Isn’t it just like with any other job?

There’s the problem: This isn’t a job. Technically according to your contract and according to the IRS, you made that money as a business. We’re talking about business taxes here.

For a lot of us, things just got really intimidating with that realization. This feels like more than we signed up for, doesn’t it?

But here’s the thing: Taxes for Uber Eats don’t have to be that difficult. They’re not this super secret mystery that so many people make it out to be.

That’s why I wanted to put this guide together. I think it’s possible to understand how it all works. And then when you know how it works, you get a better idea what to expect. That lets you plan and prepare for tax season.

We’re going to talk about nine important tax concepts. None of them are that difficult. Each concept will make it easier to understand how Uber Eats taxes work.

Also Check: Do Tax Preparers Have To Be Licensed

Do Uber Drivers Need To Pay Estimated Taxes

Self-employed people are not allowed to wait until April 15 to pay all the income and self-employment taxes they owe for the prior year. Instead, they are required to prepay their taxes by making estimated tax payments to the IRS four times per year.

You must pay estimated taxes if you expect to owe at least $1,000 in federal tax for the year from your ride-sharing business. You’ll probably need to earn a profit of at least $5,000 or $6,000 from your business to owe this much tax.

The IRS imposes modest interest penalties if you don’t pay enough estimated tax. To avoid the penalties, you must pay at least the smaller of:

- 90 percent of your total tax due for the current year

- 100 percent of the tax you paid the previous year or 110 percent if you’re a high-income taxpayer

High-income taxpayers-those with adjusted gross income of more than $150,000 -must pay 110 percent of their prior year’s income tax.

Keep A Record Of All Uber Driving Expenses

In order to claim any of the above mentioned deductions, youll need to be vigilant. When it comes to claiming costs directly related to your vehicle, youll need to keep a record just like you would for any other job.

And with all the kilometres youll be driving, you should keep a logbook. This lets you calculate the work-related portion of your car use, in a way that the ATO respects. Then, you can properly claim a wide range of vehicle-related expenses.

Weve got a blog post covering how to use a car logbook, here.

Popular second-income sources like Ebay, Airbnb and Uber make some people wonder,

Can I just spend my extra income, and leave it off of my tax return?

Theres a very simple answer to that: Dont do it!

Your activity as an Uber driver is very much out there for the world to see. Your name and plate number are shown right on the Uber app. The ATO can easily determine your actual income from Uber. The ATO can even see your bank accounts if they want to.

It will be simple for the ATO to find Uber drivers who dont declare their income. The likely consequences for people who hide their Uber income: Huge tax repayments, fines and interest charges. The ATO does not play games with this sort of thing and it is not taken lightly.

Be honest and transparent with the ATO. Youll be better off in the end and youll sleep well at night.

Read more:

Recommended Reading: Tax Preparer License Requirements

C We Pay Social Security And Medicare On Every Dollar Earned

This is the one thing I said was the same for employees as it is for self-employed.

Self-Employment tax is different than income tax in that it doesn’t wait until you’ve met your Standard or Itemized deductions before you start owing taxes. Taxes come out on every dollar you earn as an employee.

You can make $10,000 and not owe any income taxes because of deductions. But you still owe $1,530 for your Social Security and Medicare.

When it comes to the tax process, the Self-Employment Tax part is pretty much done when you’ve figured out your profits. You pay Self-Employment tax based on 15.3% of your business profit. Other income doesn’t impact your self-employment tax.

How it works is you fill out a form called Schedule SE. On that form, you list your business profits, mulitiply that by 15.3 percent, and figure out your Self Employment tax. From there you pretty much set it aside until all the other tax stuff is figured out.

Then when the taxes are all done, Self Employment tax is added to your income tax to determine what your final tax bill is. We get into that in more detail in the part of our series on Self-Employment tax for Uber Eats drivers.

Do You Owe Quarterly Taxes

Since youâre an independent contractor, you might be responsible for estimated quarterly taxesâespecially if Uber is your sole source of income.

Make sure to pay estimated taxes on time. Each quarter, you’re expected to pay taxes for that quarter’s payment period. Here are the due dates for 2021:

1st Quarter:

- Payment period: January 1 â March 31

- Tax payment is due April 15, 2021

2nd Quarter:

- Payment period: April 1 â May 31

- Tax payment is due June 15, 2021

3rd Quarter:

- Payment period: June 1 â August 31

- Tax payment is due September 15, 2021

4th Quarter:

- Payment period: September 1 â December 31

- Tax payment is due January 15, 2022

For more information, visit our Quarterly Taxes Guide.

Read Also: Doordash 1099 Nec

Uber Driver Tax Checklist Of Deductions

The following items are generally allowed deductions.

- Fees to apply for a platform or for a background check.

- Water and candy you provide to your riders.

- Transaction fees .

- Signs or lighting to identify you as a rideshare driver.

- Business software you use to help you find the best times to drive.

- Parking fees while you are actively working .

The following items are generally not deductible because they are also for your own personal use.

- Cell phone bills.

- Phone chargers, cellphone mounts, and similar accessories.

- Dash cams .

- Floor mats and other improvements to your car.

- Roadside assistance plans.

- Lease payments.

Some of the above items could be partially deductible if you can prove to the IRS what portion of the expense was for business use. This is hard to do because so many people try to deduct personal expenses, and the IRS auditor will be very skeptical.

What Is Your Likelihood Of Getting Audited As An Uber Or Lyft Driver

According to Greg Iacurcis article on CNBC, The IRS audited roughly 1 out of every 220 individual taxpayers last year. However, according to the article, wealthy Americans are much more likely to be audited than low- and middle-income taxpayers.

If youre not a wealthy Uber or Lyft driver, it doesnt quite mean youre out of the woods. There is still a chance you could be audited!

One thing you can do to help lower the likelihood of getting audited is making sure youre not throwing up certain red flags when you go to file your taxes.

Recommended Reading: What Home Improvement Expenses Are Tax Deductible

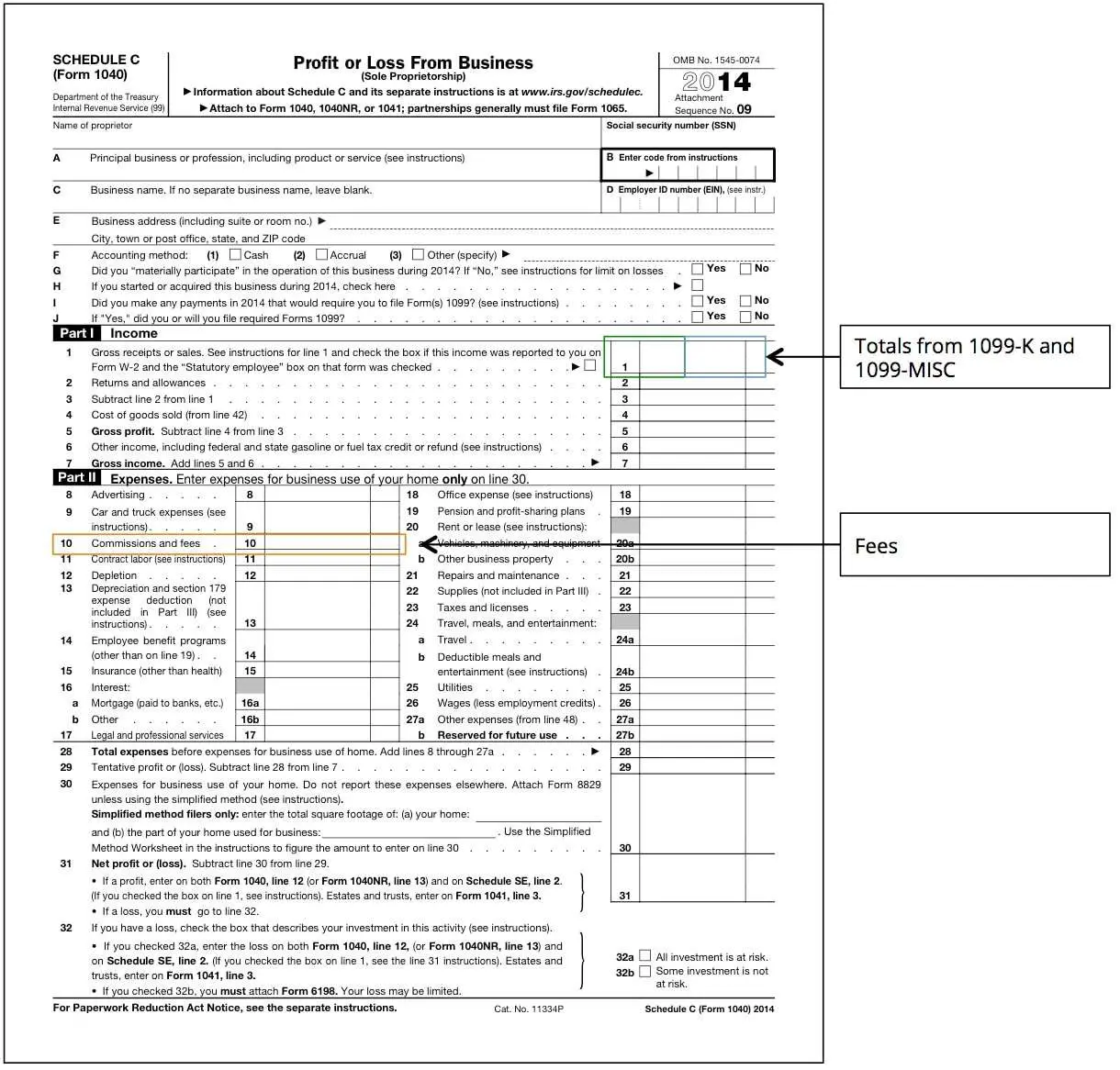

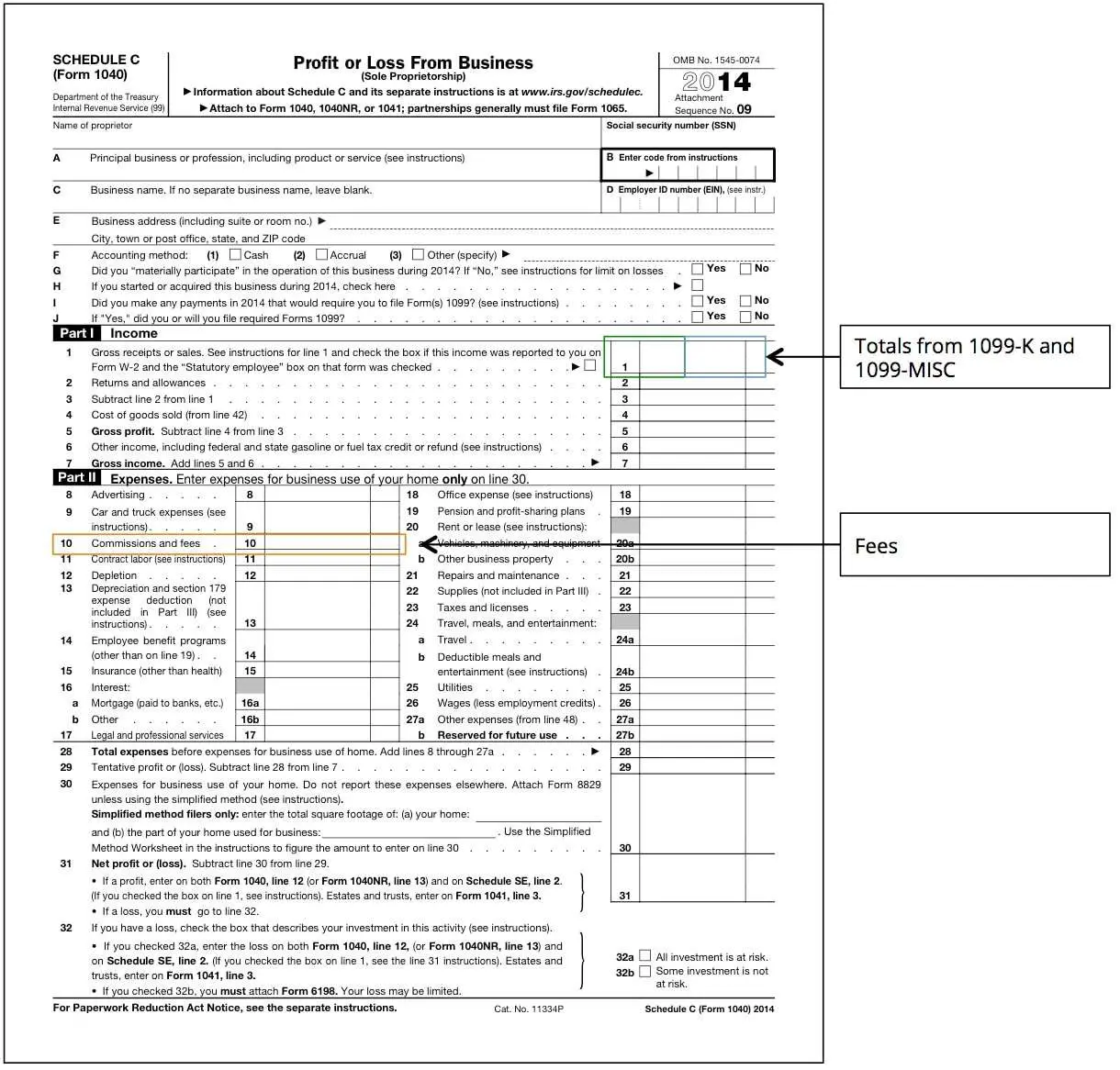

Profits Added To Other Income Determine Your Income For Your Tax Form

Again, I go back to the thing about your profits are your income.

Now that you have put your income into the income in Schedule C, then added up your expenses in the expense part of Schedule C, the difference is your profit. That profit now becomes your income from your business.

If Uber Eats is your only source of income, that profit from Schedule C is the one thing that goes in the income side of your 1040 form.

If you have other forms of income such as investment income, W2 income, etc, all of that gets added up together with your business income to become your total income. This goes into line 9.

What Taxes Do You Have To Pay As A Rideshare Driver

First things first â let’s talk about what you’re on the hook for as a rideshare driver. As self-employed workers, Uber drivers are responsible for two main types of taxes. The first? Your federal and state income taxes.

Your federal tax rate can vary from 10% to 37%, while your state rate can be anywhere from 0% to 10.75%. The exact percentage you’ll pay depends on your state and your tax bracket, which is usually based on how much you earned over the calendar year.

The second type of taxes you’re responsible for is self-employment taxes. As an Uber driver, you’re classified by the IRS as an independent contractor, rather than an employee. That means you technically run your own business, so Uber won’t withhold taxes for you the way most traditional employers do.

Recommended Reading: Pastyeartax.com Review

What To Do If You Dont Get A 1099 Form

If you donât get a 1099 from Uber or Lyft, then you likely earned less than $600 as a driver for the company. However, you can still file your taxes without a 1099 form as long as you have your Tax Summary from Uber or your Annual Summary from Lyft. These summaries arenât official tax documents but should list the main information you need for your taxes:

-

Gross earnings

-

Non-ride earnings, like referrals and bonuses

-

Operating and vehicle expenses

-

Total online miles

About This Article Series

So what’s a guy who’s not a tax professional doing writing a series of tax articles?

I’m writing this because I don’t think taxes are as complicated as we make them out to be. If a guy like me who’s been delivering for Uber Eats and several others for several years can get how it works, I think anyone can.

And then I see people putting out tax articles and graphics that just get it wrong. Some don’t seem to understand where delivery is different than rideshare. And others skip over how there are some things about Uber Eats that are different from other food delivery services.

Finally, most of the information out there is too simple. It’s always just this big overview and too often, they leave a lot more questions than they answer. Great, I can write off mileage, but what miles can I write off? What’s the best way to track and what if I forgot to track?

That’s why this is the first article in a series. This article will give you an overview of how taxes work. Then we’ll have several articles that go into more detail.

As you read through this, you’ll find links to other articles in the tax series that go into more detail about the particular topics. Sometimes we’ll link to other articles on this site that already address the topic. At the end of this article we’ll provide a list of the other articles in this series.

Recommended Reading: Dasher Tax Form

Tax Forms That Uber & Lyft Drivers Need

Your 2021 ride-share income should be reported to you on a copy of Form 1099-K, Form 1099-NEC, or both. You need these forms to file your taxes because they list exactly how much income you earned. If you drove for multiple companies, each company will send you a separate 1099 form.

Hereâs a brief explanation of each 1099 form you may receive:

-

Form 1099-K: This form shows your total income as a driver. You should receive it if you gave at least 200 rides and earned at least $20,000 during the year. Some states require the company to send you this form even if you are below those thresholds.

-

Form 1099-NEC: This form reports non-ride earnings you received, including from bonuses, referrals, and other promotions. You may only receive it if you made at least $600 from these types of payments.

-

Form 1099-MISC: Most people wonât receive this form for 2021 or 2022. This form used to be more common but was mostly replaced by Form 1099-NEC. You may still receive it if you made at least $600 from other miscellaneous payments, like if you got a legal settlement from the company.

Get a full breakdown of these forms in our guide to 1099 forms.

What If I Only Drive Part

If youre doing rideshare part-time on top of another job, this deduction also only applies to your rideshare income and not the wages from your job.

For example, if you make $50,000 a year at a job that you get a W-2 from plus $5,000 from rideshare driving, then youd get an additional deduction of $1,000.

You May Like: Finding Your Ein Number

Uber Collects The Fares And Does Not Pay Hst To The Uber Driver

Uber Canada makes a weekly deposit to your bank account of the fares it has collected for Canadian Uber operators. This amount includes HST for those drivers who are required to be HST registrants. This means that the gross deposit that an HST registered Uber driver receive includes an amount for HST. So if you receive a $100 deposit then $88.50 belongs to you as fare income and the balance is HST. You calculate the fare amount in Ontario by dividing the gross deposit by 1.13 and difference is the gross HST liability. You can deduct the HST you pay on expenses from the HST collected, and the difference is remitted to CRA.

Tax Obligations Of Uber Drivers

UBER has grown to be part of Canadas transportation landscape. Many Canadians are either earning their income primarily as UBER drivers, or are supplementing their income by driving when not otherwise working. UBER has caused a disruption in the taxi industry by providing a very large pool of potential transportation providers that are easy to access and drive a variety of vehicle. So, with UBER likely here to stay, and more sharing economy disruptors likely to appear and dominate, what are the tax consequences of being an Uber driver? And what are the uber driver tax tips to save money. Given that taxi drivers have to register for HST/GST and remit this, and pay tax on their incomes, how are UBER drivers treated by the tax man?

Almost all UBER drivers are in business, meaning that their earnings are business income. This means that Uber drivers have to report their revenues and get to deduct their expenses come tax time, and they have to pay tax on their profits. The CRA also required Form T2125 to be included with the Uber drivers tax return. What is less well known is that Uber drivers also have GST/HST obligations.

Don’t Miss: Plasma Donation Taxable Income